New Hampshire Self-Employed Technician Services Contract

Description

How to fill out Self-Employed Technician Services Contract?

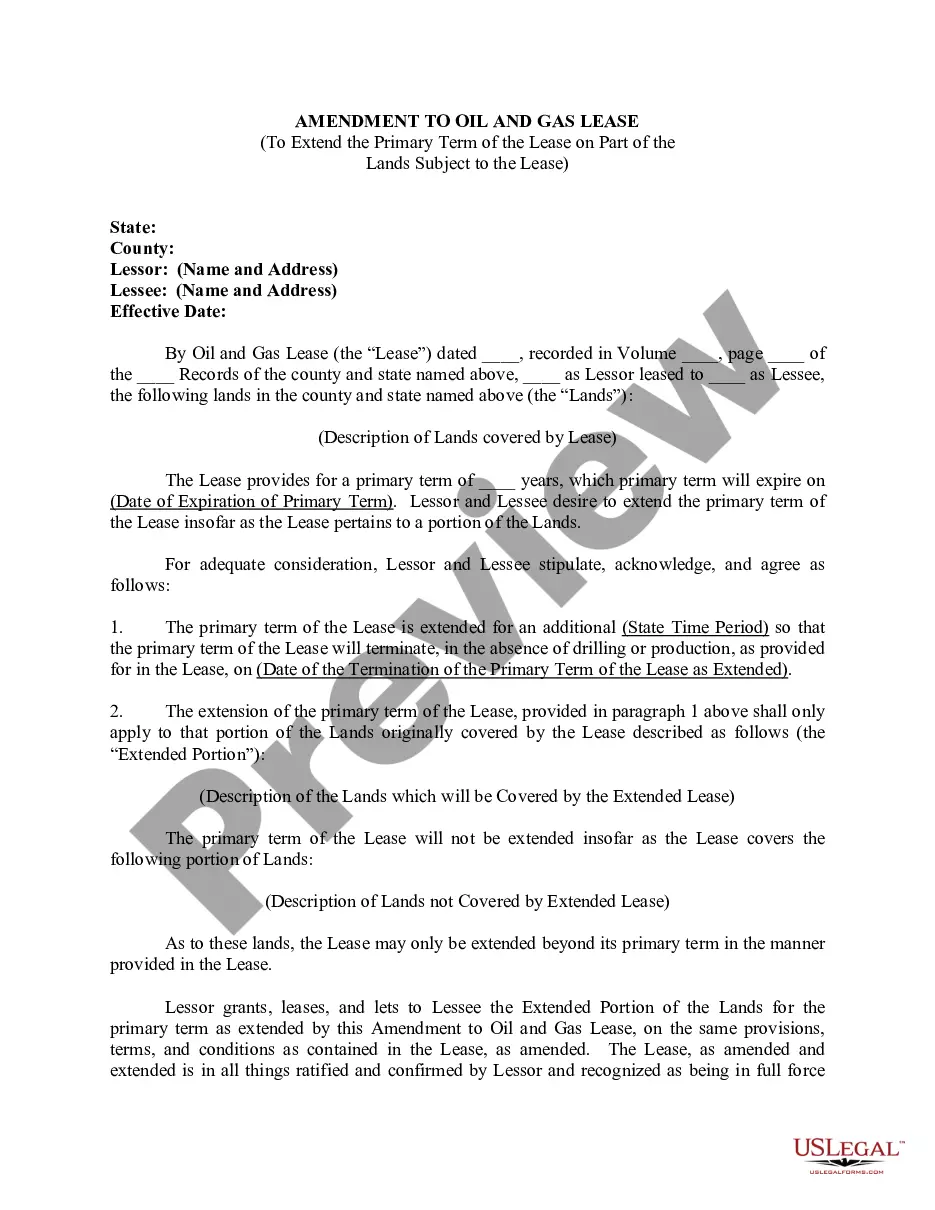

Locating the appropriate legal document template can be challenging. Naturally, there are numerous templates accessible online, but how do you find the legal form you require? Utilize the US Legal Forms website. This service offers a plethora of templates, including the New Hampshire Self-Employed Technician Services Contract, suitable for both business and personal purposes. All the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Acquire button to obtain the New Hampshire Self-Employed Technician Services Contract. Use your account to browse through the legal forms you may have previously purchased. Visit the My documents section of your account and retrieve another copy of the documents you need.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Review option and read the form details to confirm this is indeed the correct one for you. If the form does not meet your requirements, utilize the Search field to locate the appropriate form. Once you are confident that the form is suitable, choose the Get now option to receive the form. Select the pricing plan you want and provide the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired New Hampshire Self-Employed Technician Services Contract.

