New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP

Description

How to fill out Request For Loan Modification RMA Under Home Affordable Modification Program HAMP?

Are you currently in the location where you require documents for either professional or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust isn't simple.

US Legal Forms offers thousands of form templates, including the New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, designed to meet federal and state requirements.

Once you find the correct form, click Buy now.

Choose the pricing plan you want, complete the required information to create your account, and purchase your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it pertains to the correct city/region.

- Use the Preview button to review the form.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you are looking for, use the Lookup area to find the form that meets your needs and requirements.

Form popularity

FAQ

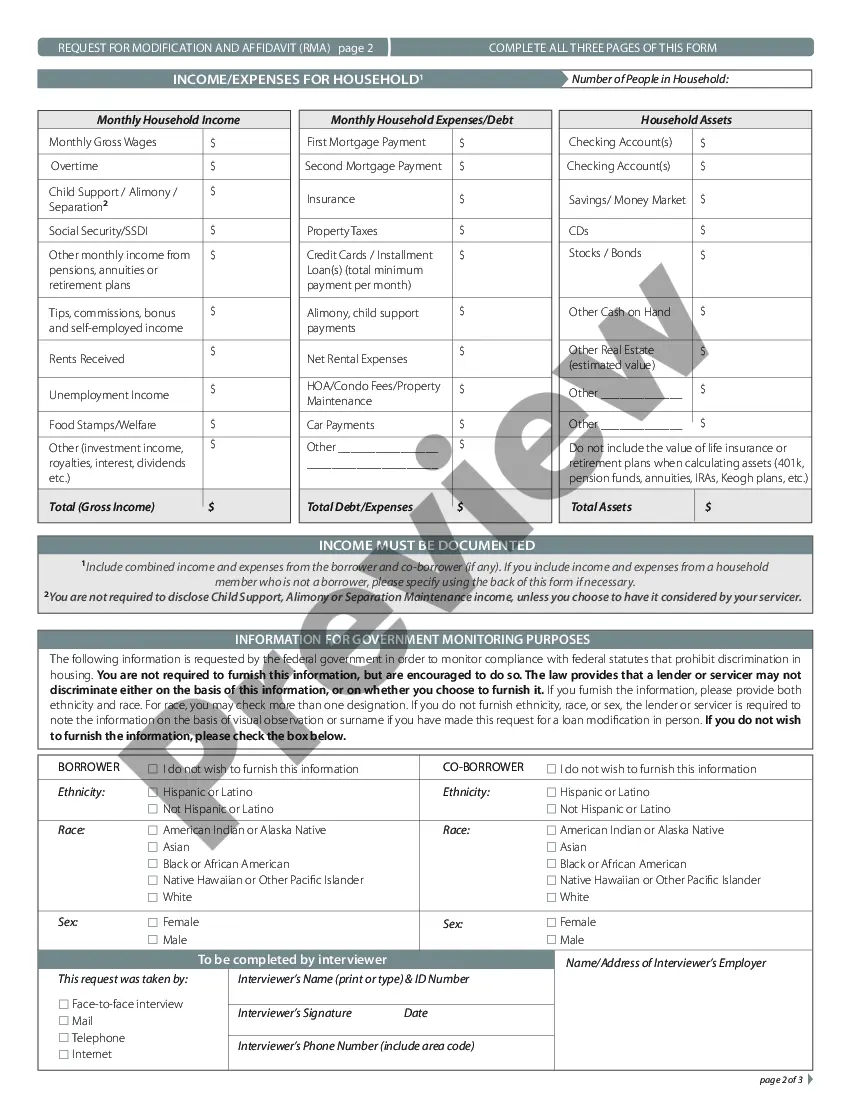

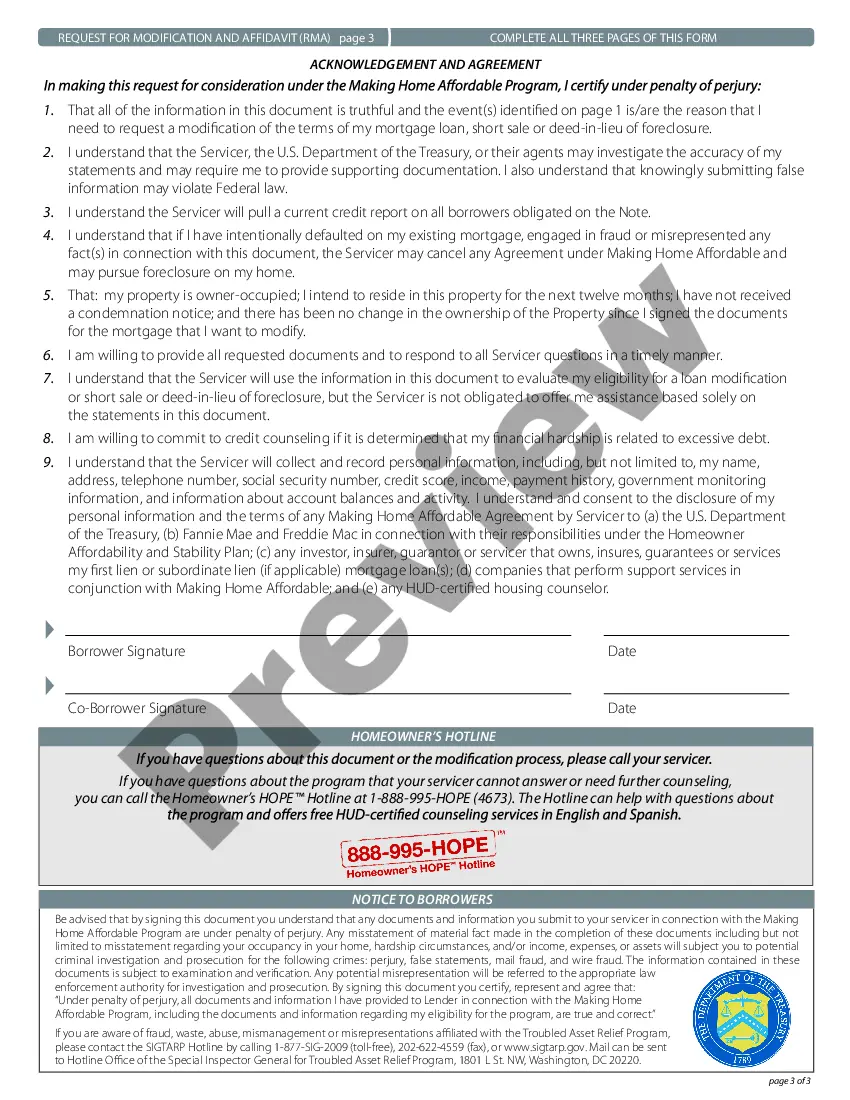

To apply for a loan modification, begin by gathering your financial documents, including income statements and hardship letters. Then, complete the Request for Mortgage Assistance (RMA). Next, submit all required paperwork to your lender for review. Utilizing resources like the uslegalforms platform can streamline your New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP process.

An example of a hardship letter for a mortgage includes a detailed account of your situation. You might discuss job loss, health issues, or family changes impacting your finances. Clearly express your need for assistance and your intention to stay in your home. This letter should accompany your request for a New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

RMA in mortgage stands for Request for Mortgage Assistance. This document provides a framework for homeowners to navigate the loan modification process. Accurate completion of the RMA helps lenders understand your financial challenges. This is crucial for those making a New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

In real estate, RMA refers to Request for Mortgage Assistance. It is an essential tool for homeowners facing financial hardships. Completing the RMA allows lenders to assess your circumstances effectively. This process is especially relevant for homeowners pursuing a New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

