New Hampshire Self-Employed Disc Jockey or DJ Services Contract

Description

How to fill out Self-Employed Disc Jockey Or DJ Services Contract?

If you wish to be thorough, acquire, or print authorized document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site's user-friendly and efficient search to locate the documents you require.

A range of templates for business and personal needs are categorized by groups and states, or keywords.

Step 4. Once you have located the form you need, click the Get Now button. Choose the payment plan you prefer and enter your information to create an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the New Hampshire Self-Employed Disc Jockey or DJ Services Agreement in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to receive the New Hampshire Self-Employed Disc Jockey or DJ Services Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

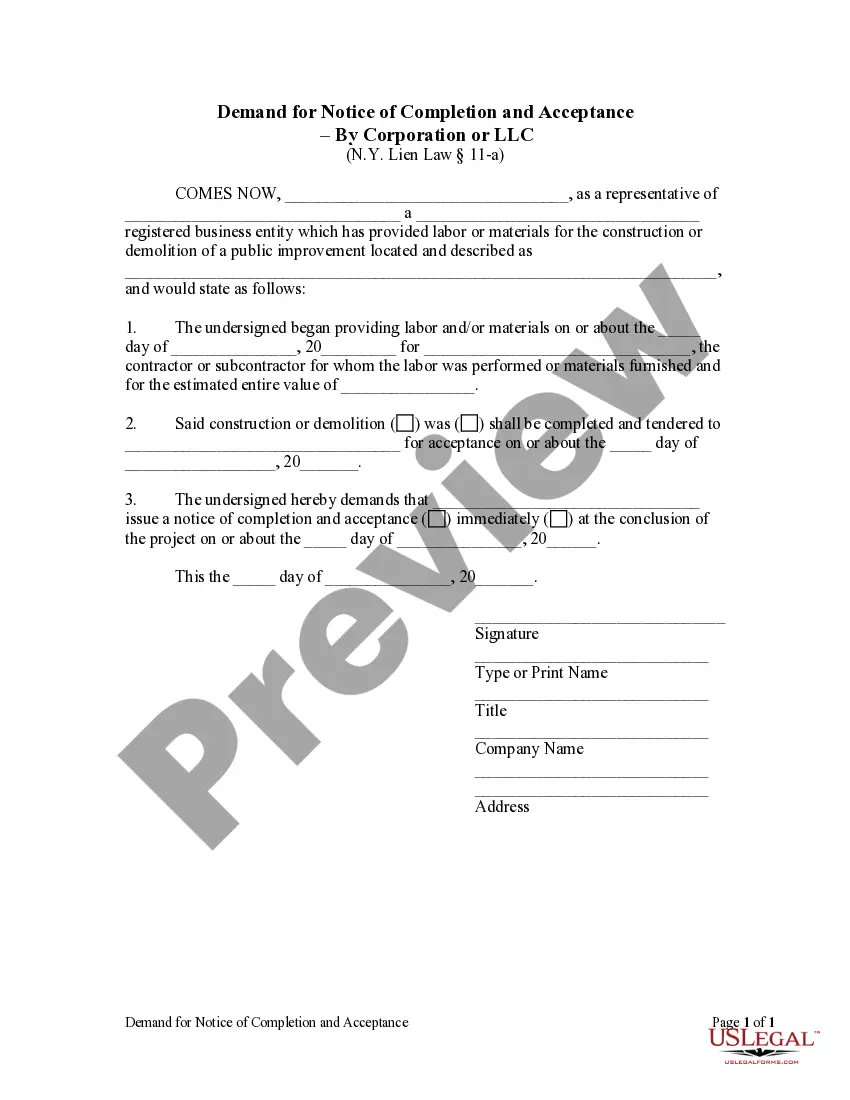

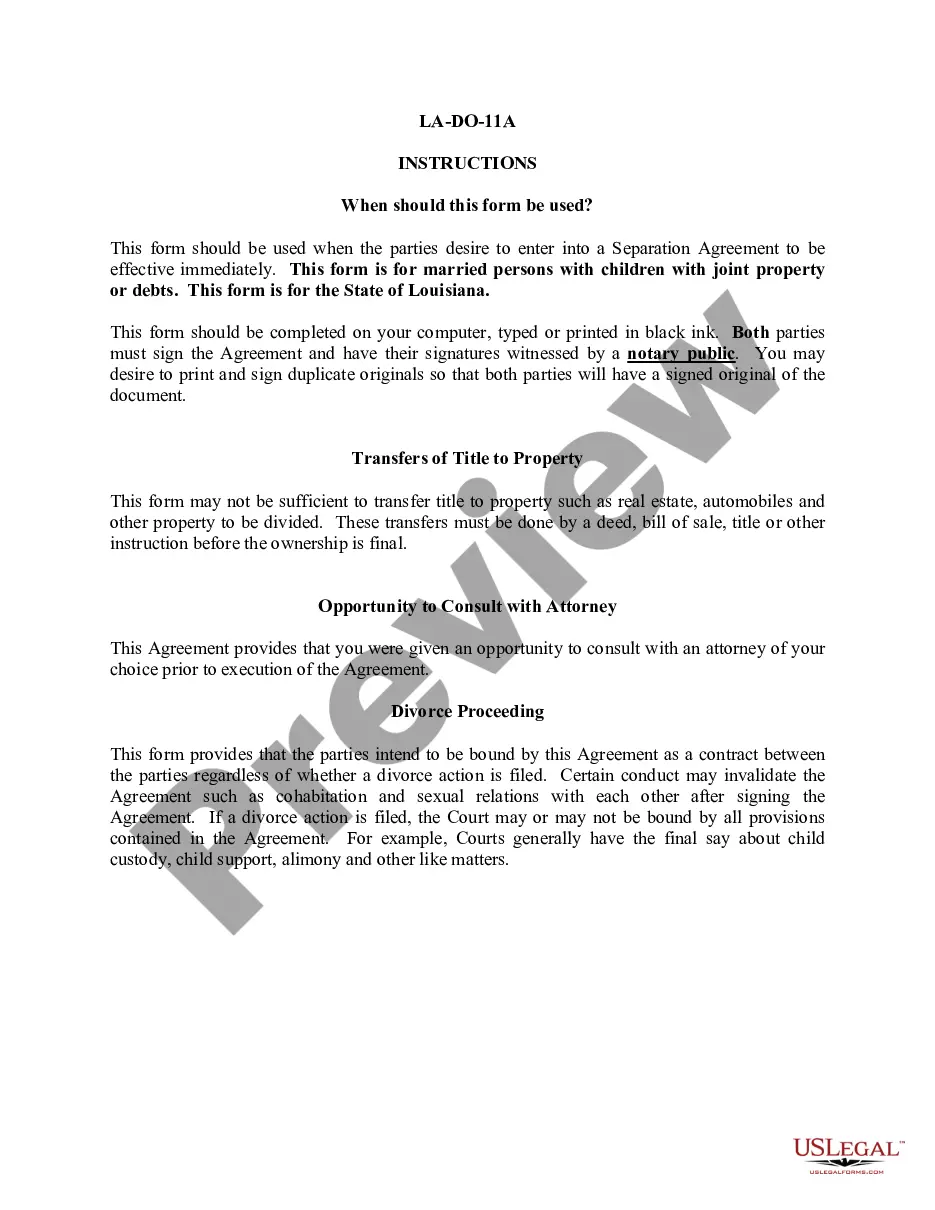

- Step 2. Use the Preview feature to review the form's content. Remember to read the summary.

- Step 3. If you are dissatisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

When considering whether $100 an hour is a good rate for a DJ, it's important to factor in experience, location, and the quality of services offered. In New Hampshire, the average rate can vary based on these elements. A well-structured New Hampshire Self-Employed Disc Jockey or DJ Services Contract can help clarify services included and ensure both parties understand expectations. Ultimately, evaluating the skills and reputation of the DJ will guide you in determining if the rate reflects their value.

As an independent contractor, you need to report all income, regardless of the amount. However, in the U.S., you typically don't owe self-employment tax on income below $400. For those working as a DJ in New Hampshire, a New Hampshire Self-Employed Disc Jockey or DJ Services Contract can help you keep track of your earnings and ensure you meet your tax obligations. Always consult a tax professional for specific advice.

You qualify as an independent contractor if you provide services under a contract, maintain control over your work methods, and accept the financial risk of your business. For DJs in New Hampshire, having a New Hampshire Self-Employed Disc Jockey or DJ Services Contract is essential to confirm your status. This contract can help ensure that you meet the necessary qualifications and comply with local laws.

