New Jersey Check Requisition Worksheet

Description

How to fill out Check Requisition Worksheet?

If you wish to complete, download, or create official document templates, utilize US Legal Forms, the largest array of official forms available online.

Employ the site's straightforward and convenient search feature to obtain the documents you need.

Various templates for business and personal purposes are categorized by types and states, or search terms.

Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Utilize US Legal Forms to acquire the New Jersey Check Requisition Worksheet in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to obtain the New Jersey Check Requisition Worksheet.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

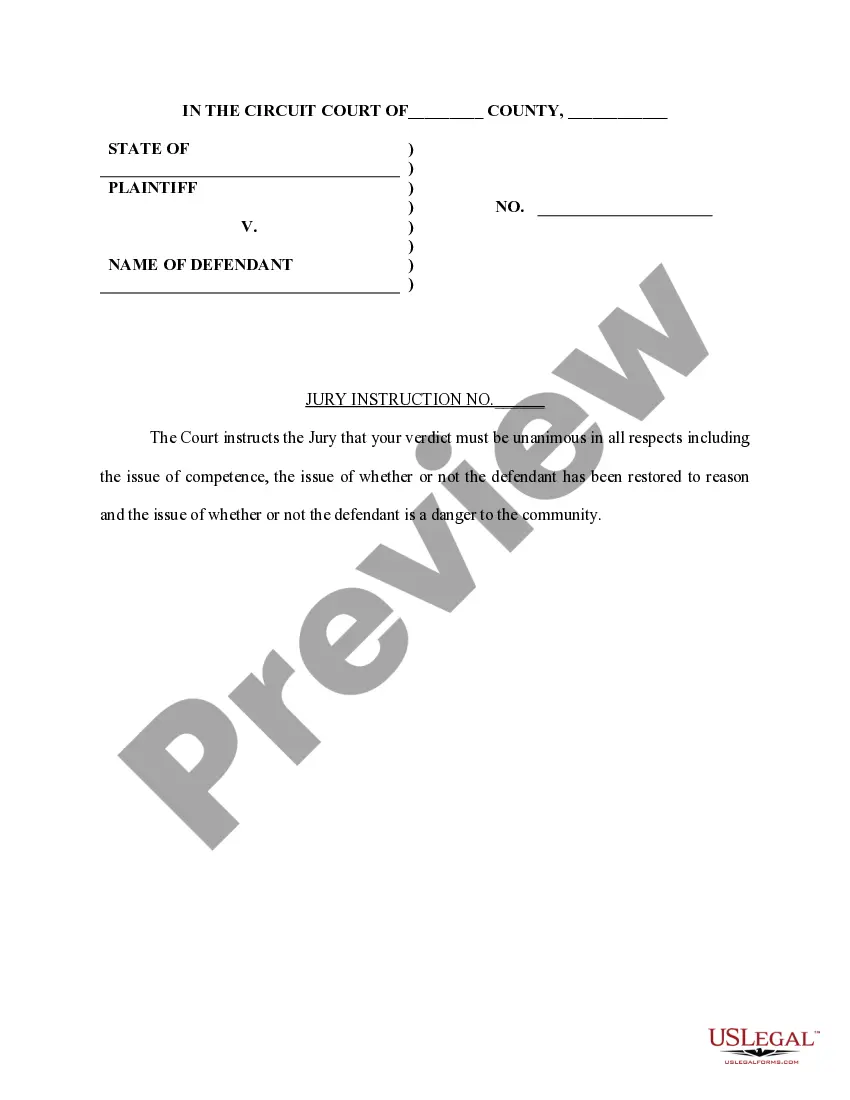

- Step 2. Use the Review option to examine the form's content. Do not forget to read the overview.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the display to find other versions of the official form template.

Form popularity

FAQ

How to Fill Out NJ Sales Tax Exempt Form ST-3?Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction.Provide your taxpayer registration number.Describe the nature of goods or services you sell in an ordinary course of business.More items...

Although certificates of exemption do not actually expire, New Jersey recommends that it would be good business practice for a seller to request a new form at least every few years.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

Agencies of the federal government and the United Nations as well as the State of New Jersey and its political subdivisions are exempt from paying Sales Tax provided the agency making the purchase supplies the seller with a copy of a valid purchase order or contract signed by an authorized official.

ST3, Certificate of Exemption. Page 1. Form ST3, Certificate of Exemption. Purchaser: Complete this certificate and give it to the seller. Seller: If this certificate is not completed, you must charge sales tax.

How to fill out the New Jersey Resale CertificateStep 1 Begin by downloading the New Jersey Resale Certificate Form ST-3.Step 2 Identify the name and business address of the seller.Step 3 Describe the nature of merchandise or service of the buyer.Step 4 List the merchandise or services being purchased.More items...?

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

2014 Schedule NJ-BUS-1Use Part IV to report all other net gains or income less net losses from rents, royal- ties, patents, and copyrights.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.