New Jersey Cash Register Payout

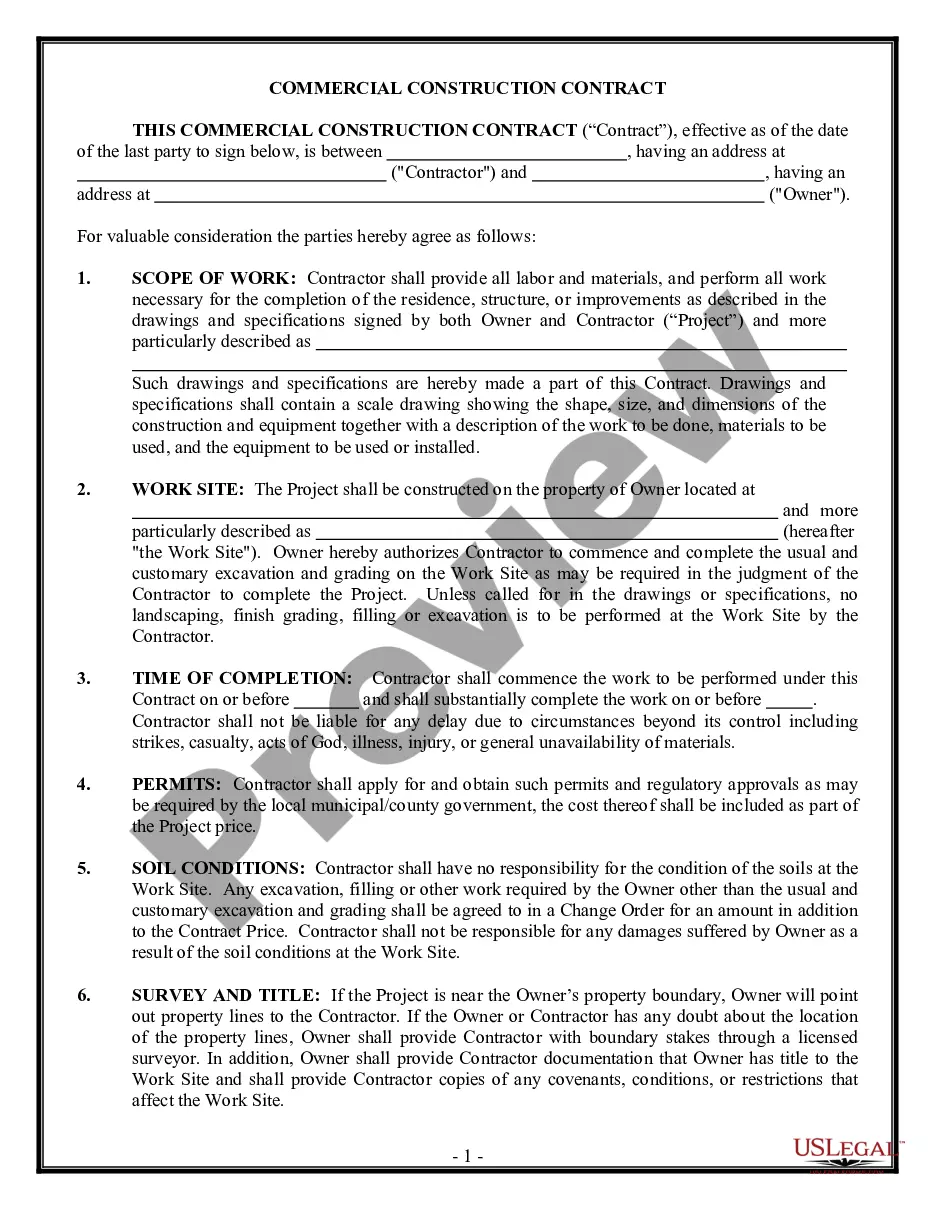

Description

How to fill out Cash Register Payout?

If you wish to obtain thorough, download, or print out valid document templates, utilize US Legal Forms, the largest selection of valid forms that are accessible online.

Employ the site's straightforward and convenient search to find the documentation you require. Various templates for business and personal applications are categorized by types and states, or keywords.

Utilize US Legal Forms to acquire the New Jersey Cash Register Payout within just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you saved within your account. Click the My documents section and select a form to print or download again.

Stay competitive and download, and print the New Jersey Cash Register Payout with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to receive the New Jersey Cash Register Payout.

- You can also access forms you previously stored from the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the following instructions.

- Step 1. Ensure you've selected the form for your specific city/state.

- Step 2. Use the Review option to evaluate the content of the form. Don't forget to read the instructions.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms in the legal form template.

- Step 4. Once you find the form you need, click the Purchase now button. Select the pricing scheme you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Jersey Cash Register Payout.

Form popularity

FAQ

If your prize is worth $599.99 or less, you can receive your winnings in cash at any New Jersey Lottery Retailer. If your prize is over $599.99, you must file a claim form with the New Jersey Lottery. Claim forms are available at all New Jersey Lottery Retailers or at New Jersey Lottery Headquarters.

Under California Labor Code 351 LC, tips are the property of the employee they are paid to or left for. This means that an employer may not: Take any part of an employee's tips or gratuities for themselves, Deduct any amount from a worker's wages due to the tips they've received, or.

The withholding rates for gambling winnings paid by the New Jersey Lottery are as follows: 5% for Lottery payouts between $10,001 and $500,000; 8% for Lottery payouts over $500,000; and. 8% for Lottery payouts over $10,000, if the claimant does not provide a valid Taxpayer Identification Number.

NJ Lottery Office Open by Appointment Only The service, which had been suspended since March 19, 2020 due to COVID-19, will resume by appointment only. Eligible claimants should call the NJ Lottery at 1-800-222-0996 to schedule an appointment Monday through Friday during normal business hours.

The 11 states that currently allow lottery winners to remain anonymous where a winning ticket was purchased in their state are: Arizona, Delaware, Georgia, Kansas, Maryland, New Jersey, North Dakota, Ohio, South Carolina, Virginia and Texas.

Because the New Jersey Lottery does not have the legal authority to cut checks on behalf of the State of New Jersey, all claims require up to two to three weeks for processing and payment. Can a Lottery retailer refuse to cash in lottery tickets? There is a policy regarding the cashing of winning tickets.

If your prize is worth $599.99 or less, you can receive your winnings in cash at any New Jersey Lottery Retailer. If your prize is over $599.99, you must file a claim form with the New Jersey Lottery. Claim forms are available at all New Jersey Lottery Retailers or at New Jersey Lottery Headquarters.

When you win a Powerball or Mega Millions jackpot, there is a 15-day waiting period between the draw date and when the jackpot will be paid out, as money from ticket sales needs to be collected in order to pay out the jackpot.

It usually takes about 2-3 weeks to validate a claim and forward a check for your winnings to you. If you wish to find out more about the status of your winning ticket claim, please contact Lottery Customer Service at 1-800-222-0996.