New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

If you need to complete, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s user-friendly and convenient search feature to find the documents you require.

A wide range of templates for business and personal purposes are sorted by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Every legal document template you obtain is yours indefinitely. You have access to every form you purchased in your account. Click the My documents section and select a form to print or download again. Be proactive and download, and print the New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to get the New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to access the New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also find forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

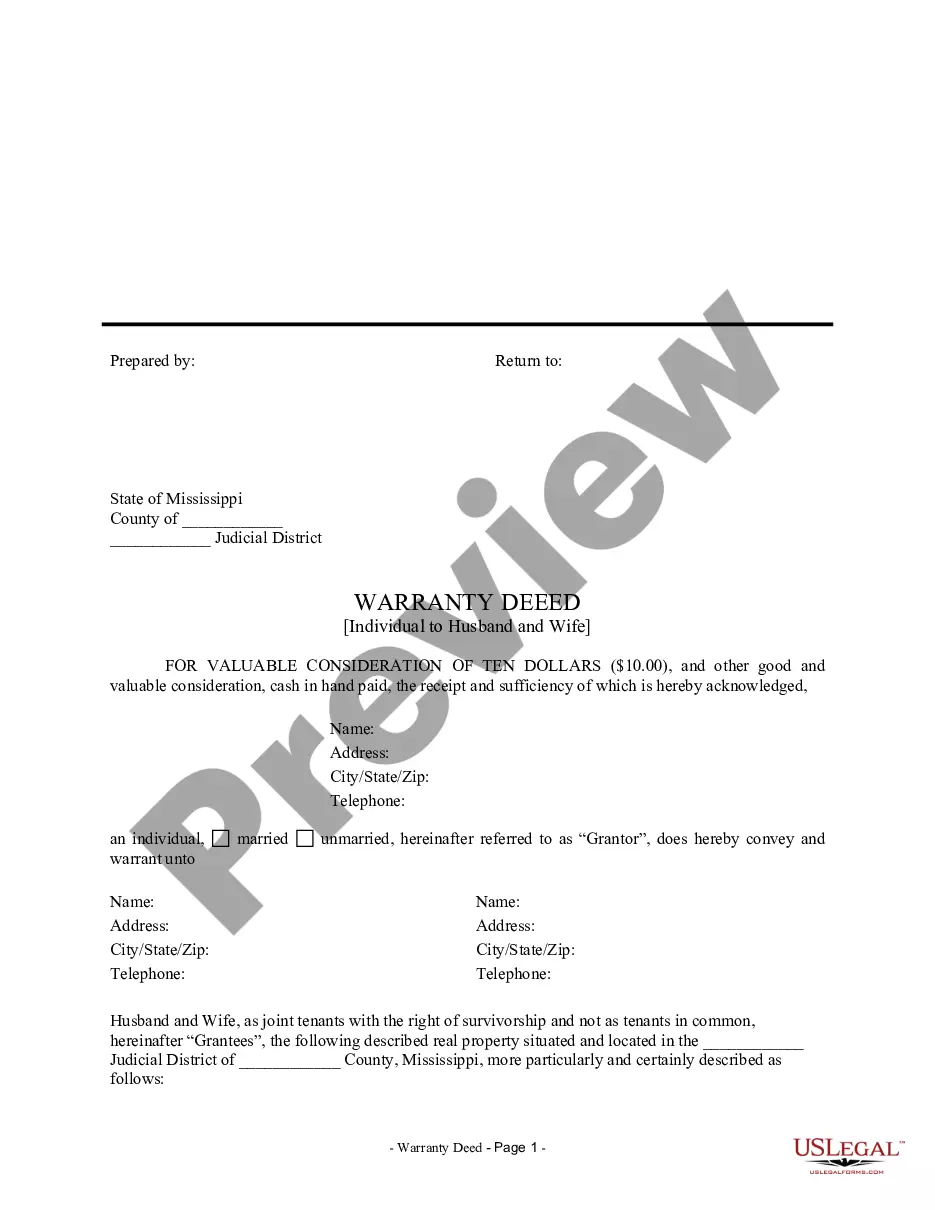

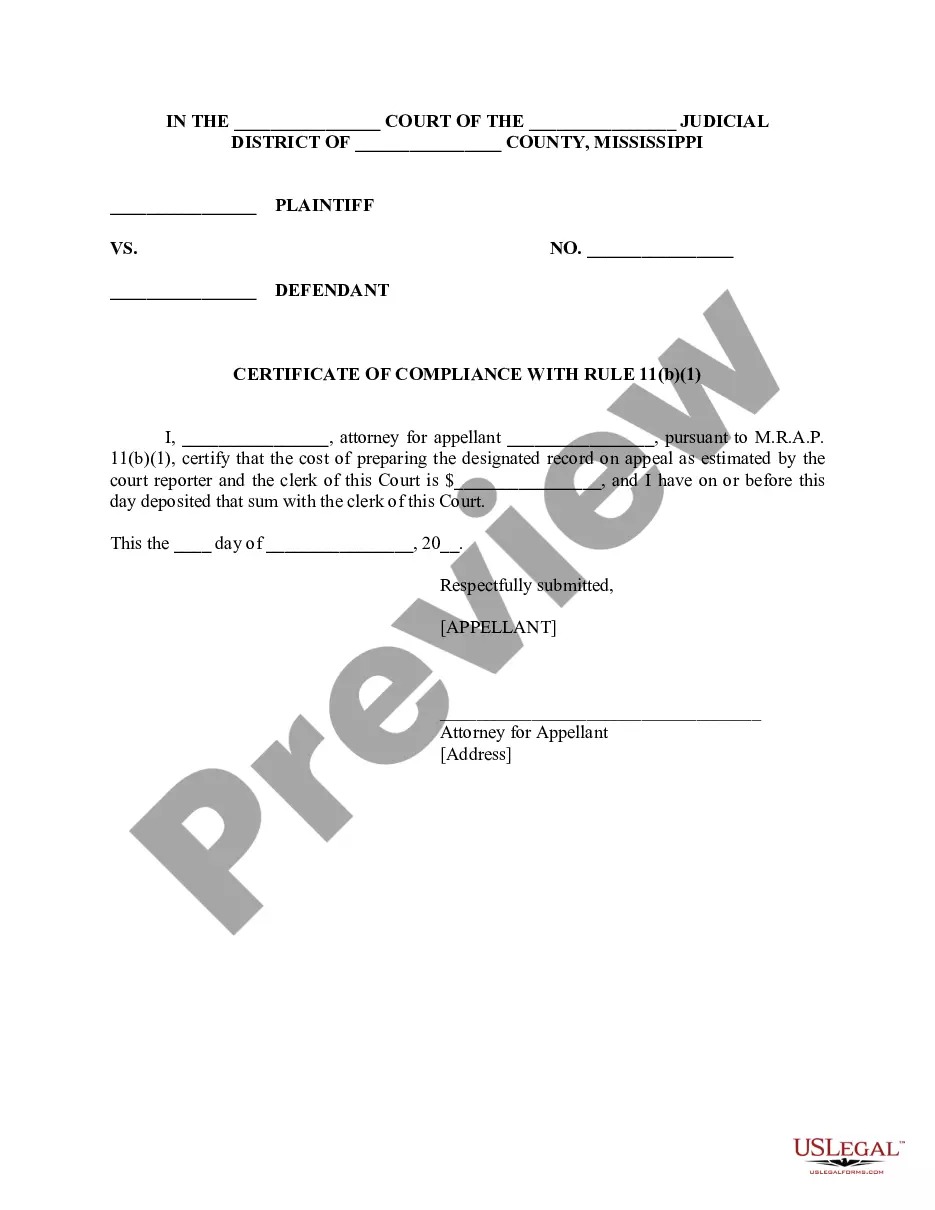

- Step 2. Use the Review option to examine the form’s content. Remember to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other forms from the legal form template.

- Step 4. Once you have found the form you want, click the Acquire now button. Choose the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Filling out the ST-4 form in New Jersey requires attention to detail. This form is used for claiming an exemption from sales tax for certain purchases, including commercial rentals under the New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Ensure you provide accurate information regarding your business, the type of lease, and any applicable exemptions. If needed, consider accessing resources on the uslegalforms platform for assistance in completing this form correctly.

In New Jersey, leases are generally taxed based on the type of property rented. For commercial leases, such as the New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, both the landlord and tenant should be aware of their tax responsibilities. The state often requires that sales tax be applied to the rental payments. To navigate these complexities, obtaining professional advice is beneficial.

The sales tax on rent for commercial properties in New Jersey typically applies to the total rent charged. For a New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, landlords may have to collect sales tax from tenants. Understanding how to calculate and apply this tax is essential for compliance. If you have questions, consider seeking guidance from a legal expert or using a platform like uslegalforms.

