New Jersey General Form of Factoring Agreement - Assignment of Accounts Receivable

Description

How to fill out General Form Of Factoring Agreement - Assignment Of Accounts Receivable?

If you require to finalize, obtain, or produce legal document formats, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Take advantage of the website's straightforward and convenient search to locate the documents you need.

Various formats for business and personal purposes are organized by categories and suggestions, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select your preferred pricing plan and enter your details to create an account.

Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the New Jersey General Form of Factoring Agreement - Assignment of Accounts Receivable in just a few clicks.

- If you are currently a US Legal Forms user, sign in to your account and click on the Download button to access the New Jersey General Form of Factoring Agreement - Assignment of Accounts Receivable.

- You can also access forms you previously acquired in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow these guidelines below.

- Step 1. Ensure you have selected the form suitable for your jurisdiction.

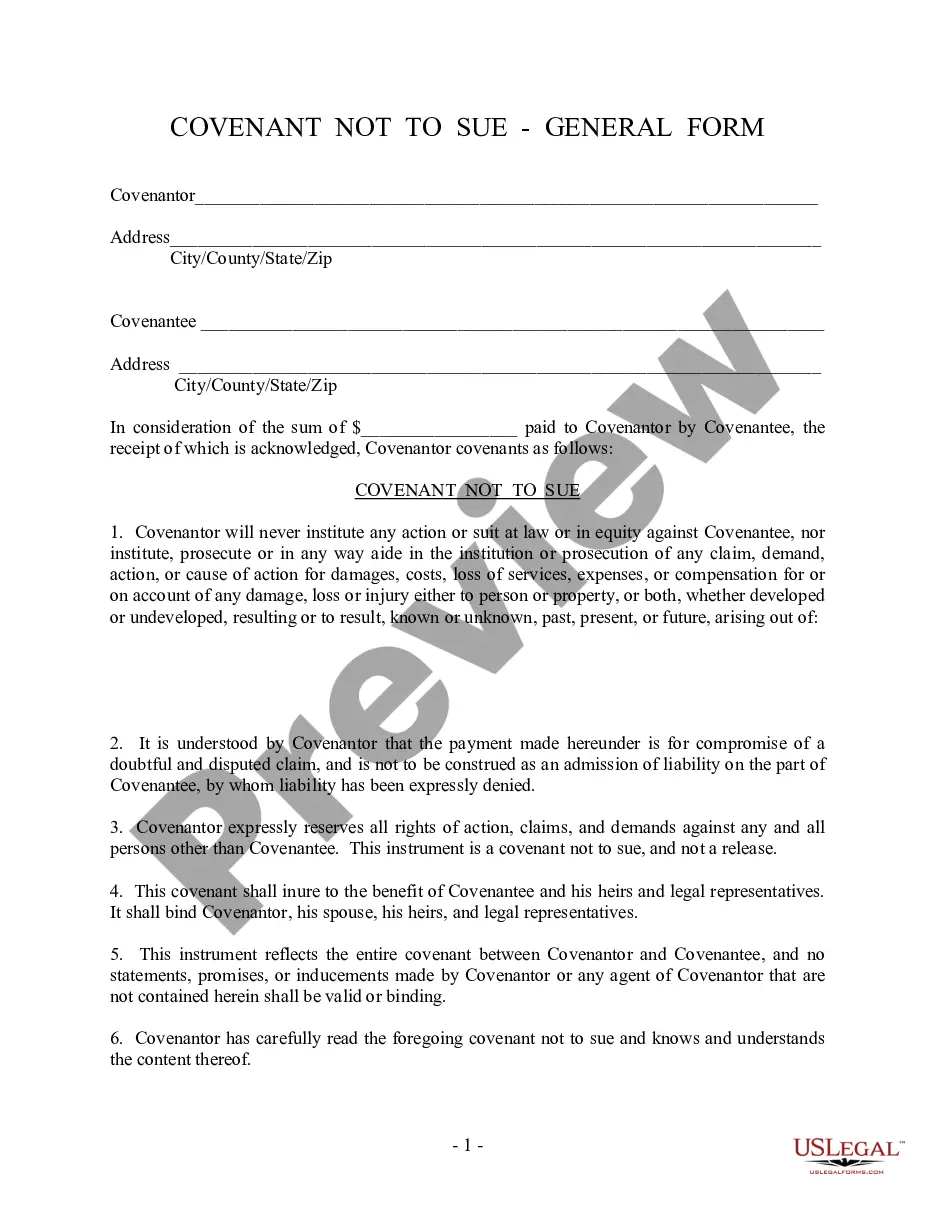

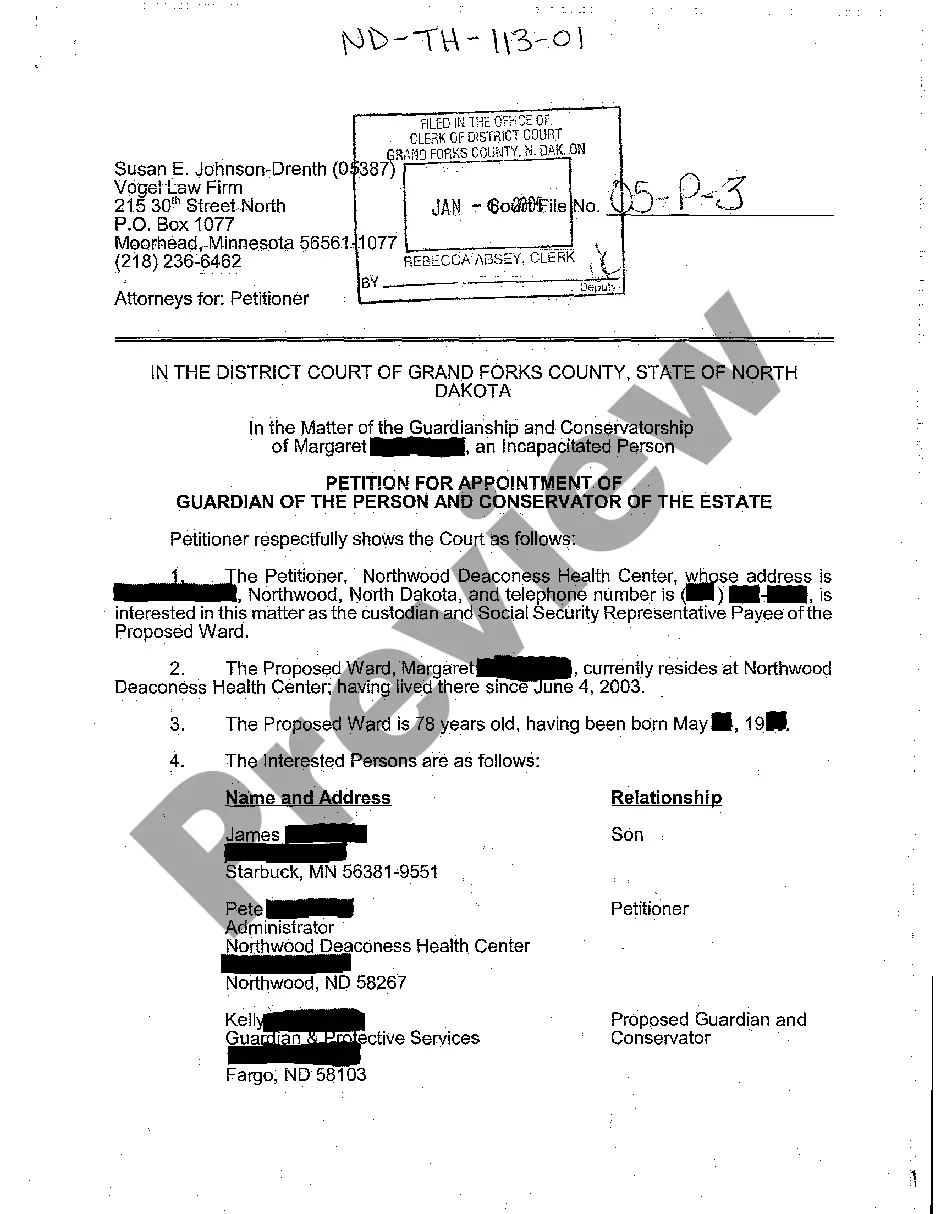

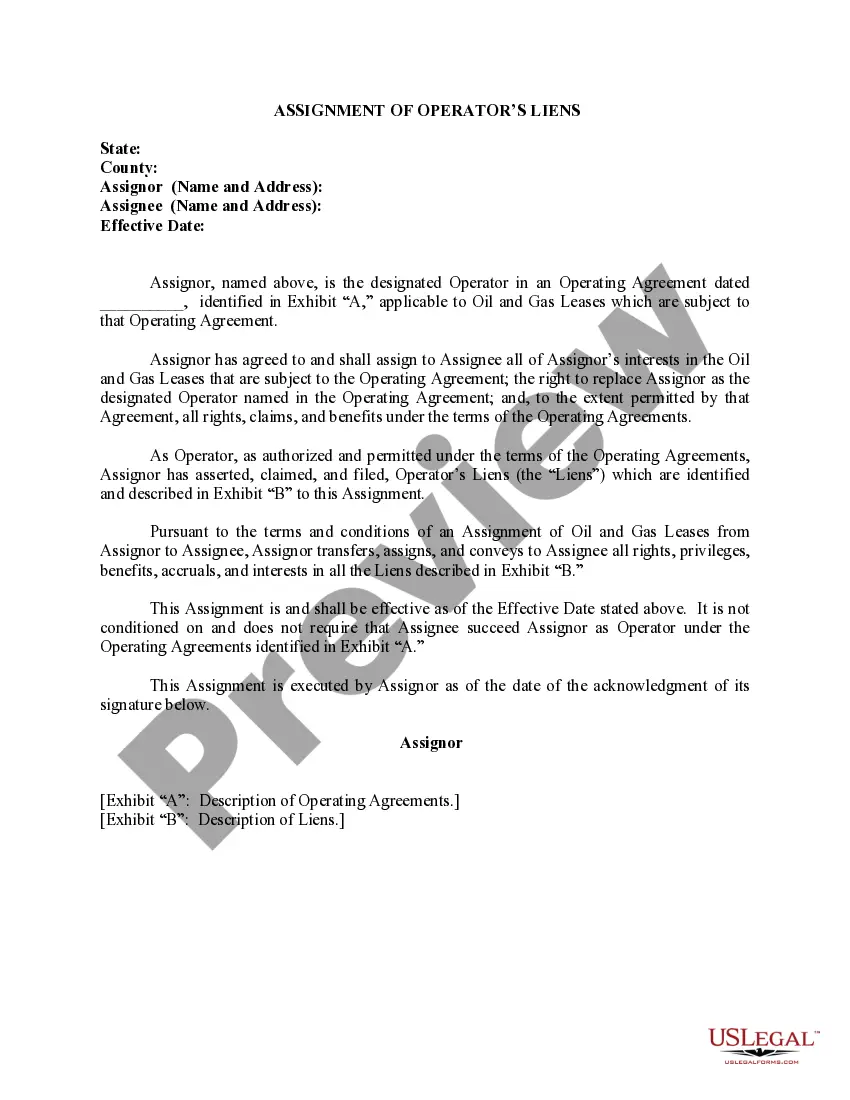

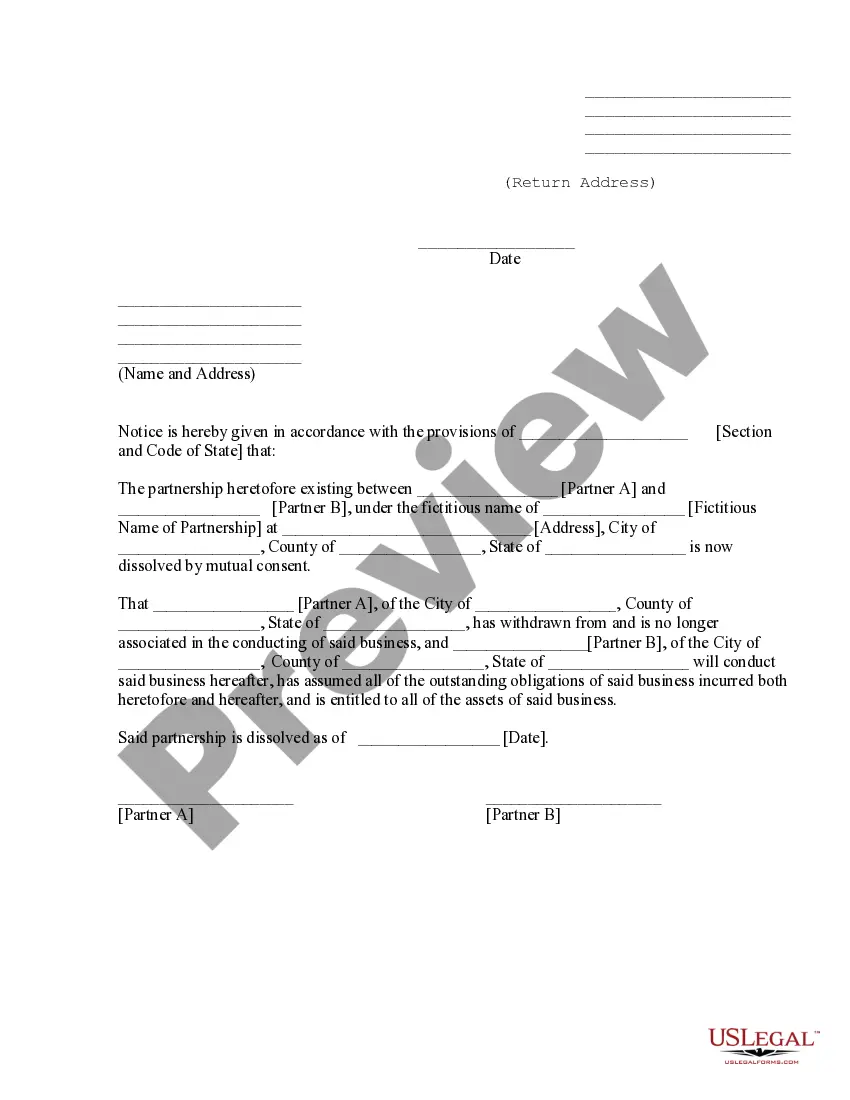

- Step 2. Use the Preview option to review the form's content. Don't forget to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the page to find other templates in the legal form directory.

Form popularity

FAQ

Consent to assignment of receivables refers to the approval given by a debtor to allow their accounts receivable to be assigned to another party. This consent is essential in a factoring arrangement, as it safeguards the interests of all parties involved. Using the New Jersey General Form of Factoring Agreement helps formalize this consent and clearly outlines the terms.

The primary task of accounts receivable is to manage incoming payments owed by customers. This includes tracking invoices, sending reminders, and ensuring timely collection. A well-structured system, such as facilitated by the New Jersey General Form of Factoring Agreement, can enhance efficiency and minimize the risk of bad debts.

