New Jersey Assignment of Mortgage

Definition and meaning

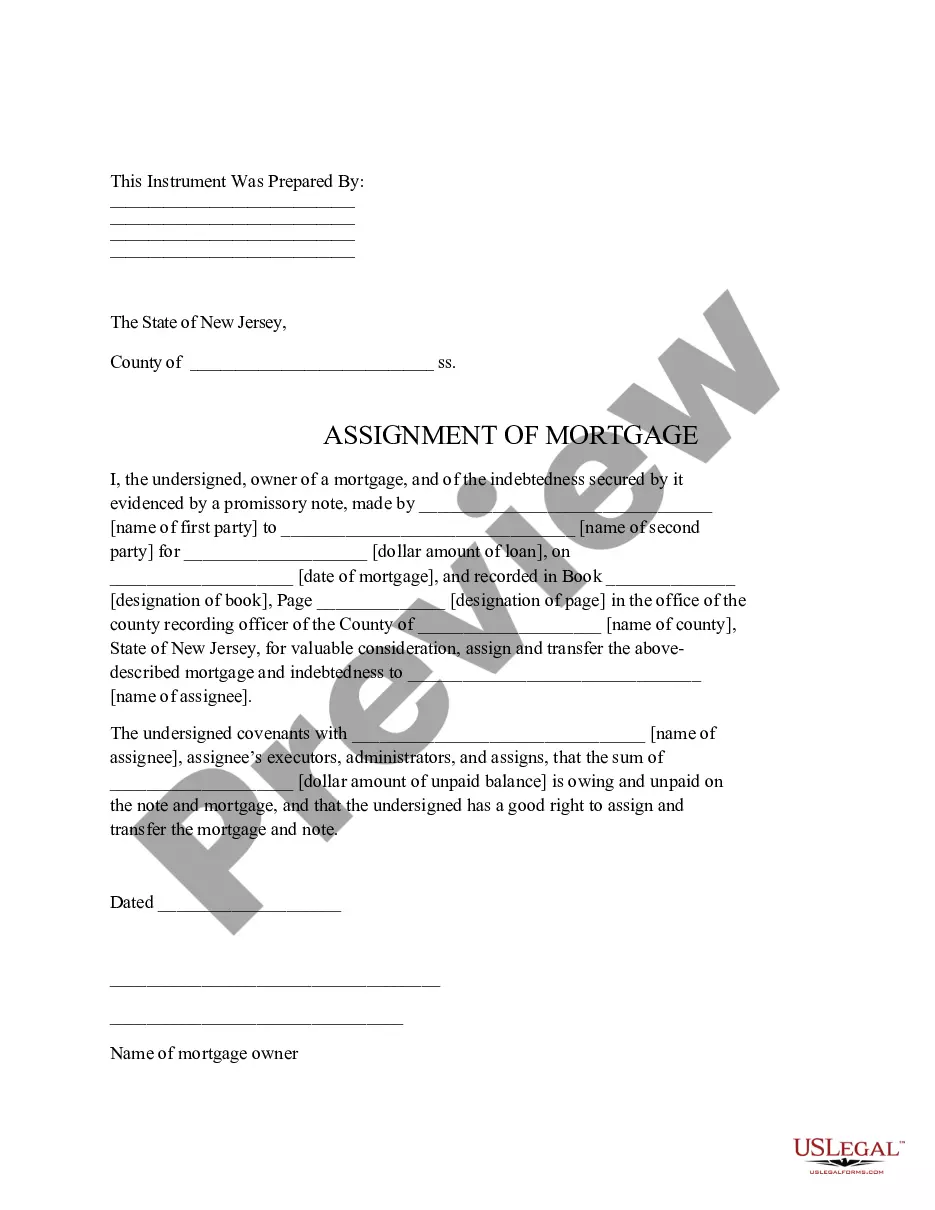

The New Jersey Assignment of Mortgage is a legal document used to transfer the ownership of an existing mortgage from one party (the assignor) to another party (the assignee). This assignment allows the assignee to assume the rights and responsibilities associated with the mortgage loan. It typically involves a promissory note that details the original debt and the terms under which it was created.

How to complete a form

To complete the New Jersey Assignment of Mortgage, follow these steps:

- Start by filling in your name and the name of the mortgage holder in the corresponding fields.

- Specify the dollar amount of the original loan and the date the mortgage was executed.

- Detail the location where the mortgage is recorded, including the book and page numbers.

- Indicate the name of the individual or entity receiving the mortgage assignment.

- Confirm the amount of any unpaid balance.

- Sign the document in the presence of witnesses, ensuring it is dated appropriately.

Make sure to review the form for accuracy before submission.

Who should use this form

The New Jersey Assignment of Mortgage should be used by individuals or businesses that hold a mortgage and wish to transfer their legal rights and obligations to another party. This form is particularly useful in situations such as:

- When a property is sold, and the buyer assumes the existing mortgage.

- When a lender assigns a mortgage to another lender.

- In cases of estate planning, where assets need to be transferred.

Legal use and context

The Assignment of Mortgage is a vital document in real estate transactions in New Jersey. It legally formalizes the transfer of mortgage rights and ensures that the assignee can enforce the terms of the mortgage loan. Proper execution of this form provides clarity in property ownership and mortgage obligations, reducing potential disputes between involved parties.

