New Jersey Worksheet for Job Requirements

Description

How to fill out Worksheet For Job Requirements?

Are you in a situation where you frequently require documents for potential business or personal objectives almost daily.

There are numerous legal document templates available online, but finding reliable ones isn't simple.

US Legal Forms offers a vast array of form templates, such as the New Jersey Worksheet for Job Requirements, which can be printed to comply with federal and state regulations.

Utilize US Legal Forms, the most comprehensive collection of legal forms, to save time and reduce errors.

The service offers professionally designed legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the New Jersey Worksheet for Job Requirements template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- 1. Acquire the form you need and ensure it corresponds to your specific city/state.

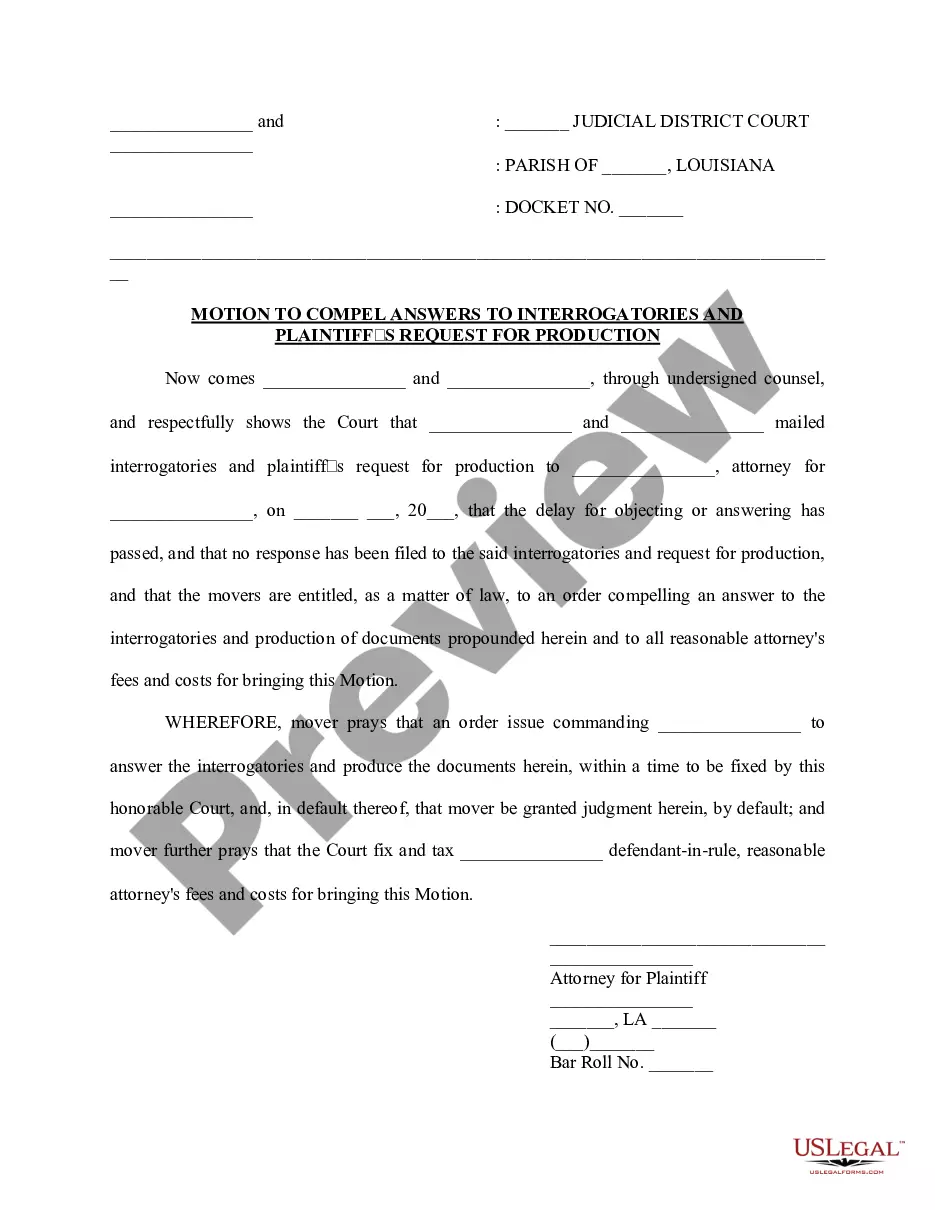

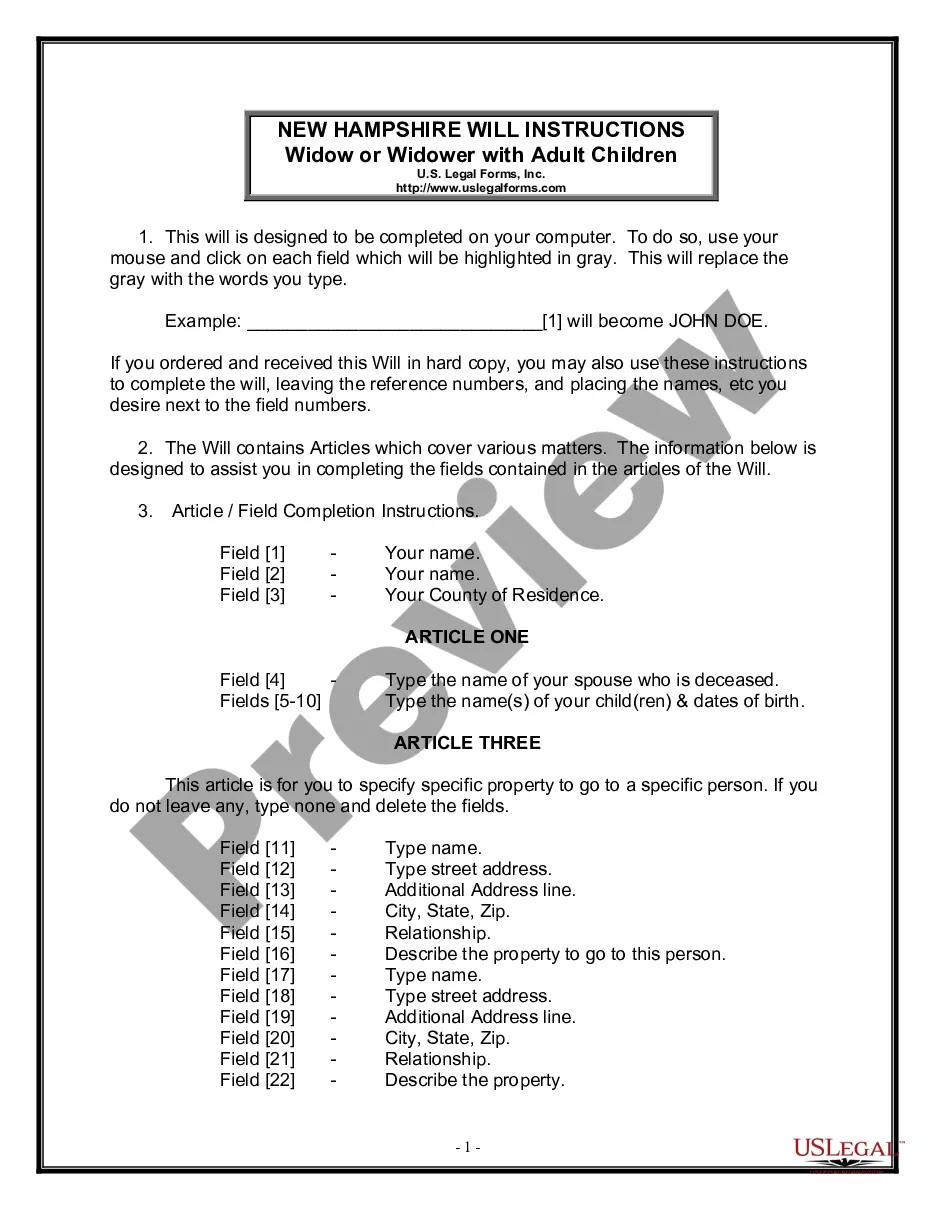

- 2. Utilize the Preview button to review the form.

- 3. Examine the description to confirm that you have selected the correct form.

- 4. If the form isn't what you're searching for, use the Look for section to find the form that fits your needs and requirements.

- 5. Once you find the right form, click Purchase now.

- 6. Choose the pricing plan you want, complete the necessary information to set up your account, and purchase your order using PayPal or Visa or MasterCard.

- 7. Choose a suitable file format and download your copy.

- 8. Access all the document templates you have acquired in the My documents section. You can retrieve another copy of the New Jersey Worksheet for Job Requirements whenever needed. Simply click on the desired form to download or print the document template.

