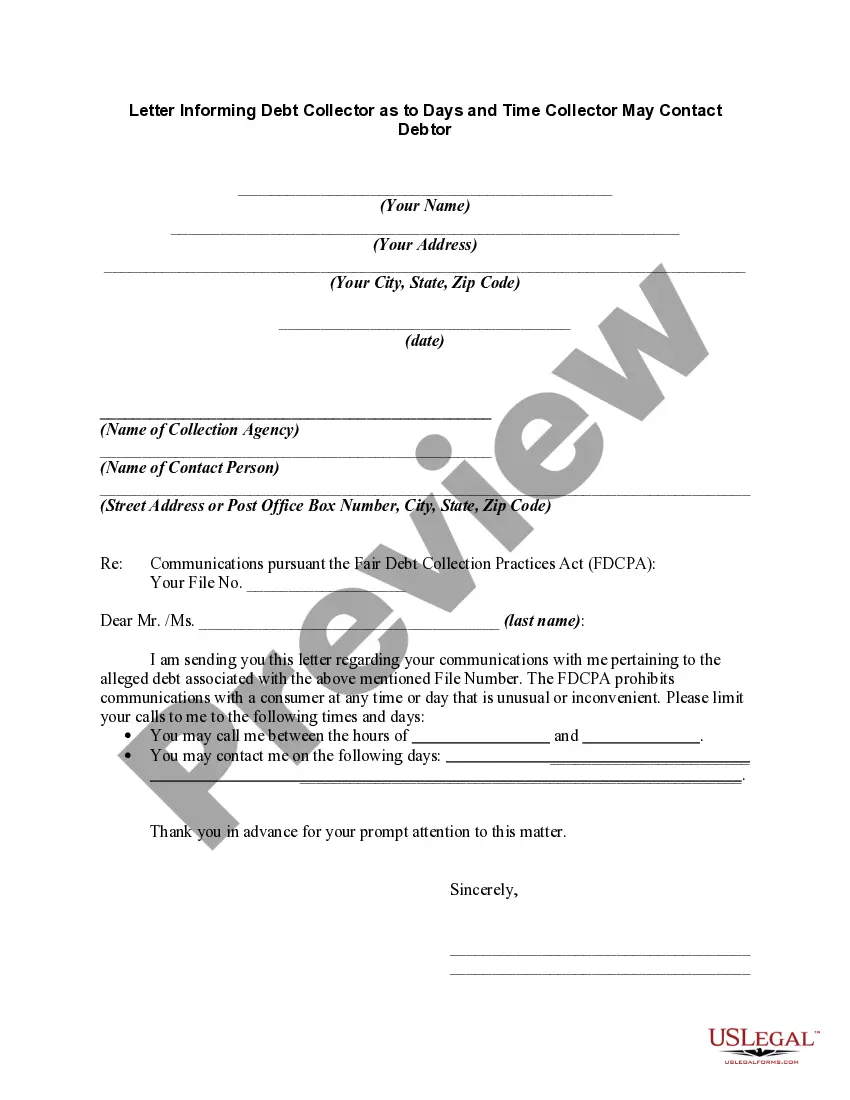

New Jersey Letter to Debt Collector - Only call me on the following days and times

