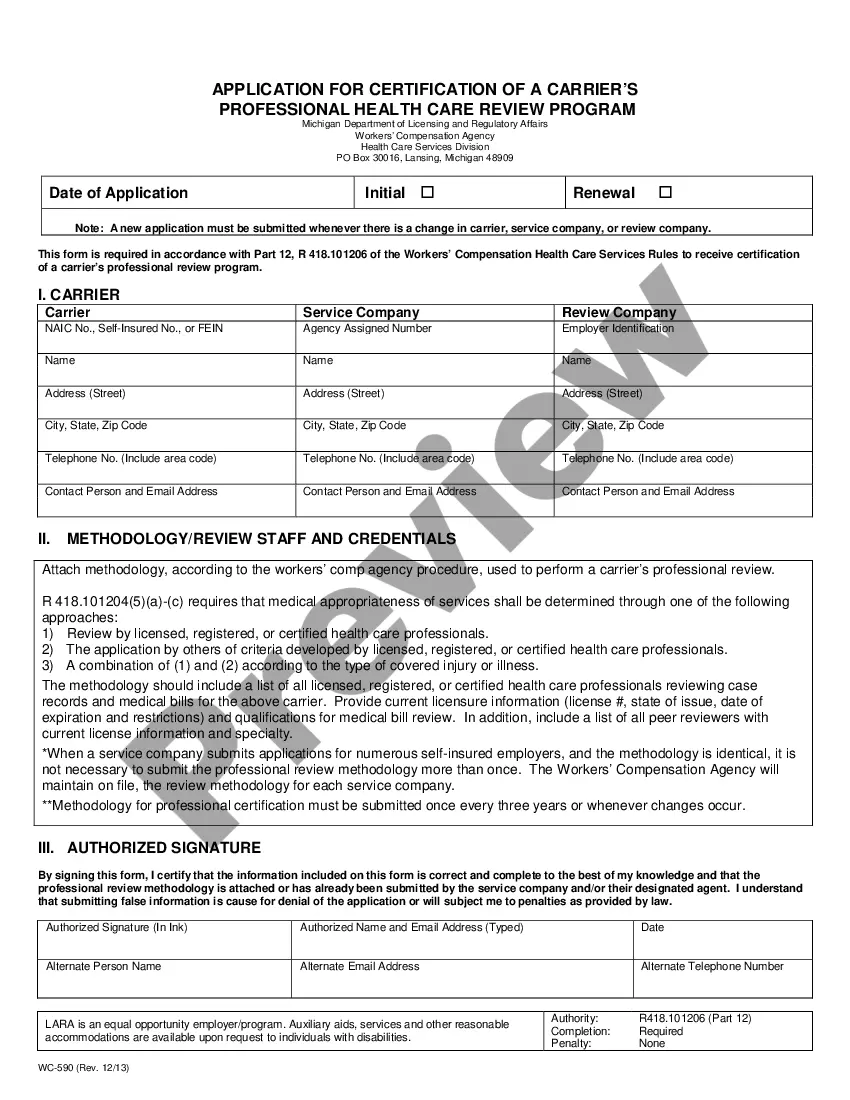

The lease form contains many detailed provisions not found in a standard oil and gas lease form. Due to its length, a summary would not adequately describe each of the terms. It is suggested that if you consider adopting the form for regular use, that you print the form and closely read and review it. The lease form is formatted in 8-1/2 x 14 (legal size).

Illinois Lessor's Form

Description

How to fill out Lessor's Form?

US Legal Forms - among the largest libraries of legal forms in the States - offers an array of legal document themes you are able to obtain or print. Making use of the web site, you may get a large number of forms for company and person functions, sorted by categories, suggests, or search phrases.You can find the latest variations of forms such as the Illinois Lessor's Form in seconds.

If you already have a monthly subscription, log in and obtain Illinois Lessor's Form from your US Legal Forms local library. The Download key can look on every kind you view. You gain access to all previously downloaded forms within the My Forms tab of your profile.

In order to use US Legal Forms initially, listed below are basic guidelines to help you get started off:

- Be sure to have chosen the correct kind to your town/county. Select the Preview key to analyze the form`s content. Look at the kind outline to actually have selected the proper kind.

- When the kind doesn`t match your specifications, make use of the Research area on top of the display to obtain the one who does.

- If you are content with the form, verify your option by clicking on the Buy now key. Then, opt for the rates plan you favor and offer your accreditations to sign up for the profile.

- Method the transaction. Use your charge card or PayPal profile to perform the transaction.

- Find the formatting and obtain the form in your system.

- Make changes. Fill out, edit and print and indication the downloaded Illinois Lessor's Form.

Each web template you included in your money does not have an expiration time which is your own property eternally. So, if you wish to obtain or print one more copy, just go to the My Forms segment and click on around the kind you require.

Get access to the Illinois Lessor's Form with US Legal Forms, by far the most comprehensive local library of legal document themes. Use a large number of skilled and state-certain themes that fulfill your business or person requires and specifications.

Form popularity

FAQ

The city of Chicago, Cook County requires a 9% tax paid in the lease. It's not exactly the best scenario when leasing a vehicle and living in Chicago but unfortunately there is no way around this.

For tax purposes, in a true lease, the lessor is the end user and must pay use tax on its cost price of the tangible personal property. Lessees do not have a tax liability under a true lease. A conditional sales agreement usually has a nominal or ?one dollar? purchase option at the close of the lease term.

As end users of titled or registered items located in Illinois, lessors owe Use Tax on the selling price of such property. The State of Illinois imposes no tax on the lease receipts. Consequently, lessees (e.g., lease customers) incur no tax liability.

You must complete Form RUT-25-LSE, Use Tax Return for Lease Transactions, if you are titling or registering in Illinois a motor vehicle, watercraft, aircraft, trailer, mobile home, snowmobile, or all-terrain vehicle (ATV) that you leased through an unregistered out-of-state dealer or retailer.

For more information about common exemptions, see Publication 104, Common Sales and Use Tax Exemptions. Sales to state, local, and federal governments. Sales to not-for-profit organizations that are exclusively charitable, religious, or educational. Sales of newspapers and magazines.

The city of Chicago, Cook County requires a 9% tax paid in the lease. It's not exactly the best scenario when leasing a vehicle and living in Chicago but unfortunately there is no way around this.

If the lessee chooses to purchase the vehicle at the end of the lease term, the lessee then becomes the owner and must pay tax on the purchase price at that time. See 86 Ill. Adm. Code 130.2010.

With a lease, you don't pay the sales tax up front. You pay sales tax monthly based on the amount of your payment. You may also have to pay an acquisition fee to the bank and a down payment called a ?cap reduction fee.?