New Hampshire Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced

Description

How to fill out Assignment Of Overriding Royalty Interest To Become Effective At Payout, With Payout Based On Volume Of Oil Produced?

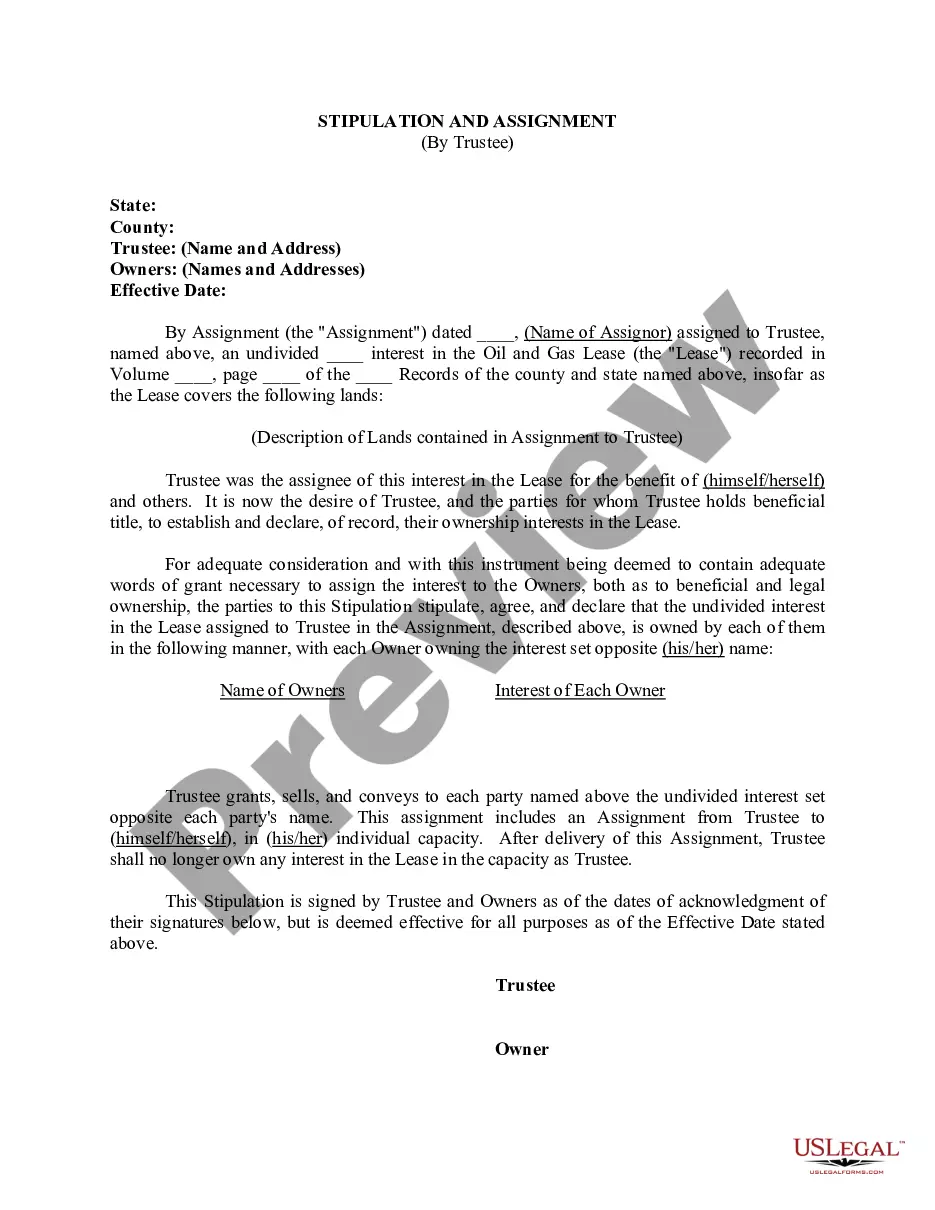

Are you in the position that you require documents for sometimes organization or individual uses almost every time? There are a lot of authorized record web templates available on the Internet, but locating versions you can trust is not easy. US Legal Forms gives a huge number of form web templates, like the New Hampshire Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, which are written to satisfy federal and state specifications.

