New Jersey Employee Evaluation Form for Farmer

Description

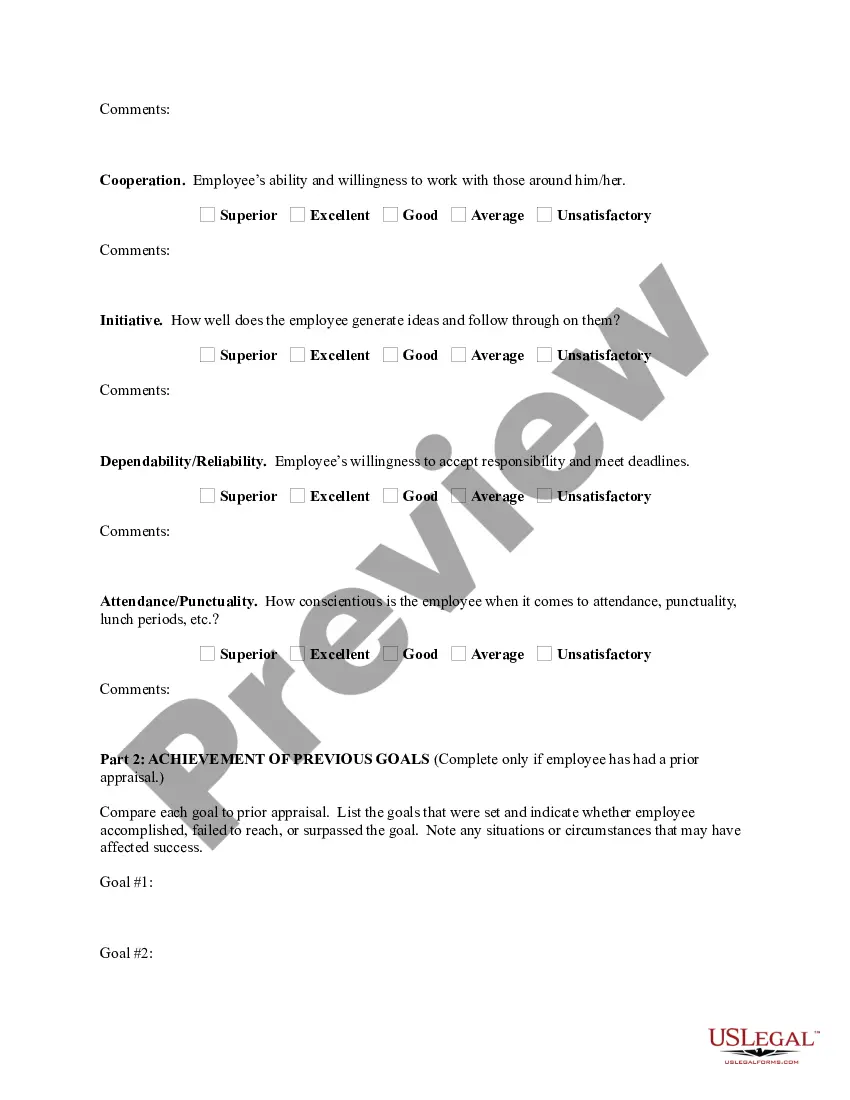

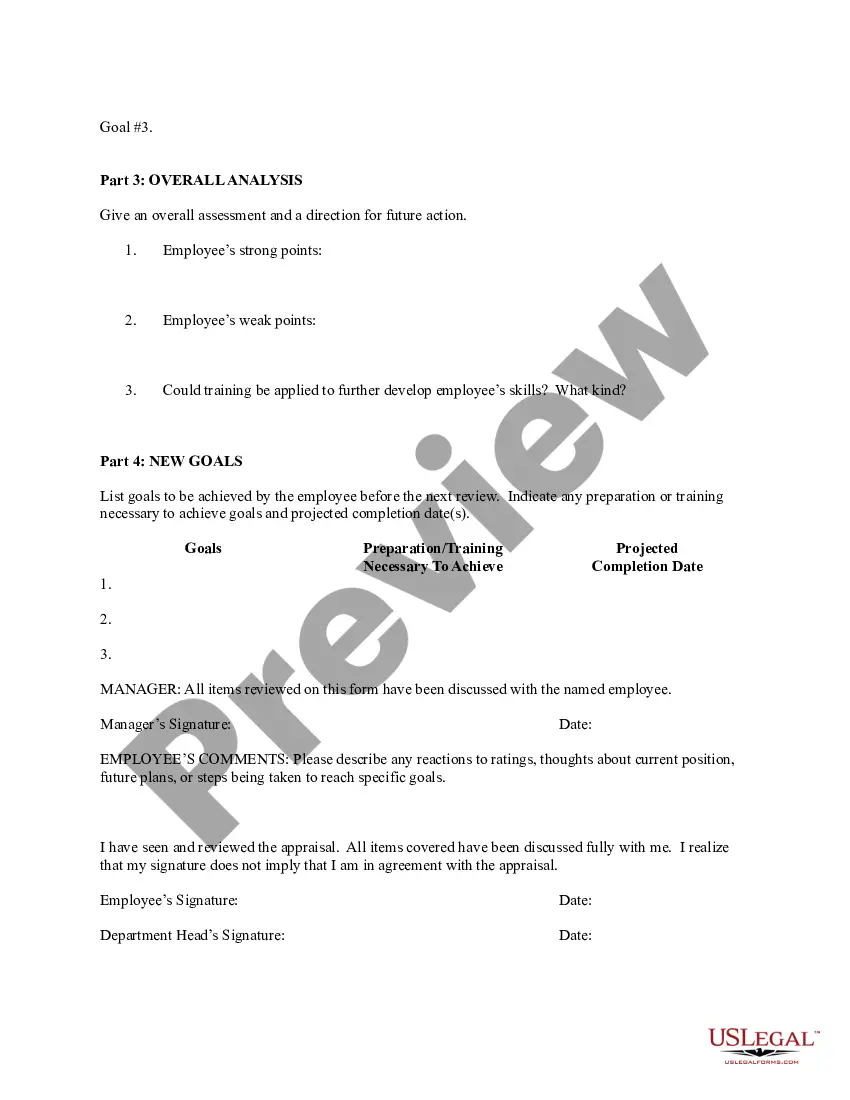

How to fill out Employee Evaluation Form For Farmer?

US Legal Forms - one of the most significant libraries of legal types in the USA - delivers a wide range of legal file templates you may download or produce. Using the web site, you can find thousands of types for company and personal uses, sorted by types, states, or key phrases.You will find the latest types of types just like the New Jersey Employee Evaluation Form for Farmer within minutes.

If you already possess a subscription, log in and download New Jersey Employee Evaluation Form for Farmer in the US Legal Forms local library. The Download key will appear on every type you look at. You have accessibility to all in the past saved types within the My Forms tab of your own bank account.

If you would like use US Legal Forms the very first time, listed below are straightforward recommendations to help you get started out:

- Ensure you have picked the best type for your personal city/region. Go through the Preview key to check the form`s articles. See the type description to ensure that you have selected the right type.

- When the type does not suit your specifications, utilize the Look for field on top of the screen to obtain the the one that does.

- If you are pleased with the form, verify your decision by clicking on the Acquire now key. Then, opt for the prices program you prefer and give your qualifications to sign up for an bank account.

- Method the purchase. Utilize your credit card or PayPal bank account to accomplish the purchase.

- Pick the structure and download the form on the system.

- Make changes. Load, change and produce and signal the saved New Jersey Employee Evaluation Form for Farmer.

Every single format you put into your account does not have an expiration date which is your own permanently. So, in order to download or produce yet another version, just visit the My Forms portion and click around the type you want.

Gain access to the New Jersey Employee Evaluation Form for Farmer with US Legal Forms, probably the most extensive local library of legal file templates. Use thousands of specialist and condition-certain templates that fulfill your business or personal requirements and specifications.

Form popularity

FAQ

