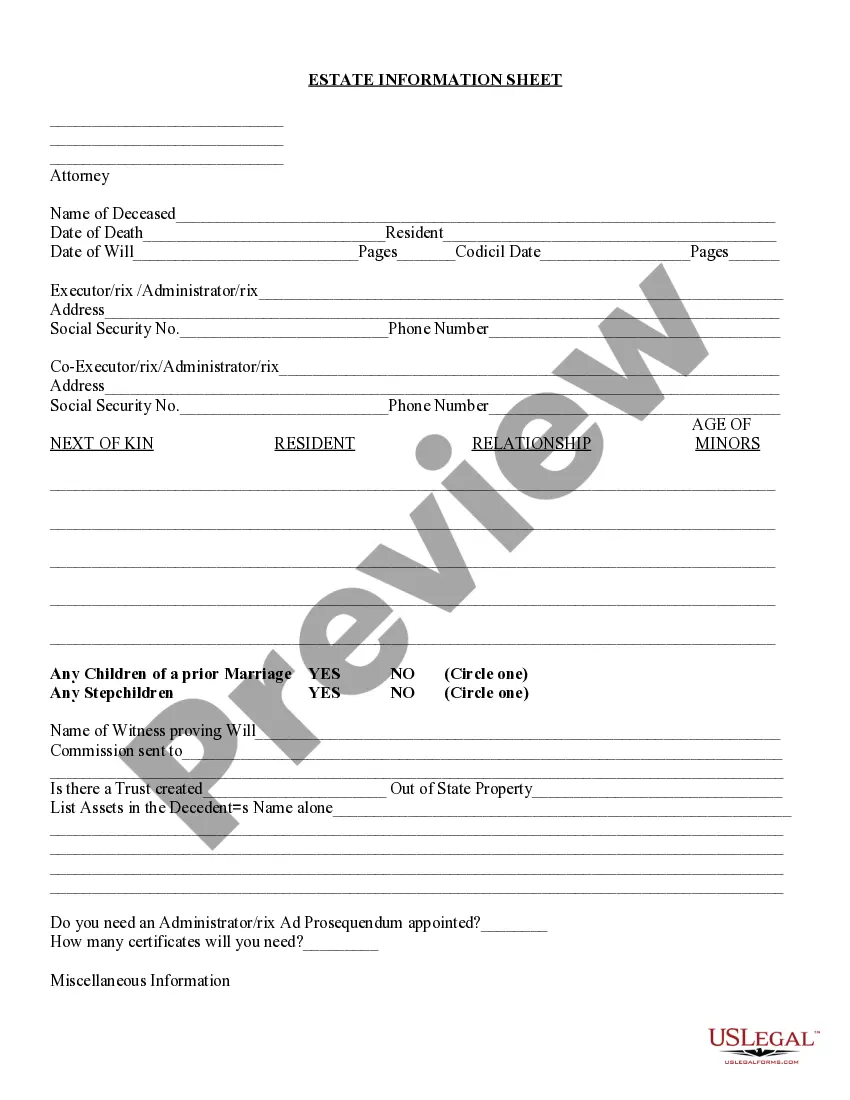

The New Jersey Estate Information Sheet is a document used by the state of New Jersey to provide information about an estate. It is typically used by estate executors and administrators to provide an inventory of assets and liabilities in an estate. The types of New Jersey Estate Information Sheets include: Form EIS-1 (Real Property Inventory), Form EIS-2 (Personal Property Inventory), Form EIS-3 (Receipts and Disbursements), Form EIS-4 (Final Account) and Form EIS-5 (Certificate of Completion). The forms provide information on the assets and liabilities of the estate and must be completed and submitted to the Surrogate Court in the county where the estate is located. The forms must be filed within six months of the date of death of the Testator (the person who wrote the will).

New Jersey Estate Information Sheet

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Jersey Estate Information Sheet?

If you’re searching for a way to appropriately complete the New Jersey Estate Information Sheet without hiring a lawyer, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of formal templates for every personal and business scenario. Every piece of documentation you find on our web service is drafted in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Adhere to these straightforward instructions on how to acquire the ready-to-use New Jersey Estate Information Sheet:

- Ensure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the document name in the Search tab on the top of the page and choose your state from the dropdown to locate an alternative template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Create an account with the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your New Jersey Estate Information Sheet and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded templates in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

Each creditor has nine months from the decedent's passing to claim the estate. After nine months, and if there are no unpaid or pending claims, the executor can distribute the assets and issue a declaration of discharge.

In New Jersey, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

To qualify for a simplified probate, the estate's assets cannot exceed $20,000 in value. If a spouse survives the deceased, the husband or wife must be entitled to the entire estate. In cases where the deceased was not married, the remaining family members have the right to designate a single heir to get the assets.

The Secretary of State has the original wills and probate records. (State Archives, 225 West State Street, PO Box 307, Trenton, New Jersey 08625-0307.

If the decedent has assets solely in his/her name at the time of death then the Will must be probated regardless of the value of the estate. You probate in order for the named executor in the Will to be given the authority to transfer the assets both real and personal to the estate.

Under New Jersey statute, where as estate is valued at less than $50,000, a surviving spouse, partner in a civil union, or domestic partner, may present an affidavit of a small estate before the Superior Court.

Most New Jersey wills cost under $200 to enter into probate, and the process is relatively straightforward. Do not let ?probate court? intimidate you. There is little chance you will need to go into a courtroom or before a judge for this proceeding.

Settling an Estate in New Jersey A petition to open probate is filed with the court.The court approves the executor or names someone if no one was listed in the will or is unable or unwilling to act as the executor.The executor takes inventory of the assets of the estate and secures them.