New Jersey Sample Letter for Short Sale Request to Lender

Description

How to fill out Sample Letter For Short Sale Request To Lender?

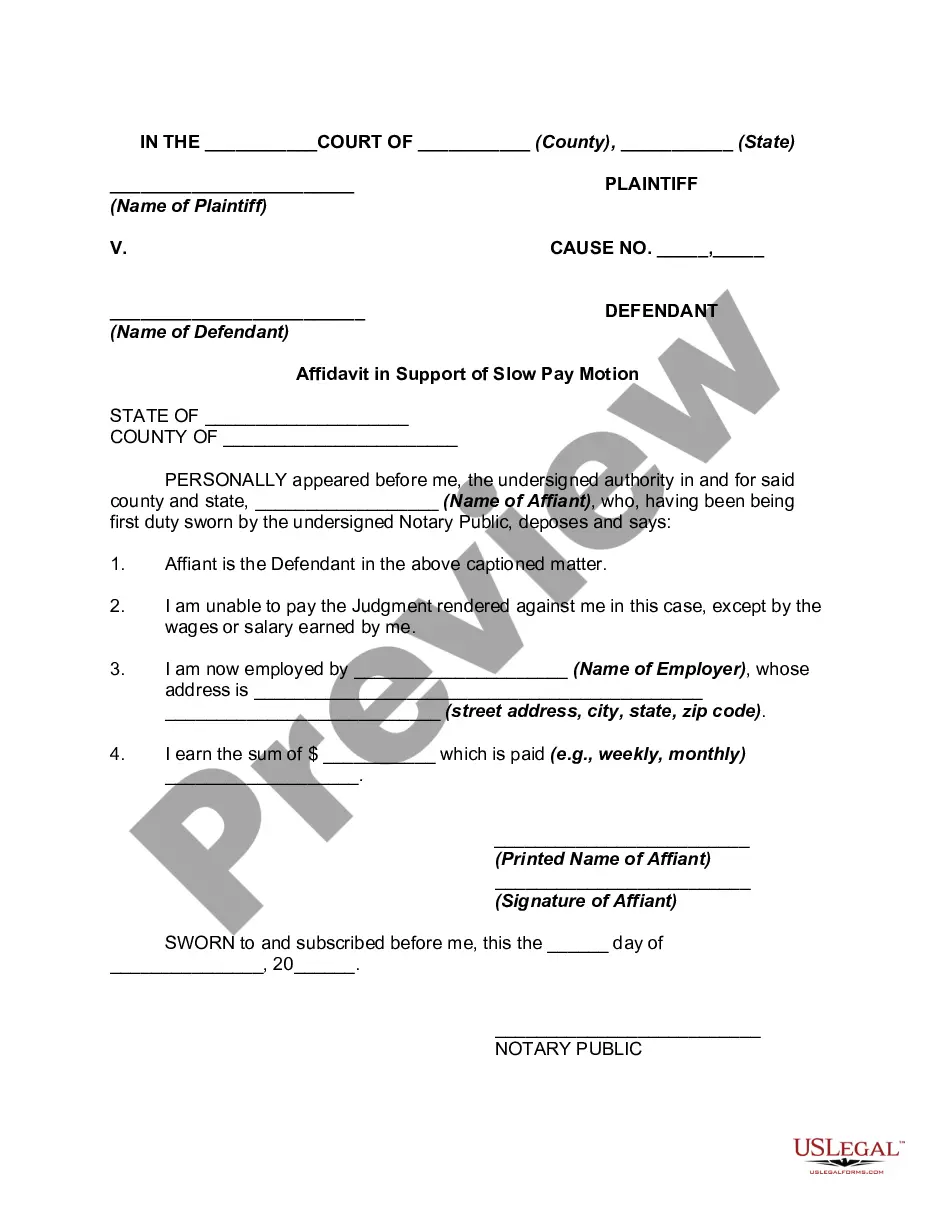

Have you ever found yourself in a scenario where you need documents for either business or personal purposes almost all the time.

