New Jersey Reorganization of corporation as a Massachusetts business trust with plan of reorganization

Description

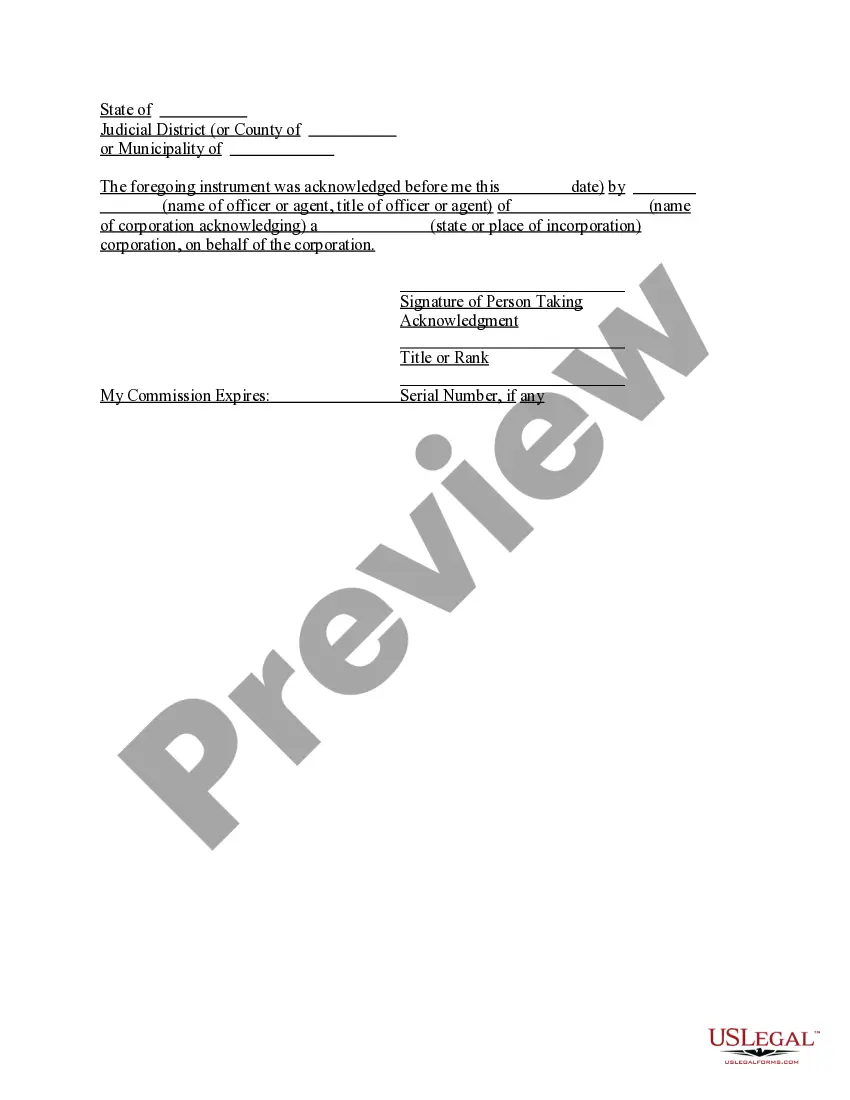

How to fill out Reorganization Of Corporation As A Massachusetts Business Trust With Plan Of Reorganization?

US Legal Forms - one of several greatest libraries of lawful varieties in the States - offers a wide array of lawful papers templates you are able to acquire or print. Using the website, you can find a huge number of varieties for enterprise and specific uses, categorized by categories, says, or key phrases.You can get the newest versions of varieties just like the New Jersey Reorganization of corporation as a Massachusetts business trust with plan of reorganization within minutes.

If you currently have a membership, log in and acquire New Jersey Reorganization of corporation as a Massachusetts business trust with plan of reorganization in the US Legal Forms collection. The Download button will appear on each form you perspective. You have accessibility to all previously acquired varieties inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms initially, allow me to share basic guidelines to obtain started off:

- Ensure you have selected the best form for your personal metropolis/area. Click the Review button to check the form`s articles. Read the form outline to ensure that you have chosen the right form.

- When the form does not satisfy your demands, utilize the Lookup area near the top of the monitor to discover the one who does.

- In case you are happy with the shape, confirm your choice by simply clicking the Purchase now button. Then, pick the rates strategy you prefer and supply your references to register for an bank account.

- Method the transaction. Use your Visa or Mastercard or PayPal bank account to perform the transaction.

- Find the formatting and acquire the shape on your own device.

- Make adjustments. Load, modify and print and sign the acquired New Jersey Reorganization of corporation as a Massachusetts business trust with plan of reorganization.

Every format you included with your account does not have an expiration time and is the one you have for a long time. So, in order to acquire or print another backup, just check out the My Forms portion and click around the form you want.

Get access to the New Jersey Reorganization of corporation as a Massachusetts business trust with plan of reorganization with US Legal Forms, by far the most substantial collection of lawful papers templates. Use a huge number of specialist and condition-specific templates that fulfill your organization or specific requires and demands.

Form popularity

FAQ

A business trust is one vital arm to the entire body of a running business. Also known as common law trusts, business trusts, such as grantor, simple, and complex trusts, give a trustee the authority to manage a beneficiary's interest in the business.

It's typically one individual serving as a trustee of a business trust. At the end of the trust's length, the business interests transfer to its beneficiaries. Business trusts are treated as corporations and may conduct business transactions just like individuals.

A Massachusetts Business Trust (MBT) is a legal trust set up for the purposes of business, but not necessarily one that is operated in the Commonwealth of Massachusetts. They may also be referred to as an unincorporated business organization or UBO.

A Massachusetts corporate trust (business trust) is generally subject to personal income tax rather than corporate excise tax. Certain corporate trusts are exempt from taxation altogether.

Massachusetts trusts (also known as common-law trusts, business trusts, or unincorporated business organizations) are a unique type of trust used by individuals to run a business outside the normal legal entities such as a corporation or partnership.

To start a corporation in Massachusetts, you need to do three things: choose a name for your business, appoint a registered agent, and file Articles of Incorporation with the state. You can file this document online, by fax or by mail. The articles cost a minimum of $275 to file.