New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor

Description

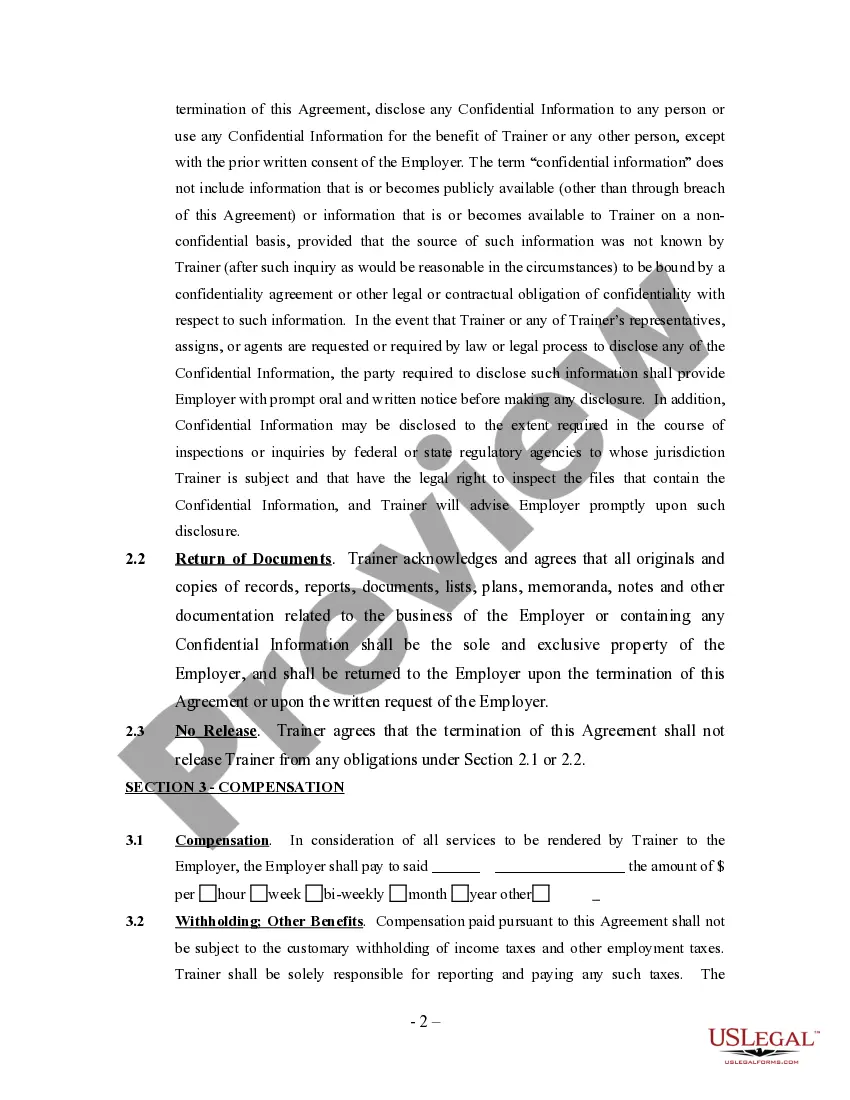

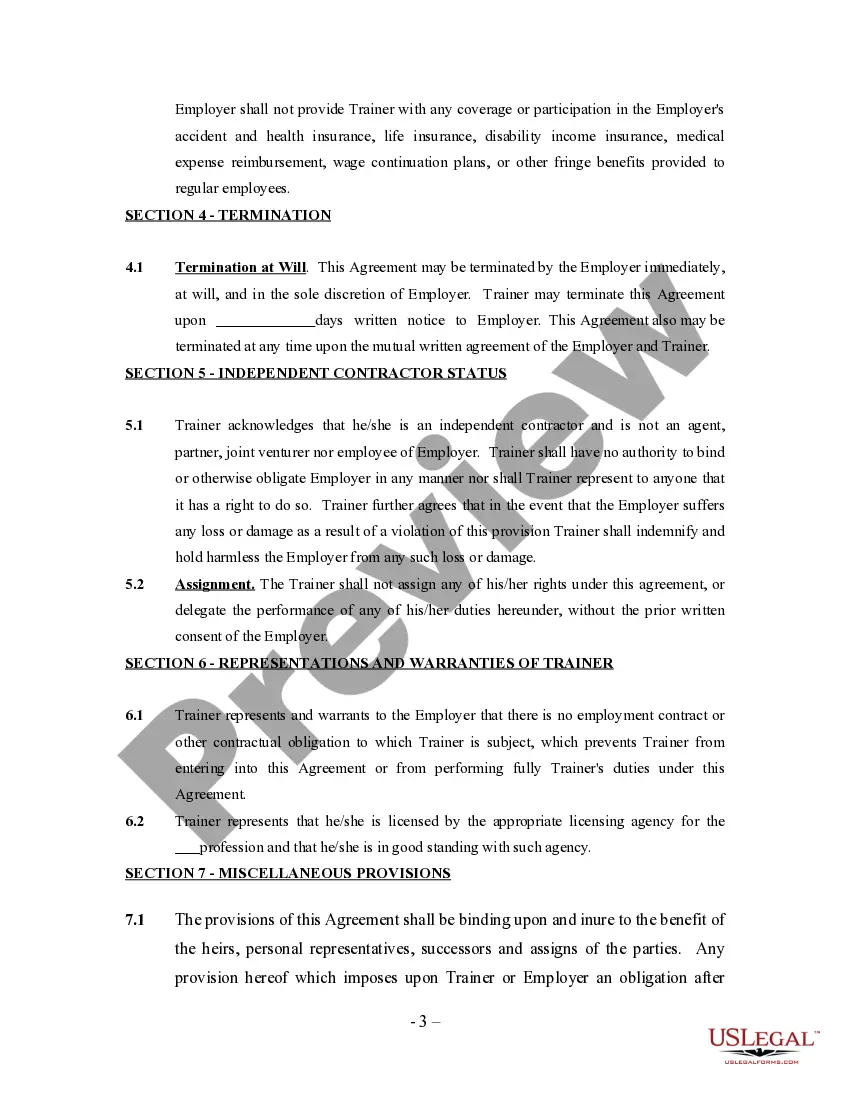

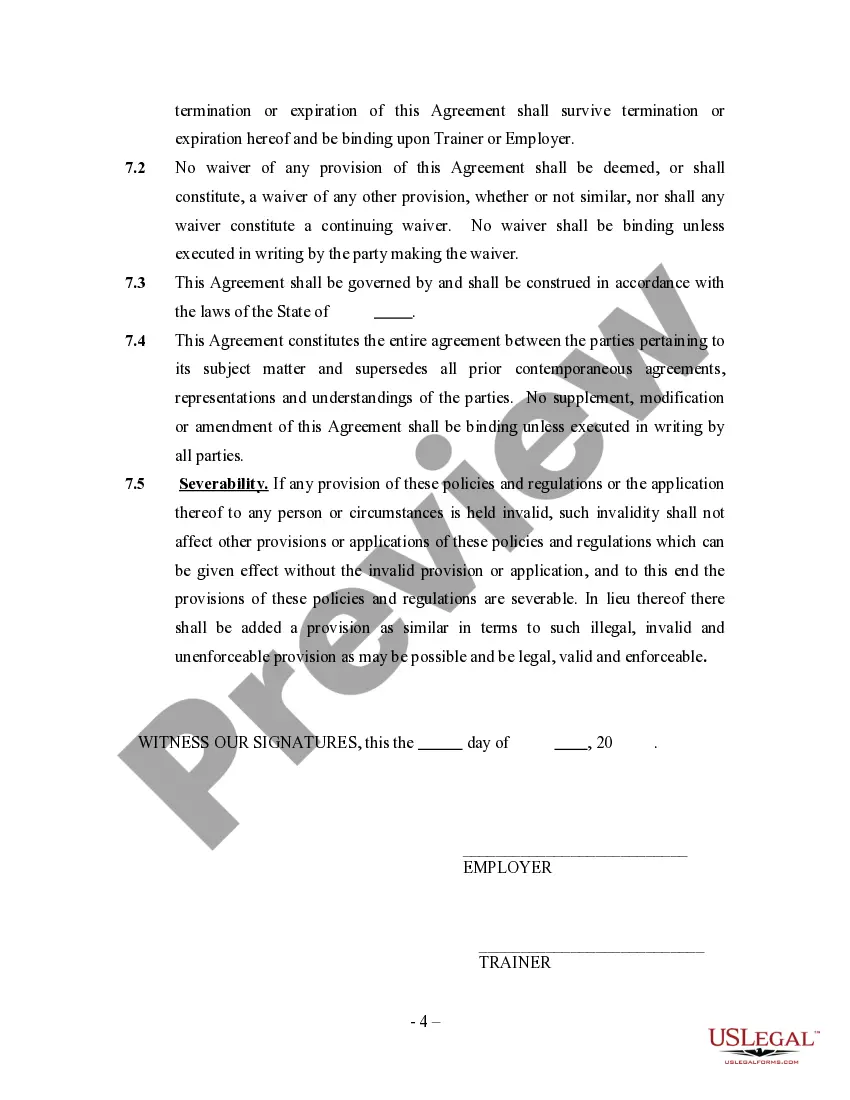

How to fill out Athletic Person Training Or Trainer Agreement - Self-Employed Independent Contractor?

Selecting the optimal legal document template may pose a challenge. Obviously, there are numerous designs accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the New Hampshire Athletic Participant Training or Trainer Agreement - Self-Employed Independent Contractor, which can be utilized for business and personal purposes.

All the documents are reviewed by professionals and comply with state and federal regulations.

If the form does not fulfill your requirements, use the Search field to locate the appropriate form. Once you are confident that the form is suitable, click on the Order now button to obtain the form. Choose the payment plan that you prefer and input the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, modify, print, and sign the acquired New Hampshire Athletic Participant Training or Trainer Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest collection of legal forms where you can find a variety of document templates. Utilize the service to download professionally crafted papers that adhere to state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the New Hampshire Athletic Participant Training or Trainer Agreement - Self-Employed Independent Contractor.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/region.