The assignment of accounts receivable is a legal process where a business transfers its rights to receive payments from clients to a third party. This is often formalized through agreements such as the New Jersey General Form of Factoring Agreement - Assignment of Accounts Receivable. By doing so, businesses can improve liquidity and manage their finances more effectively.

The process of factoring accounts receivable involves selling your outstanding invoices to a third party called a factor. Initially, you submit your invoices to the factor for review, and they assess the creditworthiness of your customers. Once approved, the factor will provide you with a percentage of the invoice amount upfront, and they then take on the responsibility of collecting the payments. Using the New Jersey General Form of Factoring Agreement - Assignment of Accounts Receivable streamlines this entire process, ensuring that you have a clear contract guiding your arrangement.

A Notice of Assignment (NOA) in factoring is a formal notice that informs debtors of the assignment of their invoices to a factoring company. This document is crucial because it helps ensure prompt payment directly to the factor. The New Jersey General Form of Factoring Agreement - Assignment of Accounts Receivable typically includes the provisions regarding the NOA, ensuring that both the business and the factoring company are aligned on payment processes.

The NOA is a simple letter that the factoring company sends to the debtors. It is used to inform them that the financial rights to invoices issued by the original lender (the factoring client) are sold to and adapted by the factoring company.

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.

A Notice of Assignment is used to inform debtors that a third party has 'purchased' their debt. The new company (assignee) takes over collection procedures, but can sometimes hire a debt collection agency to recover the money on their behalf. There are two types of debt assignment: Legal Assignment. Equitable

The notice of assignment (NOA) informs your customer that a third party (bank, financing company, or factoring company) will manage and collect your accounts receivable (AR) going forward.

Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (i.e., invoices) to a third party (called a factor) at a discount. A business will sometimes factor its receivable assets to meet its present and immediate cash needs.