Missouri Checklist - Sale of a Business

Description

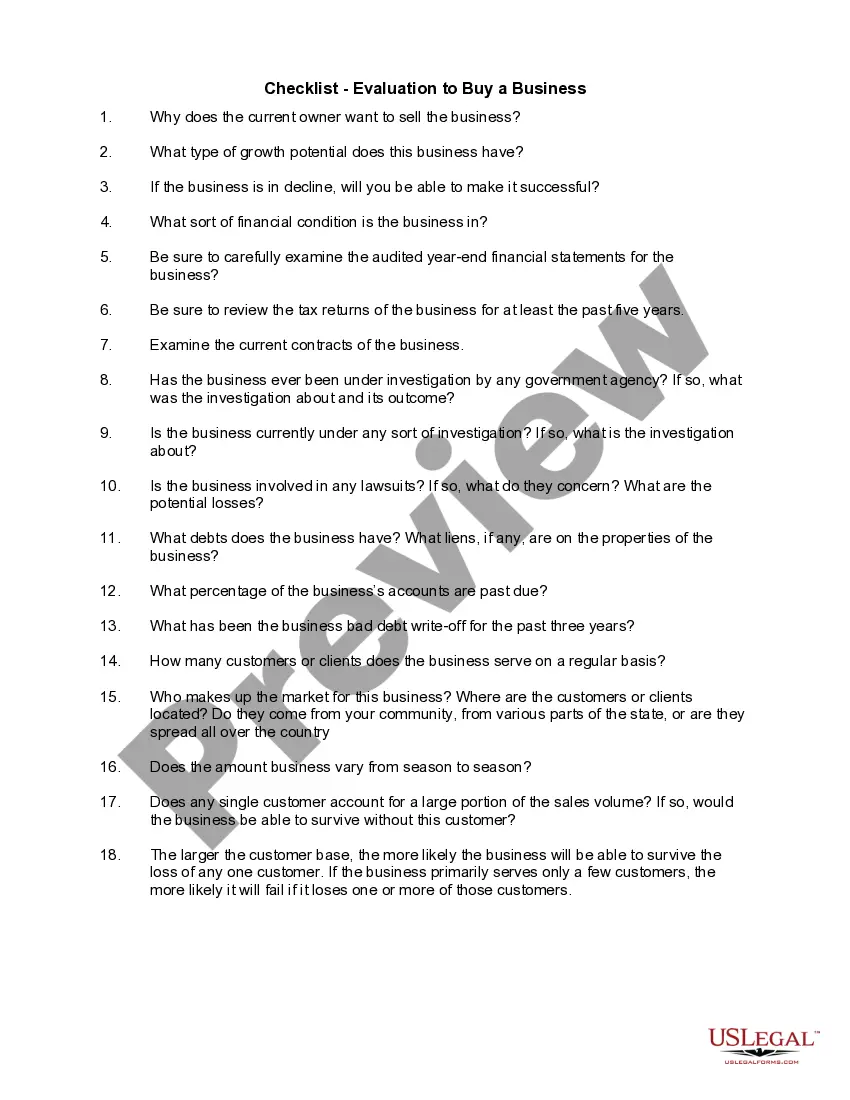

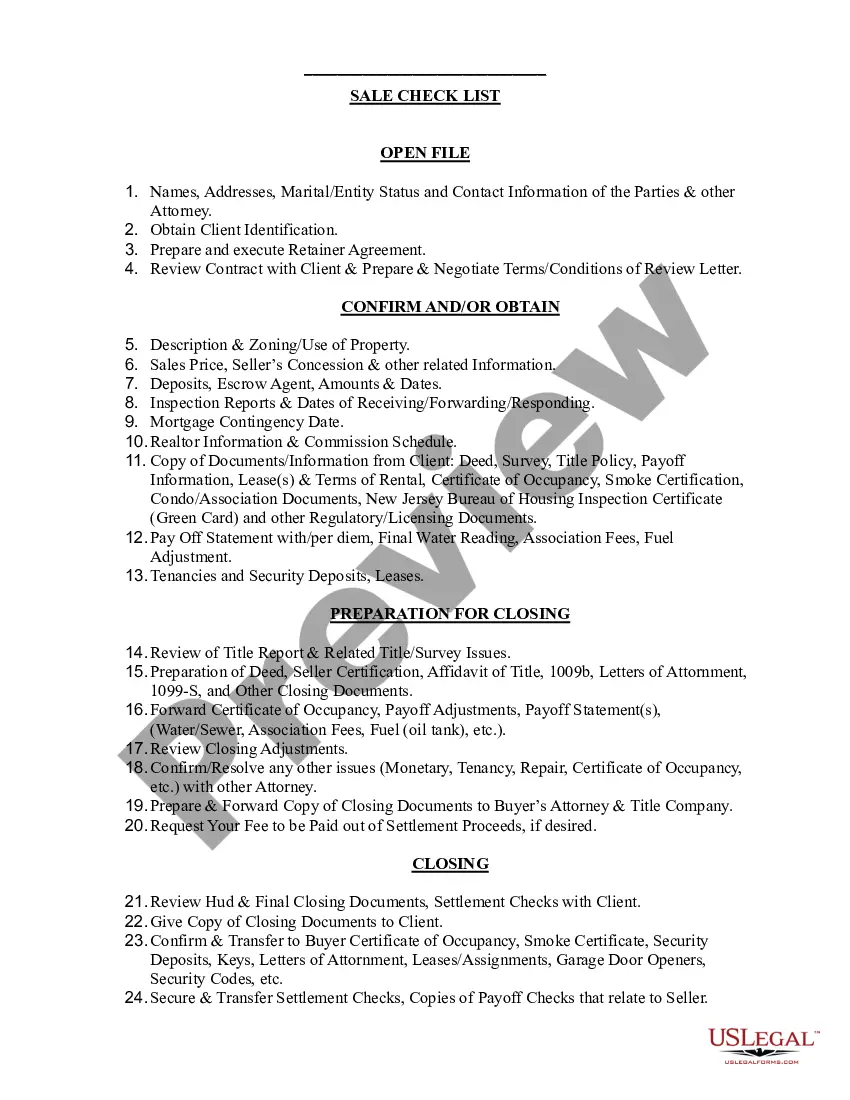

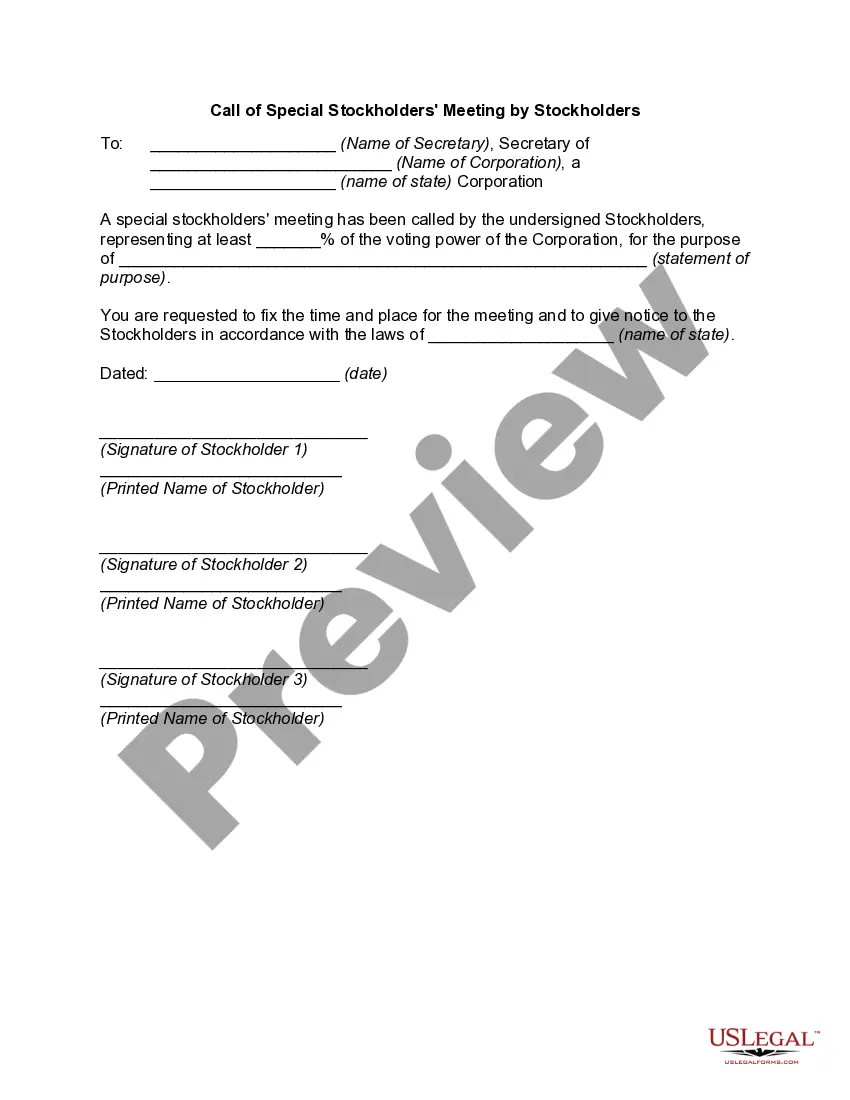

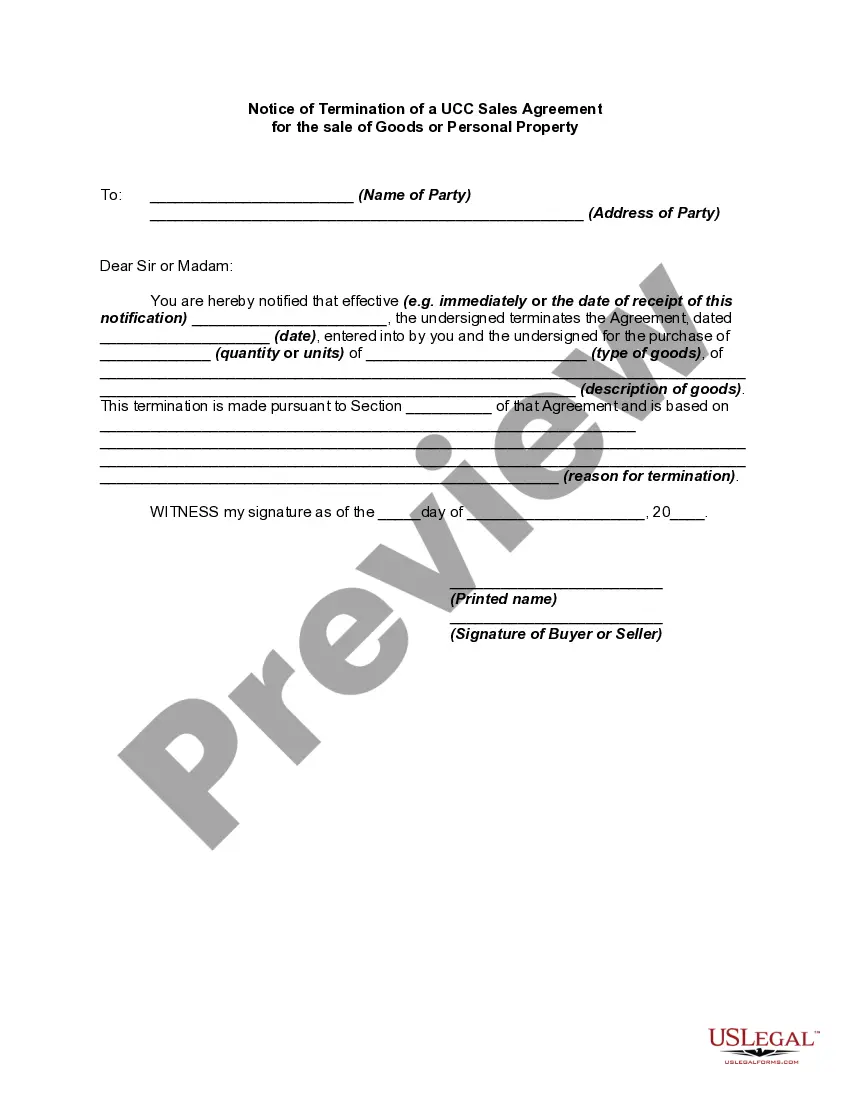

How to fill out Checklist - Sale Of A Business?

If you're seeking to obtain, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Various templates for commercial and personal purposes are categorized by type and state, or keywords. Use US Legal Forms to quickly find the Missouri Checklist - Sale of a Business.

Every legal document template you purchase is yours indefinitely. You will have access to every form you saved in your account. Go to the My documents section and choose a form to print or download again.

Be proactive and acquire, and print the Missouri Checklist - Sale of a Business with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to download the Missouri Checklist - Sale of a Business.

- You can also access the forms you've previously saved in the My documents tab of your account.

- If you're using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your specific region/state.

- Step 2. Use the Preview option to review the form’s content. Remember to read the description.

