New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed

Description

How to fill out Wedding Planner Or Consultant Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal forms in the USA - offers a vast assortment of legal document templates that you can obtain or print. By using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the latest versions of forms such as the New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed within moments.

If you possess a membership, Log In to acquire the New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed from the US Legal Forms library. The Download button will be visible on every form you view. You can retrieve all previously downloaded forms in the My documents section of your account.

To utilize US Legal Forms for the first time, here are simple steps to help you get started: Ensure you have selected the correct form for your region/locality. Click the Preview button to review the form's content. Read the form description to confirm that you have chosen the right one. If the form does not meet your needs, use the Search box at the top of the screen to find an appropriate one. Once you are satisfied with the form, finalize your selection by clicking the Buy now button. Then, select your preferred payment plan and provide your information to register for an account. Process the payment. Use a credit card or PayPal account to complete the transaction. Choose the format and download the form onto your device. Make modifications. Complete, edit, print, and sign the downloaded New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Access the New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

While it is not mandatory to have an LLC to operate as a wedding planner, having one can offer important personal liability protection and enhance your professional credibility. Forming an LLC shows clients that you are serious and provides a level of legal protection for your business. Even as a self-employed individual, considering a New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed can further establish your business foundation and clarify your operational structure.

A bridal consultant typically offers guidance on wedding-related decisions, while a wedding planner manages all aspects of the event, from planning to implementation. In essence, a wedding planner may take on a more hands-on role on the day of the event, ensuring everything runs smoothly. Understanding these differences can help you choose the right professional services for your needs, and a well-structured New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed can clarify these roles.