To be considered an independent contractor, you must operate your own business, set your own hours, and have control over how you perform your work. A New Hampshire Self-Employed Disc Jockey or DJ Services Contract can outline these responsibilities and expectations clearly. This clarity helps establish a professional relationship and protects your legal rights.

Legal requirements for independent contractors vary by state but generally include obtaining necessary licenses and permits. For those providing DJ services in New Hampshire, it is important to have a well-drafted New Hampshire Self-Employed Disc Jockey or DJ Services Contract detailing terms, conditions, and payment structures. This contract can help protect both parties and ensure that all legal obligations are met.

The independent contractor rule defines the relationship between a business and a self-employed individual, such as a DJ. This rule determines whether a worker is an independent contractor or an employee based on factors like control and independence. For a New Hampshire Self-Employed Disc Jockey or DJ Services Contract, understanding this rule is crucial to ensure proper classification and compliance with tax regulations.

To write a simple contract agreement, start by identifying the parties involved and the purpose of the contract. Clearly outline the specific services, such as those detailed in a New Hampshire Self-Employed Disc Jockey or DJ Services Contract, and include payment information. Finish with a signature line for both parties, which solidifies the agreement. This straightforward approach helps maintain focus on the essential elements of the contract.

To write a basic contract agreement, start by clearly stating the names of the parties involved and the date of the agreement. Next, outline the services to be provided, including any specific details pertinent to a New Hampshire Self-Employed Disc Jockey or DJ Services Contract. Be sure to include payment terms and any conditions for cancellation or modification. This structure fosters a clear understanding between all parties.

A simple contract can be a straightforward agreement outlining the services provided by a New Hampshire Self-Employed Disc Jockey or DJ Services Contract. For instance, it might detail the date of the event, the duration of the service, and the payment terms. This clarity helps both parties understand their responsibilities. Using a clear template can ensure all necessary elements are included.