New Hampshire Certificate of Cancellation of Certificate of Limited Partnership

Description

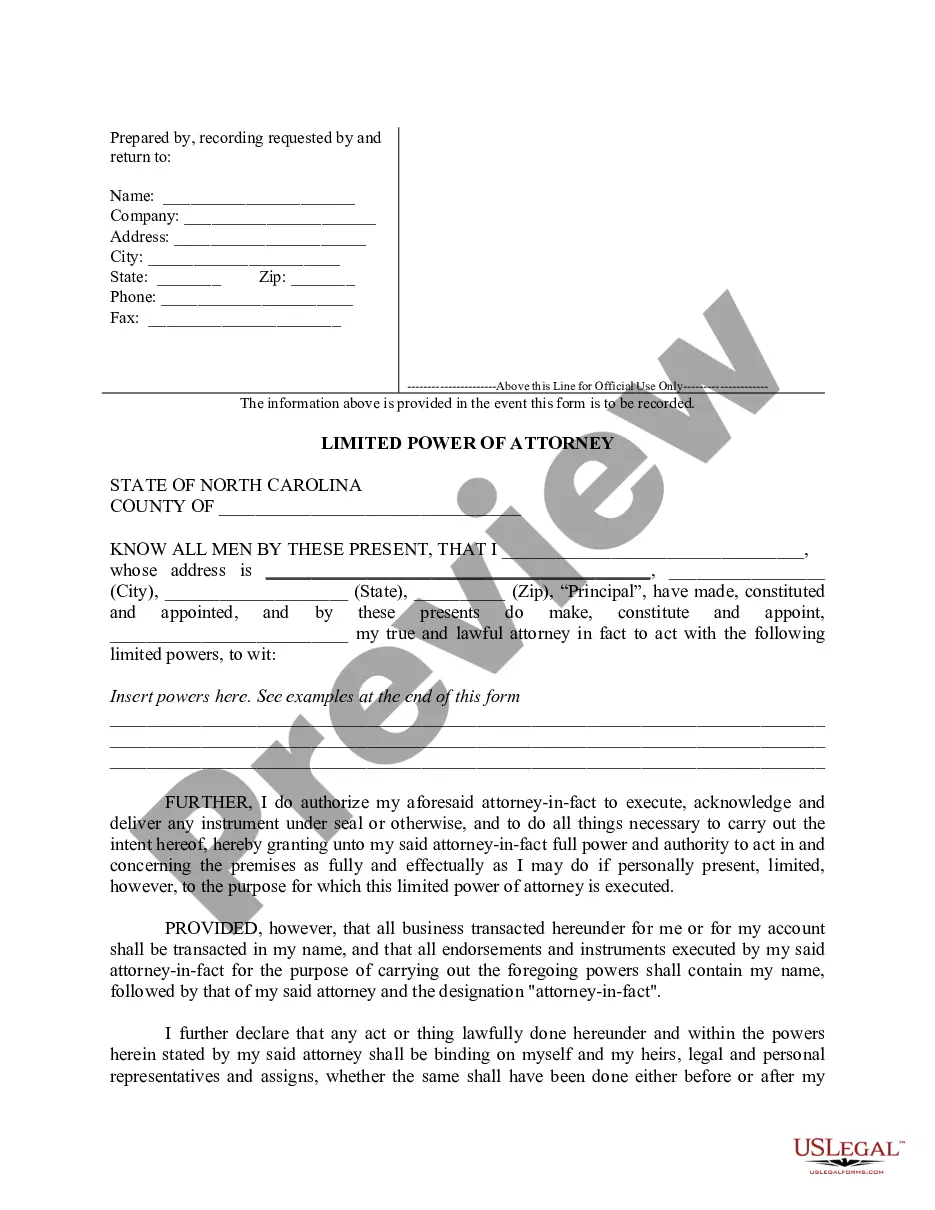

How to fill out Certificate Of Cancellation Of Certificate Of Limited Partnership?