Key components of the form

The New Jersey Assignment of Mortgage consists of various important sections, including:

- Names of parties: Identifies the assignor and assignee.

- Legal description: Provides a detailed description of the property subject to the mortgage.

- Loan details: Specifies the amount of the original loan, date, and any unpaid balances.

- Signatures: Requires signatures from the assignor and witnesses to validate the assignment.

- Notary acknowledgement: Confirms the authenticity of the signatures before a notary public.

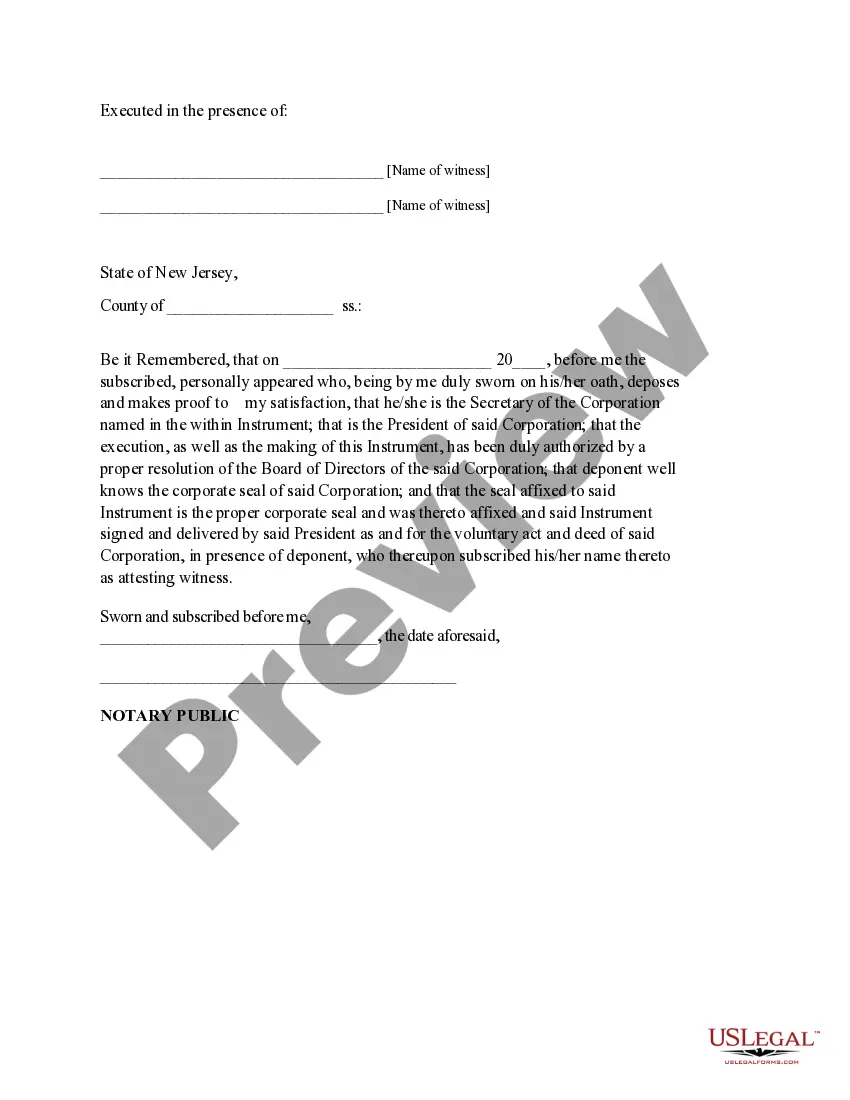

What to expect during notarization or witnessing

Notarization is an essential step in finalizing the New Jersey Assignment of Mortgage. During this process:

- A notary public will verify the identity of the assignor and witnesses.

- All parties will sign the document in the presence of the notary.

- The notary will then affix their seal and provide a certificate of acknowledgment.

This process ensures that the document is legally binding and properly recorded.

Common mistakes to avoid when using this form

When completing the New Jersey Assignment of Mortgage, consider avoiding the following common mistakes:

- Failing to fill in all required fields accurately.

- Not signing the document in the presence of witnesses and a notary.

- Ignoring the requirement for clear identification of all parties involved.

- Neglecting to review the document before submission to ensure all information is correct.

By avoiding these errors, you can help ensure a smoother transaction process.

Form popularity

FAQ

Once a loan has been assigned to MERS, it can be bought and sold any number of times later without recording assignments. Don't be surprised if you find out that your mortgage was assigned to MERS at some point. In most cases, the loan will have to be assigned out of MERS' name before a foreclosure can begin.

Assignment of Mortgage ? The Basics. When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

An assignment of mortgage is a legal term that refers to the transfer of the security instrument that underlies your mortgage loan ? aka your home. When a lender sells the mortgage on, an investor effectively buys the note, and the mortgage is assigned to them at this time.

If the mortgagee fails to execute and record a Satisfaction of Mortgage within the 60-day period afforded by statute, the mortgagor (property owner) may file suit and seek a court order directing the mortgagee to execute a satisfaction of mortgage or an order extinguishing the lien against the property.