Form popularity

FAQ

Your Guide to New Hire PaperworkRegister as an Employer With the IRS.Form W-4 for Federal Income Tax Withholding.Form I-9 and E-Verify System for Employment Eligibility.Job Application Form.Register With State Employment Agencies.Get Workplace Posters.Provide Your Employee Handbook.What to Do With New Hire Paperwork.More items...?22-May-2021

How Many Allowances Should I Claim if I'm Single? If you are single and have one job, you can claim 1 allowance. There's also the option of requesting 2 allowances if you are single and have one job.

NJ Taxation Employers must file a Gross Income Tax Reconciliation of Tax Withheld (Form NJ-W-3) each year to report the total monthly tax remitted, wages paid and withholdings. Registered employers must file Form NJ-W-3 even if no wages were paid and no tax was withheld during the year.

In general, an employee only needs to complete Form NJ-W4 once.

How to fill out a W-4 formStep 1: Personal information.Step 2: Account for multiple jobs.Step 3: Claim dependents, including children.Step 4: Refine your withholdings.Step 5: Sign and date your W-4.» MORE: See more about what it means to be tax-exempt and how to qualify.

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.15-Jun-2020

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

New Jersey employers should provide new employees with both the IRS Form W-4 and the Form NJ-W4. See Employee Withholding Forms. New Jersey employers just provide new employees with notice of employee rights under New Jersey wage and hour laws.

Have the employees you hire fill out Form I-9, Employment Eligibility Verification PDF.