New Hampshire Letter for Account Paid in Full

Description

How to fill out Letter For Account Paid In Full?

It is feasible to spend numerous hours online looking for the legal document format that complies with the federal and state regulations you require.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can download or print the New Hampshire Letter for Account Paid in Full from my services.

If available, utilize the Preview button to review the format as well. If you want to find another version of the document, use the Search field to locate the format that meets your needs and preferences. Once you have found the format you desire, click on Acquire now to proceed. Select the pricing plan you want, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Find the format in the file and download it to your device. Make changes to the document if possible. You can complete, modify, and sign and print the New Hampshire Letter for Account Paid in Full. Acquire and print a multitude of document templates using the US Legal Forms website, which offers the best selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Next, you can complete, modify, print, or sign the New Hampshire Letter for Account Paid in Full.

- Each legal document format you purchase is yours permanently.

- To obtain another copy of a purchased document, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for the county/city of your choice.

- Check the document details to confirm you have chosen the right form.

Form popularity

FAQ

The tax filing deadline in New Hampshire generally falls on April 15 each year, aligning with federal tax deadlines. However, it's important to verify specific dates each year, as they may vary based on weekends or holidays. For peace of mind during tax season, utilize resources like the New Hampshire Letter for Account Paid in Full to stay informed.

In New Hampshire, taxable income primarily includes interest and dividends, as the state does not tax wages or salaries. This unique tax structure can be beneficial for many residents. For those managing taxable income, the New Hampshire Letter for Account Paid in Full provides vital information and assistance.

New Hampshire does not impose a traditional state income tax, but it does require tax returns for specific types of income, such as dividends and interest. Therefore, while there is no general state tax return, certain individuals must file for specific income types. A New Hampshire Letter for Account Paid in Full can guide you through the necessary steps.

You may not need to file a New Hampshire state tax return if your income is below the required threshold. However, if you earn interest or dividends above a certain level, you must file. Utilizing a New Hampshire Letter for Account Paid in Full can help clarify your filing responsibilities and assist in managing your tax situation effectively.

Certain individuals in New Hampshire may not need to file taxes, including those whose income falls below the state’s minimum filing threshold. Additionally, some specific exemptions apply to certain groups, such as full-time students or those receiving certain types of income. For more detailed guidance, consider using tools provided by platforms that offer resources like the New Hampshire Letter for Account Paid in Full.

In New Hampshire, a tax lien is a legal claim against your property due to unpaid taxes. It allows the state to secure payment by placing a hold on your assets. Understanding how these liens function can be crucial, especially when resolving tax issues with a New Hampshire Letter for Account Paid in Full.

To determine if you need to file a state tax return in New Hampshire, consider your income level, residency status, and specific tax regulations. Generally, if your income exceeds a certain threshold, you must file. You can find clarity and assistance through resources like the New Hampshire Letter for Account Paid in Full, which can help confirm your filing obligations.

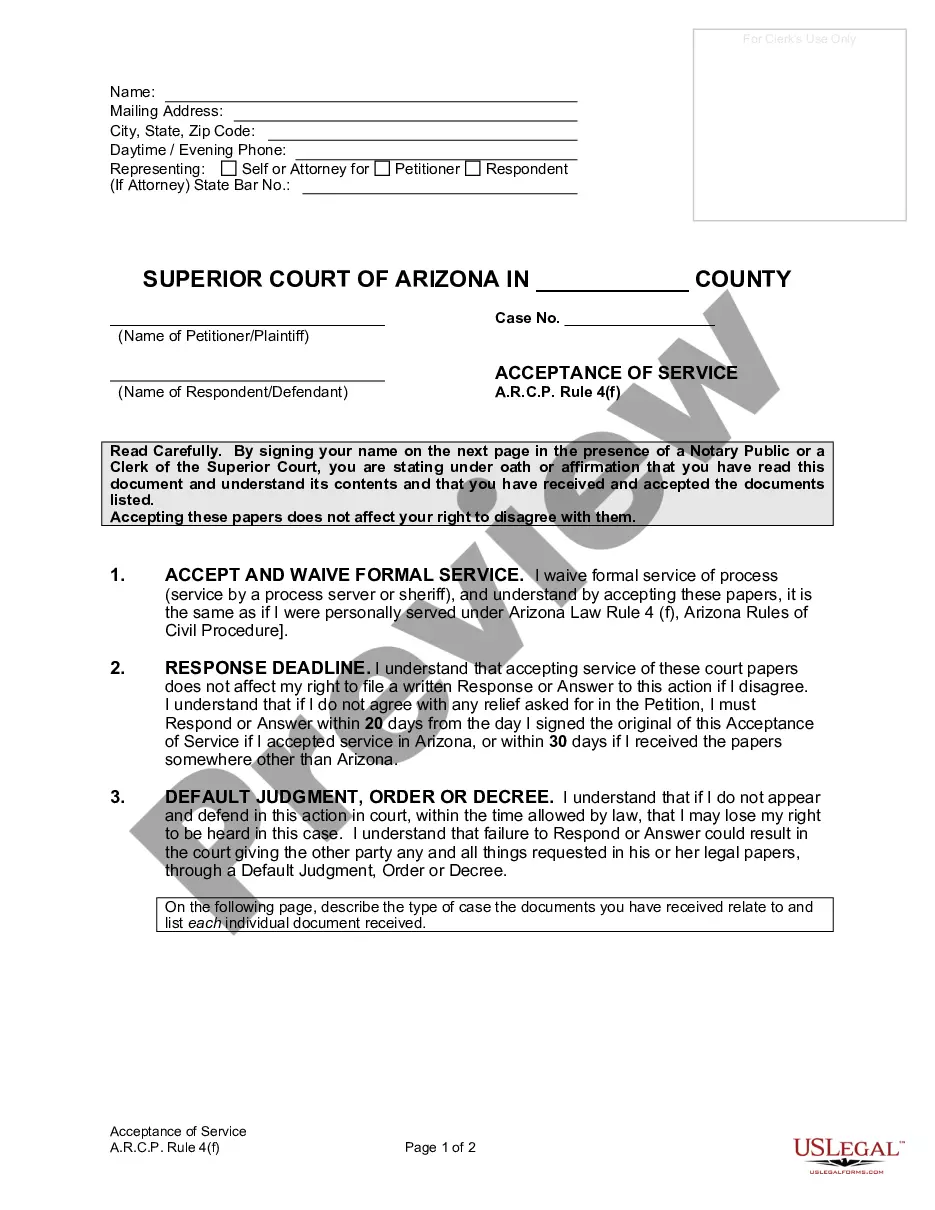

Writing a New Hampshire Letter for Account Paid in Full requires clear communication and proper format. Begin with your name and address, followed by the creditor's information. State your account number and affirm that your debt has been settled in full. To make this task easier, consider using USLegalForms to access a template that ensures you include all necessary details.

To write a New Hampshire Letter for Account Paid in Full, start with your contact information, followed by the creditor's details. Clearly state the purpose of the letter and include your account number with a statement confirming the payment has been completed. Finally, sign the letter, and keep a copy for your records. If you prefer, USLegalForms offers templates that guide you through this process step by step.

An example of a New Hampshire Letter for Account Paid in Full includes a formal document stating the account holder's name, account number, and confirmation that the debt has been fully settled. This letter should also include the creditor's contact details and the date of the final payment. You can find examples online or use USLegalForms to access professionally drafted templates.