The full form of RMA is Request for Mortgage Assistance. It plays a significant role in the loan modification process under the Home Affordable Modification Program. This form captures pertinent information about your financial situation. Submitting an accurate and complete RMA is vital for your New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

RMA in mortgage stands for Request for Mortgage Assistance. It is a crucial form required when you apply for a loan modification through the Home Affordable Modification Program. This document helps lenders evaluate your financial situation. By completing the RMA, you increase your chances of obtaining a New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP.

A hardship letter for a loan modification explains your financial difficulties. For instance, if you lost your job or faced medical emergencies, detail this in your letter. You should also mention how these circumstances affect your ability to keep up with mortgage payments. Including a clear statement of your request for a New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP is essential.

Getting approved for a loan modification under the New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP can be straightforward if you meet eligibility criteria. Many borrowers worry about the process, but maintaining clear communication with your lender can ease concerns. While financial situations vary, providing accurate documentation increases the chances of approval. If you encounter challenges, platforms like uslegalforms can help guide you through the necessary steps.

To request a mature modification on your loan, you must complete the application for the New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP. This process involves gathering documents such as proof of income and expenses, along with your mortgage details. After submitting your request, your lender will review it and inform you of their decision. Be prepared to follow up for any additional information they might need.

To qualify for a loan modification under the New Jersey Request for Loan Modification RMA Under Home Affordable Modification Program HAMP, you usually need to demonstrate financial hardship. This can include job loss, medical expenses, or any other situation that affects your income. Additionally, you must show that your mortgage is not currently in foreclosure. Providing necessary documentation is essential to support your request.