New Jersey Payout Agreement

Description

How to fill out Payout Agreement?

It is feasible to invest numerous hours online attempting to locate the legal document template that complies with state and federal regulations you will require.

US Legal Forms offers a vast array of legal forms that can be assessed by experts.

You can conveniently download or print the New Jersey Payout Agreement from our service.

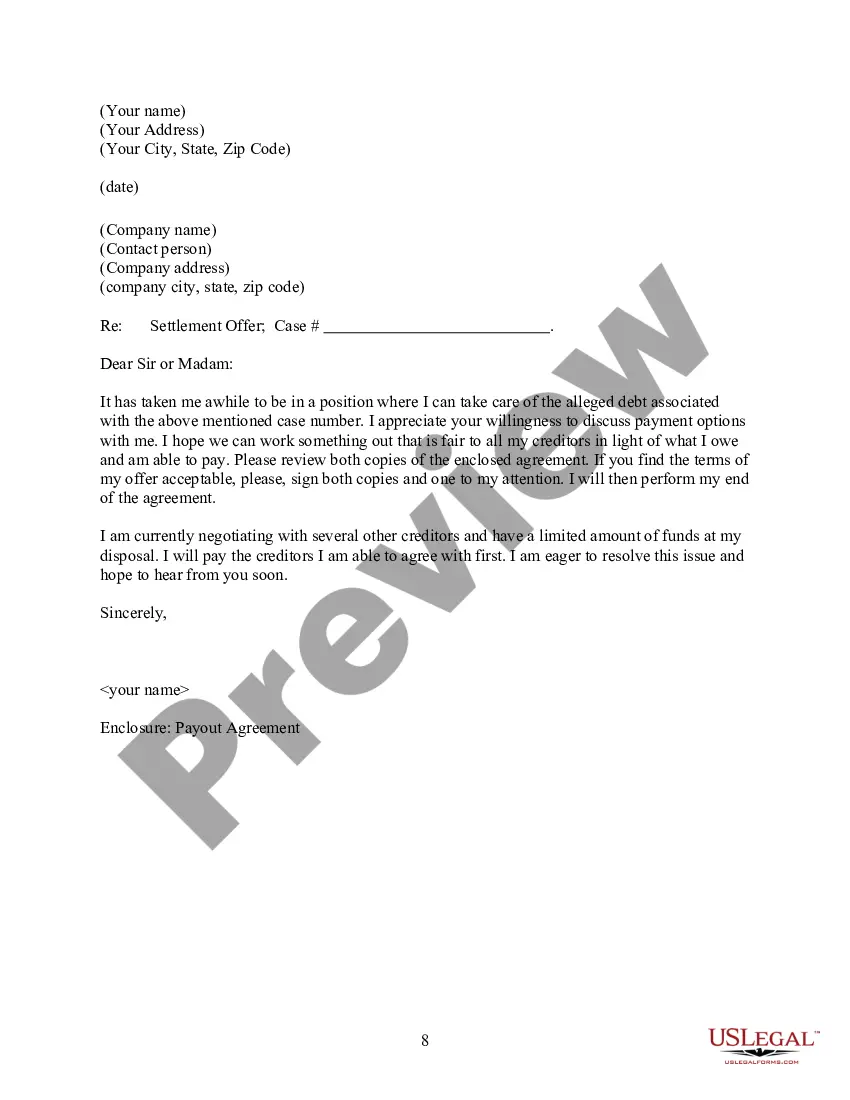

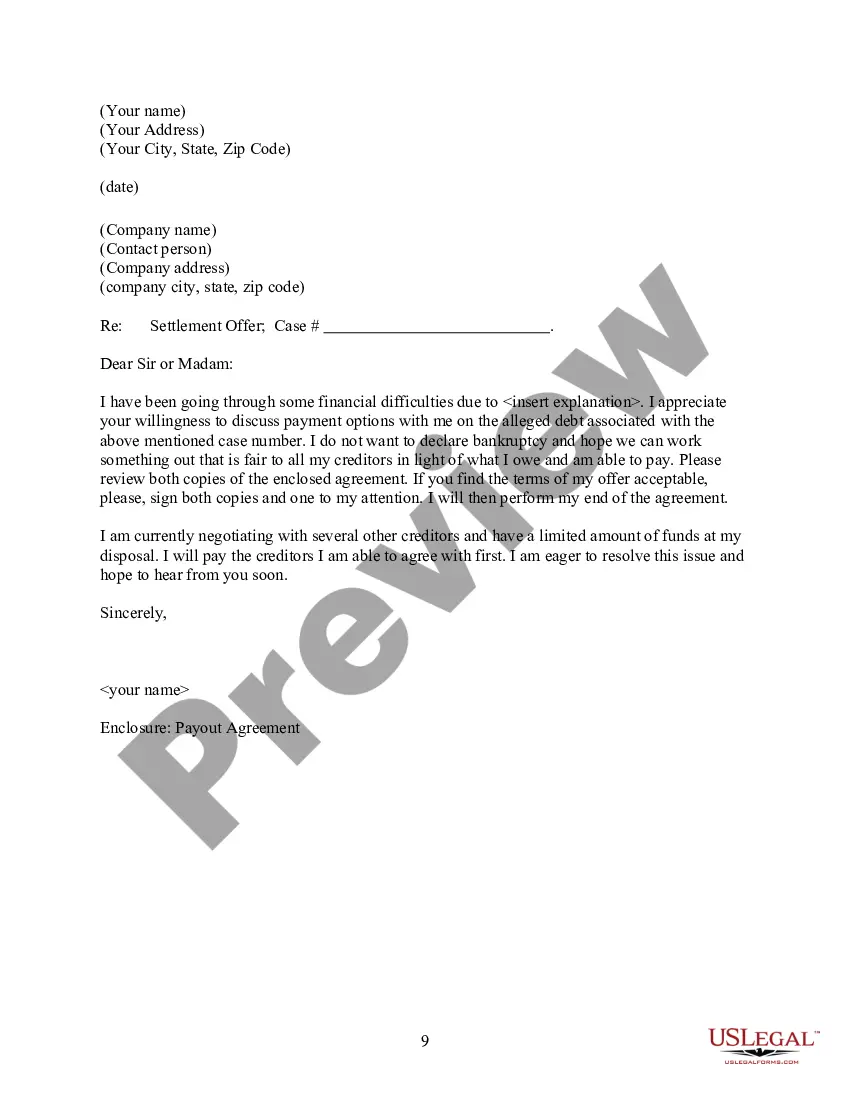

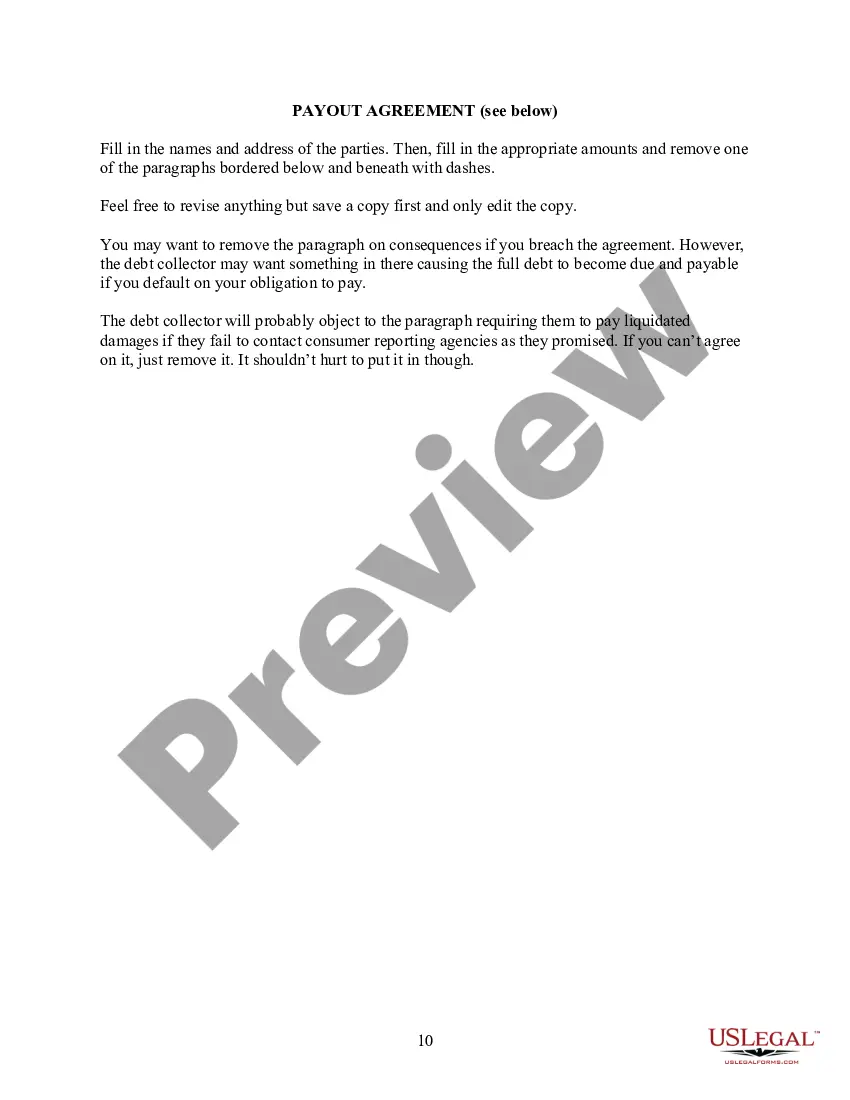

Check the form description to confirm you have selected the correct form. If available, utilize the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and press the Download button.

- After that, you can complete, modify, print, or sign the New Jersey Payout Agreement.

- Each legal document template you acquire is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your state/city of choice.

Form popularity

FAQ

In order to even be subject to the IRS covered expatriate and exit tax rules, a person must be a U.S citizen or long-term legal permanent resident. Therefore, the easiest way to avoid the long-term resident exit tax trap it is to simply avoid becoming a legal permanent resident.

When New Jersey residents sell their homes and prepare to move out of state, you must pay a standard tax rate on the profit from the sale. You need to pay this tax when you move, rather than at the time you would normally file your state income tax return.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

If you claim 0 allowances or 1 allowance, you'll most likely have a very high tax refund. Claiming 2 allowances will most likely result in a moderate tax refund.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

Since your home was your principal residence for at least 24 out of the prior 60 months there will be no taxable gain and no estimated tax payment will be required, Kiely said. Email your questions to Ask@NJMoneyHelp.com.

Exemptions to the NJ Exit Tax If you remain a New Jersey resident, you'll need to file a GIT/REP-3 form (due at closing) and it will exempt you from paying estimated taxes on the sale of your home. Instead, any applicable taxes on the gain from the sale are to be reported on your New Jersey Gross Income Tax Return.

The withholding rates for gambling winnings paid by the New Jersey Lottery are as follows: 5% for Lottery payouts between $10,001 and $500,000; 8% for Lottery payouts over $500,000; and. 8% for Lottery payouts over $10,000, if the claimant does not provide a valid Taxpayer Identification Number.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.