A revocable trust for lottery winnings in New Jersey is a legal arrangement that allows lottery winners to protect and manage their winnings effectively. It provides flexibility in managing assets and reduces potential taxes and probate issues. This type of trust can benefit anyone who wants to maintain control over their winnings while ensuring the assets are distributed according to their wishes. New Jersey offers different types of revocable trusts for lottery winnings to cater to the specific needs and preferences of individuals. These may include: 1. Standard Revocable Trust: This is the most common type of trust that allows the lottery winner to retain complete control over their assets during their lifetime. They can make changes, add or remove beneficiaries, and even revoke the trust if desired. 2. Living Revocable Trust: Similar to the standard trust, a living revocable trust allows the lottery winner to maintain control over their assets while avoiding probate. It becomes effective during the lifetime of the individual and can be adjusted or revoked at any time. 3. Testamentary Revocable Trust: This type of trust becomes effective after the lottery winner's death. It allows the lottery winner to leave instructions for the distribution of their assets upon their passing. Until then, they can maintain control and make changes to the trust provisions. 4. Charitable Revocable Trust: A charitable revocable trust is designed for individuals who wish to donate a portion of their lottery winnings to charitable organizations. It allows them to retain control over their assets during their lifetime while planning for charitable giving. By establishing a revocable trust for lottery winnings in New Jersey, winners can protect their assets from unnecessary taxes, ensure privacy, and have a clear plan for asset distribution. It is essential to consult with a qualified attorney who specializes in trusts and estates law to determine the most suitable type of trust based on individual circumstances and goals.

