New Jersey Revocable Trust for Minors

Description

How to fill out Revocable Trust For Minors?

Finding the appropriate legal document format can be a challenge.

Of course, there are numerous templates available online, but how do you obtain the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the New Jersey Revocable Trust for Minors, suitable for both business and personal purposes.

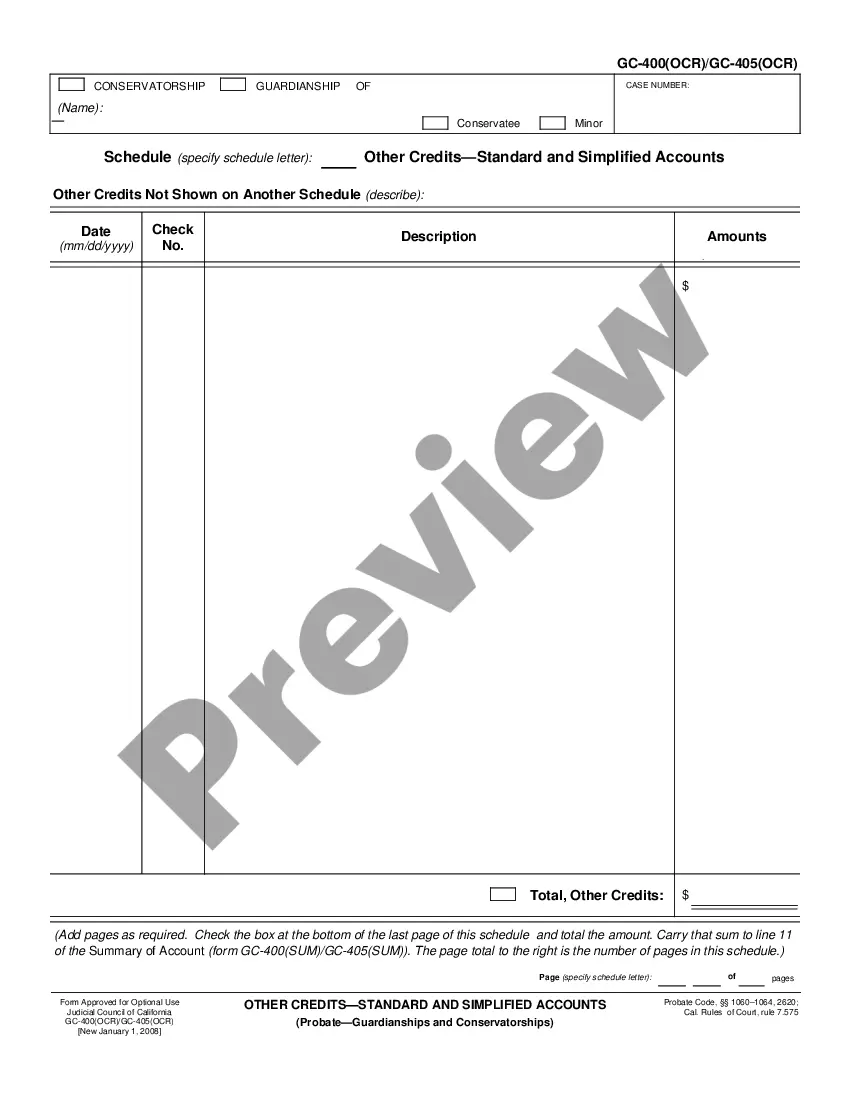

First, ensure you have chosen the correct form for your city/state. You can preview the form using the Review option and read the form details to verify it is suitable for you. If the form does not satisfy your needs, use the Search field to find the appropriate document. Once you are certain the form is correct, click the Get now button to retrieve the document. Select your preferred payment plan and enter the necessary details. Create your account and finalize the purchase using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, edit, print, and sign the acquired New Jersey Revocable Trust for Minors. US Legal Forms is the largest repository of legal templates where you can find various document forms. Use the service to obtain professionally-crafted documents that adhere to state requirements.

- All templates are reviewed by professionals and comply with federal and state regulations.

- If you are already a member, sign in to your account and click the Download button to obtain the New Jersey Revocable Trust for Minors.

- Use your account to browse the legal documents you previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you're a new user of US Legal Forms, here are simple steps for you to follow.

Form popularity

FAQ

The New Jersey Revocable Trust for Minors can be an excellent choice for parents looking to manage their children's inheritance responsibly. This trust offers flexibility, allowing changes as your children grow and their needs evolve. Additionally, it provides a clear framework for asset distribution when your children reach a designated age, ensuring their financial wellbeing.

To set up a revocable trust in New Jersey, start by identifying and outlining your goals for the trust. Ensure you include the New Jersey Revocable Trust for Minors aspect if you want to protect your children's assets. Consulting with an attorney or using an online resource like USLegalForms can simplify the process and help ensure compliance with state laws.

Many parents mistakenly assume that once a trust is set up, they can forget about it. This oversight can be detrimental, especially with a New Jersey Revocable Trust for Minors. Regular reviews and updates are necessary to adapt to changes in family dynamics, financial situations, or legal regulations.

One disadvantage of a family trust is that it can create a sense of entitlement among beneficiaries, potentially leading to conflict. In the case of a New Jersey Revocable Trust for Minors, parents may worry that their children might expect immediate access to assets without understanding the importance of delayed distribution for their financial education.

Pitfalls in setting up a trust often include inadequate funding and failure to update the trust as circumstances change. If you establish a New Jersey Revocable Trust for Minors, it's essential to consistently review the trust's provisions and assets. Otherwise, the trust may not effectively serve its purpose in securing your children's future.

A common negative aspect of a trust is the potential complexity involved in its management. Trusts, including the New Jersey Revocable Trust for Minors, require ongoing oversight to ensure compliance with legal requirements. Moreover, there may be costs associated with setting up and maintaining the trust, which can discourage some families from pursuing this beneficial option.

One major mistake parents often make is failing to properly structure the trust. Inadequate planning can lead to confusion about asset distribution, especially when it comes to a New Jersey Revocable Trust for Minors. Ensure you clearly outline the beneficiaries, the age at which they will receive assets, and any specific conditions for distribution.

Setting up a New Jersey Revocable Trust for Minors involves a few straightforward steps. Start by gathering important information about your assets and determining how you wish to distribute them among your minor beneficiaries. Next, draft the trust document, which outlines the terms of the trust and appoint a trustee. For an easier process, consider using uslegalforms, which provides templates and guidance to help you navigate the setup of your revocable living trust efficiently.

A New Jersey Revocable Trust for Minors offers several advantages. It allows you to manage and distribute assets in a flexible manner while maintaining control during your lifetime. Additionally, it can help avoid the lengthy probate process, ensuring that your minor beneficiaries receive their inheritance more quickly and efficiently. Moreover, it provides privacy since the trust does not go through public probate, safeguarding your family's financial information.

There is no one-size-fits-all answer to the best age to set up a trust, but starting early can be beneficial. Establishing a New Jersey Revocable Trust for Minors when your child is young allows you to dictate how and when they receive assets later on. By doing so, you can prepare for any future needs and adapt the trust as your child grows. Ultimately, setting up a trust sooner rather than later can provide both security and clarity for your family's financial future.