In New Jersey, rentals for residential use are generally not taxable. However, certain commercial rentals, including the New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, may be subject to sales tax. It's crucial for landlords and tenants to understand how these tax rules apply to their specific situations. Consulting with a tax professional can help clarify any uncertainties.

In New Jersey, luxury tax applies to certain high-end goods but does not directly pertain to commercial leases like a New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. If your retail store sells taxable luxury items, those sales may be subject to a luxury tax, affecting your overall tax obligations. Review current regulations or seek expert advice to navigate this complexity.

To calculate a percentage lease for a New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you first determine the total gross sales during the lease period. Next, apply the agreed-upon percentage to this total to find your additional rent amount. This structure aligns the landlord's income with your store's performance, creating a mutually beneficial arrangement.

In New Jersey, the sales tax on leases is generally applicable to the rental of tangible personal property. However, for a New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, you should review your lease agreement to determine if any sales tax applies to additional rent or leasing terms. Maintaining compliance ensures you avoid unexpected tax liabilities.

Rental income in New Jersey is considered taxable income and should be reported on your state and federal tax returns. For a New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, any additional rent based on gross sales also contributes to your taxable rental income. It's advisable to keep thorough records and consider consulting a tax professional to optimize your tax obligations.

The lease rate for a New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate typically involves a base rent alongside additional rent calculated as a percentage of your gross sales. Landlords often require a minimum guaranteed rent, allowing them to benefit from your store's success. Lease terms and market factors also play crucial roles in determining the final lease rate.

The breakpoint percentage is the rate at which gross sales exceed the predetermined breakpoint, prompting additional rent payment. This percentage usually reflects the landlord's share of sales, providing them with income in line with the tenant's success. Understanding the breakpoint percentage is essential for maintaining financial clarity in a New Jersey Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.