New Jersey Use of Company Equipment

Description

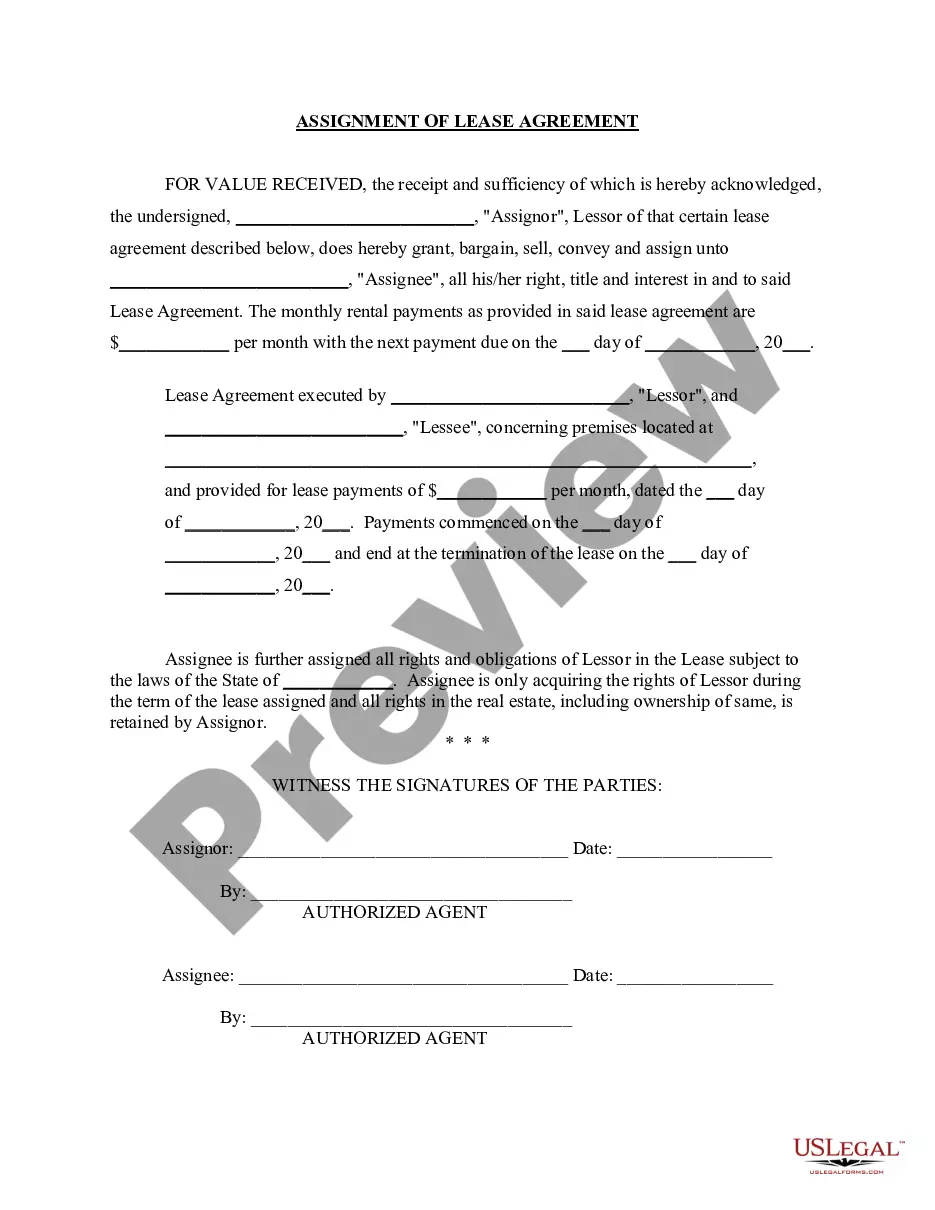

How to fill out Use Of Company Equipment?

Are you in a circumstance where you will require paperwork for either organizational or personal reasons almost consistently.

There are numerous legitimate form templates accessible online, but finding ones you can rely on is not easy.

US Legal Forms provides a wide array of template forms, such as the New Jersey Use of Company Equipment, which are designed to comply with state and federal regulations.

Once you find the appropriate form, just click Get now.

Select the pricing plan you desire, fill in the necessary information to make your payment, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New Jersey Use of Company Equipment template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/state.

- Use the Review button to examine the document.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, utilize the Lookup section to find the form that suits your requirements.

Form popularity

FAQ

To fill out the NJ ST-4 form, you need to specify the name and address of the buyer, the type of property, and the reason for the exemption. It’s crucial to ensure all information is accurate, as errors can lead to tax liabilities. If you're dealing with New Jersey Use of Company Equipment, make sure you document everything properly to avoid complications.

Filling out the NJ ST-3 form requires you to provide details about the purchaser, including the address and the reason for the exemption. Be sure to indicate the specific type of property or service acquired and list the related exemption number. This is particularly important for businesses using New Jersey Use of Company Equipment to ensure proper tax exemption.

Includes all motor vehicles used for the transportation of passengers for hire, except school buses, limousines, and taxis.

In general, an employee only needs to complete Form NJ-W4 once. An employee completes a new form only when they want to revise their withholding information.

In general, clothing, groceries, medicines and medical devices and industrial equipment are sales tax exempt in many states (but don't assume they'll be exempt in all states. Every state is different when it comes to sales tax!)

Some examples of nontaxable goods and services are: Unprepared food for human consumption, clothing, certain professional and personal services, and real estate sales.

If a vehicle bears a yellow number plate with black text used to denote number of the vehicle, it means the vehicle is a commercial vehicle such as a taxi or a bus and can be used for any commercial purpose.

Here's a list of TAXABLE items you may encounter on your weekly trip to the store:Acne products cleansers or soaps (creams or lotions are exempt)Air fresheners.Alcoholic beverages.Aluminum foil.Ammonia.Antiperspirants, deodorants.Baby bath soaps, lotions, powder, shampoos.Bags (Plastic, cloth)More items...?

The Gross Vehicle Weight Rating (GVWR) or the combined gross vehicle weight rating if vehicle is 26,001 pounds or more and the vehicle is registered or principally garaged in New Jersey. Lettering height must be at least three inches.

The Sales and Use Tax Act provides an exemption for sales of machinery, apparatus or equipment for use or consumption directly and primarily in the production of tangible personal property by manufacturing, processing, assembling or refining. N.J.S.A.