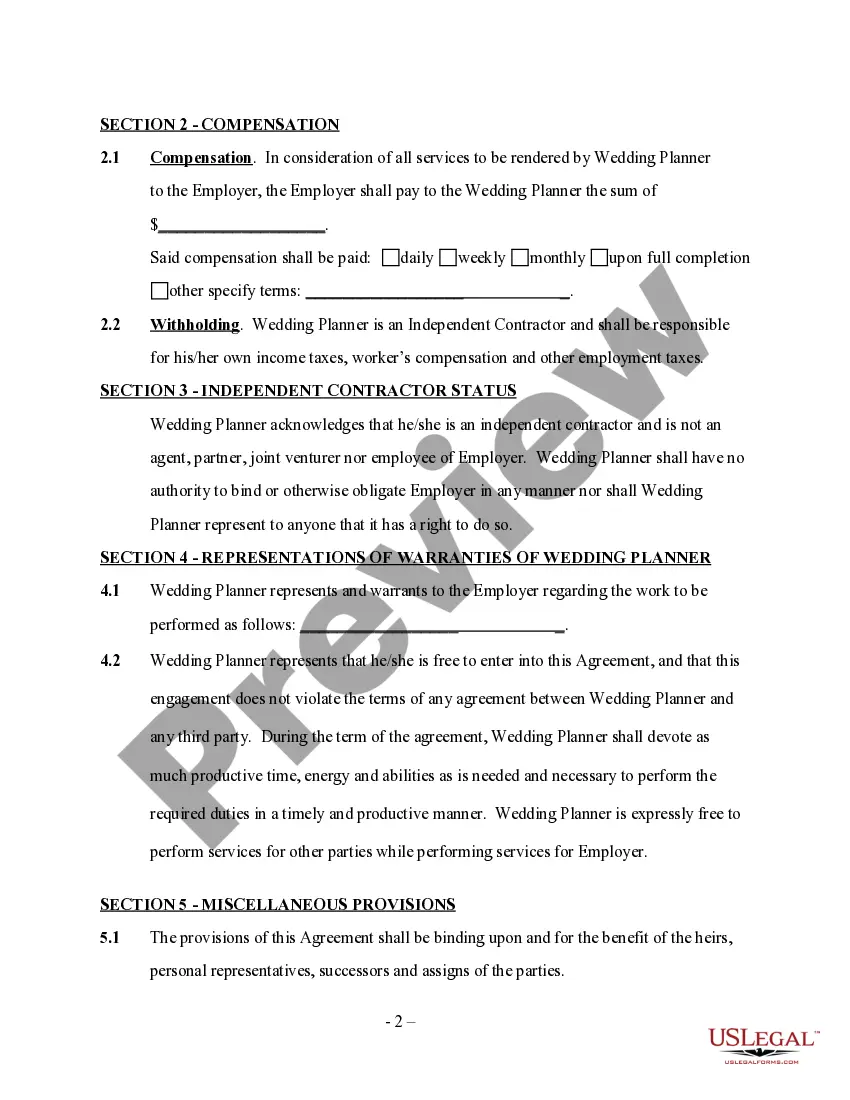

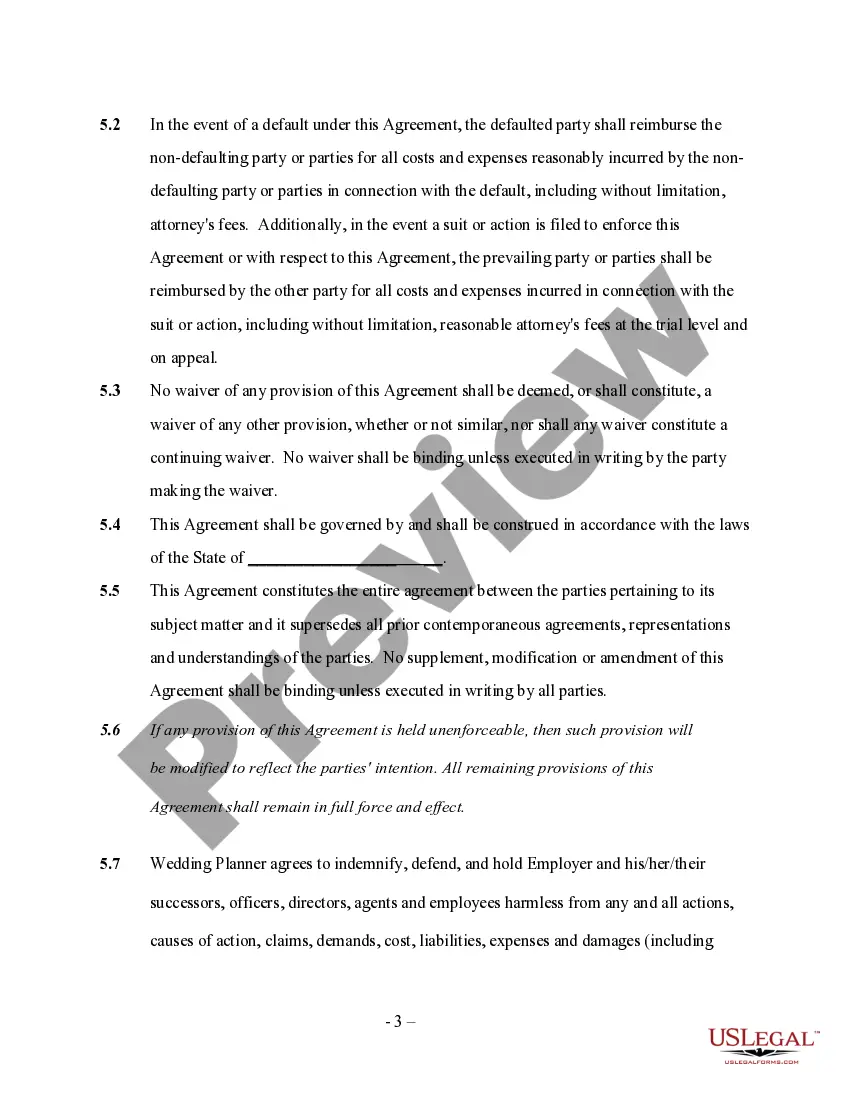

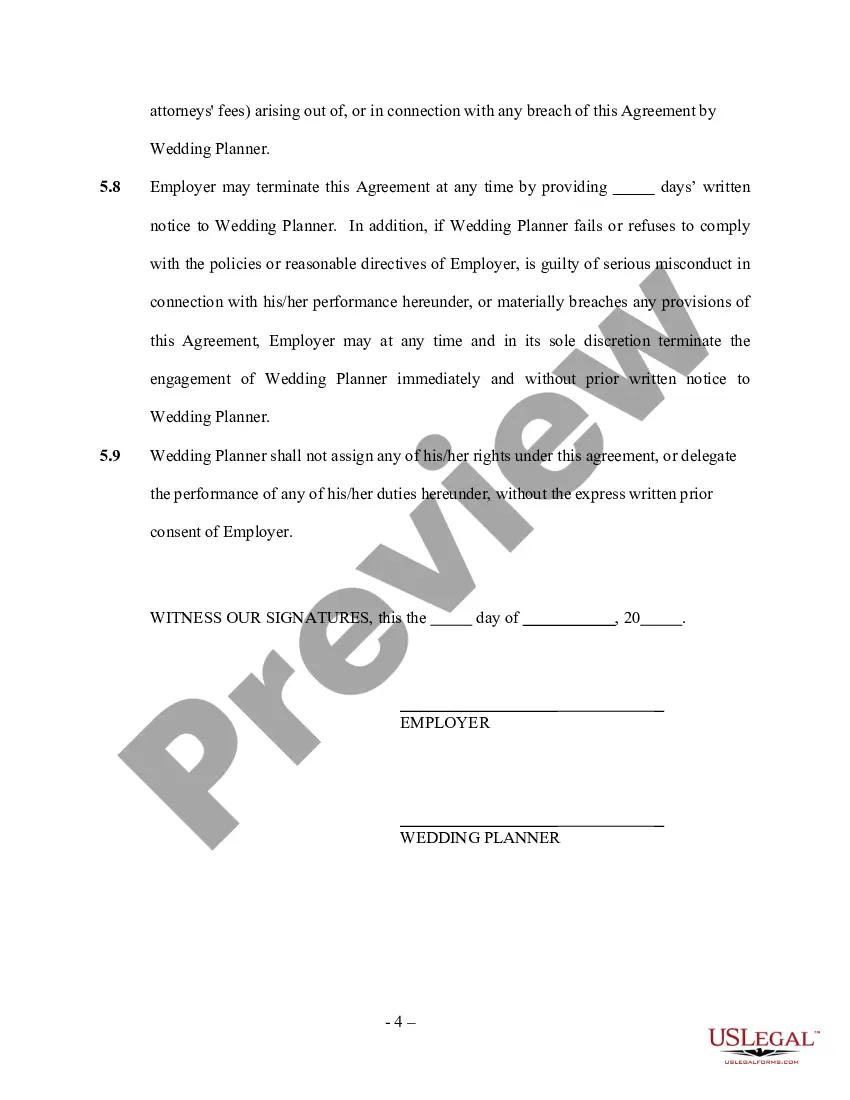

A comprehensive wedding planner contract should clearly outline the services offered, payment terms, cancellation policy, and any additional fees. You should also specify the timeline for services and responsibilities of both parties. Including a clause about handling unforeseen circumstances can protect both you and the client. Utilizing our platform for a New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed can help you create a solid agreement.

New Hampshire does not tax 1099 income at the state level, allowing self-employed individuals to retain more of their earnings. As a New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed, you're responsible for reporting this income on your federal tax return. Utilizing uslegalforms can provide you with the necessary resources and documents to manage your contracts and taxation effectively.

Several states, such as Wyoming and Florida, do not impose a self-employment tax. If you operate under a New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed, it's helpful to be aware of these states for potential relocation or business expansion. Researching tax regulations can help you make informed choices for your business.

New Hampshire does not impose a tax on self-employment income at the state level. However, any income earned from your New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed must still be reported on your federal tax return. It is essential to consult with a tax professional to ensure compliance with all tax obligations.

The independent contractor rule defines the relationship between a business and a self-employed individual. A New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed operates independently, providing services without being under the direct control of a client. Understanding this rule can help you navigate contracts and legal obligations effectively.

In New Hampshire, most income is not subject to state income tax. However, self-employment income, such as that earned by New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed, can be subject to federal taxes. It is important to keep accurate records of your earnings and expenses to comply with tax regulations.

The 50 30 20 rule is a budgeting guideline that allocates 50% of your budget to needs, 30% to wants, and 20% to savings or unexpected costs. When planning a wedding, a New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed can help you follow this rule for a balanced approach. This ensures that you cover critical components while still enjoying enhancements that make your day special. Incorporating this method helps maintain financial control as you navigate the wedding planning journey.

Yes, wedding planners typically operate under a contract, which is crucial for outlining the terms of their services. A New Hampshire Wedding Planner or Consultant Services Contract - Self-Employed protects both parties by detailing roles, expectations, and payment terms. This helps ensure clarity and prevents misunderstandings. It's essential to review the contract carefully and discuss any questions with your planner before signing.