Mississippi Warranty Deed from Individual to Two Individuals / Husband and Wife

Overview of this form

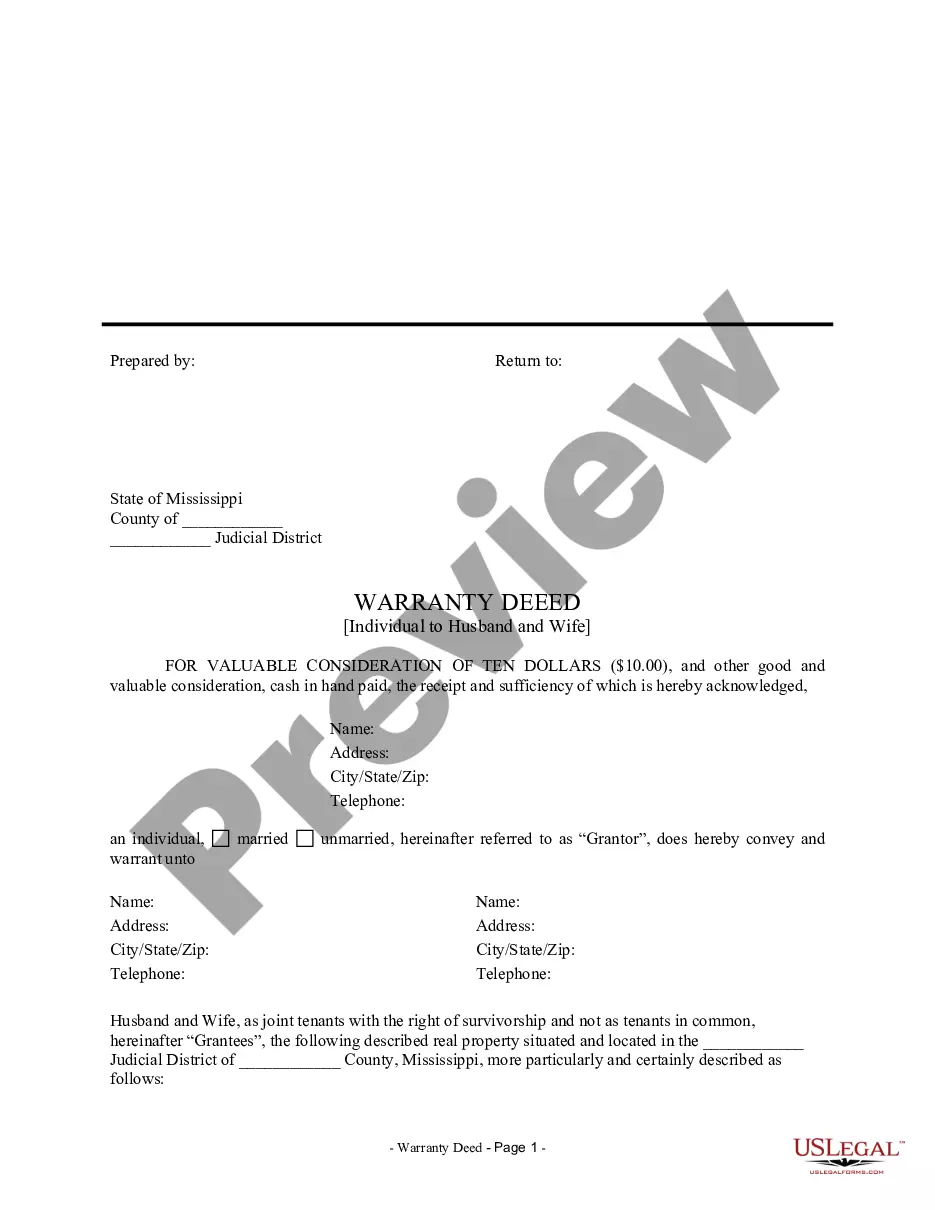

The Warranty Deed from Individual to Two Individuals, also known as a Warranty Deed to Husband and Wife, is a legal document where one party, the Grantor, transfers ownership of real property to two individuals or a married couple, the Grantees. This form provides a warranty that the Grantor has the legal right to sell the property and guarantees that there are no undisclosed claims against it. This form is commonly used to establish joint ownership with rights of survivorship, distinguishing it from other deeds such as quitclaim deeds or bargain and sale deeds.

Key components of this form

- Identification of the parties: Names and details of the Grantor and Grantees.

