New Jersey Returned Items Report

Description

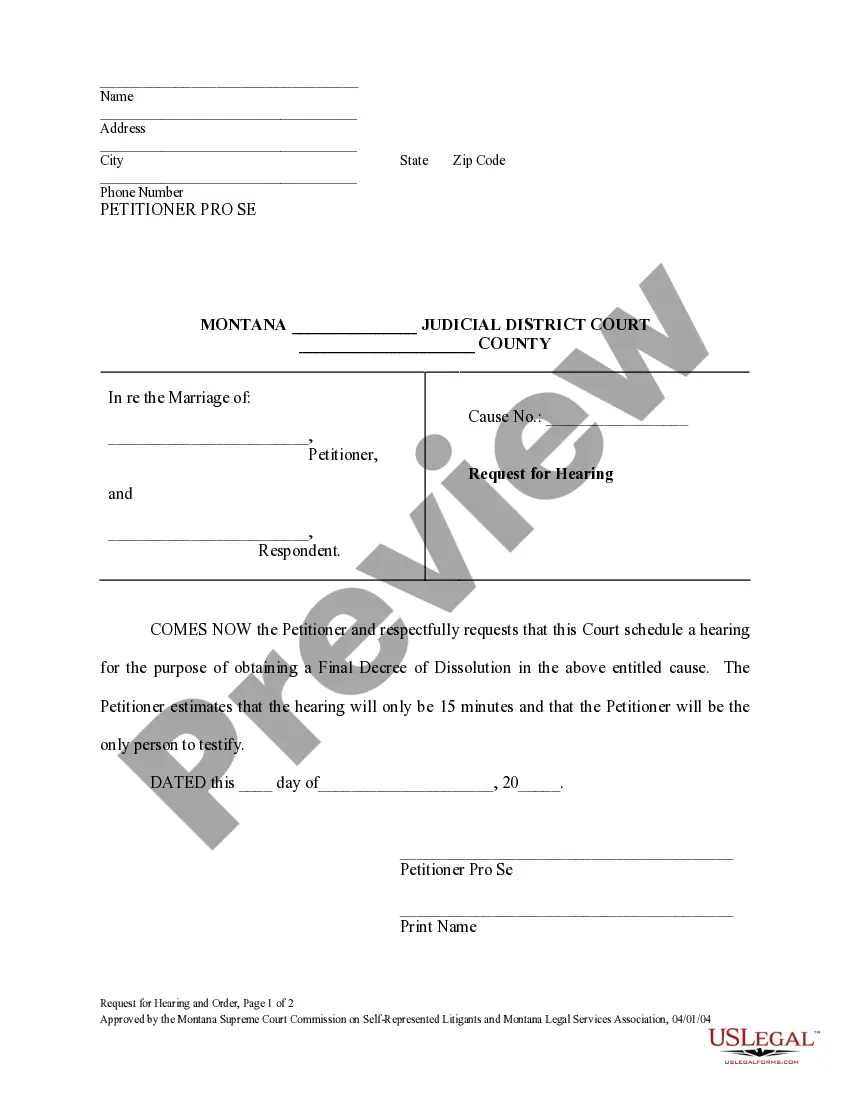

How to fill out Returned Items Report?

You might spend a few hours online trying to locate the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are examined by experts.

You can easily obtain or print the New Jersey Returned Items Report from my service.

Review the form description to verify you have selected the correct template. If available, utilize the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can fill out, modify, print, or sign the New Jersey Returned Items Report.

- Every legal document template you acquire is yours indefinitely.

- To receive another copy of any downloaded form, navigate to the My documents section and click on the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city that you choose.

Form popularity

FAQ

If you are a resident of NJ, according to the NJ department of revenue, you are required to file an NJ resident state income tax return if: your filing status is married filing jointly and your gross income from everywhere for the entire year was more than the filing threshold of $20,000.

Any person who became a resident of New Jersey or moved out of this State during the year, and whose income from all sources for the entire year is greater than $7,500 ($3,750 for married persons filing separately), must file a resident return and report that portion of the income received while a resident of New

The ST-5 exemption certificate grants your organization exemption from New Jersey sales and use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services.

In addition to proof of your identity, and the identities of your family members, documents you should bring to a tax preparer include: Social Security documents. Income statements such as W-2s and MISC-1099s. Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations.

If less than zero, make no entry. If your income for the entire year is not more than $20,000 ($10,000 if your filing status is single or married/CU partner filing separate return), you have no tax liability to New Jersey and are not required to file a return.

If your New Jersey gross income is less than $10,000 ($20,000 if filing as Married Filing Jointly, Head of Household, or Qualifying Widow(er)) then you are not required to file a New Jersey tax return.

They will include important information such as where to file, what to attach to the return (i.e. W-2s, 1099s, etc.), refund or balance due, information about estimated tax payments, etc. Note. File your return, schedules, and other attachments on standard size paper.

NJ Income Tax Who Must FilePart-year residents are subject to tax and must file a return if their income for the entire year was more than the filing threshold amount for their filing status. Similar filing requirements apply for nonresidents.

Where to FileMail Amended Returns (Form NJ-1040X) to: STATE OF NEW JERSEY.DIVISION OF TAXATION. REVENUE PROCESSING CENTER.PO BOX 664. TRENTON NJ 08646-0664.

How to Assemble Paper Tax ReturnsSign your return.Prepare your refund or payment information.Gather your tax forms and schedules for assembly.Attach additional statements.Staple all your forms and schedules together in the upper right corner.Attach W-2 and 1099 income documents.More items...