With US Legal Forms, you can efficiently access the legal templates necessary for your personal and business needs.

- US Legal Forms is the largest repository of legal forms where you can find various document templates.

- Use the service to download professionally-crafted documents that comply with state regulations.

- Access a wide range of templates for different legal needs.

- Ensure your documents are accurate and legally sound.

- Navigate the website easily to find forms tailored to your requirements.

- Get assistance from legal experts if needed.

Form popularity

FAQ

In New Hampshire, services are generally not subject to sales tax, which can be beneficial for independent contractors. However, specific services may have different tax implications, so you should verify the rules applicable to your particular situation. A New Hampshire Self-Employed Technician Services Contract can also help clarify your tax obligations by defining the scope of your services. Consider consulting a tax professional for personalized advice.

As an independent contractor, you need to file specific tax forms such as the IRS Form 1040, Schedule C, and possibly the self-employment tax form. Additionally, keeping accurate records of your income and expenses is crucial. Utilizing a New Hampshire Self-Employed Technician Services Contract can simplify your documentation and provide a clear outline of your services. This contract serves as a valuable reference for both you and your clients.

To be authorized as an independent contractor in the US, you must typically register your business and obtain any necessary licenses or permits. In New Hampshire, obtaining a New Hampshire Self-Employed Technician Services Contract can help clarify your status and responsibilities. This contract outlines the terms of your services, ensuring compliance with local regulations. Always check state-specific requirements, as they can vary.

In New Hampshire, an operating agreement is not legally required for all businesses, including self-employed technicians. However, having a New Hampshire Self-Employed Technician Services Contract can help outline the terms of your business operations and protect your interests. An operating agreement clarifies roles and responsibilities, which can prevent disputes down the line. Utilizing platforms like uslegalforms can help you create a comprehensive agreement tailored to your needs.

Working without a signed contract is generally not advisable, especially for self-employed technicians in New Hampshire. A New Hampshire Self-Employed Technician Services Contract provides important protections for both parties involved. Without a contract, you risk misunderstandings regarding payment terms, job responsibilities, and liability issues. To ensure clarity and legal standing, it is best to establish a contract before beginning any work.

Yes, New Hampshire does tax self-employment income, but it does not impose a personal income tax on wages. Instead, self-employed individuals may be subject to business profits tax. It's essential to understand your tax obligations as a self-employed technician. Consult a tax professional for guidance, and ensure your contracts are in order with a New Hampshire Self-Employed Technician Services Contract from US Legal Forms.

Having a contract is highly recommended if you are self-employed. A contract protects your interests and clarifies the scope of work and payment expectations. It also provides legal recourse in case of disputes. For a comprehensive New Hampshire Self-Employed Technician Services Contract, you can find useful templates on US Legal Forms.

You can write your own service contract by defining the services offered, payment terms, and duration. Make sure to include conditions for modification and termination. A personalized service contract can clarify expectations between you and your client. Consider using US Legal Forms to access a reliable New Hampshire Self-Employed Technician Services Contract template.

Yes, you can write your own legally binding contract, provided it meets specific legal criteria. Ensure it includes essential elements like offer, acceptance, and consideration. However, it is wise to review it for compliance with local laws. US Legal Forms offers templates to help you create a valid New Hampshire Self-Employed Technician Services Contract effortlessly.

When writing a contract for a 1099 employee, define the services provided and specify the payment terms. It is essential to clarify that the individual is self-employed, which affects tax responsibilities. A well-drafted contract can protect both parties and set clear expectations. Look at US Legal Forms for a New Hampshire Self-Employed Technician Services Contract template that fulfills these requirements.