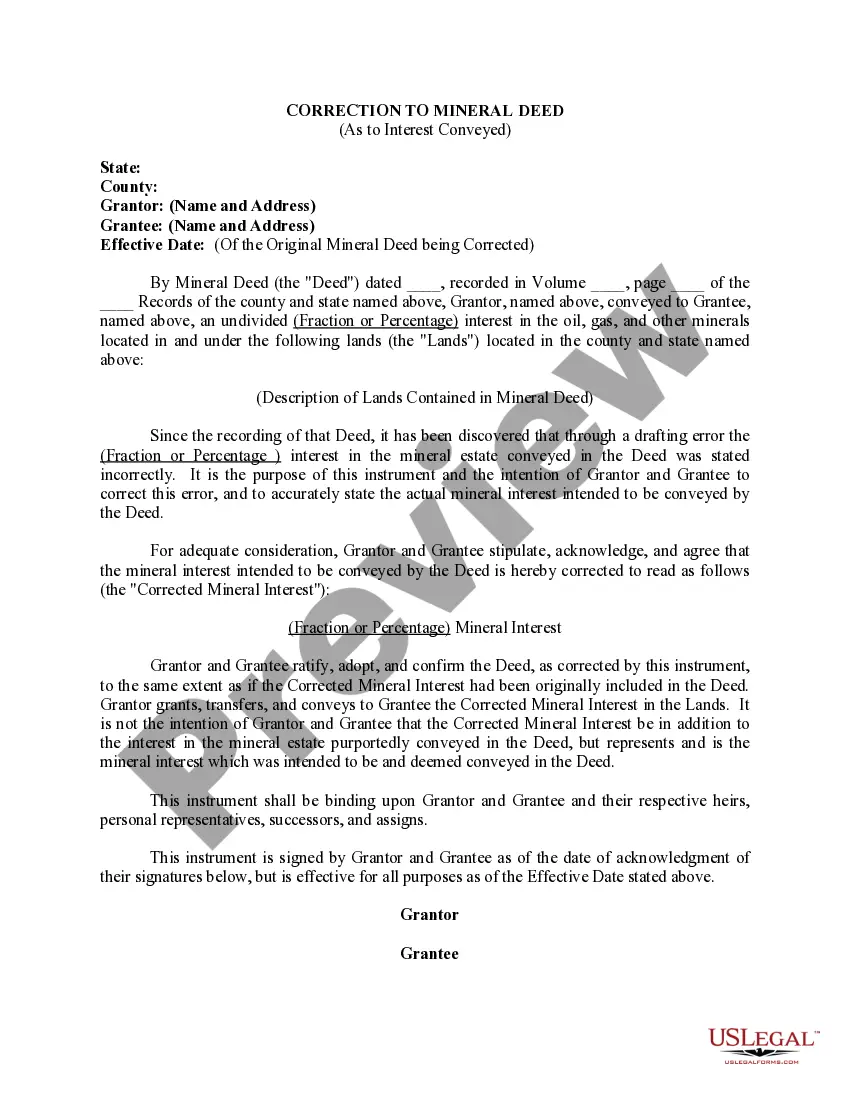

This form is used to when it has been discovered that through a drafting error the (Fraction or Percentage ) interest in the mineral estate conveyed in a Deed was stated incorrectly. It is the purpose of this instrument and the intention of Grantor and Grantee to correct this error, and to accurately state the actual mineral interest intended to be conveyed by the Deed.

New Hampshire Correction to Mineral Deed As to Interest Conveyed

Description

How to fill out Correction To Mineral Deed As To Interest Conveyed?

Have you been inside a placement the place you require documents for both enterprise or specific reasons just about every working day? There are a variety of authorized record templates available online, but finding ones you can depend on is not simple. US Legal Forms provides 1000s of kind templates, just like the New Hampshire Correction to Mineral Deed As to Interest Conveyed, that are created to meet state and federal requirements.

If you are already familiar with US Legal Forms internet site and possess a merchant account, merely log in. After that, you can download the New Hampshire Correction to Mineral Deed As to Interest Conveyed web template.

Should you not have an accounts and would like to start using US Legal Forms, abide by these steps:

- Get the kind you need and ensure it is to the correct town/state.

- Utilize the Review key to review the shape.

- Read the description to ensure that you have chosen the appropriate kind.

- When the kind is not what you`re looking for, use the Look for field to get the kind that fits your needs and requirements.

- When you obtain the correct kind, click on Acquire now.

- Pick the pricing prepare you need, complete the necessary info to produce your account, and pay money for your order utilizing your PayPal or charge card.

- Pick a hassle-free file file format and download your copy.

Discover each of the record templates you may have bought in the My Forms food selection. You can get a additional copy of New Hampshire Correction to Mineral Deed As to Interest Conveyed anytime, if needed. Just go through the necessary kind to download or print the record web template.

Use US Legal Forms, probably the most substantial collection of authorized kinds, in order to save efforts and avoid errors. The assistance provides expertly made authorized record templates that can be used for a variety of reasons. Produce a merchant account on US Legal Forms and commence generating your lifestyle a little easier.

Form popularity

FAQ

The only way to change, add or remove a name on a deed is to have a new deed drawn up. Once a document is recorded, it can not be changed.

New Hampshire has no income or sales tax, and therefore relies very heavily on property taxes. If both state and local revenues are taken into account, property taxes make up 64.7% of money raised by the government. That's the highest reliance on property taxes in the U.S.

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

Requirements: Must be a New Hampshire resident for 3 consecutive years. Must be 65 on or before April 1st (or spouse) The property for which the exemption is applied must be the legal residence of applicant(s) Property Transfers: the property cannot be transferred within the last 5 years from a blood relative or marriage.

The irony in New Hampshire is that it prides itself in having no income or sales tax, yet it ranks high on property taxes. That means New Hampshire relies most heavily on the property tax to fund local services and public education.

The view tax is a term for the fact that the appraisal of a piece of real estate in preparation for assessing property tax includes aspects of a property that are subjective, such as its view. It was also the informal name for a 2005 bill in the legislature of the U.S. state of New Hampshire (see below).

New Hampshire Property Tax Rates Tax rates are expressed in mills, with one mill equal to $1 of tax for every $1,000 in assessed property value. Because mill rates can differ so much between counties and towns, it's easiest to compare property taxes using effective property tax rates and not mill rates.

Located in western New Hampshire, Sullivan County has the highest property tax rates in the state. The county's average effective property tax rate is 2.78%. In Claremont, which is the largest city in the county, the total rate is 40.98 mills.

New Hampshire has no income tax on wages and salaries. However, there is a 5% tax on interest and dividends. The state also has no sales tax. Homeowners in New Hampshire pay some of the highest average effective property tax rates in the country.