There are numerous legal document templates available online, but finding trustworthy ones isn't easy.

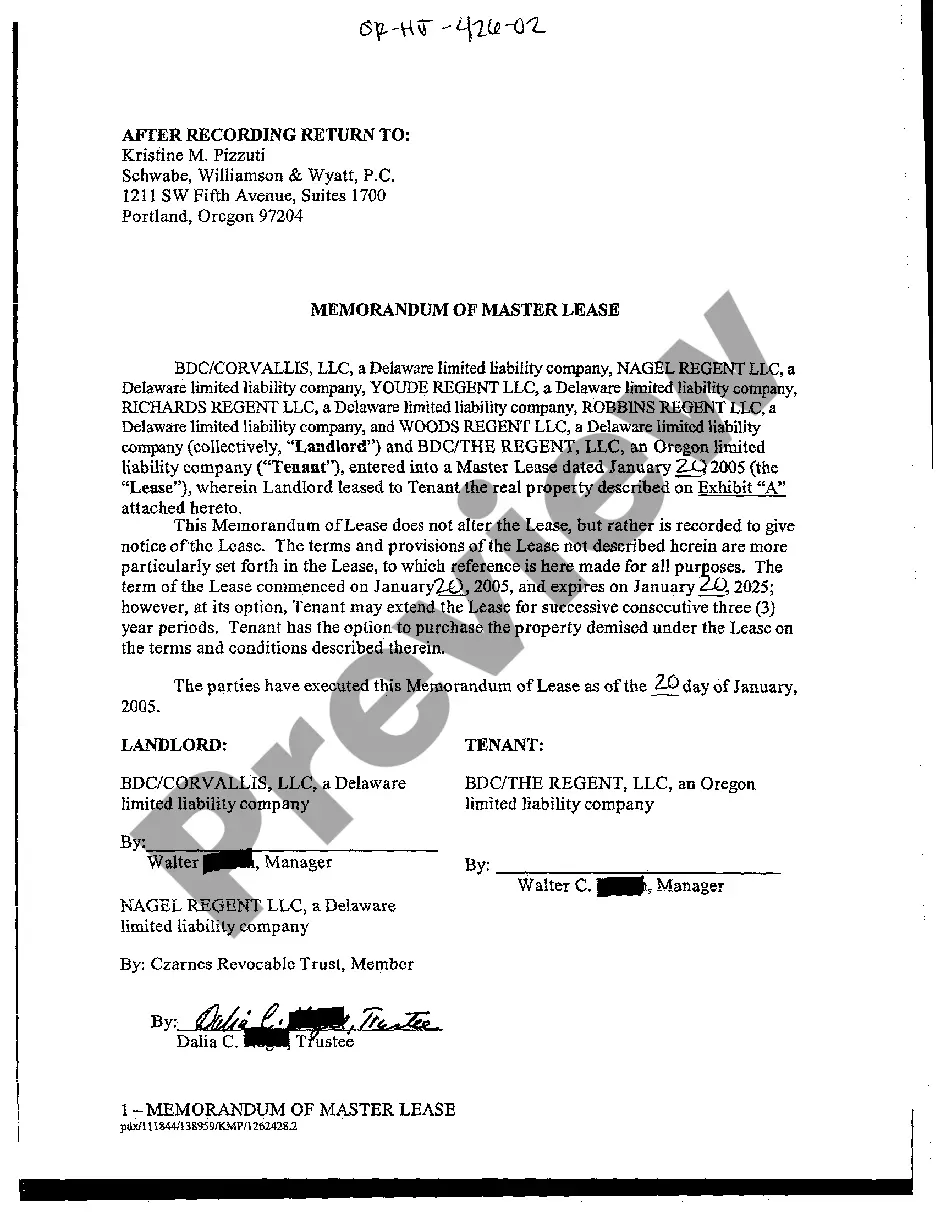

US Legal Forms offers a vast array of template options, such as the New Jersey Sample Letter for Short Sale Request to Lender, which can be tailored to meet state and federal requirements.

