Rhode Island Party Verification Letter

Description

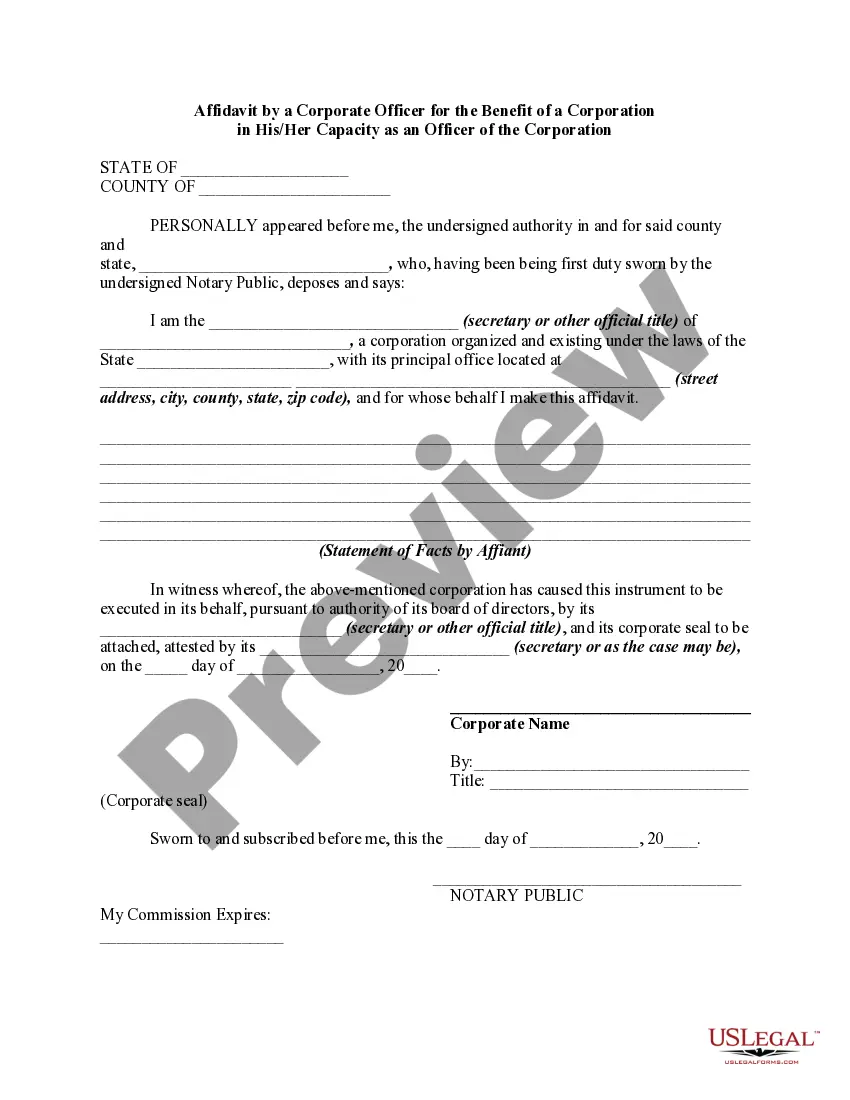

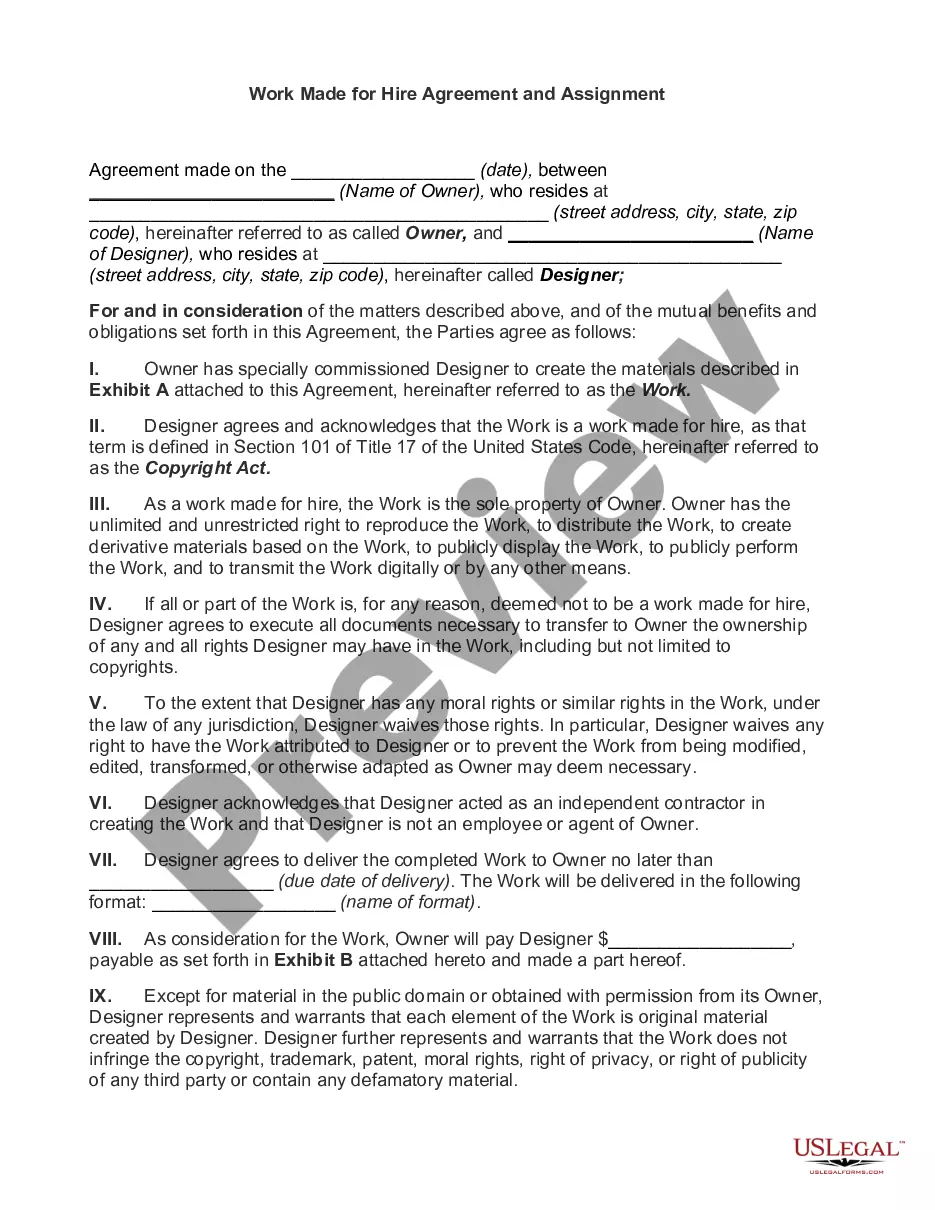

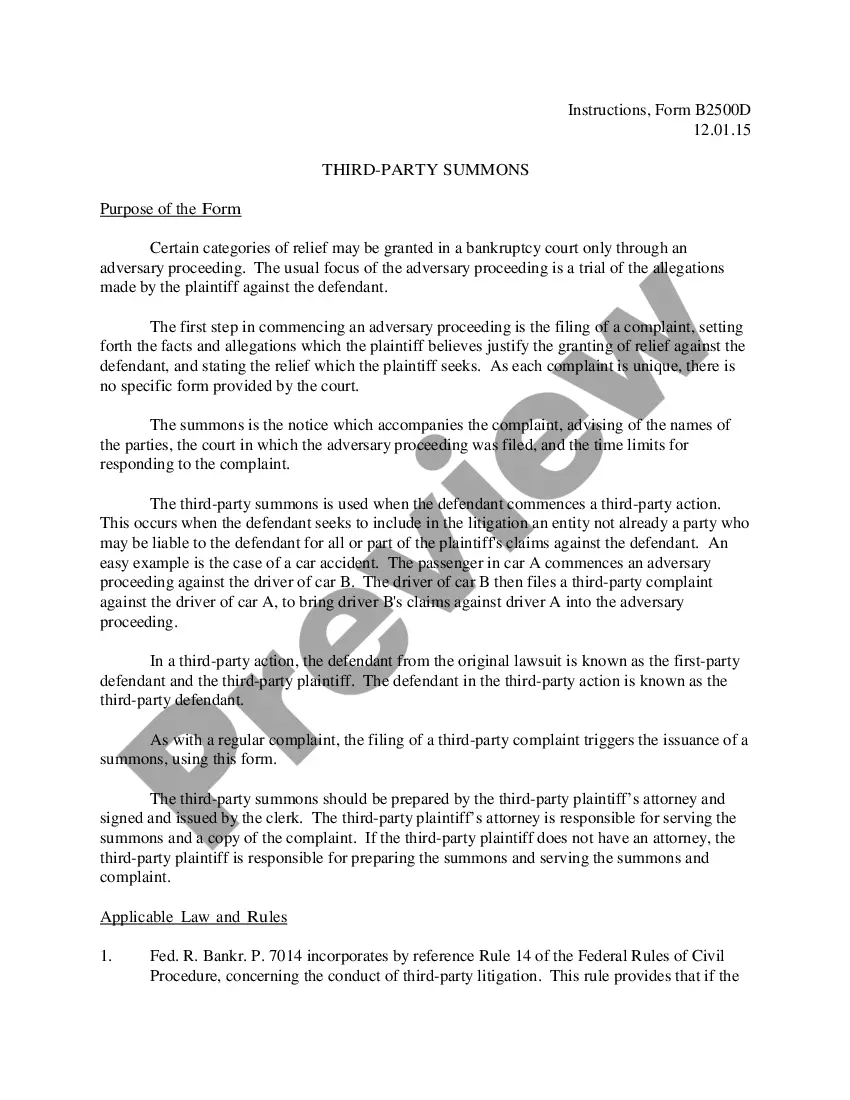

How to fill out Party Verification Letter?

Discovering the right legal papers design can be a battle. Obviously, there are a variety of layouts available on the Internet, but how will you find the legal type you will need? Use the US Legal Forms internet site. The assistance offers thousands of layouts, including the Rhode Island Party Verification Letter, which can be used for business and private demands. All of the types are checked out by experts and meet state and federal requirements.

When you are currently authorized, log in for your profile and then click the Download switch to have the Rhode Island Party Verification Letter. Make use of profile to appear from the legal types you might have purchased earlier. Visit the My Forms tab of your profile and acquire an additional duplicate from the papers you will need.

When you are a fresh consumer of US Legal Forms, here are straightforward instructions for you to stick to:

- Initial, be sure you have chosen the appropriate type for the area/region. You may check out the shape making use of the Review switch and read the shape information to guarantee this is basically the best for you.

- When the type fails to meet your preferences, take advantage of the Seach discipline to get the proper type.

- When you are sure that the shape is acceptable, click the Purchase now switch to have the type.

