New Jersey Proposal to approve agreement of merger with copy of agreement

Description

How to fill out Proposal To Approve Agreement Of Merger With Copy Of Agreement?

If you want to comprehensive, download, or produce lawful record web templates, use US Legal Forms, the greatest collection of lawful types, that can be found online. Utilize the site`s basic and convenient lookup to get the paperwork you want. Various web templates for company and personal reasons are categorized by classes and claims, or search phrases. Use US Legal Forms to get the New Jersey Proposal to approve agreement of merger with copy of agreement in a number of mouse clicks.

If you are currently a US Legal Forms buyer, log in to your profile and then click the Obtain button to get the New Jersey Proposal to approve agreement of merger with copy of agreement. You can even accessibility types you earlier downloaded from the My Forms tab of your respective profile.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have chosen the form to the appropriate area/land.

- Step 2. Use the Preview option to look over the form`s content. Never neglect to learn the information.

- Step 3. If you are unhappy together with the type, use the Research discipline towards the top of the display screen to get other models from the lawful type format.

- Step 4. When you have found the form you want, go through the Acquire now button. Select the rates strategy you choose and add your accreditations to sign up for the profile.

- Step 5. Process the financial transaction. You can utilize your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Pick the format from the lawful type and download it on the product.

- Step 7. Comprehensive, revise and produce or sign the New Jersey Proposal to approve agreement of merger with copy of agreement.

Every single lawful record format you get is your own eternally. You have acces to every single type you downloaded with your acccount. Go through the My Forms area and select a type to produce or download once again.

Compete and download, and produce the New Jersey Proposal to approve agreement of merger with copy of agreement with US Legal Forms. There are many professional and condition-particular types you may use for your personal company or personal requires.

Form popularity

FAQ

In the law of real property, the merger doctrine stands for the proposition that the contract for the conveyance of property merges into the deed of conveyance; therefore, any guarantees made in the contract that are not reflected in the deed are extinguished when the deed is conveyed to the buyer of the property.

