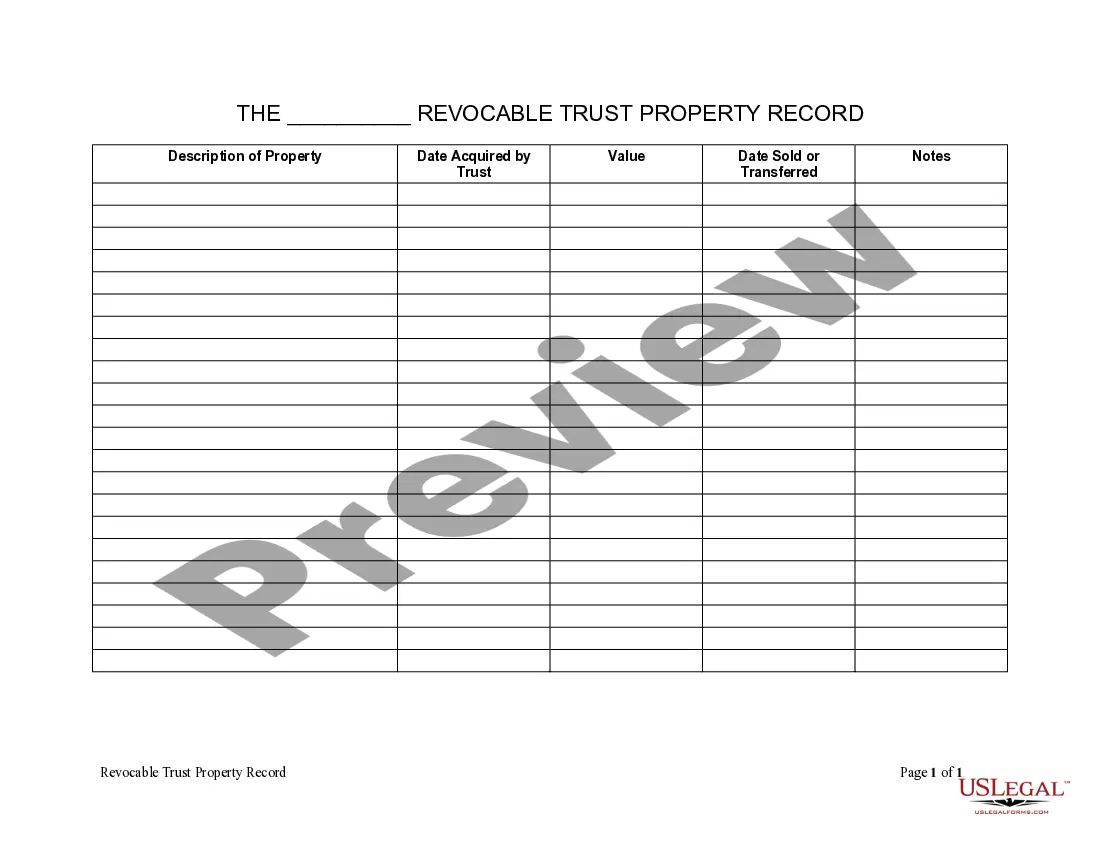

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

New Jersey Living Trust Property Record

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

Key Concepts & Definitions

Living Trust: A living trust is a legal document created during an individual's lifetime where a trustee is appointed to manage the trust's assets for the benefit of the eventual beneficiary. Property Record: In the context of living trusts, a property record refers to the documentation that records and details the inclusion of real estate assets within a trust.

Step-by-Step Guide

- Set Up the Trust: Establish a living trust by drafting a trust document with a legal professional, specifying the trustee and the beneficiaries.

- Select the Property: Identify the real estate properties to include in the living trust.

- Record the Transfer: Transfer the title of the property from the individual to the trustee of the living trust. This involves signing a deed to officially record this transfer.

- Record Keeping: Maintain comprehensive records of all transactions and documents related to the property for legal compliance and future reference.

Risk Analysis

- Improper Recording: Failing to properly record the transfer of property into the living trust can lead to disputes or legal complications.

- Financial Risks: There could be financial implications, such as taxes and fees, when transferring property into a trust.

- Legal Disputes: Incorrectly managed trusts or unclear records can lead to beneficiary disputes.

Key Takeaways

- Setting up a living trust with real estate involves legally transferring property titles into the trust.

- Meticulous record keeping and legal guidance are essential to manage a living trust effectively and securely.

- Understanding potential risks helps in making informed decisions while dealing with living trust property records.

Pros & Cons

Pros:- Helps in estate planning and avoids probate.

- Can provide tax benefits under specific circumstances.

- Offers control over assets even after the grantor's death.

- Potential for mismanagement if not properly handled.

- Initial set up can be complex and requires legal assistance.

- May involve ongoing maintenance costs and fees.

Best Practices

- Consult Professionals: Engage with legal and financial advisors to ensure the trust is set up and managed correctly.

- Detailed Documentation: Keep detailed and accurate records of all property transfers and related documents.

- Regular Updates: Regularly review and update the trust documents to reflect any changes in assets or personal circumstances.

Common Mistakes & How to Avoid Them

- Neglecting Proper Formalities: Ensure all legal requirements are met during the trust formation and property transfer to avoid future legal challenges.

- Insufficient Record Keeping: Maintain organized and accessible records for all trust-related transactions to prevent complications.

How to fill out New Jersey Living Trust Property Record?

US Legal Forms is a special system where you can find any legal or tax document for completing, including New Jersey Living Trust Property Record. If you’re tired with wasting time seeking ideal samples and spending money on papers preparation/legal professional fees, then US Legal Forms is exactly what you’re looking for.

To reap all the service’s benefits, you don't need to download any software but simply choose a subscription plan and register an account. If you have one, just log in and find an appropriate template, save it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need New Jersey Living Trust Property Record, take a look at the instructions below:

- check out the form you’re looking at applies in the state you want it in.

- Preview the form its description.

- Simply click Buy Now to get to the register webpage.

- Choose a pricing plan and continue registering by providing some info.

- Decide on a payment method to complete the registration.

- Download the document by selecting your preferred format (.docx or .pdf)

Now, complete the file online or print out it. If you feel unsure regarding your New Jersey Living Trust Property Record sample, speak to a lawyer to examine it before you decide to send out or file it. Start hassle-free!

Form popularity

FAQ

When you set up a Living Trust, you fund the trust by transferring your assets from your name to the name of your Trust. Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee.

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

Based on these rules, upon creation of a trust, title to trust property is split between the trustee and the beneficiaries. The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Trusts Are Not Public Record.However, trusts aren't recorded. Not having to file the trust with the court is one of the biggest benefits of a trust because it keeps the settlement a private matter between the successor trustees and trust beneficiaries.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.