Use US Legal Forms, the most extensive collection of legal templates, to save time and reduce errors.

The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Jersey Sample Letter for Short Sale Request to Lender template.

- If you don't have an account and wish to use US Legal Forms, follow these steps.

- Locate the form you need and ensure it's for the correct city/area.

- Use the Review button to examine the form.

- Check the description to ensure you have selected the right form.

- If the form isn't what you're seeking, use the Search field to find the document that meets your needs and specifications.

- Once you identify the appropriate form, click Get now.

- Choose the pricing plan you want, complete the necessary information to create your account, and finalize your order using PayPal or a credit card.

- Select a suitable file format and download your copy.

- Access all the document templates you have purchased from the My documents menu.

- You can obtain an additional copy of the New Jersey Sample Letter for Short Sale Request to Lender anytime if needed. Click the desired form to download or print the document template.

Form popularity

FAQ

Requesting a short sale involves writing to your lender with a clear explanation of your circumstances and financial difficulties. Include relevant documents like your income statements and a hardship letter. Using a New Jersey Sample Letter for Short Sale Request to Lender can ensure you cover all essential details in a professional manner.

To ask for a short sale, submit a formal request to your lender that includes your financial situation and reasons why a short sale is necessary. Be honest and present supporting documentation to strengthen your case. A well-crafted New Jersey Sample Letter for Short Sale Request to Lender can effectively convey your request.

Short sales do have an impact on your credit score, but it may be less severe than a foreclosure. Generally, a short sale can lower your credit score by about 100 to 150 points. To minimize damage, use a New Jersey Sample Letter for Short Sale Request to Lender and communicate openly with your lender throughout the process.

The amount you can offer on a short sale depends on the property’s current market value and the lender’s willingness to negotiate. Typically, buyers can propose an offer that is significantly lower than the outstanding mortgage. Keep in mind, leveraging a New Jersey Sample Letter for Short Sale Request to Lender can help articulate your offer effectively.

To write a letter to a lender, start by clearly stating your purpose. Use a formal tone and include your personal information, property details, and reasons for the short sale. Consider utilizing a New Jersey Sample Letter for Short Sale Request to Lender as a guide to ensure you cover all necessary points effectively.

A short sale approval letter is a document from your lender that confirms they agree to your short sale request. This letter outlines the terms and conditions for the sale, allowing you to sell your property for less than the amount owed on your mortgage. By obtaining a New Jersey Sample Letter for Short Sale Request to Lender, you can effectively communicate with your lender and increase your chances of receiving approval. Using uslegalforms can help streamline this process and provide you with the necessary templates for your negotiations.

When writing a letter to a mortgage company for hardship, it is crucial to be honest and detailed about your financial situation. Outline your current difficulties, such as job loss or medical expenses, and express your desire to resolve the matter. A well-structured communication, like a New Jersey Sample Letter for Short Sale Request to Lender, can help convey your message clearly and effectively. This approach encourages the lender to consider your request favorably.

A short sale in New Jersey is a real estate transaction where the homeowner sells their property for less than the mortgage balance, with lender approval. This process helps homeowners avoid foreclosure and move on from financial struggles. It is crucial to highlight hardship and motivation in communications, such as through a New Jersey Sample Letter for Short Sale Request to Lender. Understanding this concept can clarify your options in difficult times.

Short sales in New Jersey can vary significantly in duration, typically ranging from a few months to over a year. Factors influencing the timeline include lender responsiveness, the number of liens on the property, and market conditions. Staying organized and using a New Jersey Sample Letter for Short Sale Request to Lender can help streamline the process. Setting realistic expectations with your real estate agent can also be beneficial.

In New Jersey, a short sale occurs when a homeowner sells their property for less than what they owe on their mortgage. To initiate a short sale, the homeowner must obtain approval from the lender, as they must agree to accept the reduced amount. This process often requires a detailed financial statement, which can be aided by a New Jersey Sample Letter for Short Sale Request to Lender. Clear communication with your lender is key to navigating this process successfully.