Tennessee Sample Self-Employed Independent Contractor Agreement - for ongoing relationship

Description

How to fill out Sample Self-Employed Independent Contractor Agreement - For Ongoing Relationship?

Have you ever been in a location where you require documents for either business or personal reasons nearly every workday.

There are numerous legitimate document templates accessible online, but locating trustworthy versions can be challenging.

US Legal Forms offers thousands of form templates, such as the Tennessee Sample Self-Employed Independent Contractor Agreement - for ongoing relationship, designed to comply with state and federal requirements.

Once you find the correct form, click Acquire now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already aware of the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Tennessee Sample Self-Employed Independent Contractor Agreement - for ongoing relationship template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

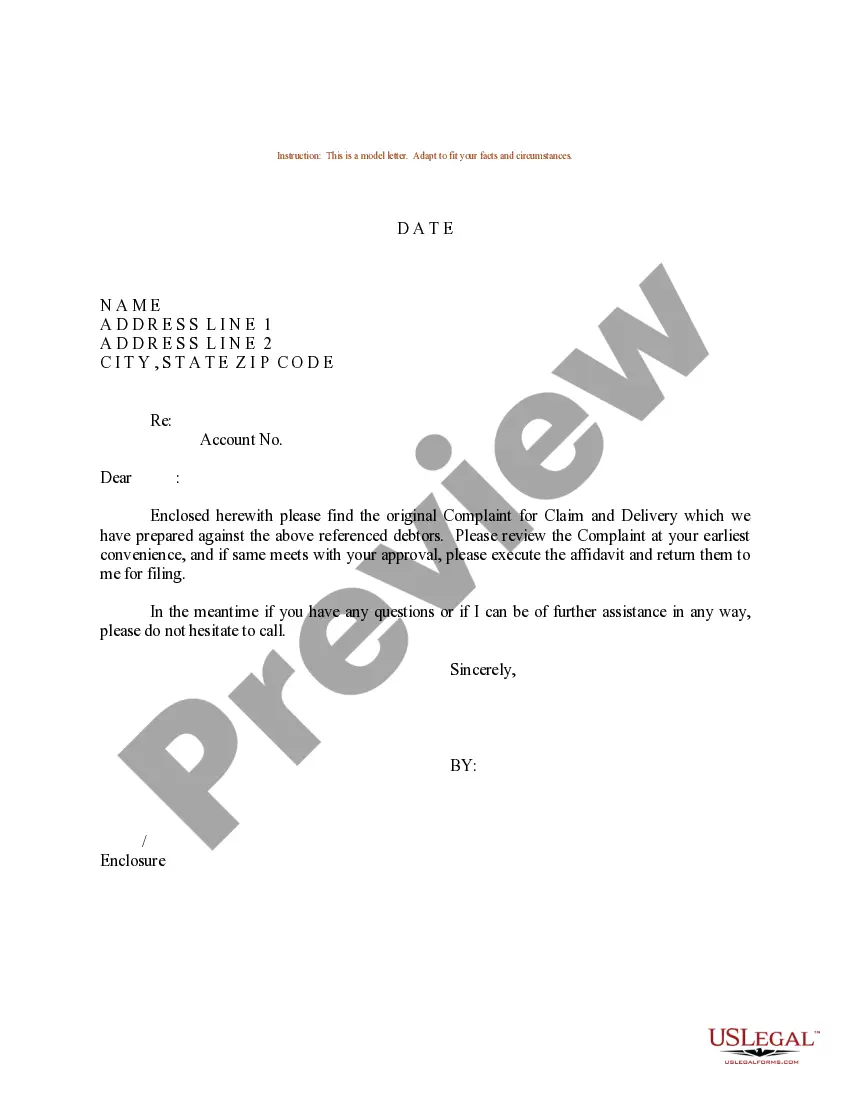

- Utilize the Preview button to examine the form.

- Review the description to confirm that you have selected the accurate form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your requirements.

Form popularity

FAQ

Yes. The contractor should receive a 1099 form if the LLC is treated as a partnership as well as a single-member LLC (disregarded entity).

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

One of the biggest differences between contractors and employees is the way they are paid and taxed. An employee is on a business's payroll, so the company pays the employee their hourly wage or salary and withholds the appropriate taxes (e.g., federal income tax, Social Security tax, Medicare tax).

Even as a sole proprietor, an independent contractor is technically its own business entity. Therefore, a company and an independent contractor are in a business-to-business relationship. On the other hand, an employment relationship is formed between a business and individual once an employment contract is signed.

Partners in a partnership (including certain members of a limited liability company (LLC)) are considered to be self-employed, not employees, when performing services for the partnership.

Like all self-employed workers, independent contractors can pick and choose which projects they want to work on. They can take multiple short-term jobs, but it's more common that they opt for longer-term work arrangements with one or two clients. Because of this, most are paid by the hour.

Such a partner who devotes time and energy in the conduct of the trade of business of the partnership, or in providing services to the partnership as an independent contractor, is a self- employed individual rather than a common law employee.

The fixed, periodic compensation of a partner (often referred to as guaranteed payments or the partner's draw) is therefore self-employment income rather than employee wages. A partner's salary is reported to the partner on a Schedule K-1 as a guaranteed payment rather than on a Form W-2.

Is A Contractor A Business Partner? The subcontracts referred to by general contractors in projects may be regarded as partners, but in law they are independent contractors as well.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.