New Jersey Employee Evaluation Form for Nonprofit

Description

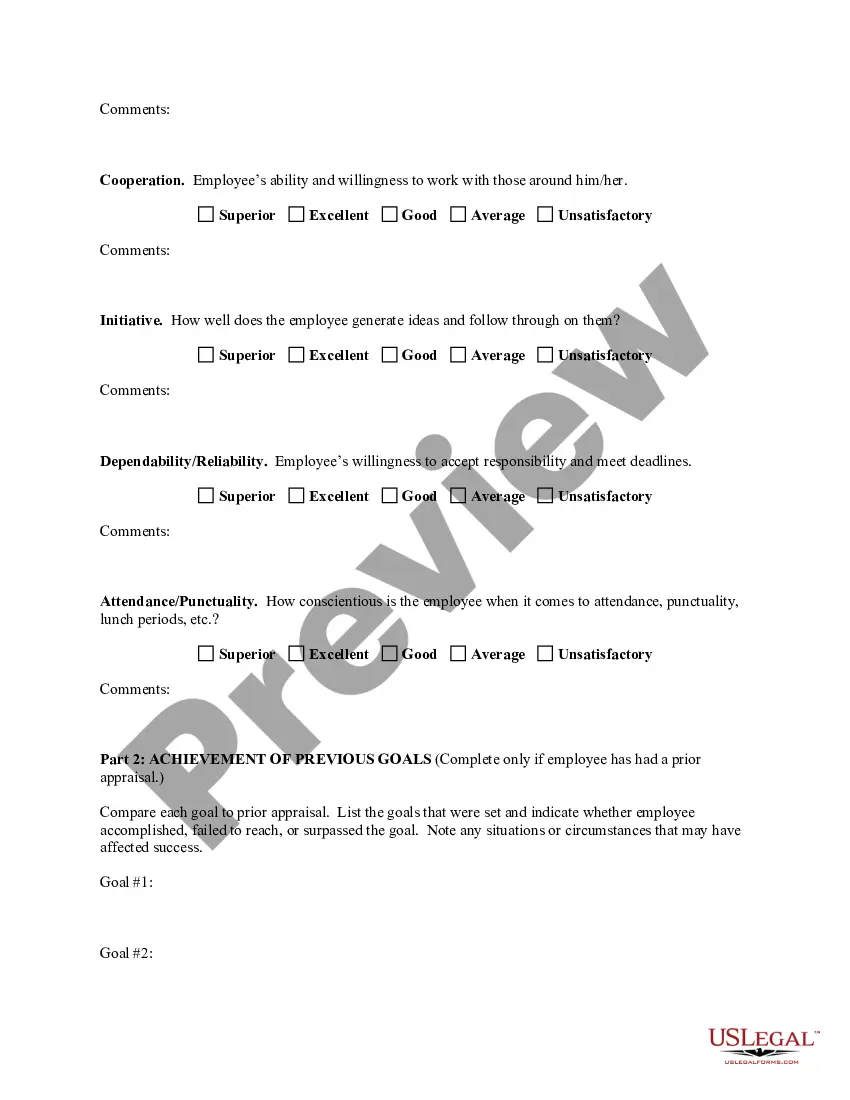

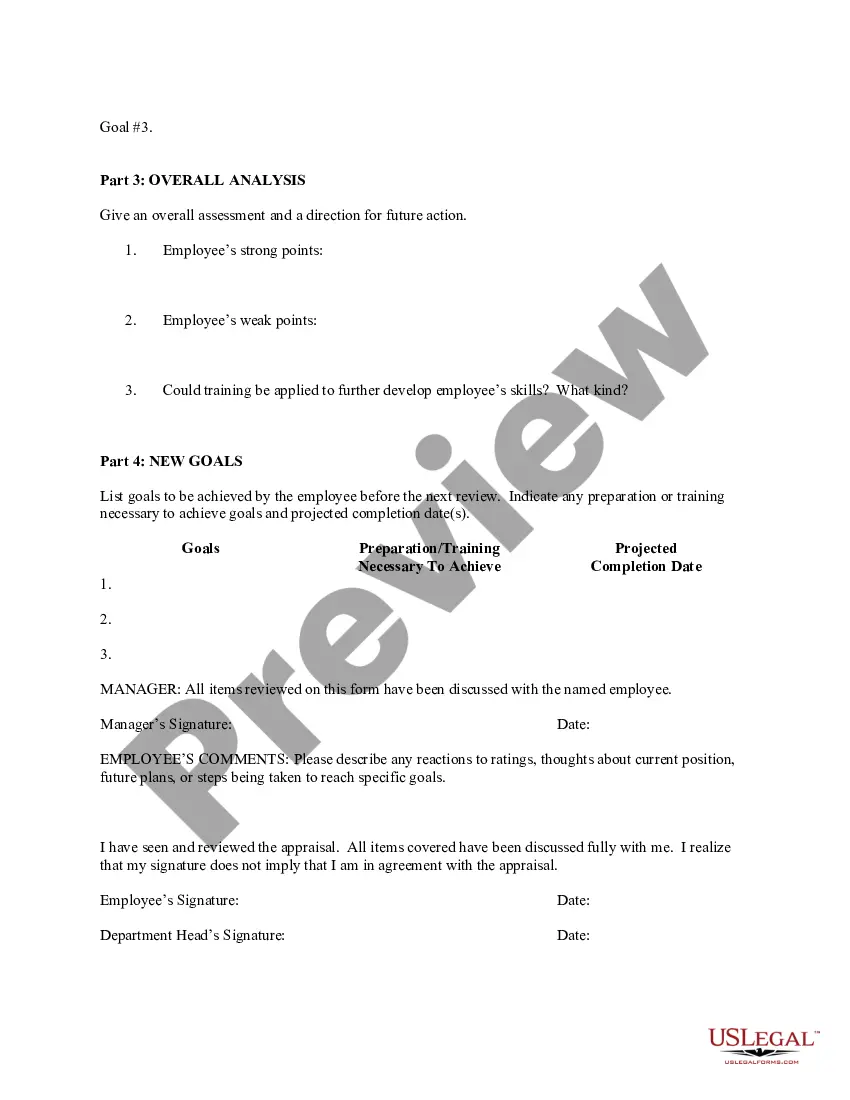

How to fill out Employee Evaluation Form For Nonprofit?

If you need to thorough, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Utilize the website's straightforward and user-friendly search to find the documents you require.

Various templates for corporate and personal purposes are categorized by types and states, or keywords.

Step 4. After identifying the form you need, click the Purchase now button. Select your preferred pricing plan and enter your details to create an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the New Jersey Employee Evaluation Form for Nonprofit within just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to retrieve the New Jersey Employee Evaluation Form for Nonprofit.

- You can also find forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you've chosen the form for your correct city/state.

- Step 2. Use the Review option to examine the form's content. Be sure to read the summary.

- Step 3. If you are not content with the form, utilize the Search field at the top of the screen to discover other variations of your legal form template.

Form popularity

FAQ

When filling out a New Jersey title as a buyer, you need to provide key information such as the vehicle's details, your name, and address. Ensure each section of the title is accurately documented to prevent future legal issues. Completing this form correctly can facilitate a smooth ownership transfer process.

To fill out the ST4 form in New Jersey, start by gathering the necessary organizational information, including your tax-exempt status and related documents. Clearly follow the instructions provided with the form to ensure each section is properly filled. Successful submission of the form can enhance your nonprofit’s efficiency in financial management.

