New Jersey Renunciation of Legacy by Child of Testator

Description

How to fill out Renunciation Of Legacy By Child Of Testator?

Are you currently in a position where you need documents for sometimes enterprise or personal reasons just about every working day? There are tons of authorized papers layouts available on the Internet, but discovering versions you can rely on is not simple. US Legal Forms offers 1000s of kind layouts, just like the New Jersey Renunciation of Legacy by Child of Testator, which can be published in order to meet federal and state demands.

When you are currently acquainted with US Legal Forms web site and get a free account, simply log in. Following that, it is possible to acquire the New Jersey Renunciation of Legacy by Child of Testator format.

Unless you offer an profile and wish to begin to use US Legal Forms, follow these steps:

- Find the kind you want and ensure it is for that right town/area.

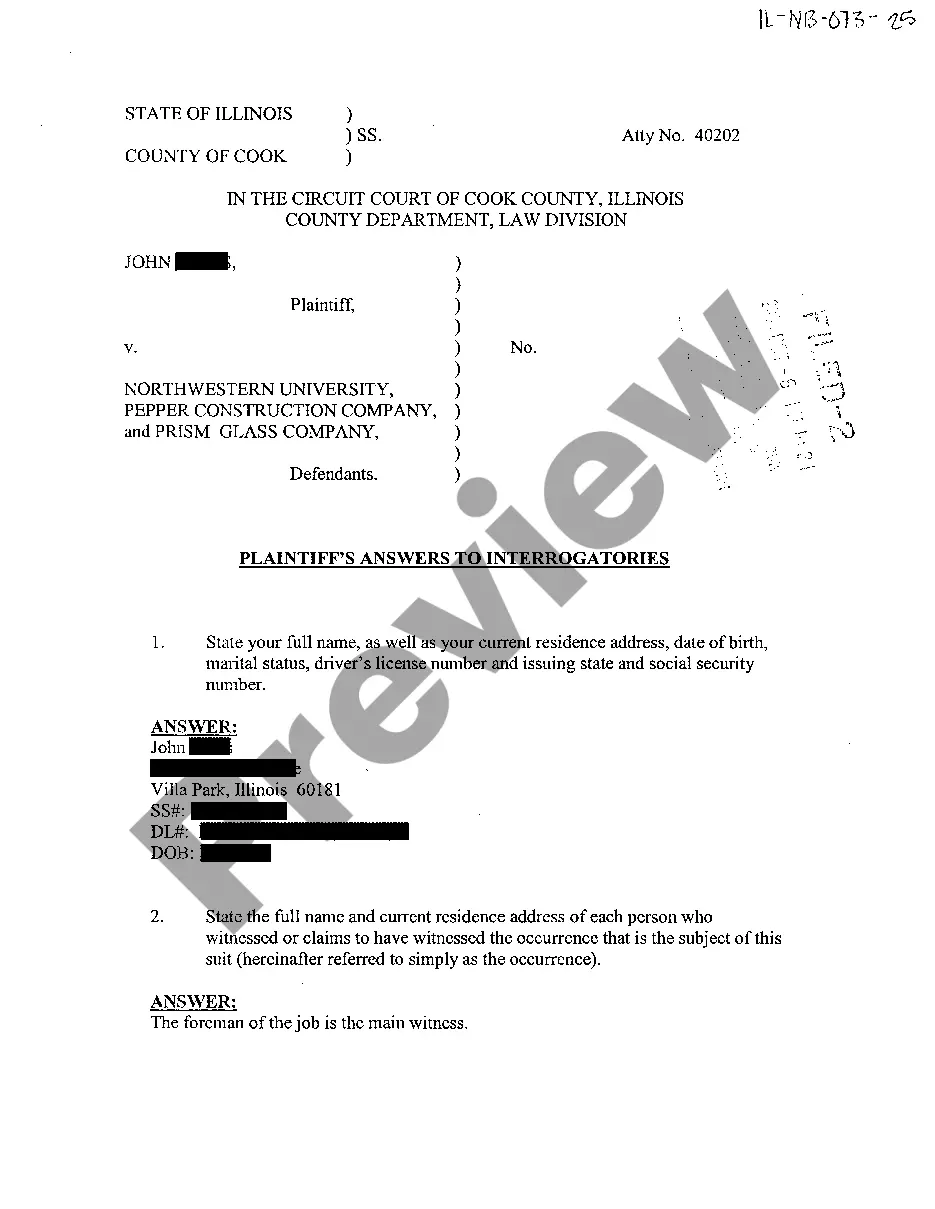

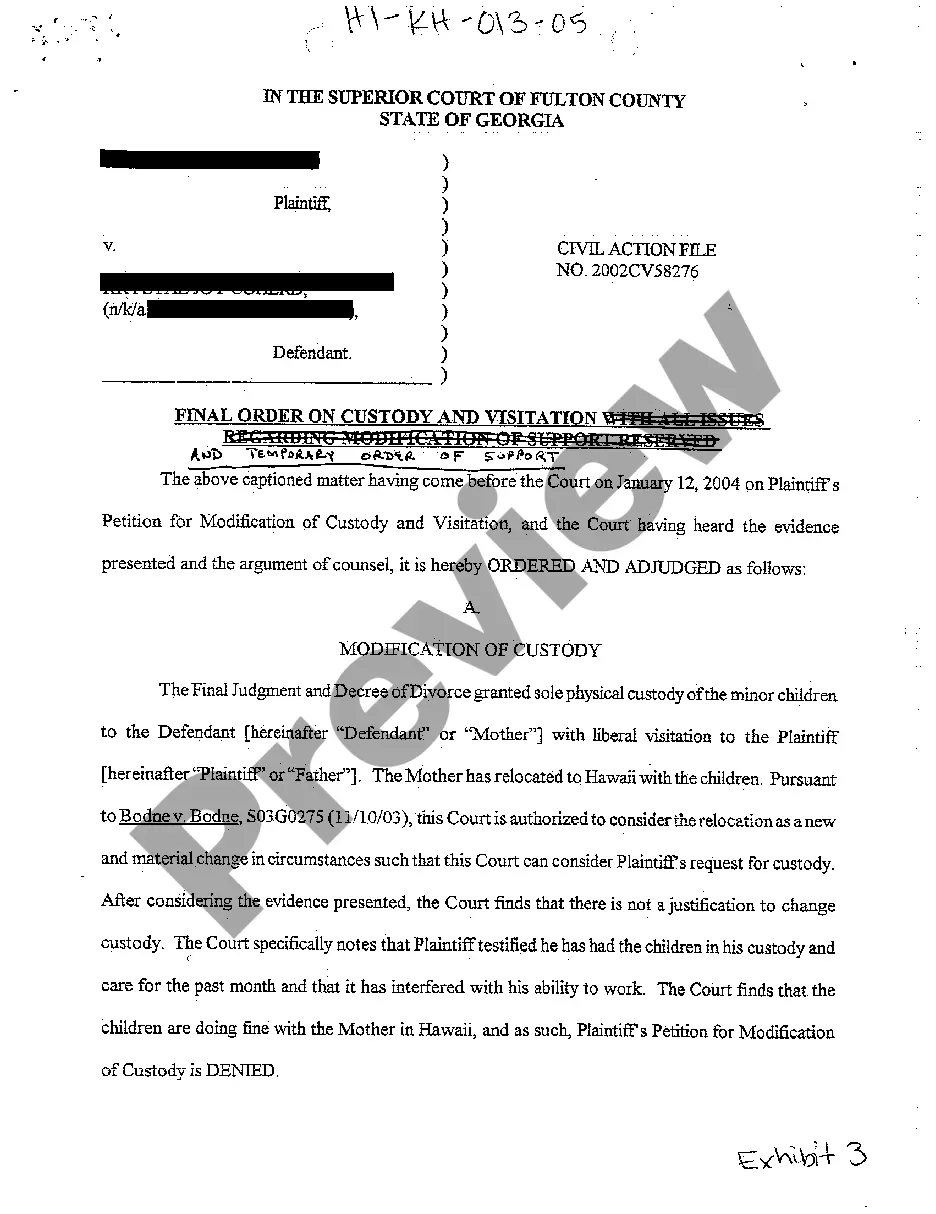

- Make use of the Review option to check the form.

- Read the explanation to actually have selected the appropriate kind.

- In case the kind is not what you`re looking for, utilize the Lookup area to obtain the kind that meets your requirements and demands.

- Once you discover the right kind, click on Acquire now.

- Opt for the pricing prepare you desire, fill out the required details to create your money, and purchase an order with your PayPal or credit card.

- Select a hassle-free file formatting and acquire your copy.

Find all of the papers layouts you possess bought in the My Forms food selection. You can get a additional copy of New Jersey Renunciation of Legacy by Child of Testator whenever, if needed. Just click on the necessary kind to acquire or print the papers format.

Use US Legal Forms, by far the most extensive selection of authorized kinds, to save lots of efforts and steer clear of faults. The assistance offers appropriately created authorized papers layouts which you can use for an array of reasons. Produce a free account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