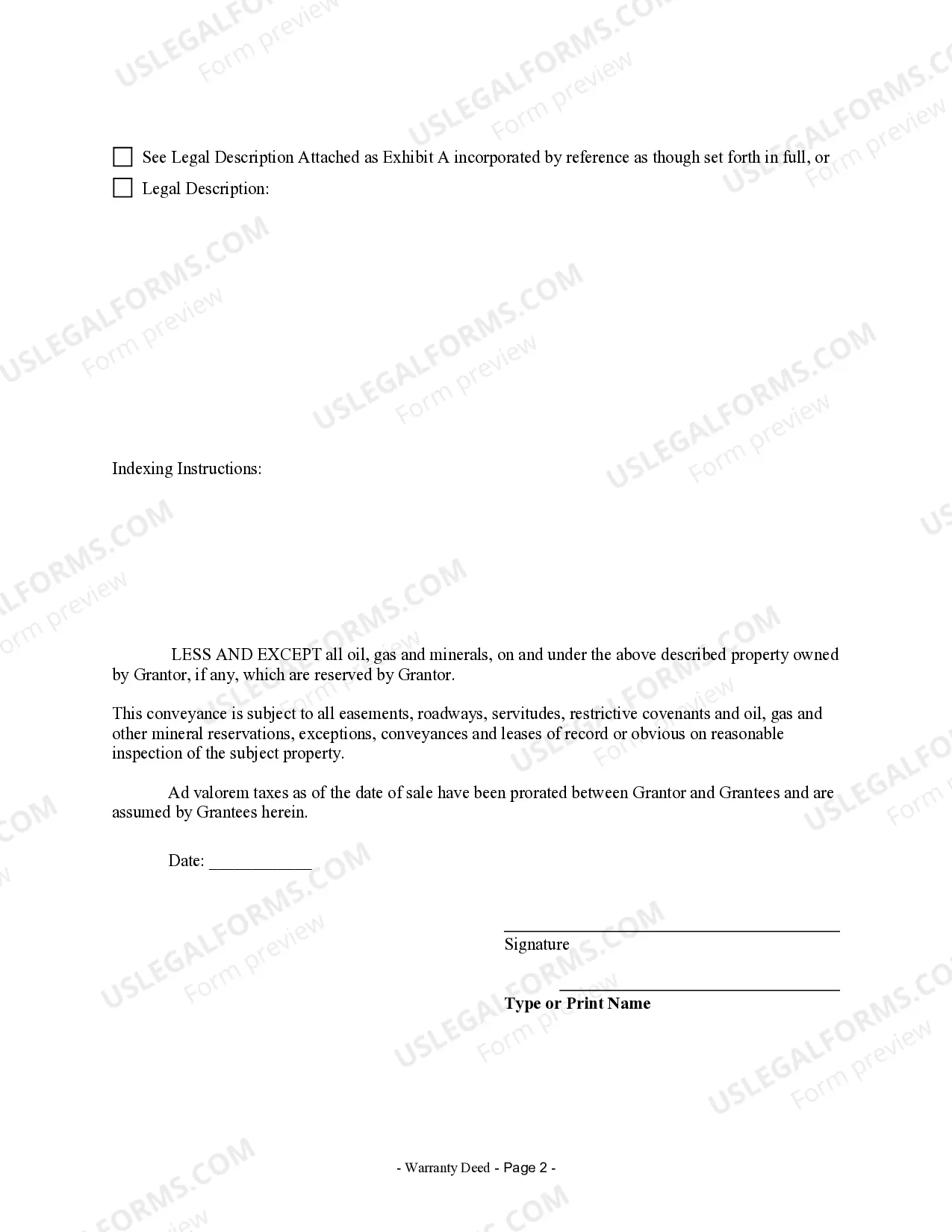

- Property description: A detailed description of the property being conveyed, including its legal identifier.

- Consideration clause: The acknowledgment of the payment or exchange involved in the transaction.

- Statement of warranty: Assurance that the Grantor holds clear title to the property.

- Signatures: Required signatures of the Grantor and, in some cases, the Grantees.

When to use this document

This Warranty Deed should be used when an individual wishes to convey property to two individuals, typically a married couple. It is particularly important in situations where the couple intends to hold the property as joint tenants with survivorship rights, ensuring that if one owner passes away, the other automatically becomes the sole owner without the need for probate.

Who should use this form

- Individuals transferring real property to two people or a husband and wife.

- Married couples seeking to establish joint ownership of property.

- Real estate professionals assisting clients with property transfers.

Steps to complete this form

- Identify the Grantor and Grantees by entering their full names.

- Describe the property being conveyed, referring to the legal description attached as Exhibit A.

- Specify the consideration amount, typically acknowledging a nominal payment.

- Ensure all parties sign the document where indicated.

- File the completed deed with the appropriate county office to officially record the transfer.

