This form is an official document from the California Judicial Council, and it complies with all applicable state and Federal codes and statutes. USLF updates all state and Federal forms as is required by state and Federal statutes and law.

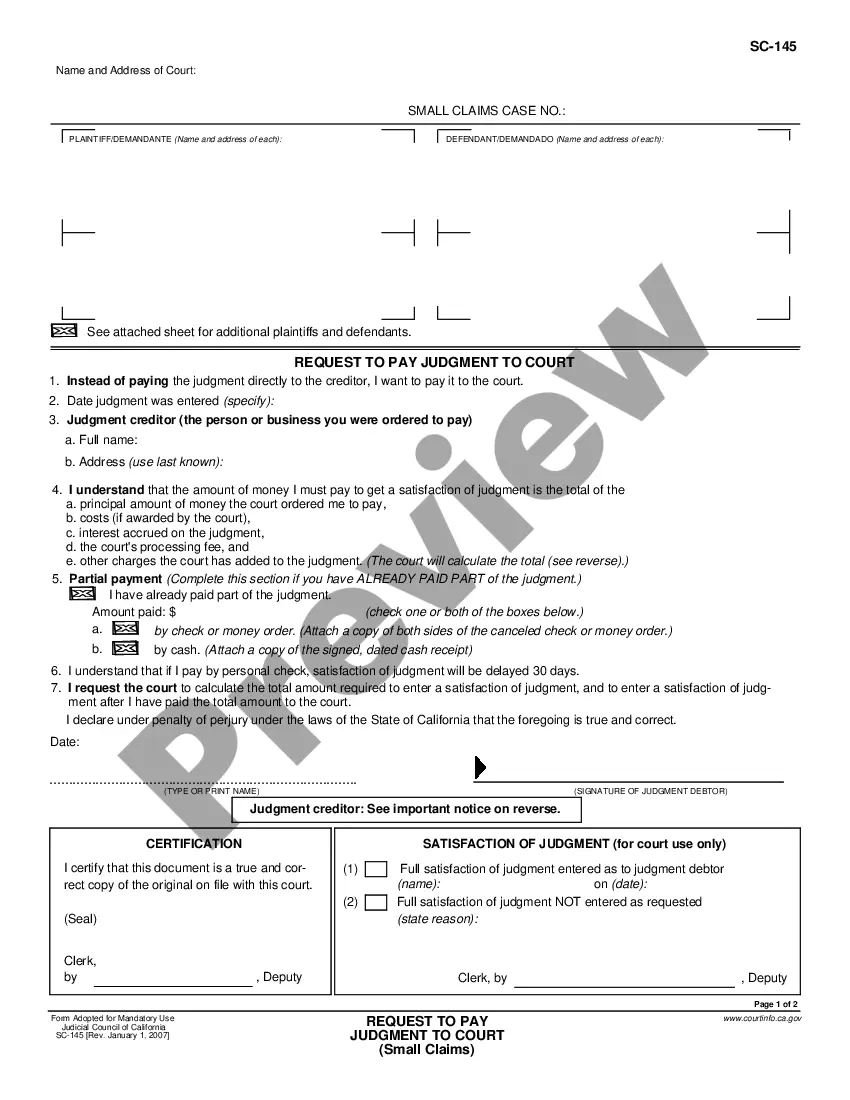

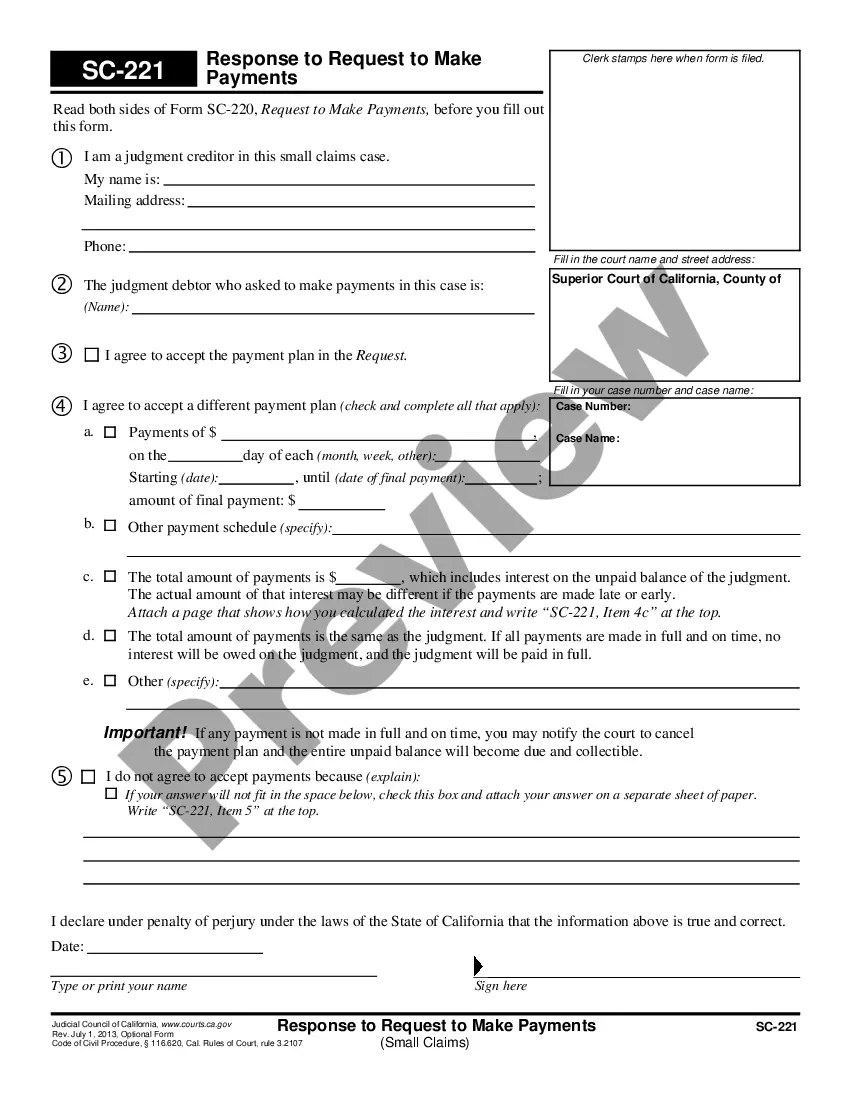

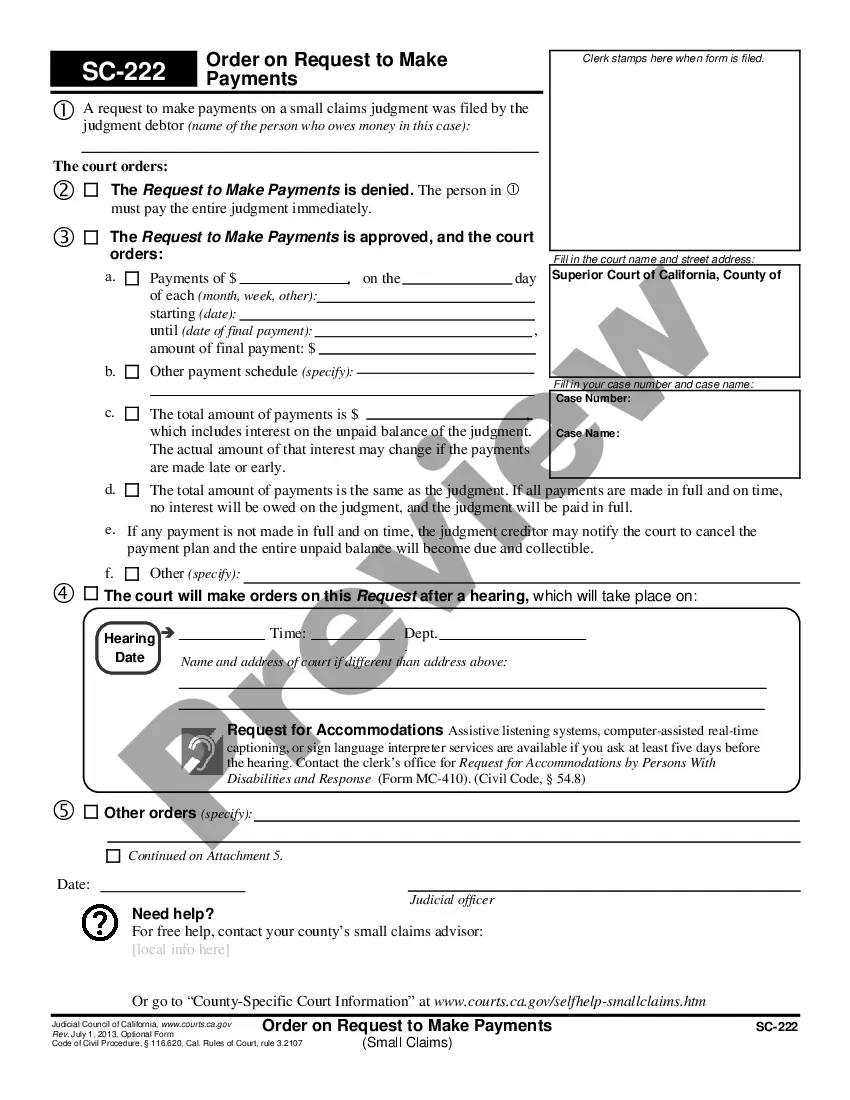

California Request to Make Payments

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Request To Make Payments?

If you are searching for exact California Request to Make Payments web designs, US Legal Forms is what you require; find documents supplied and reviewed by state-certified lawyers.

Using US Legal Forms not only saves you from concerns about legal documents; you also conserve time, effort, and money! Downloading, printing, and filling out a professional template is considerably more cost-effective than hiring a lawyer to do it for you.

And there you have it. In just a few straightforward steps, you possess an editable California Request to Make Payments. Upon creating your account, all future orders will be processed even more easily. When you have a US Legal Forms subscription, just Log In and click the Download option found on the form’s page. Then, when you need to use this template again, you can always find it in the My documents section. Don't waste your time comparing numerous forms on different sites. Purchase precise templates from a single reliable service!

- To start, finalize your registration process by providing your email and creating a secure password.

- Follow the steps below to create an account and obtain the California Request to Make Payments sample to fulfill your needs.

- Use the Preview feature or check the document description (if available) to confirm that the template is the one you need.

- Verify its relevance in your state.

