New Jersey Employment of Executive with Stock Options and Rights in Discoveries

Description

How to fill out Employment Of Executive With Stock Options And Rights In Discoveries?

If you require to complete, acquire, or create legitimate document templates, use US Legal Forms, the premier collection of legal forms available online.

Utilize the site's user-friendly and practical search feature to locate the documents you need.

Various templates for business and personal use are categorized by types and states, or keywords. Use US Legal Forms to access the New Jersey Employment of Executive with Stock Options and Rights in Discoveries with just a few clicks.

Every legal document template you purchase is yours indefinitely. You have access to every form you downloaded in your account.

Click the My documents section and select a form to print or download again. Compete and get, and generate the New Jersey Employment of Executive with Stock Options and Rights in Discoveries with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to obtain the New Jersey Employment of Executive with Stock Options and Rights in Discoveries.

- You can also find previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

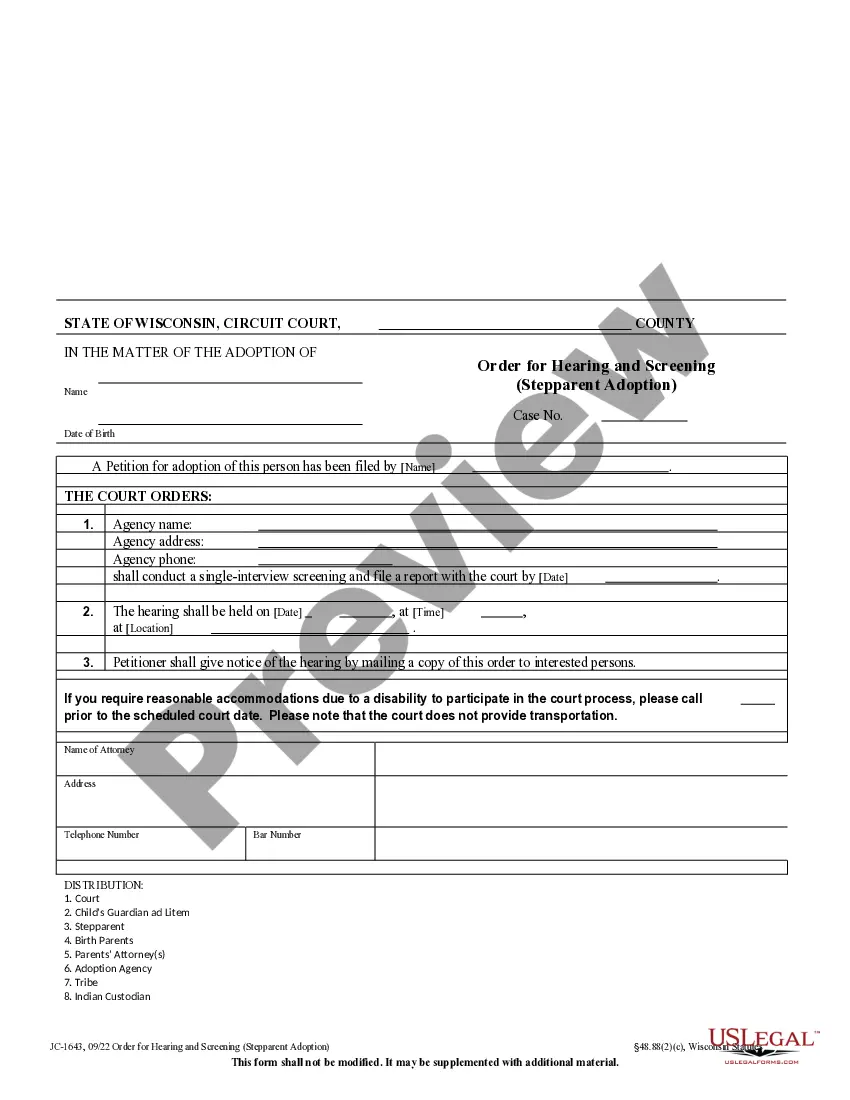

- Step 2. Use the Preview feature to review the form's contents. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. After locating the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Jersey Employment of Executive with Stock Options and Rights in Discoveries.

Form popularity

FAQ

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying assetthe company's stockat a specified price for a finite period of time.

An executive stock option is a contract that grants the right to buy a specified number of shares of the company's stock at a guaranteed "strike price" for a period of time, usually several years.

A stock option is a financial contract that basically allows someone the right but not the obligation to buy a certain number of company shares in the future, at today's market price. Thus, stock options allow CEOs to benefit if the company's stock price rises, but not lose out if the stock price falls.

By increasing the number of shares executives control, option grants have dramatically strengthened the link between pay and performance. Take a look at the exhibit Tying Pay to Performance. It shows how two measures of the pay-to-performance link have changed since 1980.

Exercising a stock option means purchasing the shares of stock per the stock option agreement. The benefit of the option to the option holder comes when the grant price is lower than the market value of the stock at the time the option is exercised.

Non-qualified stock options (NSOs) can be granted to employees at all levels of a company, as well as to board members and consultants. Also known as non-statutory stock options, profits on these are considered as ordinary income and are taxed as such.

Eligibility. Excluding directors and promoters of a company who have more than 10% equity in the company, every employee is eligible for ESOP. However, an employee should meet any of the following criteria. A full-time or part-time Director of the Company.

Eligibility. Excluding directors and promoters of a company who have more than 10% equity in the company, every employee is eligible for ESOP. However, an employee should meet any of the following criteria. A full-time or part-time Director of the Company.

The Pay-to-Performance Link. The main goal in granting stock options is, of course, to tie pay to performanceto ensure that executives profit when their companies prosper and suffer when they flounder.

An employee stock option is the right given to you by your employer to buy ("exercise") a certain number of shares of company stock at a pre-set price (the "grant," "strike" or "exercise" price) over a certain period of time (the "exercise period").