But in some rare situations, an inheritance could be subject to both estate and inheritance taxes. ing to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023).

There is no need for all heirs to agree to sell a property if it is still in probate. The heirs need to petition the court for approval to sell the property. If they file a suit for partition, the court can order a property sale.

If you are the spouse, civil union partner, domestic partner, child, grandchild, great-grandchild, mutually acknowledged child or stepchild, parent or grandparent of the deceased, you are exempt from New Jersey's inheritance tax.

New Jersey has had an Inheritance Tax since 1892, when a tax was imposed on property transferred from a deceased person to a beneficiary. Inheritance Tax is based on who specifically will receive or has received a decedent's assets, and how much each beneficiary is entitled to receive.

Form L-8 ? Affidavit for Non-Real Estate Investments: Resident Decedents. Use this form for release of: ? New Jersey bank accounts; ? Stock in New Jersey corporations; ? Brokerage accounts; and ? New Jersey investment bonds. This form cannot be used for real estate.

Property passing to a surviving spouse, civil union or domestic partner, parents, grandparents, children, stepchildren or grandchildren is exempt from the tax. All other beneficiaries (except qualified charitable organizations) are subject to NJ inheritance tax.

If you are the spouse, civil union partner, domestic partner, child, grandchild, great-grandchild, mutually acknowledged child or stepchild, parent or grandparent of the deceased, you are exempt from New Jersey's inheritance tax.

There is a $25,000 exemption for amounts inherited by Class C beneficiaries. The tax rate is 11% on the first $1,075,000 inherited above the exemption amount, 13% on the next $300,000, 14% on the next $300,000, and 16% on the amount above $1,700,000. Class D beneficiaries can receive $500 tax free.