- Select the prices program you want and type in the essential info. Design your profile and buy the transaction utilizing your PayPal profile or bank card.

- Opt for the data file format and down load the legal papers design for your device.

- Complete, modify and printing and sign the acquired Rhode Island Party Verification Letter.

US Legal Forms will be the most significant local library of legal types for which you will find numerous papers layouts. Use the service to down load expertly-created papers that stick to condition requirements.

Form popularity

FAQ

Any gambling winnings are subject to federal income tax. If you win more than $5,000 on a wager, and the payout is at least 300 times the amount of your bet, the IRS requires the payer to withhold 24% for income taxes. Any gambling losses can offset your gambling winning as long as you meet certain criteria.

Effective July 1, 1989, winnings and prizes received from the Rhode Island Lottery are taxable under the provisions of the Rhode Island personal income tax (R.I. Gen. Laws § 44-30-1 et seq., as amended) and are includable in the income of both residents and nonresidents alike.

Some states do not levy income tax or tax lottery winnings, they include: Alaska. California. Delaware. Florida. Nevada. New Hampshire. South Dakota. Tennessee.

Taxpayers claiming a credit for income taxes paid to another state must complete RI Schedule II on page 3. Nonresidents and part-year residents will file their Rhode Island Individual Income Tax Returns using Form RI-1040NR. Complete your 2021 Federal Income Tax Return first. 2021 instructions for filing ri-1040 - RI Division of Taxation RI Division of Taxation (.gov) ? files ? xkgbur541 ? files RI Division of Taxation (.gov) ? files ? xkgbur541 ? files PDF

Withholding Tax on Gambling Winnings: If a must withhold for federal purposes, RI must withhold federal tax withheld multiplied by the Rhode Island personal income tax withholding rate in effect on the date of the payment. Rhode Island - American Gaming Association americangaming.org ? uploads ? 2019/07 americangaming.org ? uploads ? 2019/07

Rhode Island ? like the federal government and many states ? has a pay-as-you-earn income tax system. Under that system, employers are required to withhold a portion of their employees' wages and to periodically turn over those withheld funds to the RI Division of Taxation. Withholding Tax - RI Division of Taxation - RI.gov ri.gov ? tax-sections ? withholding-tax ri.gov ? tax-sections ? withholding-tax

In Rhode Island, you'll have a 5.99% state tax, and after all taxes roughly $45,320,340 would be withheld from the lump sum payout, leaving the winner (if they're a single-filer) with about $431,374,705, USA Mega reports.

( Instructions, Form RI-1040, Rhode Island Resident Individual Income Tax Return) Effective January 1, 2011, itemizing deductions is no longer allowed. Rhode Island - Itemized Deductions - Explanations - CCH AnswerConnect cch.com ? document ? state ? itemi... cch.com ? document ? state ? itemi...