- Step 3. If you're not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Step 4. Once you've found the form you need, click the Buy now button. Choose the payment plan you prefer and input your information to create the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Missouri Checklist - Sale of a Business.

Form popularity

FAQ

Rather than petitioning the court to remove a member from an LLC, members can petition the court to dissolve the LLC. An LLC must be dissolved in order for it to be terminated, i.e., for it to legally cease to exist. The LLC cannot enter into new contracts, although it may be required to satisfy existing agreements.

A business tax ID number, also called an employer identification number (EIN) or federal tax ID, is a unique nine-digit number that identifies your business with the IRS.

LLC ownership percentage is usually determined by how much equity each owner has contributed. The ownership interest given to each owner can depend on the need of the limited liability company and the rules of the state where the LLC has been formed.

In Missouri, you must first file a Notice of Winding Up to inform the state that you are in the process of ending your business. Then, once you wind up your LLC, you must file the Articles of Termination. Both forms are $25. Missouri requires business owners to submit their Articles of Termination" by mail or online.

A Missouri tax ID number, also referred to as an EIN or Employer Identification Number, is given to a business entity from the IRS. It's also called a Tax ID Number or Federal Tax ID Number (TIN).

Find Your Missouri Tax ID Numbers and RatesYou can find your Employer Account Number on any previous quarterly report, or on any notices you've received from the Department of Labor and Industrial Relations.If you're unable to locate this, contact the agency at (573) 751-1995.

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others.

Choose the right business structure (formation) for you....Full Transfer: Selling Your Missouri LLCDetermine whether the buyer wants your entire entity or just your LLC's assets.Obtain the consent of every LLC member to sell the business.Consult your Operating Agreement for help drafting a buy/sell agreement.

Change ownership You should contact the Department to determine if you will need to apply for a new number businesstaxregister@dor.mo.gov or call 573-751-5860.

If you want to change the name of your Missouri LLC, you will have to submit a completed Amendment of Articles of Organization form to the Secretary of State. You can file by fax, mail, or in person. You will also have to include $25 for the filing fee.