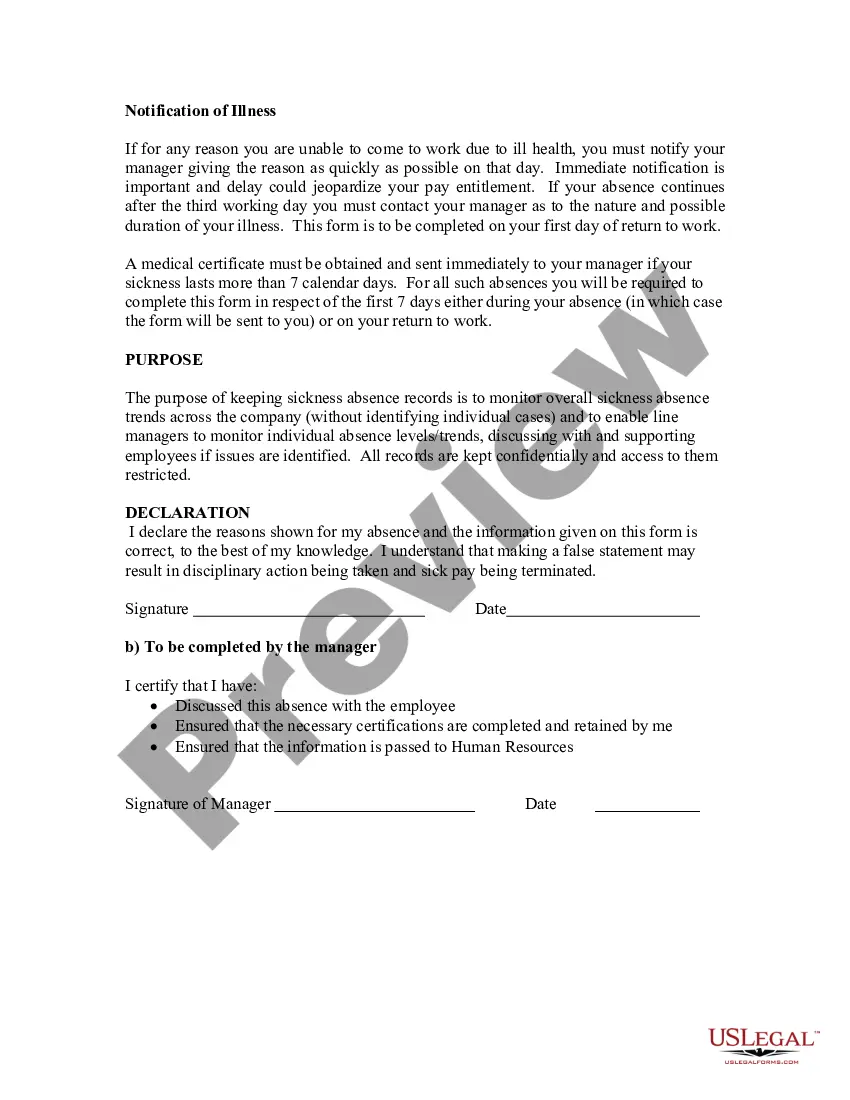

New Jersey Record of Absence - Self-Certification Form

Description

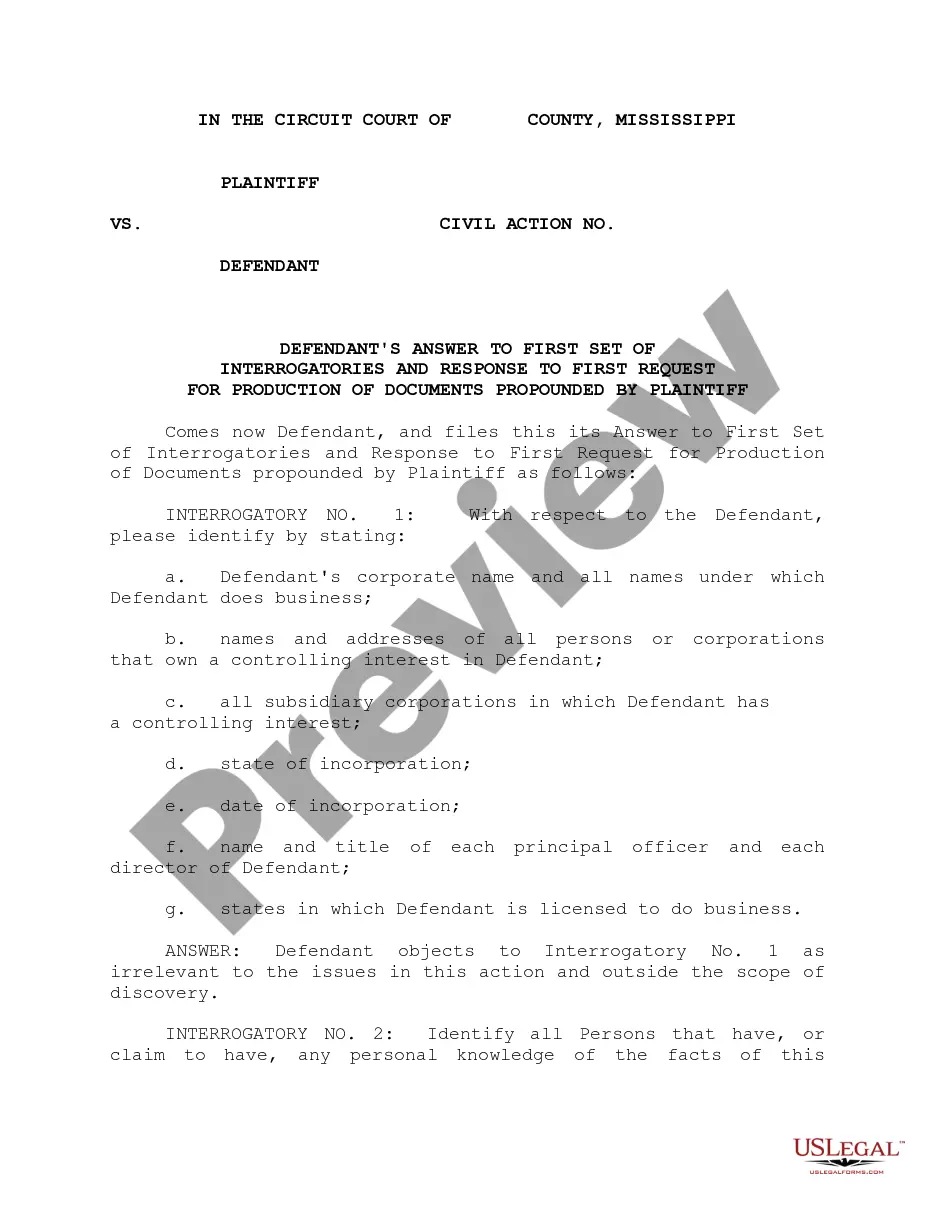

How to fill out Record Of Absence - Self-Certification Form?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can access thousands of documents for business and personal needs, sorted by categories, states, or keywords. You can obtain the latest versions of documents such as the New Jersey Record of Absence - Self-Certification Form in just a few minutes.

If you already have an account, Log In to download the New Jersey Record of Absence - Self-Certification Form from the US Legal Forms library. The Download button will be visible on every document you preview. You will have access to all previously downloaded documents in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment.

Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the downloaded New Jersey Record of Absence - Self-Certification Form. Each document you add to your account does not have an expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you want. Access the New Jersey Record of Absence - Self-Certification Form with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your area/region.

- Click the Review button to examine the form's content.

- Check the form description to confirm you have chosen the right one.

- If the form does not meet your needs, use the Search bar at the top of the screen to find a suitable alternative.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, select your preferred payment plan and provide your information to create an account.

Form popularity

FAQ

The FL1 form in New Jersey is an application for family leave insurance benefits. This form allows eligible employees to request time off for family caregiving purposes. Completing the FL1 form correctly can ensure that you receive the benefits you're entitled to, which can be documented effectively alongside the New Jersey Record of Absence - Self-Certification Form.