What is Farmland Assessment? The New Jersey Farmland Assessment Act of 1964 permits farmland and woodland acres that are actively devoted to an agricultural or horticultural use to be assessed at their productivity value. The Act does not apply to buildings of any kind, or to the land associated with the farmhouse.

To be eligible for Farmland Assessment, land actively devoted to an agricultural or horticultural use must have not less than 5 acres devoted to the production of crops; livestock or their products; and/or forest products under a woodland management plan.

Under section 10(1) of the Income Tax Act, 1961, agricultural income is exempted from tax. Any proceeds from rent, revenue or transfer of agricultural land and incomes from farming are considered as agricultural income under the law.

Sales of tangible personal property as well as production and conservation services to a farmer are exempt from New Jersey sales and use tax when used directly and primarily in the production, handling and preservation for sale of agricultural or horticultural commodities at the farming enterprise of that farmer.

--An agricultural assessment provides for a reduction in property taxes for land used in agricultural production. --The farmer must apply to the town assessor on an annual basis.

What is an agricultural assessment? An agricultural assessment allows land utilized for agricultural purposes to be assessed based on its agricultural value as opposed to its commercial value. An agricultural assessment applies to school, country and town property taxes and is based on the soil types on the farm.

Under the program:An applicant for a farmland assessment must own the land and file an application with the municipal tax assessor.Land must be devoted to agricultural and/or horticultural uses for at least two years prior to the tax year the applicant is applying for an assessment.More items...?

2022 Farm saved seed exception or exemption (also known as farmers' privilege) refers to the. optional exception permitted by the breeder's right in Article 15(2) of the 1991 Act of the. UPOV Convention which within reasonable limits and subject to the safeguarding of the.

Even with Farmland Tax Assessment, New Jersey farmers pay many times the national average property taxes per acre of farmland (US Census of Agriculture). Farmers are not exempt from market value assessed property taxes.