- Click on Buy Now to place your order.

- Choose a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

- Select a suitable file format and save the documents.

Form popularity

FAQ

To create a payment plan for taxes owed, start by applying through the IRS online portal or contacting them directly. Ensure you know your total tax liability and payment capabilities. The California Request to Make Payments option can assist you in understanding available plans to structure your payments effectively.

The IRS does not set a universally applicable minimum payment amount; it varies based on your tax situation. Generally, payments should be enough to cover your tax liability and fees to avoid penalties. If you’re struggling, working through the California Request to Make Payments feature can provide options tailored to your financial standing.

The FTB mandatory electronic payment notice informs taxpayers of their responsibilities to make electronic payments if they meet certain criteria. This notification aims to encourage compliance through the California Request to Make Payments platform. Being aware of this notice is essential, as it provides guidance on avoiding penalties and streamlining your payment process. Staying informed can help you meet your obligations efficiently.

Yes, the IRS requires electronic payment methods for certain tax liabilities. Taxpayers who owe significant amounts must use the IRS's electronic payment systems, similar to California's Request to Make Payments program. By opting for electronic payment, you can simplify your tax obligations and ensure timely submissions. Understanding these requirements can help you avoid unnecessary fees.

Yes, California mandates electronic filing for certain taxpayers, particularly for those with income above specific thresholds. The California Request to Make Payments service supports your e-filing requirements, making it easier to comply with state regulations. By using e-file, you can expedite processing and receive confirmation of your submissions faster. Staying informed about these requirements can save you time and hassle.

In California, the $350 payment applies to specific taxpayers, generally including certain business entities like partnerships and LLCs filing on behalf of their members. You will need to check the eligibility criteria on the California FTB website or through the California Request to Make Payments platform. This information is crucial for ensuring that you stay compliant and make the necessary payments on time. Ensure your documentation is in order before proceeding.

To make a PTE payment in California, you can use the California Request to Make Payments program, which allows for convenient electronic submissions. You typically need to access the California Franchise Tax Board (FTB) website and follow the prompts for electronic payments. Ensure you have your tax information ready, as this will make the process smoother. Once successfully submitted, you will receive confirmation of your payment.

Yes, you can make payments on a traffic ticket in California. The process typically involves visiting your local court's website or contacting them directly. By submitting a California Request to Make Payments, you can explore options for settling your ticket in installments, easing the financial impact. Always check for available payment plans that suit your situation.

Yes, you can make payments on your California state taxes through various methods. California offers options such as online payments, mailing a check, or setting up a payment plan. It is advisable to submit a California Request to Make Payments if your balance is substantial. This allows you to manage your tax obligations more effectively and comfortably.