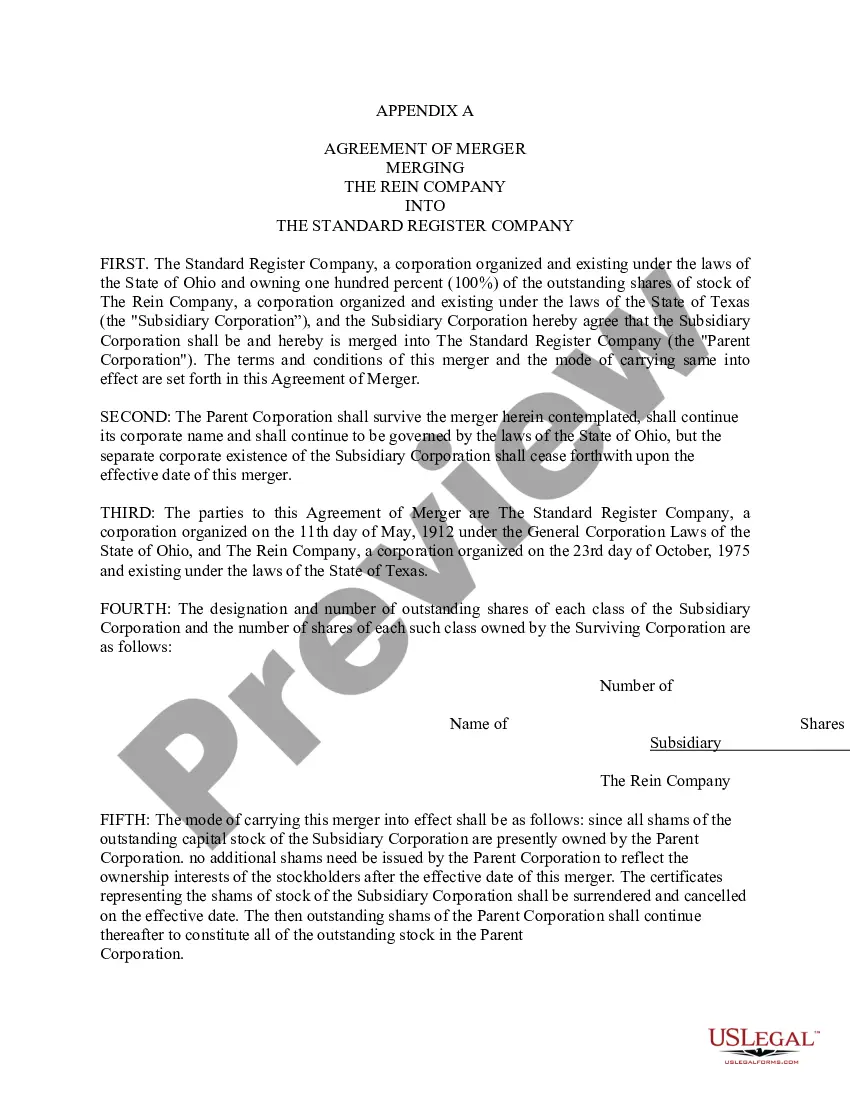

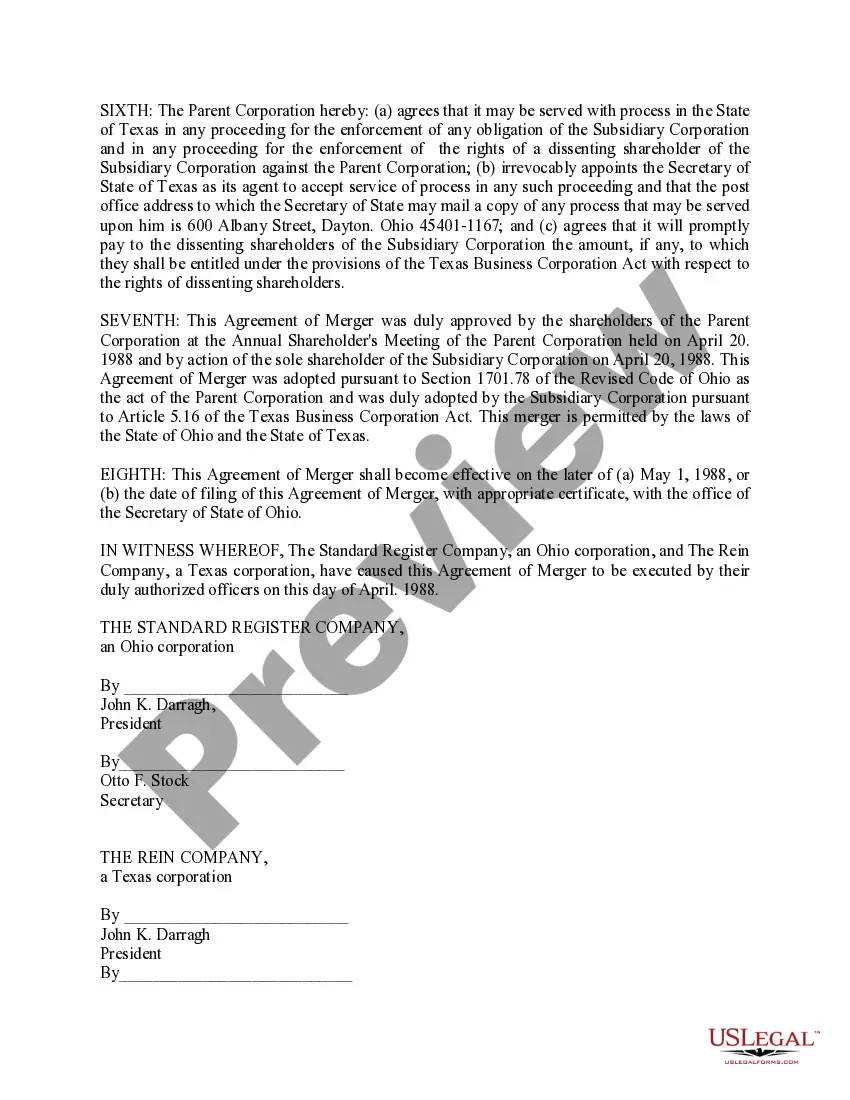

An agreement of merger is a legal document that establishes the terms and conditions to combine two or more businesses into one new entity. The business owners of the merging companies agree to sell all their stock and assets to the newly formed company for an agreed upon price.

New Jersey law prohibits domestic corporations from merging/consolidating with another business entity, if authority for such merger/consolidation is not granted under the laws of the jurisdiction under which the other business entity is organized. Other business entities may participate.

The doctrine of "merger" involves adjacent lots, which do not conform to the lot area or lot width requirements of the zoning code and which are held in common ownership, merging to become one zoning lot.

