New Jersey Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate

Description

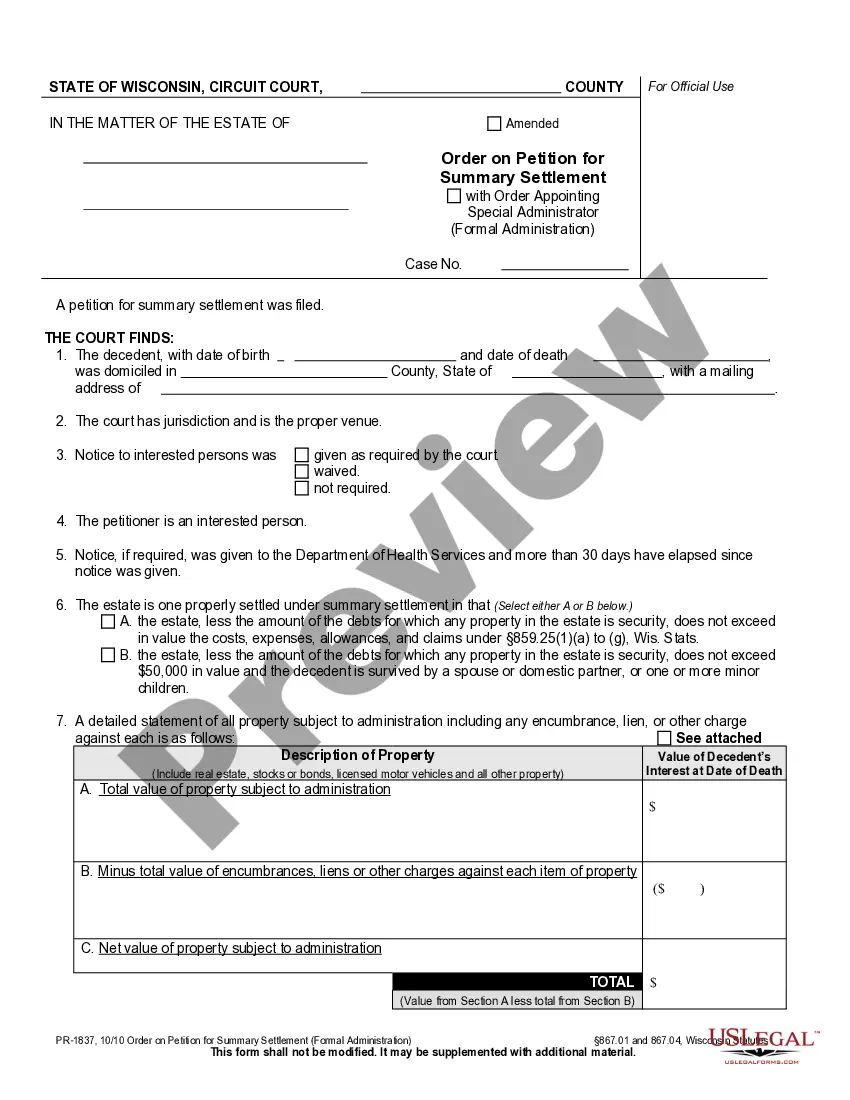

How to fill out Affidavit By An Attorney-in-Fact In The Capacity Of An Executor Of An Estate?

US Legal Forms - one of several largest libraries of lawful forms in America - delivers a wide array of lawful record themes you are able to acquire or produce. While using site, you can find a huge number of forms for organization and person uses, categorized by types, says, or key phrases.You can find the most up-to-date models of forms such as the New Jersey Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate within minutes.

If you already possess a registration, log in and acquire New Jersey Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate from your US Legal Forms catalogue. The Obtain button will appear on every form you view. You gain access to all formerly acquired forms inside the My Forms tab of your respective bank account.

If you want to use US Legal Forms for the first time, allow me to share easy recommendations to obtain started off:

- Be sure to have picked out the proper form for the city/region. Select the Review button to check the form`s content material. See the form description to actually have chosen the appropriate form.

- In the event the form doesn`t fit your needs, take advantage of the Research area towards the top of the screen to obtain the one who does.

- In case you are content with the shape, confirm your choice by visiting the Get now button. Then, select the costs prepare you want and supply your qualifications to register to have an bank account.

- Process the financial transaction. Utilize your charge card or PayPal bank account to finish the financial transaction.

- Find the formatting and acquire the shape on your system.

- Make adjustments. Complete, modify and produce and signal the acquired New Jersey Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate.

Each format you included with your account lacks an expiration day and is your own property for a long time. So, if you would like acquire or produce yet another duplicate, just proceed to the My Forms portion and click about the form you require.

Gain access to the New Jersey Affidavit by an Attorney-in-Fact in the Capacity of an Executor of an Estate with US Legal Forms, one of the most considerable catalogue of lawful record themes. Use a huge number of expert and state-certain themes that meet your company or person demands and needs.

Form popularity

FAQ

Beneficiaries have the right to be informed As a beneficiary, you are entitled to have an accounting from the executor, also known as a personal representative or fiduciary.

After nine months, and if there are no unpaid or pending claims, the executor can distribute the assets and issue a declaration of discharge. Closing an estate can take just a little over nine months if there's no litigation, no problems determining beneficiaries, and no creditor issues.

I mentioned that you can legally close an estate without an accounting to beneficiaries. New Jersey probate law allows beneficiaries, however, the right to demand an accounting regarding the affairs and transactions of the estate.

New Jersey law states that executor fees should be: 5% of the first $200,000 of all assets (real and personal); 3.5% on the excess over $200,000 up to $1,000,000; and 2% on the excess over $1,000,000.

As a beneficiary, you are entitled to review the trust's records including bank statements, the checking account ledger, receipts, invoices, etc. Before the trust administration is complete, it is recommended you request and review the trust's records which support the accounting.

Beneficiary rules Once an account owner assigns a beneficiary, the beneficiary only has access to the account upon the owner's death. The account owner may also remove or change who they designate at any time. Assigning a beneficiary doesn't override survivorship.

New Jersey probate law requires that the executor must act in the best interests of the estate and the beneficiaries. After the will is probated, the executor must provide formal notice of the probate to the beneficiaries named in the will and the deceased person's next of kin.

New Jersey probate law requires that the executor must act in the best interests of the estate and the beneficiaries. After the will is probated, the executor must provide formal notice of the probate to the beneficiaries named in the will and the deceased person's next of kin.