Choosing the right authorized record web template can be quite a struggle. Naturally, there are a variety of templates available on the Internet, but how would you get the authorized develop you need? Make use of the US Legal Forms website. The services provides 1000s of templates, like the New Hampshire Certificate of Cancellation of Certificate of Limited Partnership, which you can use for organization and private requires. Every one of the types are checked out by professionals and fulfill federal and state specifications.

If you are currently signed up, log in in your accounts and click on the Down load button to get the New Hampshire Certificate of Cancellation of Certificate of Limited Partnership. Make use of your accounts to check from the authorized types you have purchased formerly. Check out the My Forms tab of your own accounts and acquire another version of the record you need.

If you are a brand new customer of US Legal Forms, here are easy instructions that you can follow:

- Very first, make certain you have chosen the proper develop for your personal metropolis/state. You can check out the form using the Preview button and study the form information to ensure this is basically the best for you.

- If the develop is not going to fulfill your expectations, take advantage of the Seach area to obtain the right develop.

- Once you are certain the form is suitable, select the Acquire now button to get the develop.

- Select the rates plan you want and enter in the needed details. Design your accounts and buy an order with your PayPal accounts or Visa or Mastercard.

- Pick the submit format and acquire the authorized record web template in your gadget.

- Comprehensive, modify and produce and signal the attained New Hampshire Certificate of Cancellation of Certificate of Limited Partnership.

US Legal Forms is the most significant collection of authorized types that you can discover a variety of record templates. Make use of the company to acquire professionally-manufactured paperwork that follow state specifications.

Form popularity

FAQ

How do you dissolve a New Hampshire Corporation? To dissolve your New Hampshire Corporation, you file Articles of Dissolution by Board of Directors and Shareholders with the New Hampshire Department of State (DOS).

To request the issuance of a tax certification for a withdrawal, cancellation, dissolution or good standing, the Form AU-22, Certification Request Form, must be completed in full and submitted with a non-refundable fee of $30.00 made payable to the State of New Hampshire.

To withdraw/cancel your foreign New Hampshire Corporation, file an Application for Certificate of Withdrawal with the Department of State by mail or in person. Type or print on the form in black ink. Submit the signed, dated original cancellation/withdrawal form, the tax clearance certificate, and the fee.

(b) Form DP-10 shall be filed if the taxpayer has received interest and dividend income exceeding the provisions of RSA , IV even though there is no tax due because of the additional exemptions provided under RSA . N.H. Code Admin. R. Rev 906.02 - Form DP-10, Interest and Dividends ... cornell.edu ? regulations ? new-hampshire cornell.edu ? regulations ? new-hampshire

An essential step in dissolving the business is filing an official dissolution document with the New Hampshire Secretary of State: Corporation Division. This will let the New Hampshire Corporate Commission know that you're winding up the business and intend to dissolve.

Loss of good standing Failure to pay a registration renewal fee. Failure to file a required periodic document, such as an annual report or renewal form. Failure to pay various types of state business taxes or fees. Mistakes made in a filed form, such as not signing the form or not fully completing it. What happens if you lose your certificate of good standing .com ? articles ? what-happens-if-... .com ? articles ? what-happens-if-...

To request forms, please email forms@dra.nh.gov or call the Forms Line at (603) 230-5001. If you have a substantive question or need assistance completing a form, please contact Taxpayer Services at (603) 230-5920. Forms & Instructions | NH Department of Revenue Administration nh.gov ? forms nh.gov ? forms

A POA is required prior to the Department of Revenue Administration communicating with anyone other than the taxpayer regarding any issue relating to the taxpayer. All applicable items must be filled in to properly complete Form DP-2848 New Hampshire Power of Attorney (POA). DP-2848 - Town of Lyme NH | Town of Lyme NH | (.gov) ? vyhlif4636 ? uploads Town of Lyme NH | (.gov) ? vyhlif4636 ? uploads PDF