New Jersey Acknowledgment by Debtor of Correctness of Account Stated

Description

How to fill out Acknowledgment By Debtor Of Correctness Of Account Stated?

If you desire to be thorough, acquire, or print valid document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's user-friendly and efficient search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. After you have located the desired form, select the Get now option. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to quickly find the New Jersey Acknowledgment by Debtor of Correctness of Account Stated.

- If you are an existing US Legal Forms customer, Log In to your account and click on the Get button to obtain the New Jersey Acknowledgment by Debtor of Correctness of Account Stated.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

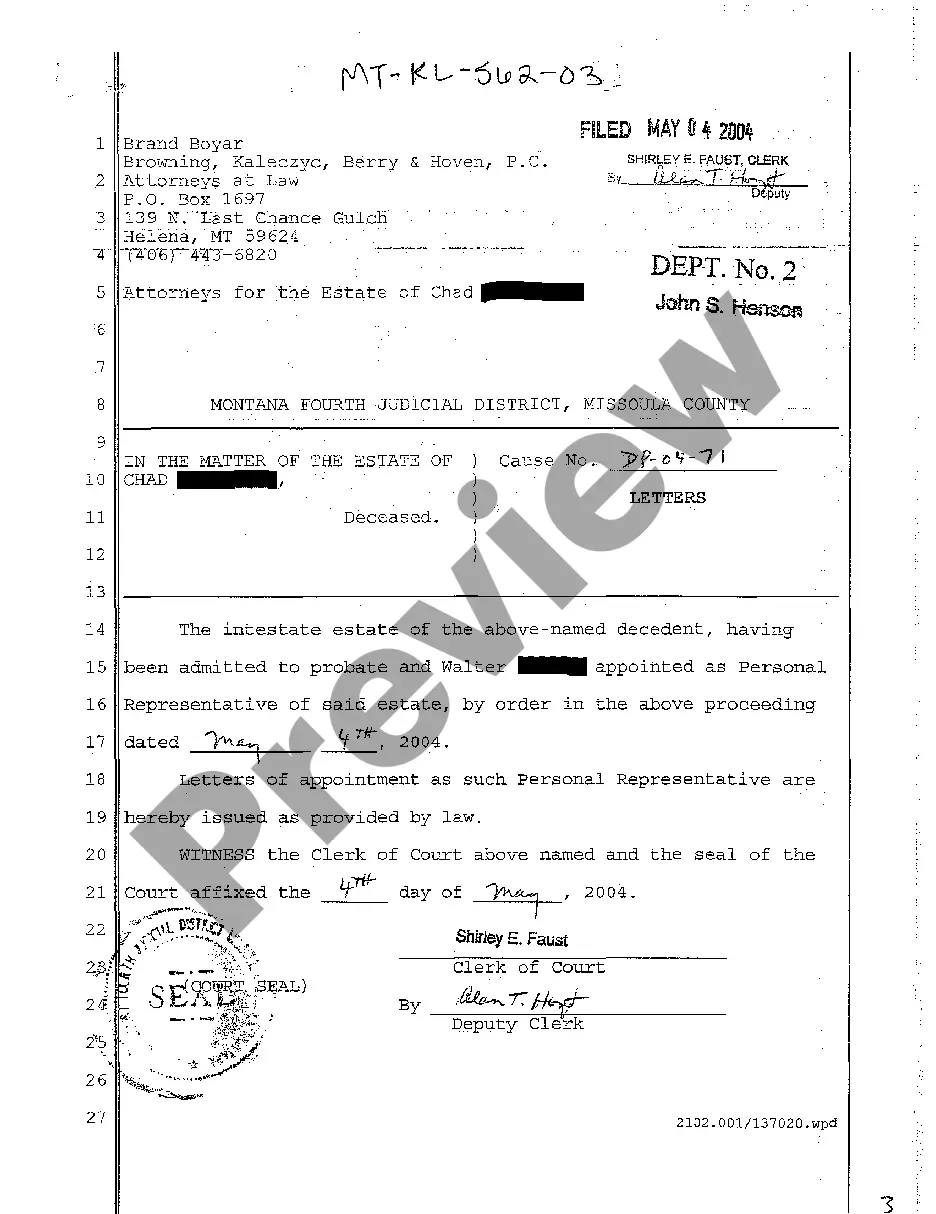

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other types of the legal document template.

Form popularity

FAQ

A debtor may overcome a prima facie case of an account stated by meeting the burden of proving fraud, mistake, or error in the account. The cause of action for an account stated is based on the agreement of the parties to pay the amount due upon the accounting, and not any written instrument.

Time limitations The Statute of Limitation is three years in South Africa. Once this time period has elapsed the debtor can refuse to pay the outstanding account, unless summons has been issued by the courts prior to the expiration date.

Account stated refers to a document summarizing the amount a debtor owes a creditor, and account stated is a cause of action in many states that allows a creditor to sue for payment.

The Creditor's claim will only prescribe after the period of three years have lapsed from the date of the acknowledgement of debt, even if the debt was admitted without prejudice.

The statute of limitations on a judgment is 20 years not six. Further, a creditor can renew the judgment. Also, he said, there is an exception to NJ Statute of Limitation law. The six-year statute of limitation does not apply to contracts between merchants or a sale of goods under NJ's Commercial Code.

Account stated is a cause of action for payment where one party sent an invoice to the other and the recipient of the invoice failed to object within a reasonable period. By failing to timely object, the recipient of an invoice may be liable for the entire amount of the invoice.

Under California law, "an account stated is an agreement, based on prior transactions between the parties, that the items of an account are true and that the balance struck is due and owing."4 The three elements of the claim are 1) previous transactions between the parties establishing the relationship between debtor

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

The creditor or the debt collector still can sue you to collect the debt. The Fair Debt Collection Practices Act prohibits debt collectors from using abusive, unfair or deceptive practices when attempting to collect a debt.

Statute of Limitations in New Jersey The statute of limitations on credit card debt and most other debt in New Jersey is six years (it's four years for auto loans). That means that the debt collector has that amount of time to file a lawsuit.