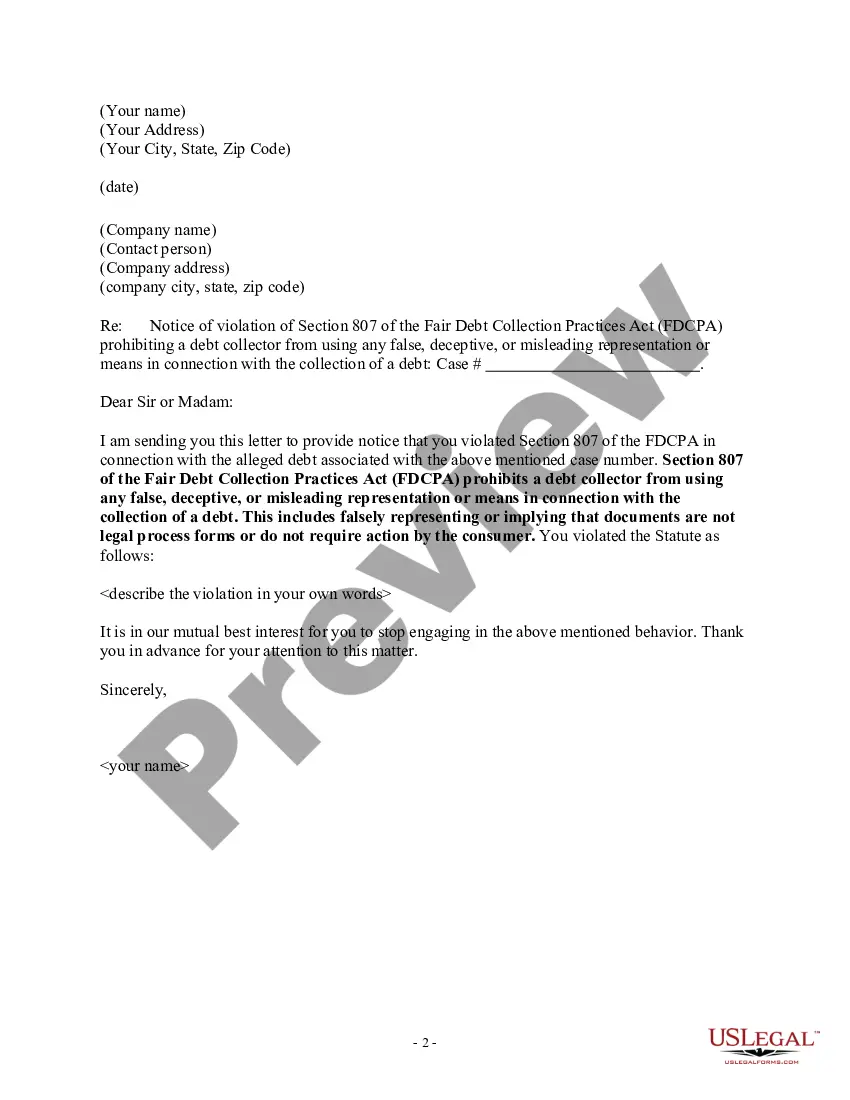

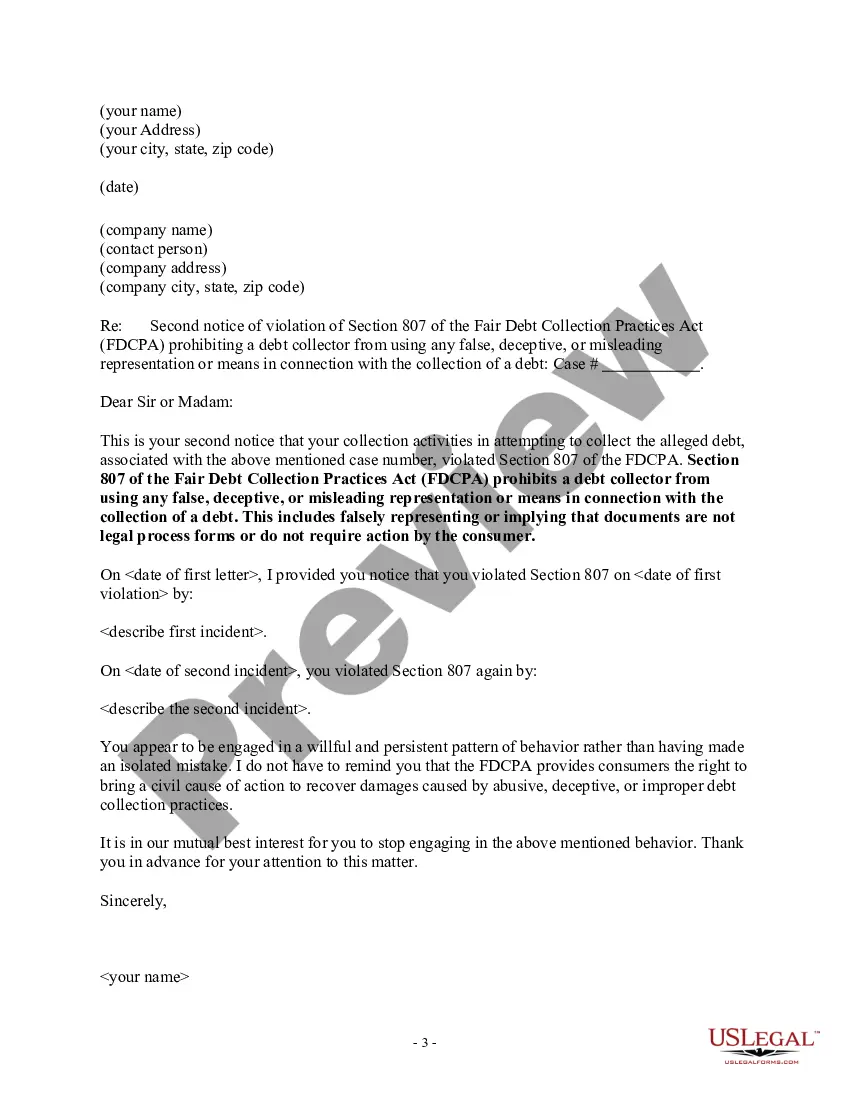

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Montana Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

It is feasible to spend hours online attempting to discover the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal documents that are evaluated by specialists.

It is easy to acquire or print the Montana Notice to Debt Collector - Misrepresenting Documents are Not Legal Processes or Do Not Necessitate Action from your service.

If available, utilize the Examine button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and press the Obtain button.

- Afterward, you can fill out, modify, print, or sign the Montana Notice to Debt Collector - Misrepresenting Documents are Not Legal Processes or Do Not Necessitate Action.

- Every legal document template you purchase is yours permanently.

- To get another copy of any purchased form, navigate to the My documents section and click the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/area you choose.

- Review the form description to confirm that you have chosen the right document.

Form popularity

FAQ

One of the most common violations of the Fair Debt Collection Practices Act involves debt collectors misrepresenting the amount owed or failing to provide validation of the debt. These actions can lead to confusion and unnecessary stress, impacting your financial well-being. If you experience such violations, you can assert your rights, referencing the Montana Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action. Legal resources like those found on the US Legal Forms platform can be invaluable.

A debt collector may not communicate with a consumer at any unusual time (generally before a.m. or after p.m. in the consumer's time zone) or at any place that is inconvenient to the consumer, unless the consumer or a court of competent jurisdiction has given permission for such contacts.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

5 things debt collectors can doSeek payment on an expired debt. All unsecured debts, like credit cards and medical bills, have a statute of limitations.Pressure you.Sue you for payment on a debt.Sell your debt.Negotiate what you owe.5 Ways the Fair Debt Collection Practices Act Protects You.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

A debt collector may state that certain action is possible, if it is true that such action is legal and is frequently taken by the collector or creditor with respect to similar debts; however, if the debt collector has reason to know there are facts that make the action unlikely in the particular case, a statement that

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

The FDCPA does not cover business debts. It also does not generally cover collection by the original creditor to whom you first became indebted. Under the FDCPA, debt collectors include collection agencies, debt buyers, and lawyers who regularly collect debts as part of their business.