In corporate law, a merger is the absorption of one corporation into another. The surviving corporation acquires all the assets and liabilities of the corporation getting absorbed. The joining of non-corporate entities such as associations may sometimes be called a merger as well.

14A:10-1. Procedure for merger. (1) Any two or more domestic corporations, or any one or more domestic corporations and any one or more other business entities, may merge into one of such corporations or other business entities pursuant to a plan of merger approved in the manner provided in this act.

A tax clearance certificate, issued by the New Jersey Division of Taxation must be obtained and submitted with the merger/consolidation documents for each participating corporation when the surviving or resulting business is not a registered or authorized domestic or foreign business entity in New Jersey.

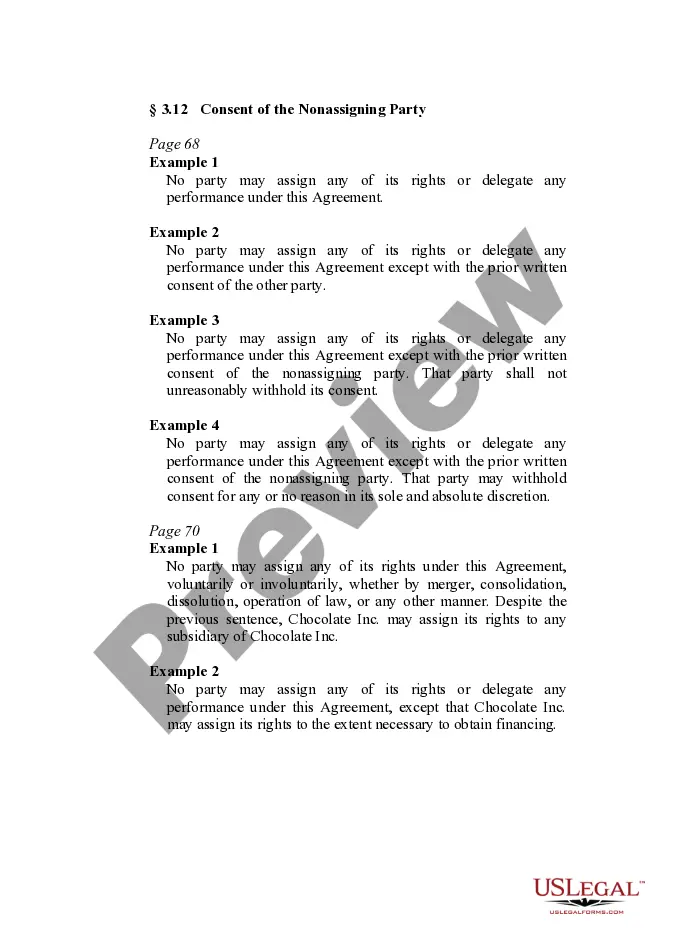

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.