New Jersey Revocable Trust for Lottery Winnings

Description

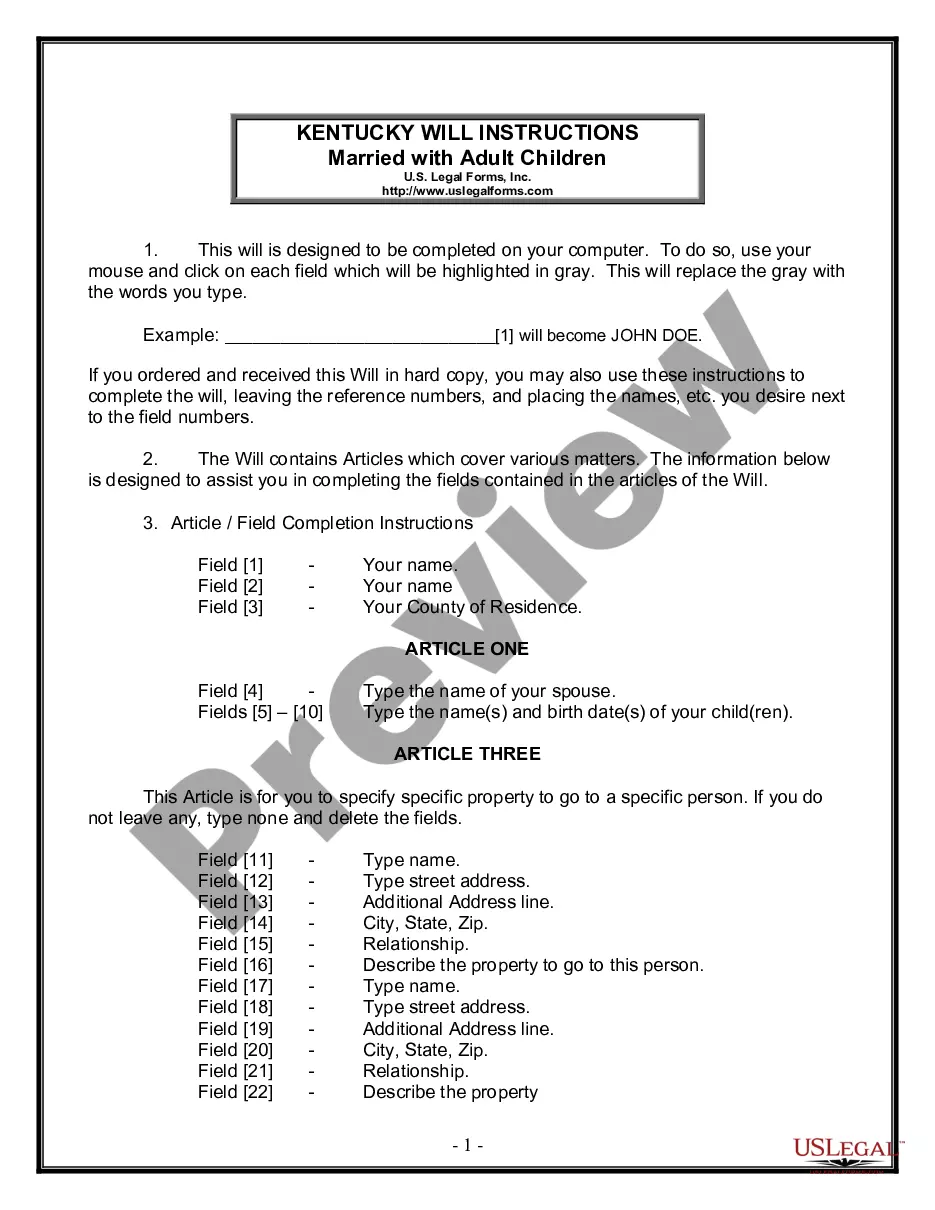

How to fill out New Jersey Revocable Trust For Lottery Winnings?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse assortment of legal document templates that you can download or print.

Through the website, you can discover thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the latest editions of documents such as the New Jersey Revocable Trust for Lottery Winnings in just a few moments.

If you already have a subscription, Log In and download the New Jersey Revocable Trust for Lottery Winnings from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded documents in the My documents tab of your account.

Proceed with the payment. Use your credit card or PayPal account to complete the purchase.

Choose the format and download the document to your device. Make modifications. Fill out, edit, print, and sign the downloaded New Jersey Revocable Trust for Lottery Winnings. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the document you need. Access the New Jersey Revocable Trust for Lottery Winnings with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Make sure to have selected the appropriate document for your area/county.

- Click the Preview button to review the document's content.

- Check the document details to ensure that you have selected the correct document.

- If the document does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the document, confirm your selection by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

If you do not file a tax return when required, you could face penalties and interest charges from the IRS. However, since a revocable trust typically does not require a separate filing, ensure that you report its income as part of your individual tax return. It's always wise to consult a financial advisor to avoid any pitfalls. Proper management through a New Jersey Revocable Trust for Lottery Winnings can keep you on the right track.

You do not need to file a separate tax return for a revocable trust since its income is reported on your individual tax return. As the grantor, you are responsible for any taxes owed on the income generated by the trust. This simplifies the tax process for holders of a New Jersey Revocable Trust for Lottery Winnings making it easier to manage your finances.

Generally, a revocable trust does not file an income tax return separately from the grantor. Income from the trust is considered part of your personal income, thus reported on your tax return. This aspect makes it easier to manage, especially for a New Jersey Revocable Trust for Lottery Winnings, as it simplifies your tax obligations.

There are no outright exemptions for lottery winnings in New Jersey. However, certain deductions or credits may apply based on your overall income and tax situation. It's essential to consult with a tax professional to explore possible benefits. In particular, utilizing a New Jersey Revocable Trust for Lottery Winnings can lead to effective strategies in managing your taxes.

One downside to a revocable trust is that it does not provide asset protection against creditors. Since you retain control over your assets, they can still be subject to claims. Furthermore, it may not reduce taxes, as any income generated from the trust is still reported on your personal return. However, a New Jersey Revocable Trust for Lottery Winnings can efficiently manage distribution and fit your specific financial strategies.

A revocable trust is often the best choice for managing lottery winnings. This type of trust offers flexibility, allowing you the ability to alter terms as needed. Additionally, it helps in maintaining privacy regarding your assets, which can be crucial after a significant win. A New Jersey Revocable Trust for Lottery Winnings is particularly suited to support your financial planning.

Setting up a revocable living trust in New Jersey involves several steps. First, you will need to draft the trust document, which outlines the terms and your wishes. Then, you fund the trust by transferring assets into it, ensuring they pass seamlessly to beneficiaries, especially for lottery winnings. Using US Legal Forms can simplify this process, providing templates and guidance tailored for a New Jersey Revocable Trust for Lottery Winnings.

Yes, a revocable grantor trust typically does not file a separate tax return. Instead, the income generated by the trust is reported on the grantor's personal tax return. This means that as the grantor, you will include the trust’s income on your Form 1040. A New Jersey Revocable Trust for Lottery Winnings serves a smooth transition for tax reporting.

While New Jersey does not generally allow winners to claim their lottery winnings anonymously, there are ways to protect your privacy. By establishing a New Jersey Revocable Trust for Lottery Winnings, your trust can claim the prize on your behalf. This method provides a layer of confidentiality and helps manage your wealth in a secure manner.

Yes, New Jersey does reveal lottery winners as part of state regulations. This transparency can come as a shock to winners unprepared for the public scrutiny that accompanies their success. Utilizing a New Jersey Revocable Trust for Lottery Winnings can provide a degree of privacy by allowing your trust to claim the winnings, potentially shielding your identity from the public eye.