- You can examine the form using the Review button and read the form details to confirm it is suitable for you.

Form popularity

FAQ

Personal trainers can be either employees or independent contractors, depending on their working arrangements. If they work exclusively for one gym or studio and receive benefits, they are likely employees. Alternatively, trainers who manage their own clients typically fall under the independent contractor category, making the New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor an essential reference.

Absolutely, a personal trainer can be self-employed, which provides greater autonomy and the chance to build a personal brand. Becoming self-employed enables trainers to create unique service offerings tailored to their client's needs. The New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor is a valuable resource in this journey.

Yes, fitness instructors can be classified as 1099 workers if they operate as independent contractors. This classification allows them flexibility in setting their hours and working with multiple clients. The New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor can help outline the terms of this relationship.

Both terms describe similar work situations, but 'independent contractor' often emphasizes your work with various clients. Saying you're self-employed might imply a broader entrepreneurial focus. Regardless of how you describe your status, using the New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor ensures clarity in your contractual relationships.

Yes, many fitness trainers operate as independent contractors. This status allows trainers to work with various clients and set their own schedules. It's important to review the New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor to understand your rights and responsibilities.

Setting up an LLC as a personal trainer can provide you with essential legal protection and credibility. It helps separate your personal assets from your business liabilities. Additionally, the New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor can guide you on structuring your business appropriately.

Yes, you can require training for independent contractors, especially if it improves their performance or safety. Training ensures that all contractors comply with your specific standards and expectations. However, it's vital to keep the relationship under the framework of the New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor to maintain their independent status. Utilizing resources from uslegalforms can help clarify how to structure these requirements effectively.

To write an independent contractor agreement, start by clearly defining the scope of work. Include essential elements like payment terms, responsibilities, and timelines. It’s crucial to specify the nature of the relationship, ensuring it aligns with the New Hampshire Athletic Person Training or Trainer Agreement - Self-Employed Independent Contractor guidelines. For a more streamlined process, consider using the ulegalforms platform, which offers templates and guidance tailored to your needs.