Filling out the ST-4 form in New Jersey involves providing information about your organization and the nature of your tax-exempt status. First, ensure that you have all required details, such as your organization’s name and federal tax ID. Accurate completion of this form can help your nonprofit benefit from sales tax exemptions effectively.

What is Form ST-8? The Form ST-8 (certificate of exempt capital improvements) is to be used when the association is undertaking a capital improvement that is exempt from NJ sales tax.

ST-3 (3-17) The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. State of New Jersey. Division of Taxation. SALES TAX.

Most tax-exempt organizations that have gross receipts of at least $200,000 or assets worth at least $500,000 must file Form 990 on an annual basis. Some organizations, such as political organizations, churches and other religious organizations, are exempt from filing an annual Form 990.

Form ST-4 makes it possible for businesses to purchase production machinery, packaging supplies, and other goods or services without paying Sales Tax if the way they intend to use these items is specifically exempt under New Jersey law.

Even though nonprofits are exempt from income tax and not subject to withholding taxes, you must fill out and issue Form W-9 to the requesting business entities. In fact, all nonprofits must submit this form in order to be eligible for the tax-exempt status.

Websites like Economic Research Institute, and Pro Publica have free search tools to access 990s. Websites of the Secretary of State or Attorney General where the organization is incorporated. Some states may make 990s and other public documents available online or upon individual request.

Evaluations should include input from program participants and should monitor the satisfaction of participants. They should be candid and should be used by leadership to strengthen the organization's effectiveness, and, when necessary, be used to make programmatic changes.