New Jersey Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide range of legal document templates that you can download or print.

On the website, you can find thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can access the latest versions of forms such as the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form in minutes.

If you already have a membership, Log In and download the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded New Jersey Minimum Checking Account Balance - Corporate Resolutions Form. Every template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

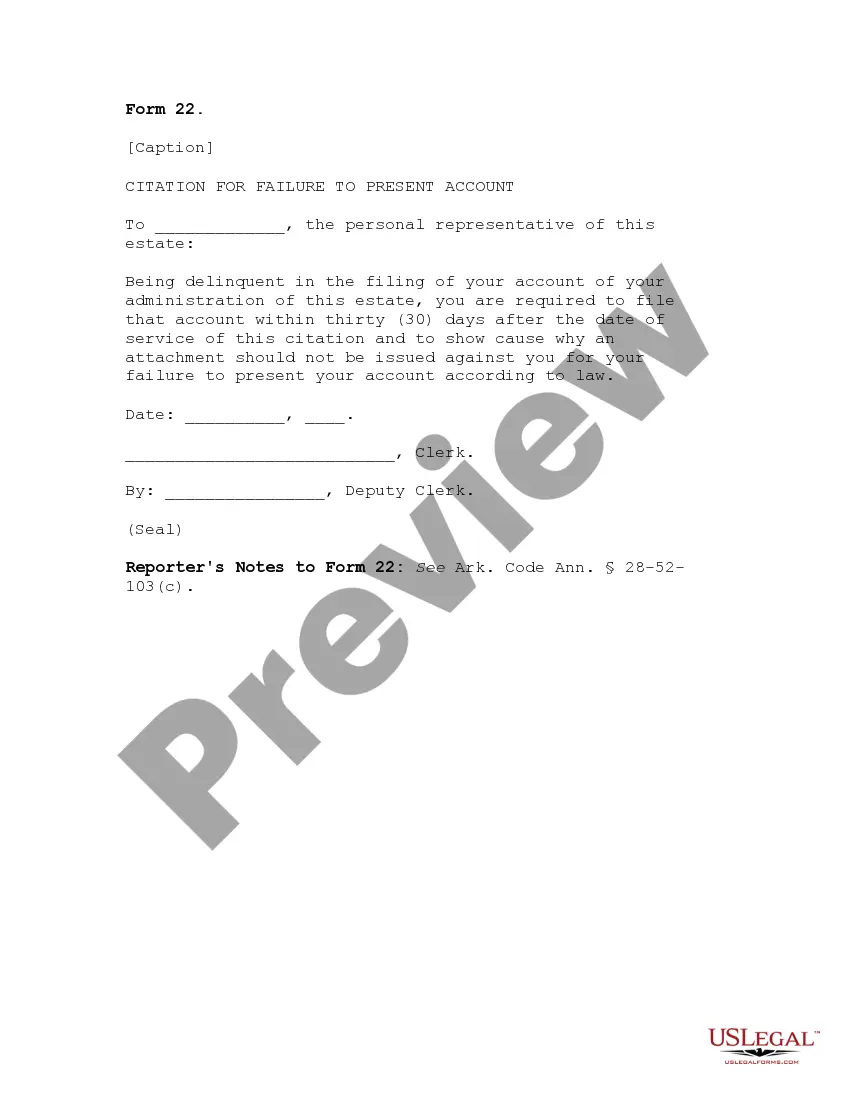

- Click the Preview button to review the form's details.

- Check the form summary to confirm you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- Once satisfied with the form, confirm your choice by clicking on the Download Now button.

- Next, select your preferred pricing plan and provide your credentials to register for an account.

Form popularity

FAQ

Doing business in New Jersey typically includes engaging in commercial activities, operating retail locations, or conducting any business transactions within the state. If your company meets these criteria, it may need to comply with state regulations. Utilizing tools like the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form can assist your business in meeting necessary legal requirements effectively.

New Jersey does not mandate the use of a corporate seal for corporate resolutions. However, having one can add a layer of professionalism and authenticity to your documents. When preparing the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form, consider including a seal to strengthen your documentation, even if it is not legally required.

A company resolution refers to a formal decision made by the board of directors or shareholders of a corporation. This document serves to authorize specific actions, such as opening bank accounts or appointing officers. When utilizing the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form, a well-drafted resolution can facilitate smoother transactions with financial institutions.

Another name for a corporate resolution is a board resolution. This document outlines decisions made by a company's board of directors. It is crucial for official record-keeping and ensures compliance with legal requirements. When dealing with matters like the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form, having a clear resolution can simplify banking processes.

A corporate resolution in New Jersey is a legal document that records a corporation’s decisions made during its meetings regarding banking transactions or other corporate actions. This resolution is crucial for meeting the legal requirements set by the state while ensuring transparency. Completing the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form provides an efficient way to fulfill these requirements.

The purpose of a corporate resolution is to formally document decisions made by a corporation’s board or members, especially regarding financial matters. This ensures that all actions taken are documented and compliant with corporate governance. For businesses dealing with bank accounts, the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form smooths this process.

Yes, a non-US citizen can open a bank account in the United States, though there are specific requirements to meet. Generally, they must provide valid identification and tax identification numbers. If you are looking to understand the implications or need assistance, refer to the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form to guide your setup.

A corporate resolution for a bank account is a written document that empowers specific individuals within a company to access and manage its bank accounts. This resolution must be clearly articulated to prevent any confusion about who holds the authority. Utilizing the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form helps to formalize this arrangement effectively.

A bank mandate resolution specifies who has the authority to operate a bank account for a corporation. This document is essential for clarifying the roles and responsibilities of authorized signatories. For businesses needing guidance on maintaining compliance, the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form can provide clear direction.

A corporate bank resolution is a formal record that authorizes specific individuals to conduct banking transactions on behalf of a corporate entity. This document typically includes details about signatories and their powers concerning the company’s accounts. Completing the New Jersey Minimum Checking Account Balance - Corporate Resolutions Form helps ensure that all banking transactions meet your corporate governance standards.