New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor

Description

How to fill out Self-Employed X-Ray Technician Self-Employed Independent Contractor?

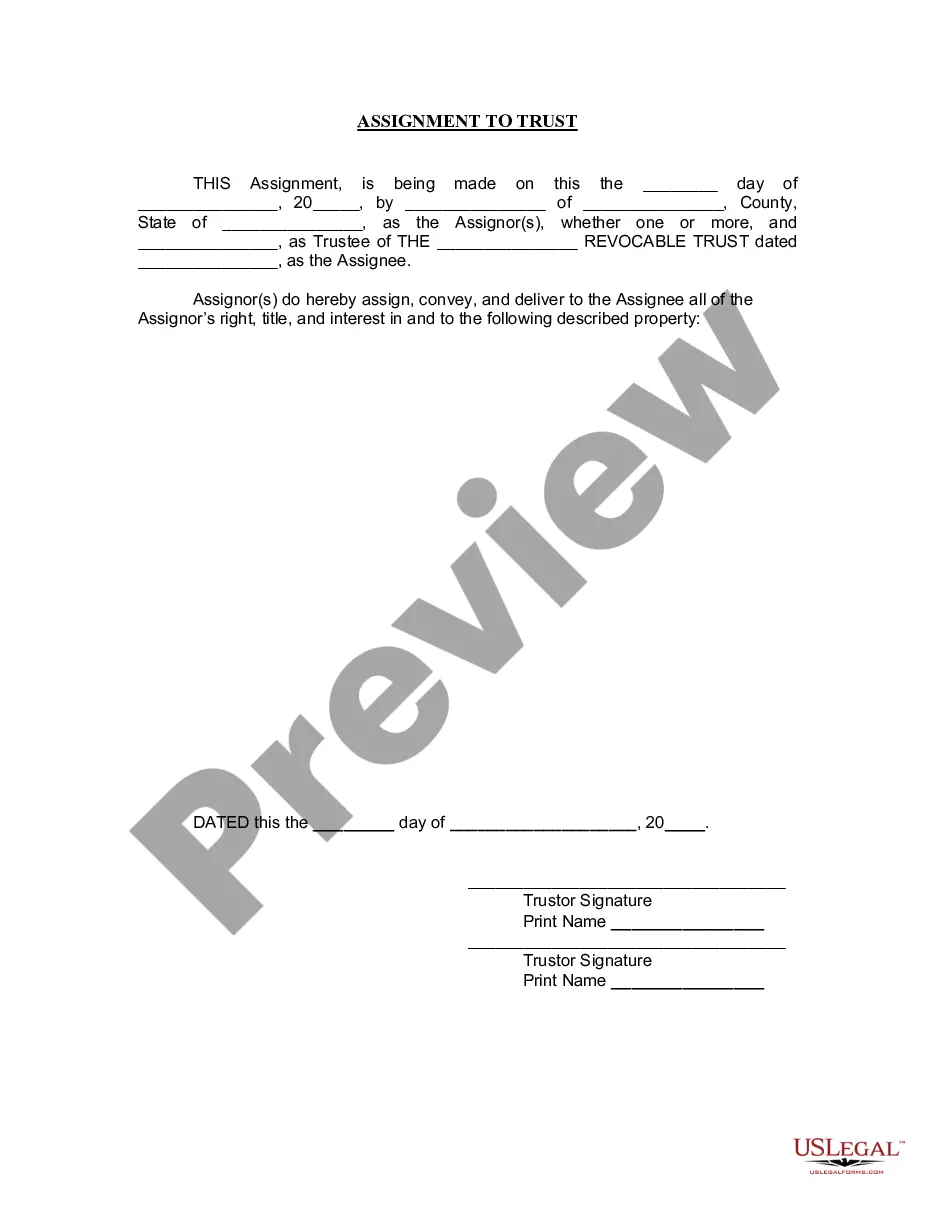

Locating the correct legal document template can be quite a challenge. Certainly, there are numerous templates available online, but how do you discover the legal form you need? Utilize the US Legal Forms website. The service offers a vast array of templates, including the New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor, which can be utilized for both business and personal purposes. All documents are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to locate the New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor. Use your account to search through the legal documents you have purchased previously. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have selected the correct form for your city/region. You can browse the form using the Review button and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is accurate, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the required information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the acquired New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor.

Take full advantage of the available resources to access the legal documents that meet your requirements effectively.

- US Legal Forms is the largest repository of legal forms where you can find countless document templates.

- Utilize the service to download professionally crafted documents that conform to state regulations.

- Access a wide range of legal templates suitable for various needs.

- Benefit from expert-reviewed documents ensuring compliance with legal standards.

- Simplify the process of obtaining necessary legal forms with a user-friendly platform.

- Ensure you have the right legal documentation for your business and personal endeavors.

Form popularity

FAQ

The independent contractor rule outlines the criteria that distinguish independent contractors from employees. As a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor, you need to meet specific standards regarding autonomy and control over your work. Understanding this rule is crucial for compliance and can help you avoid potential legal issues. Uslegalforms offers resources that clarify these guidelines and assist you in maintaining your independent status.

There are a few states in the U.S. that do not impose a self-employment tax, such as Nevada and Wyoming. If you are considering relocating as a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor, these states might offer a tax-friendly environment. However, it is essential to weigh other factors, such as business opportunities and living conditions. Evaluating all aspects will help you make an informed decision.

Yes, New Hampshire taxes self-employment income, which directly impacts you as a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor. You should report this income on your tax return and comply with the state's tax regulations. By keeping accurate records and seeking expert advice, you can ensure that you meet your tax obligations. Uslegalforms can provide the necessary forms and information to simplify this process.

New Hampshire does not apply a personal income tax on LLCs, but it does impose a Business Profits Tax and a Business Enterprise Tax. As a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor operating under an LLC, you need to be aware of these taxes. Understanding your obligations can help you effectively manage your business finances. You can find valuable resources on uslegalforms to assist you in navigating LLC taxation.

Yes, New Hampshire does tax 1099 income, which is relevant for you as a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor. The state requires you to report this income on your tax return. However, New Hampshire does not impose a personal income tax on wages. It is essential to keep track of your earnings and consult resources like uslegalforms for guidance on filing your taxes correctly.

Yes, a 1099 employee is typically considered self-employed. This classification applies to individuals who receive a Form 1099 for their work, indicating they are not employees of a company but rather independent contractors. As a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor, understanding your tax obligations under this classification is crucial for compliance.

employed person can be referred to as a freelancer, entrepreneur, or independent contractor. Each term may carry specific implications about the nature of their work. As a New Hampshire SelfEmployed XRay Technician SelfEmployed Independent Contractor, you can choose the title that best represents your profession and business style.

To prove you are an independent contractor, you should keep detailed records of your contracts, invoices, and correspondence with clients. Documentation showing your business operations and financial transactions is vital. As a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor, using platforms like uslegalforms can help you organize these records effectively.

No, an independent contractor is not considered an employee. The distinctions between these classifications are important for tax and legal purposes. As a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor, understanding this difference helps you navigate your rights and responsibilities effectively.

Both terms are commonly used, but they can carry slightly different connotations. 'Self-employed' is a broader term that encompasses anyone running their own business, while 'independent contractor' specifically refers to someone contracted to provide services. As a New Hampshire Self-Employed X-Ray Technician Self-Employed Independent Contractor, you might choose the term that best fits your business model.