New Jersey Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner

Description

How to fill out Agreement To Devise Or Bequeath Property Of A Business Transferred To Business Partner?

Finding the appropriate legal document template can be quite a challenge.

Of course, there are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New Jersey Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner, which can be used for both business and personal purposes.

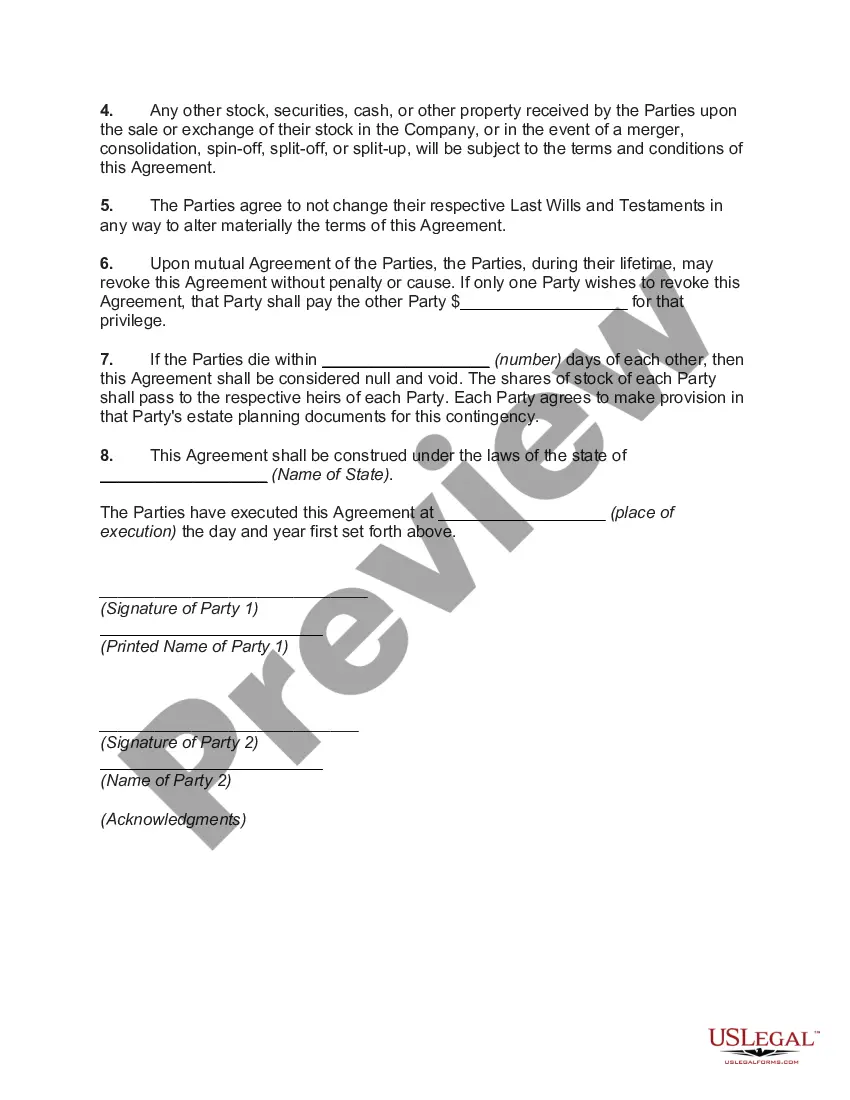

If the form does not meet your requirements, use the Search area to find the correct form. Once you are sure the form is accurate, click the Buy now button to obtain the form. Select the pricing plan you want and input the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the document format and download the legal document template for your system. Complete, modify, print, and sign the obtained New Jersey Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner. US Legal Forms is the largest catalog of legal forms where you can find numerous document templates. Utilize the service to get professionally crafted documents that comply with state regulations.

- All the templates are verified by professionals and meet state and federal requirements.

- If you are already registered, Log In to your account and click the Obtain button to search for the New Jersey Agreement to Devise or Bequeath Property of a Business Transferred to Business Partner.

- Use your account to look up the legal forms you have purchased previously.

- Navigate to the My documents section of your account and retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your city/state. You can view the form using the Preview option and review the form details to confirm it suits your needs.

Form popularity

FAQ

A partial distribution, sometimes called a preliminary distribution, is a distribution of some of the trust assets before the trust administration is complete and the trust assets are fully distributed. A trustee is required to complete trust distributions within a reasonable time.

Taxpayers who are over 65, blind or disabled can claim an additional $1,000 exemption as of this writing. New Jersey allows a $1,500 deduction for each child whom taxpayers claim as a dependent on their federal income tax returns. New Jersey lottery winnings under $10,000 are also exempt from state income tax.

In New Jersey, the deed must be in English, identify the seller/buyer (grantor/grantee), name the person that prepared the deed, state the consideration (amount paid) for the transfer, contain a legal description of the property (a survey), include the signature of the grantor and be signed before a notary.

New Jersey does not allow real estate to be transferred with transfer-on-death deeds.

In general, New Jersey's probate process for most estates is relatively simple and affordable. The state only requires you to probate a will if there are probate assets included. A probate asset is one that does not already have a beneficiary designation through other means.

The executor, administrator, or heir at law of the estate must file a 2017 New Jersey Estate Tax return (Form IT-Estate 2017 ) if the deceased person's gross estate exceeds $2 million as determined by the provisions of the Internal Revenue Code in effect on January 1, 2017.

If real estate is owned in the deceased's name alone or with someone other than a surviving spouse or a domestic partner, an application must be made to the Division of NJ Taxation to release the property from New Jersey's estate tax lien.

The New Jersey inheritance tax is imposed on the inheritors of New Jersey real or tangible property, by whomever owned, and on inheritors of all propertytangible or intangibleowned by a resident of New Jersey N.J.S.A. -1(a), (d).

If you were a resident of New Jersey for only part of the year and your income from all sources for the entire year was more than $20,000 ($10,000 if filing status is single or married/CU partner, filing separate return), you must file a New Jersey resident Income Tax return and report any income you received while you