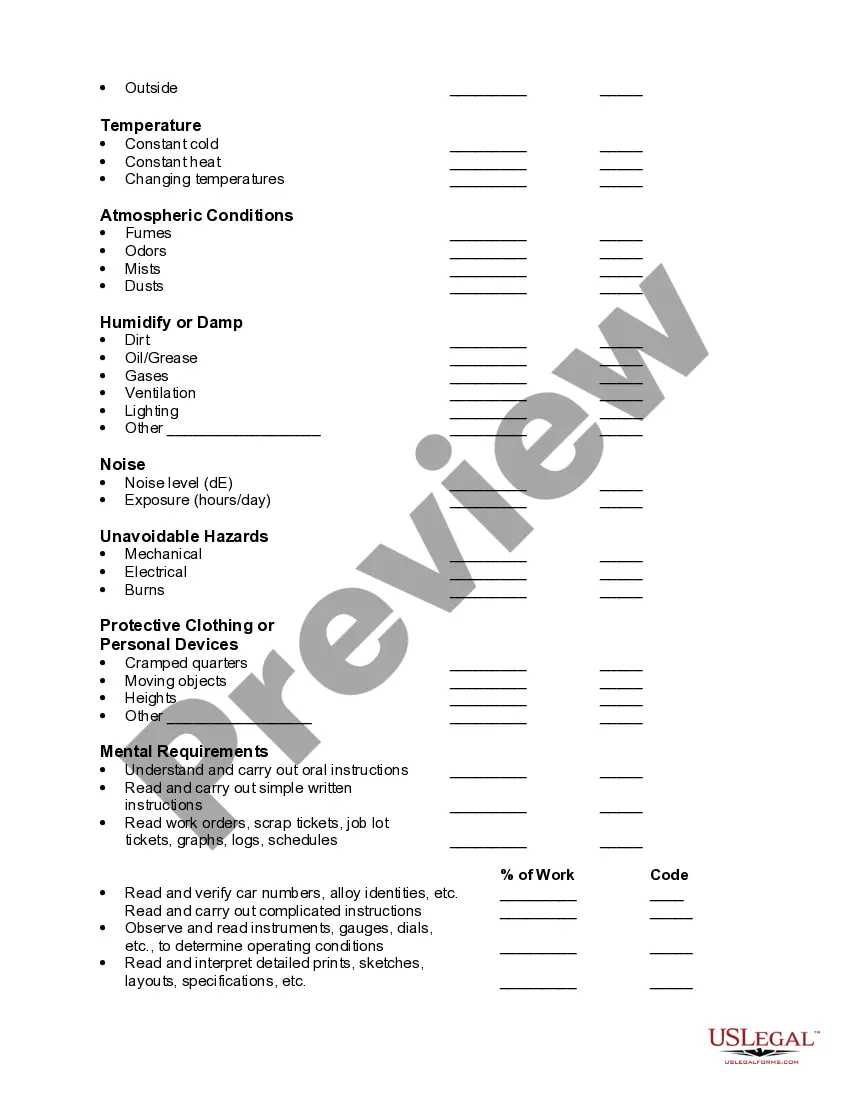

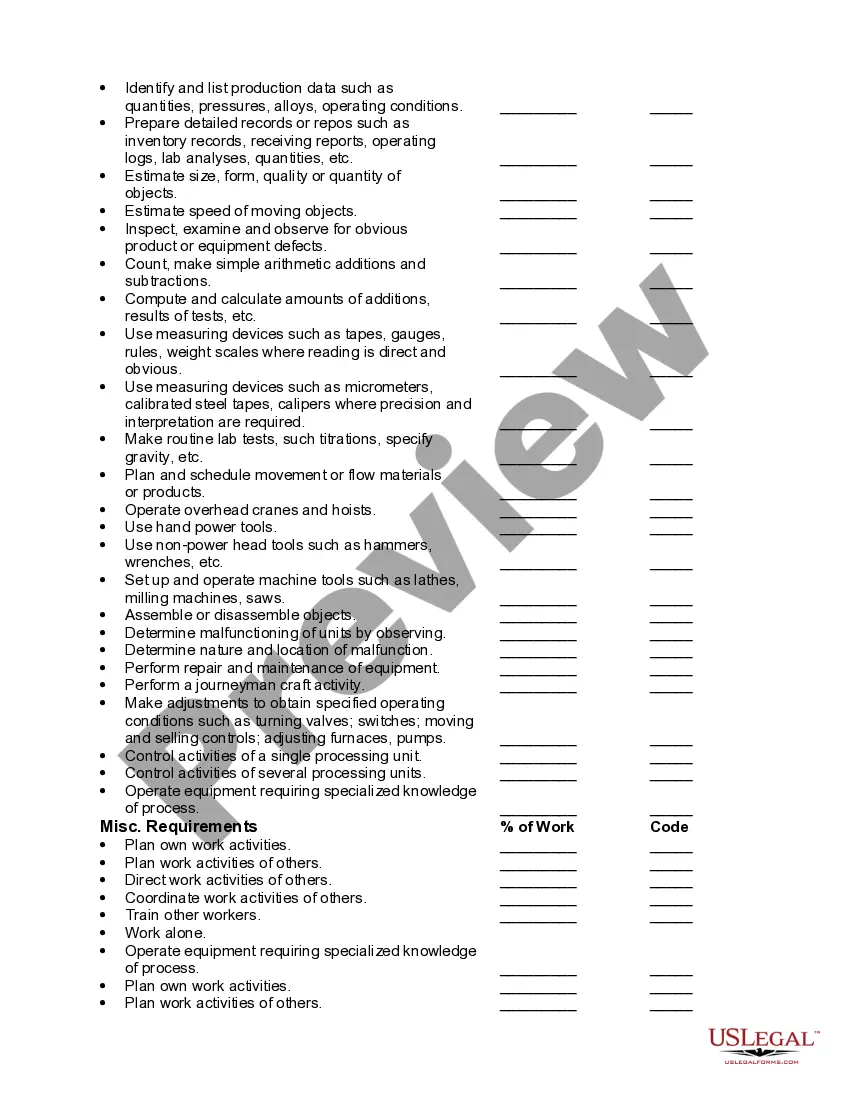

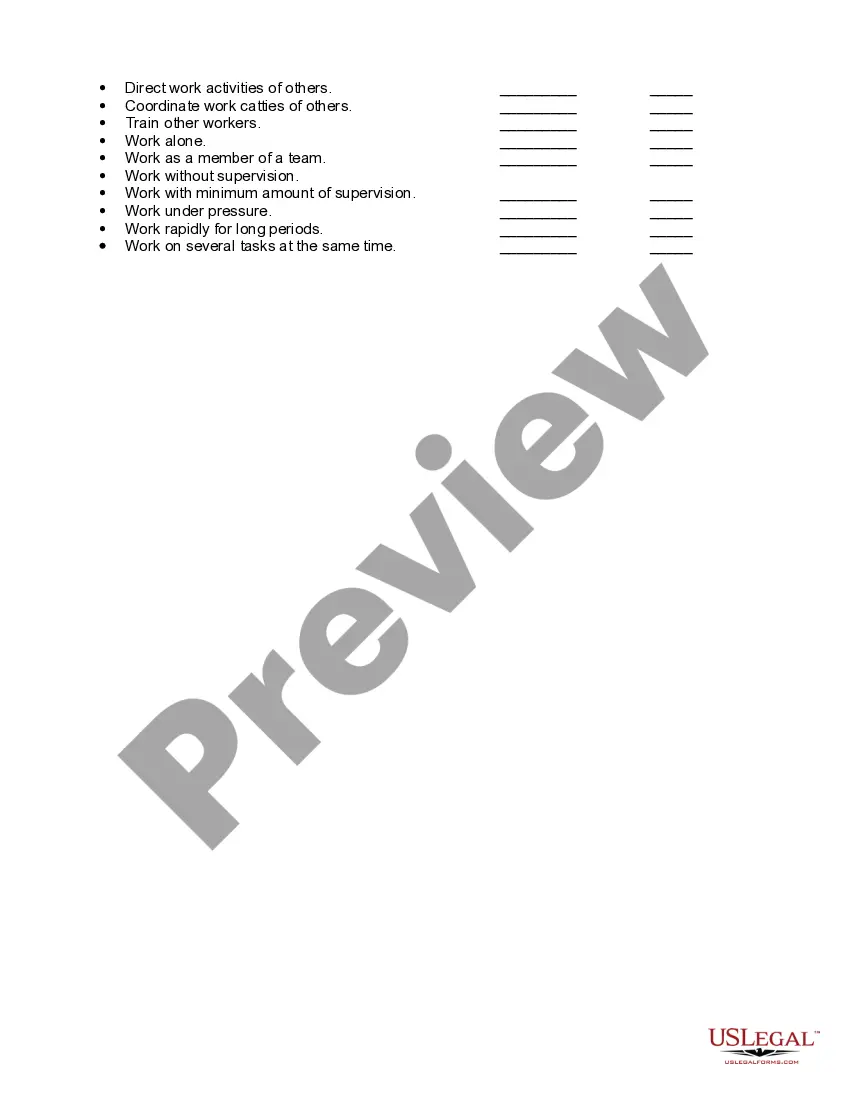

New Jersey Sample Job Requirements Worksheet

Description

How to fill out Sample Job Requirements Worksheet?

If you need to acquire, obtain, or print legal document templates, use US Legal Forms, the largest repository of legal forms available online.

Utilize the site’s straightforward and user-friendly search feature to locate the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy Now button. Choose your desired pricing plan and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Use US Legal Forms to find the New Jersey Sample Job Requirements Worksheet in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the New Jersey Sample Job Requirements Worksheet.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the form for the correct city/region.

- Step 2. Use the Preview feature to review the document’s contents. Don’t forget to read the information.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

New Jersey employers should provide new employees with both the IRS Form W-4 and the Form NJ-W4. See Employee Withholding Forms. New Jersey employers just provide new employees with notice of employee rights under New Jersey wage and hour laws.

In general, an employee only needs to complete Form NJ-W4 once. An employee completes a new form only when they want to revise their withholding information.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

If you claim 0 allowances or 1 allowance, you'll most likely have a very high tax refund. Claiming 2 allowances will most likely result in a moderate tax refund.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

How Many Allowances Should I Claim if I'm Single? If you are single and have one job, you can claim 1 allowance. There's also the option of requesting 2 allowances if you are single and have one job.

You can claim anywhere between 0 and 3 allowances on the 2019 W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

To know how much income tax to withhold from employees' wages, you should have a Form W-4, Employee's Withholding Certificate, on file for each employee. Ask all new employees to give you a signed Form W-4 when they start work. Make the form effective with the first wage payment.