New Jersey Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator

Description

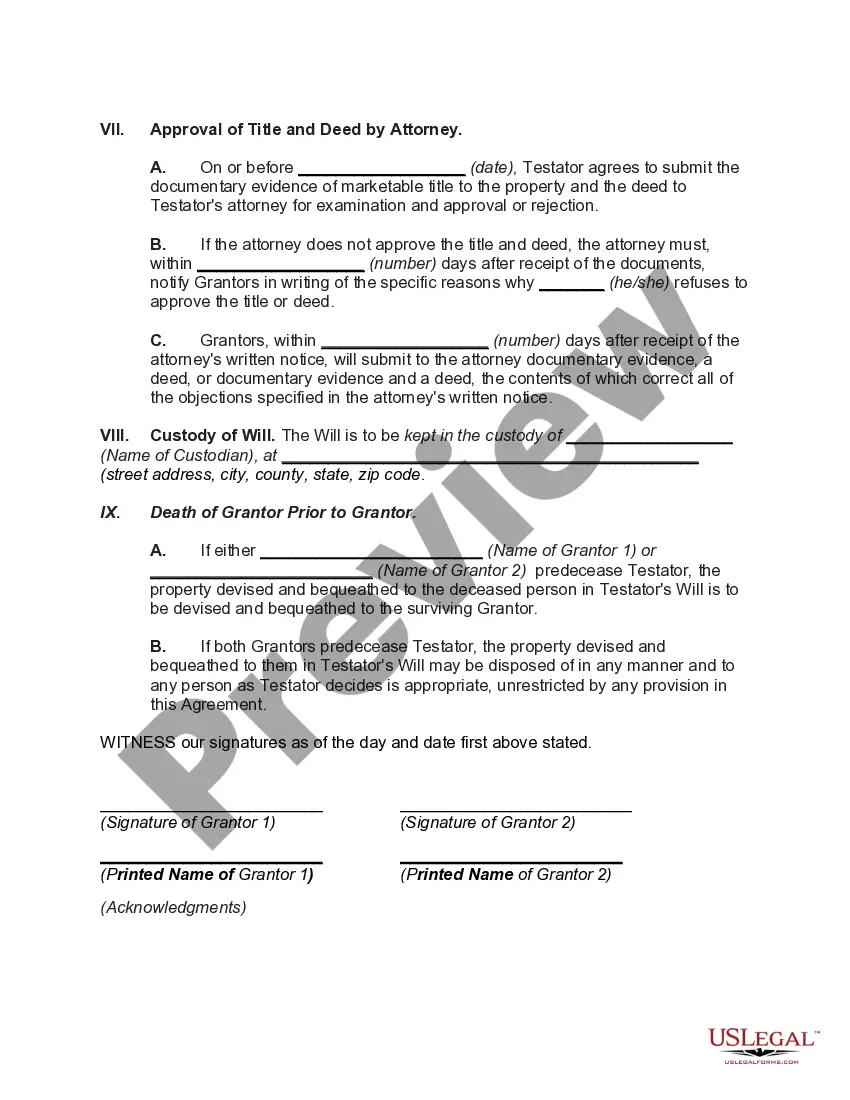

How to fill out Agreement To Devise Or Bequeath Property To Grantors Who Convey Property To Testator?

Finding the appropriate valid document template can be a challenge.

Certainly, there are numerous templates accessible online, but how can you locate the exact form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the New Jersey Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator, that you can employ for business and personal purposes.

If the form does not meet your requirements, use the Search field to find the suitable form. Once you are confident the form is appropriate, select the Get now button to retrieve the form. Choose the pricing plan you desire and enter the required information. Create your account and complete your order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained New Jersey Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator. US Legal Forms is the largest library of legal forms where you can discover various document templates. Use the service to obtain professionally crafted documents that comply with state regulations.

- All of the forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the New Jersey Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator.

- Use your account to review the legal forms you have previously purchased.

- Visit the My documents tab of your account to get another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/state. You can inspect the document using the Preview button and read the document description to confirm it is the right fit for you.

Form popularity

FAQ

In New Jersey, the NJ IT-R is a tax form that must be filed by any decedent's estate. If the estate has a gross income that exceeds certain thresholds, the executor or administrator is responsible for filing this return. Using the New Jersey Agreement to Devise or Bequeath Property to Grantors Who Convey Property to Testator ensures that all financial aspects, including tax obligations, are addressed. Check with US Legal Forms for detailed filing guidelines.

A bequest is a financial term describing the act of giving assets such as stocks, bonds, jewelry, and cash, to individuals or organizations, through the provisions of a will or an estate plan. Bequests can be made to family members, friends, institutions, or charities.

A gift you make through last will and testament is known as a bequest. Any bequest you make can be placed into one of four different classes or types: Specific gifts. When you name a specific property you want to gift to someone through your will, this is known as a specific gift.

The properties which are self-acquired can be bequeathed by Will by owner to any one even other than his heirs or legal representatives or relatives. A person has two properties one made out of own earnings and other inherited. Can a person Will away even the inherited property to any one other than the legal heirs?

Testamentary Gifts Traditionally, a gift of real property in a will is known as a devise. Traditionally, a gift of money in a will is known as a legacy. Traditionally, a gift of personal property other than money in a will is known as a bequest. Today, any gift of personal property may be known as bequest or legacy.

This is usually a cash endowment given to children or grandchildren, but an inheritance may also include assets like stocks and real estate. Asset distribution is determined during the estate planning process, when wills are written and heirs or beneficiaries are designated. The will specifies who will receive what.

The terms of the will shall come into effect after the death of the testator (your father), and being a legal heir, you can challenge your father's will in a court of law.

A 'Gift in Will' or bequest is a donation left to a charity or Not For Profit of your choice, as stated in your Will. Gifts in Wills and bequests help to support the daily activities of the charities you love and enable them to continue to support the community.

Beneficiary. While the term "heir" legally refers to a person who receives the property of an individual who died intestate, in common parlance, the word "heir" is often used to describe those inheriting property, as designated by a will.

What is the difference between these two phrases? Traditionally, a devise referred to a gift by will of real property. The beneficiary of a devise is called a devisee. In contrast, a bequest referred to a gift by will of personal property or any other property that is not real property.