Also effective January 2022, Temporary Disability Insurance benefits provide 85% of the covered employee's average weekly wage, capped at $993/week (70% of the state average weekly wage) for a maximum duration of 26 weeks in most cases. Read more about Temporary Disability Insurance here.

New Jersey Family Leave Insurance (FLI) is a partial wage-replacement program. It does not guarantee employer-approved time off or job protection.

Official Site of The State of New Jersey Want to Extend or End Your Claim? You can only extend or end a claim online if you received a Form P30 (Request to Claimant For Continued Claim Information) in the mail. It has a unique Form ID number you will need to enter into the online system.

You may be eligible for Temporary Disability Insurance benefits if your physical or mental illness or injury prevents you from working and was not caused by your work, or if you are at high risk for COVID-19 due to underlying health conditions.

You can get benefits for up to 26 weeks. This means that even if your injury or illness lasts more than 26 weeks, your benefits will stop. However, if you suffer a new disabling medical condition and apply for TDI, the 26 weeks will start again.

It can take two to six weeks to approve a claim and pay benefits after we have a complete application. stop working due to your need to care for an ill or injured family member/loved one; see the law's generous definition of family here.

To be covered by the FMLA, you need to have worked (1) for the employer for at least 12 months; (2) at least 1,250 hours during the previous 12 months; and (3) in a location that has at least 50 employees within a 75 mile radius.

C10 - Request to Claimant for Information We send this form if your application is missing information, or if the information you provide doesn't match the statement of your medical provider and/or employer.

You can take credit on your New Jersey tax return for any excess unemployment insurance (UI)/workforce development partnership fund (WF)/supplemental workforce fund (SWF) contributions, disability insurance (DI) contributions, and/or family leave insurance (FLI) contributions withheld by two or more employers.