In case you are previously acquainted with US Legal Forms site and get an account, simply log in. After that, it is possible to download the New Hampshire Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced web template.

If you do not offer an accounts and need to start using US Legal Forms, abide by these steps:

- Get the form you want and ensure it is for that correct city/county.

- Make use of the Review option to review the shape.

- Look at the information to ensure that you have selected the proper form.

- In the event the form is not what you are looking for, use the Research discipline to obtain the form that suits you and specifications.

- Once you find the correct form, simply click Get now.

- Opt for the costs strategy you desire, fill out the necessary info to generate your money, and purchase your order with your PayPal or credit card.

- Select a convenient data file file format and download your copy.

Locate every one of the record web templates you have purchased in the My Forms food selection. You can aquire a additional copy of New Hampshire Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced any time, if possible. Just go through the essential form to download or printing the record web template.

Use US Legal Forms, one of the most substantial assortment of authorized kinds, in order to save time as well as stay away from mistakes. The service gives expertly made authorized record web templates which can be used for a variety of uses. Create an account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

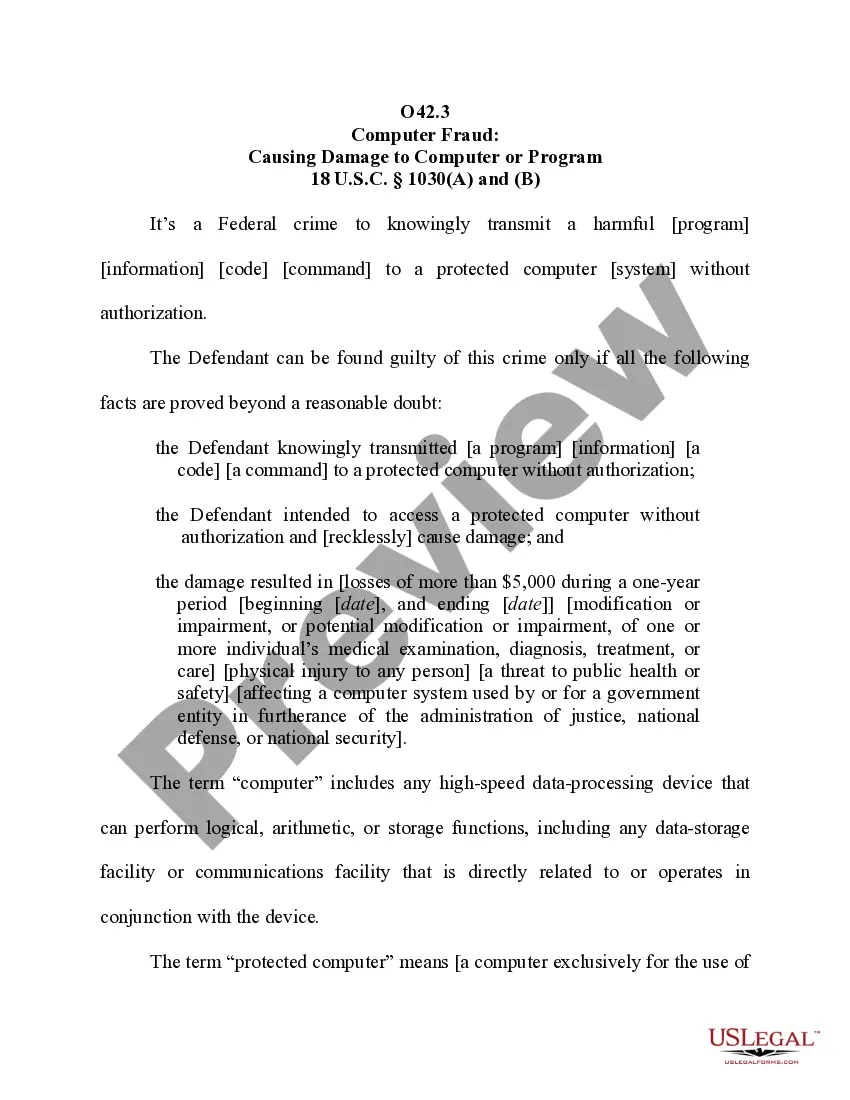

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

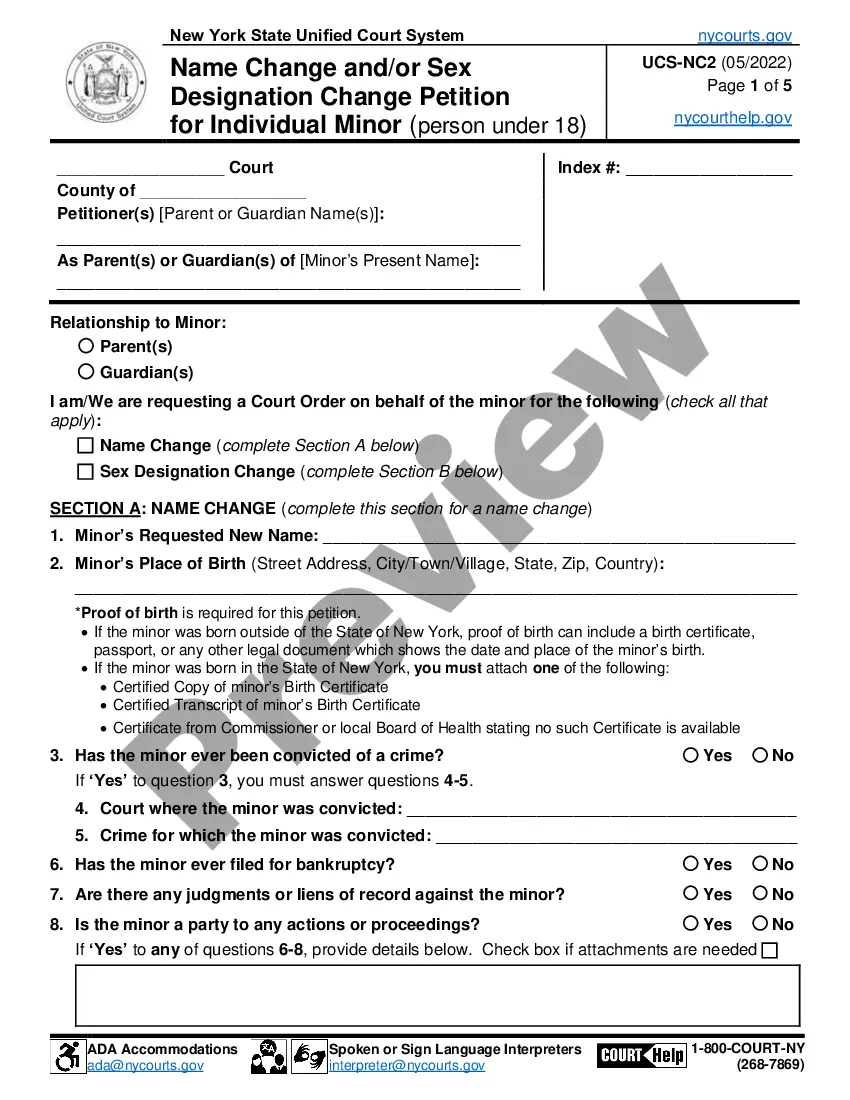

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

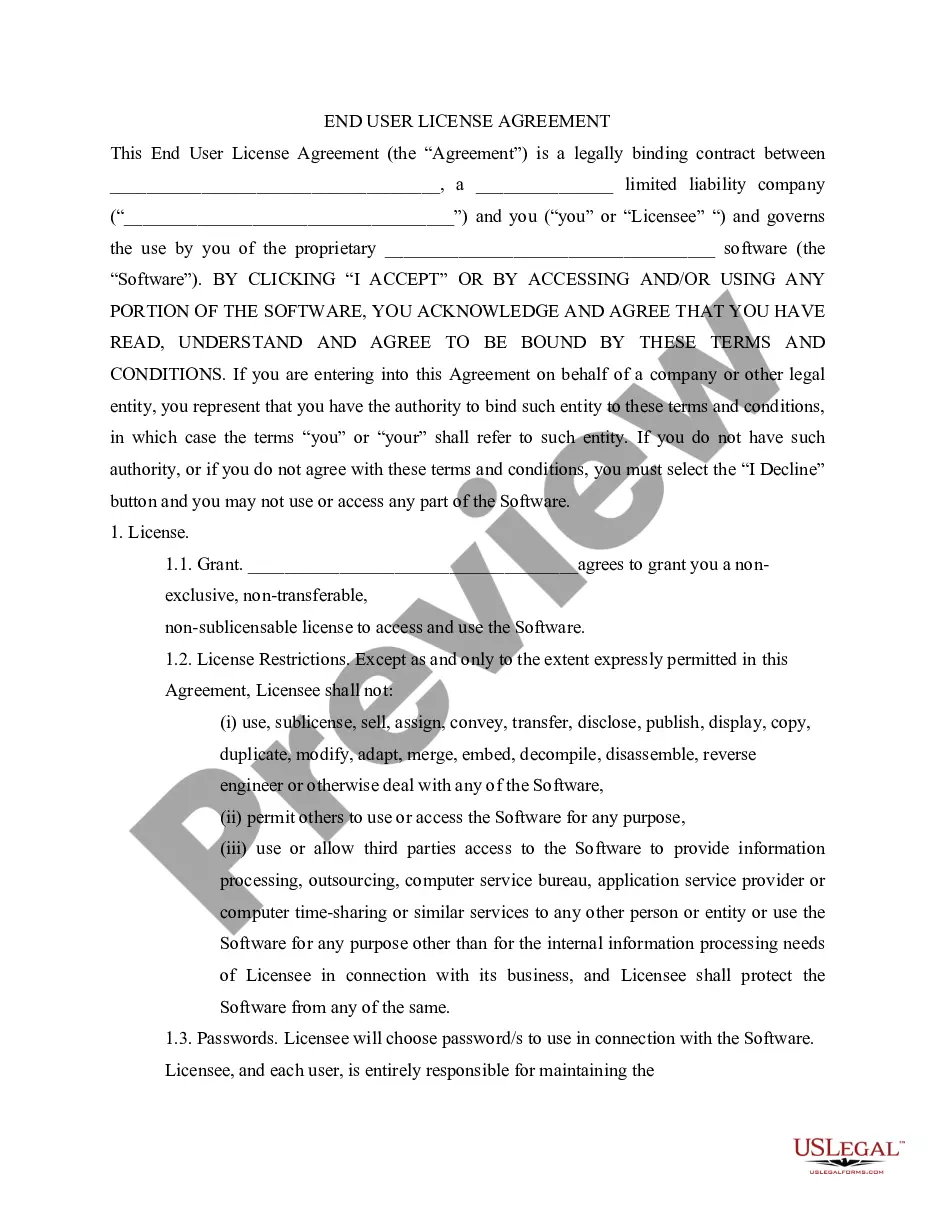

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

To calculate the NMA, you need the gross number of acres and the percentage of your mineral interest. To complete the calculation, simply multiply the gross acreage by your mineral interest. For example, if you owned 25% interest on the minerals under a 400-acre tract of land, you would have 100 NMA.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

If there is an NPRI that exists, you would have to determine the # of net royalty acres by taking your royalty rate and subtracting the NPRI from it and then dividing by 12.5%.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

NRA = 40.00 net mineral acres x ([1/5] Lease Royalty Rate / [1/8] Standard Royalty Rate) NRA = 40.00 x (0.20 / 0.125) NRA = 40.00 x 1.60 NRA = 64.00 Net Royalty Acres This mathematical concept can also be used inversely to calculate your net mineral acres in a parcel based on the Net Revenue Interest (NRI) you are ...