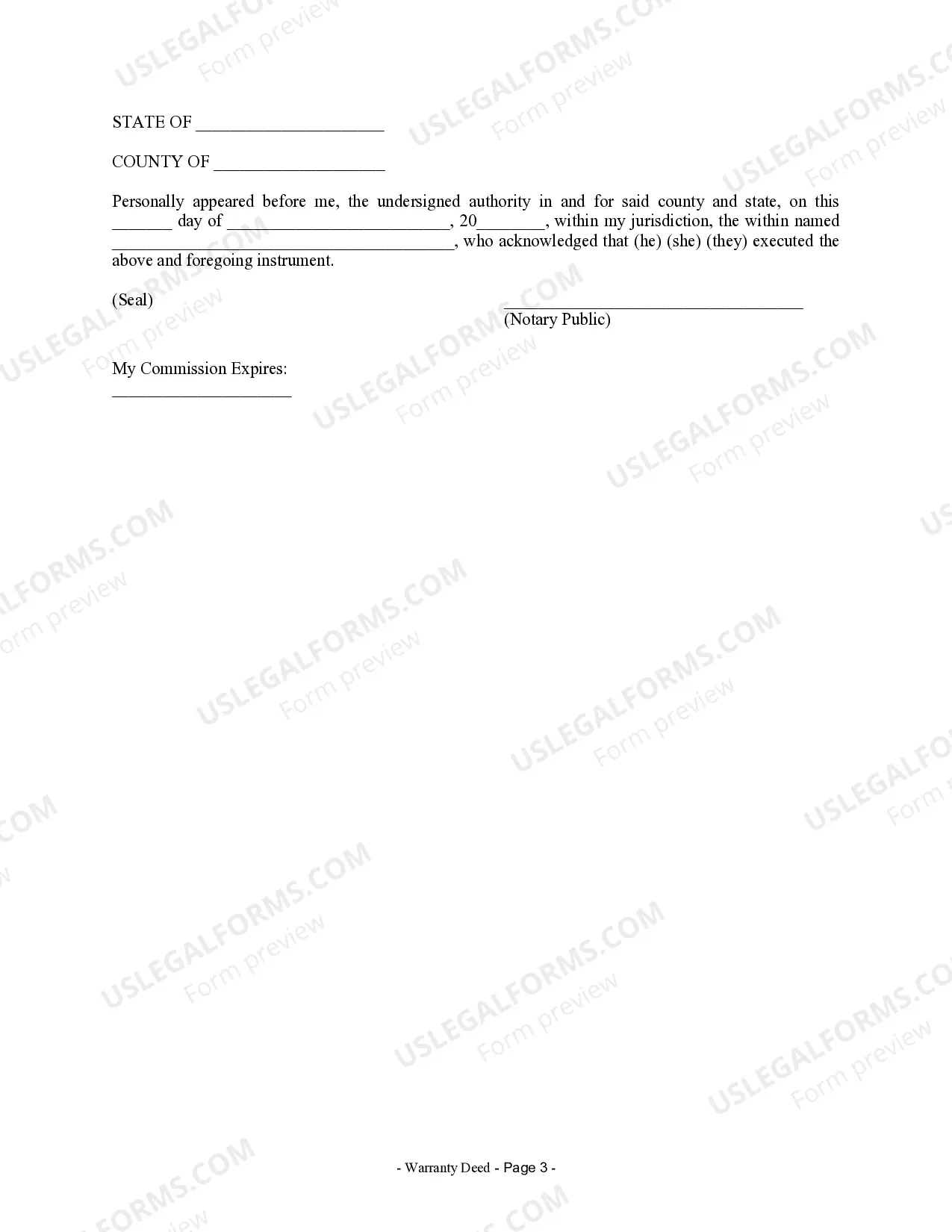

Notarization guidance

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Common mistakes

- Failing to provide a complete property description.

- Not signing the deed or missing signatures from all parties.

- Using outdated forms that do not comply with current state laws.

- Omitting the consideration clause or inaccurately filling it out.

Why complete this form online

- Convenience of downloading and completing the form at your own pace.

- Access to templates drafted by licensed attorneys, ensuring legal validity.

- Ability to edit and customize the form as necessary for your specific situation.

- Secure and easy storage of your documents for future reference.

Jurisdiction-specific notes

This form complies with the statutory laws applicable in Mississippi and may need to be adjusted if used in other jurisdictions. Always review local property laws and consult a licensed attorney if needed.

Form popularity

FAQ

If you've recently married and already own a home or other real estate, you may want to add your new spouse to the deed for your property so the two of you own it jointly. To add a spouse to a deed, all you have to do is literally fill out, sign and record a new deed in your county recorder's office.

How long will home warranty coverage last? Most home warranty terms are one year. This is a 12-month contract which in many cases is renewable from year to year. Make sure to renew your home warranty promptly each year so that you're not caught without coverage.

Purchasing a home warranty, though, can help alleviate some of the financial burden new homeowners face when a major appliance or home system goes out. Yes, you'll pay for a warranty upfront but the savings could be worth the added expense.

If you don't want to worry about paying out of pocket when a key household item breaks down, spending $25 to $50 per month for protection is often worth it. The average home warranty costs between $300 and $600 per year, typically covering more than $20,000 worth of appliances and systems in your home.

What does a $500 home warranty cover? An annual service contract for $500 will typically cover basic systems like air conditioning, electrical, and plumbing, and important appliances like your refrigerator, dishwasher, washer, and dryer.