Description

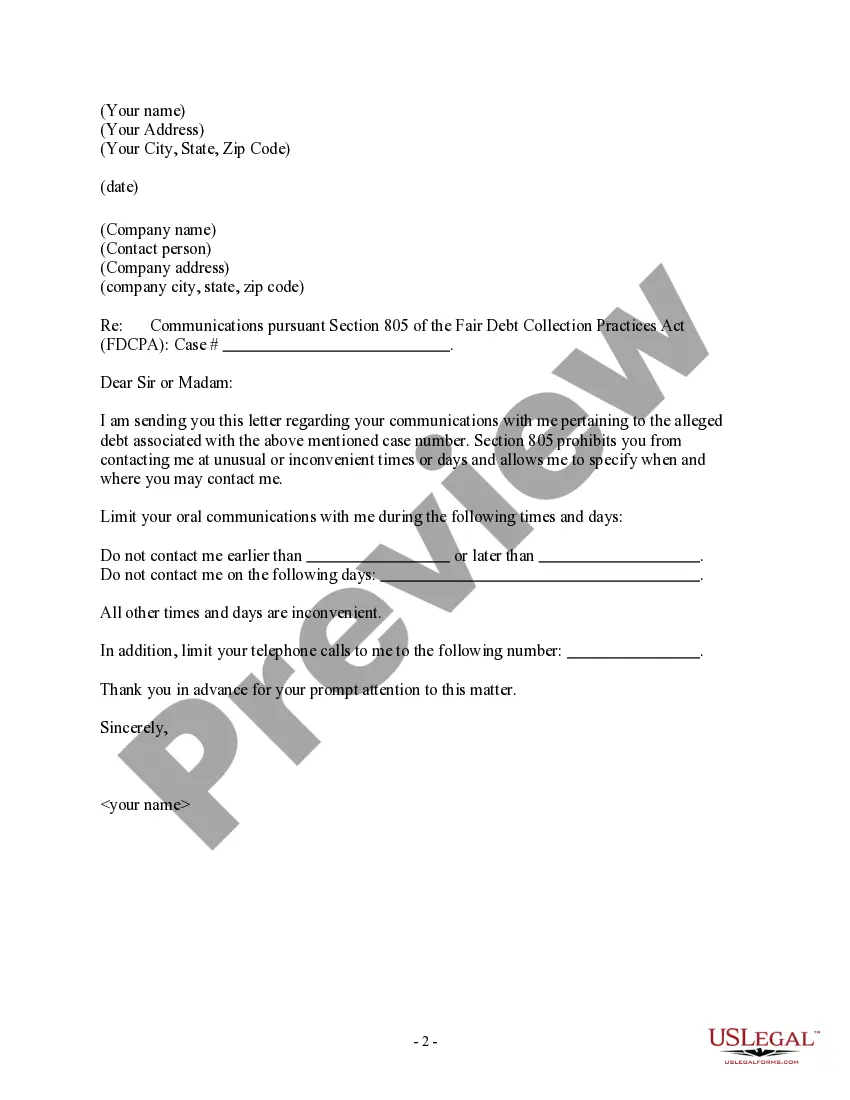

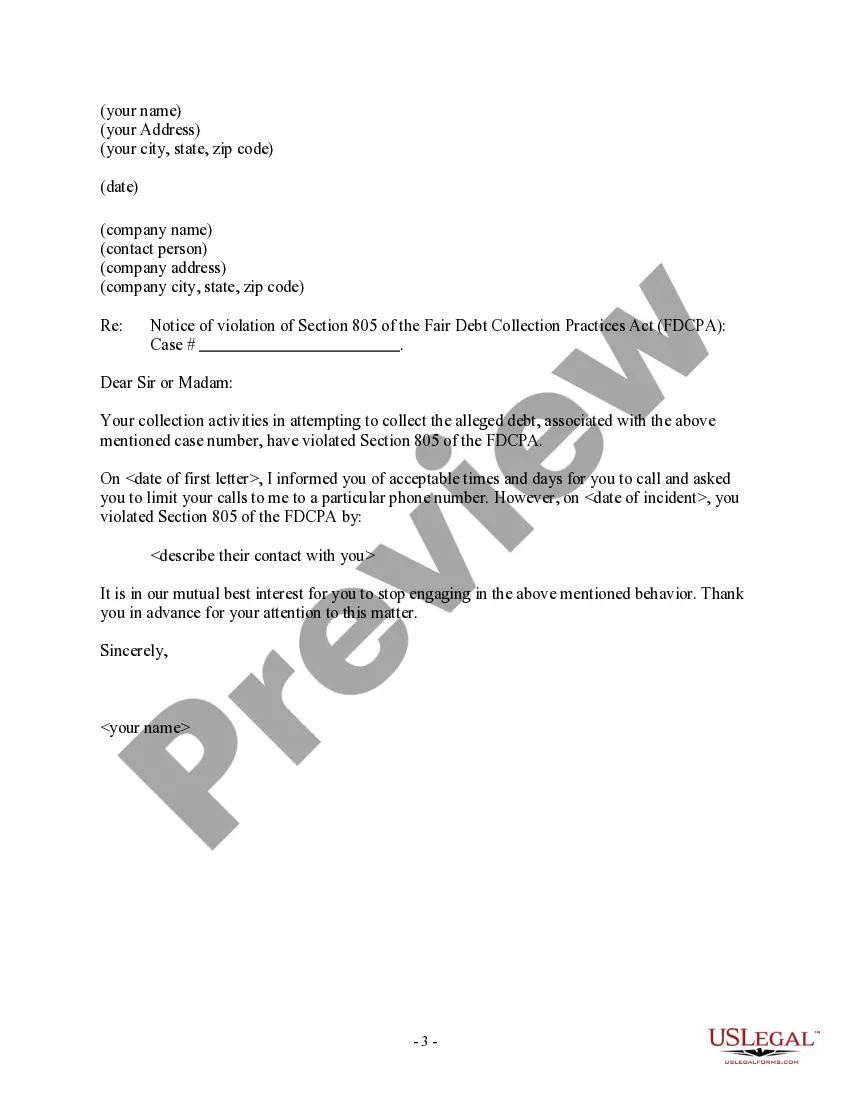

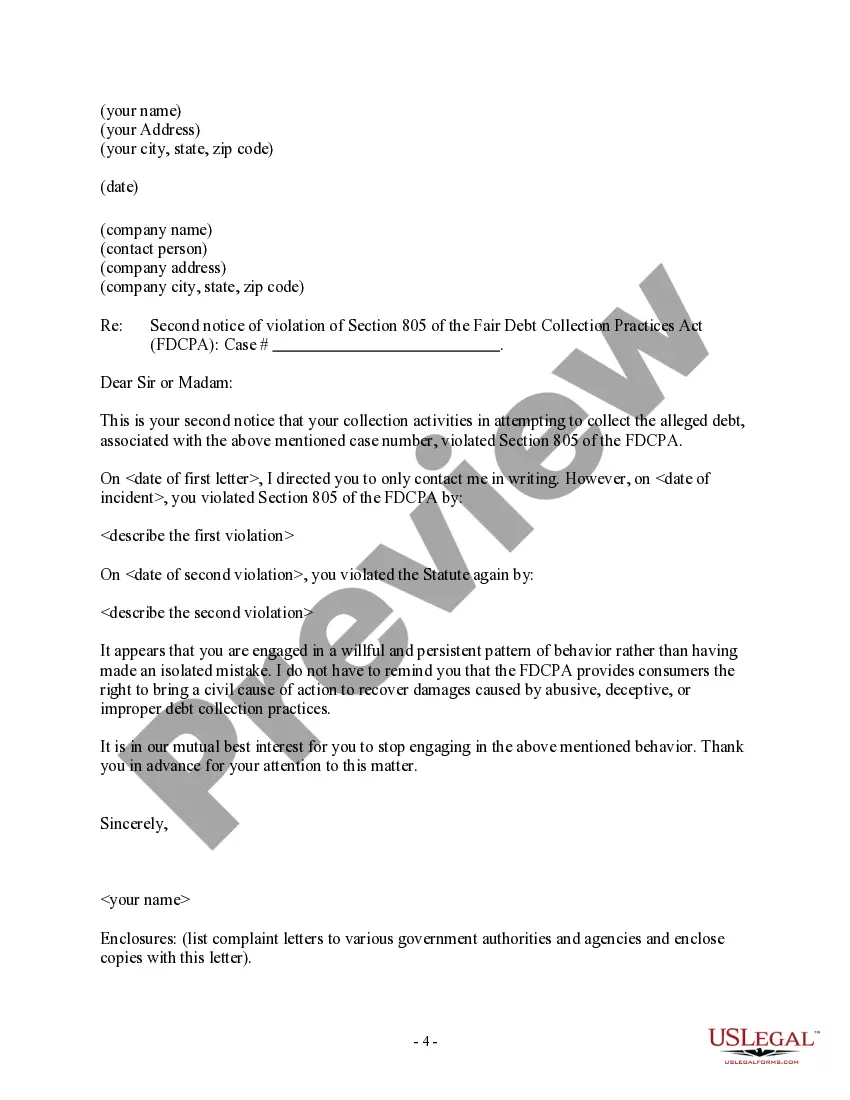

How to fill out Letter To Debt Collector - Only Call Me On The Following Days And Times?

Locating the appropriate legal document format can be quite challenging.

It goes without saying that there are numerous templates available online, but how do you find the legal document you require.

Utilize the US Legal Forms website. The platform offers a wide selection of templates, including the New Jersey Letter to Debt Collector - Only contact me on the following days and times, which can be used for business and personal purposes.

If the form does not meet your needs, take advantage of the Search field to find the appropriate form. Once you are certain the form is suitable, click the Get now button to obtain the document. Choose your desired pricing plan and input the necessary information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document to your device. Complete, edit, and print the New Jersey Letter to Debt Collector - Only contact me on the following days and times securely. US Legal Forms is the largest repository of legal documents where you can find various file templates. Use the service to get professionally crafted documents that comply with state requirements.

- All of the documents are reviewed by specialists and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to acquire the New Jersey Letter to Debt Collector - Only contact me on the following days and times.

- Use your account to search through the legal documents you have previously ordered.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple tips for you to follow.

- First, ensure you have selected the correct document for your city/state. You can view the form using the Review button and check the form details to make sure it is suitable for you.

Form popularity

FAQ

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Also, debt collectors can't call you numerous times a day. Doing so is considered a form of harassment by the Federal Trade Commission (FTC) and is explicitly not allowed.

Yes, a debt collector can call on Sunday, unless you've told them that Sunday is inconvenient for you. If you tell them not to call on Sunday, and they do so anyway, then the call violates the Fair Debt Collection Practices Act.

A statement that if you write to dispute the debt or request more information within 30 days, the debt collector will verify the debt by mail. A statement that if you request information about the original creditor within 30 days, the collector must provide it.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

The only permissible means of communicating is by regular mail. Alberta and Nova Scotia have a similar "three strikes" rule limiting the amount of contact from collectors within a seven-day consecutive period.

Creditors do not have to respond to every debt verification letter sent to them. Under the FDCPA, if a collector contacts you about a debt, you have 30 days to request validation. If you send a verification request within that time, the creditor is legally obligated to respond to you.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.