New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor

Description

How to fill out Visiting Professor Agreement - Self-Employed Independent Contractor?

If you wish to be thorough, obtain, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms, that are accessible online.

Employ the site’s straightforward and user-friendly search to find the documents you require. Various templates for commercial and personal objectives are categorized by groups and regions, or keywords.

Utilize US Legal Forms to acquire the New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Stay competitive and download, and print the New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and then click the Download button to obtain the New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for your correct region/country.

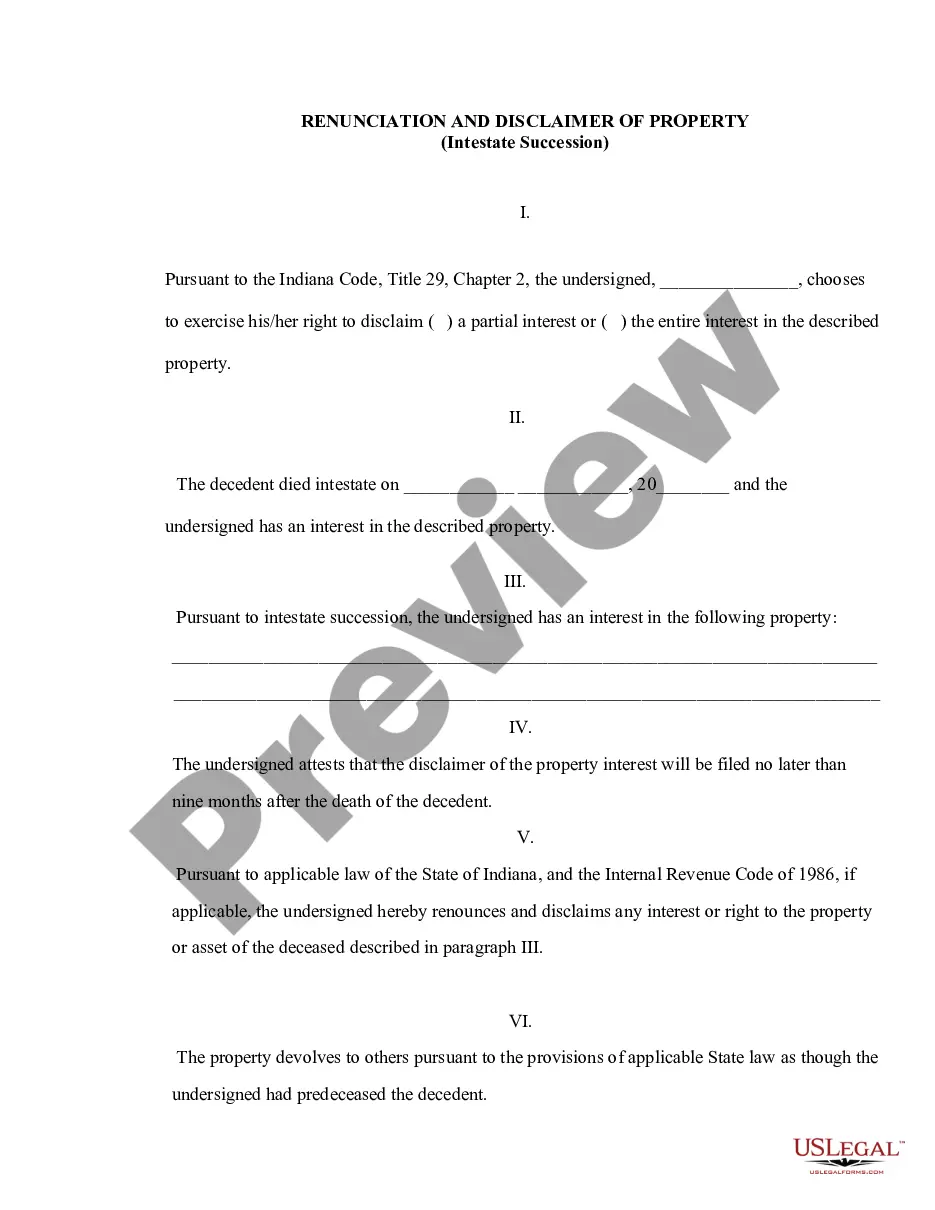

- Step 2. Use the Preview feature to review the form's content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Buy now button. Select the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Generally, your job cannot force you to attend a meeting if you are classified as an independent contractor under the New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor. It is essential to refer to your contract to determine if meeting attendance is required. If your contract does not state this obligation, your participation is at your discretion.

Yes, you can refuse to attend a meeting if it is not mandated by your New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor. It is important to consider the specifics of your contract and any agreements made. If attendance at meetings is voluntary, you have the right to decline involvement.

The 72 hour rule in New Hampshire relates to the notice required for certain employment changes. Under this rule, employers must provide at least 72 hours' notice before changes affecting an independent contractor's work conditions or contract terms. This is vital for maintaining clear communication and expectation between the contractor and employer under the New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor.

Yes, independent contractors can be required to attend meetings if this is stipulated in their New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor. However, it is essential to review the contract details to understand your obligations fully. If meetings are not specified in the contract, your attendance may be voluntary.

Yes, New Hampshire does impose taxes on self-employment income. As a self-employed independent contractor under a New Hampshire Visiting Professor Agreement, you are responsible for paying taxes on the income you earn. It is crucial to maintain accurate records of your earnings and expenses to comply with state tax regulations.

Typically, under the New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor, attendance at meetings depends on the terms of the contract. If the agreement specifies that participation in meetings is required, then yes, contractors must attend. Conversely, if the contract does not mandate attendance, contractors have the flexibility to choose whether they wish to participate.

In the context of the New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor, independent contractors must adhere to specific guidelines. They should usually have a written contract outlining their services, responsibilities, and payment terms. Additionally, they must meet IRS criteria, ensuring that they are not classified as employees, which involves showcasing their independence in work execution.

Adjunct professors often work as independent contractors, particularly when teaching specific courses on a contract basis. They usually receive compensation per course, allowing them to manage their own teaching schedules. This classification aligns with a New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor, enabling adjuncts to navigate their professional paths more freely.

Teachers generally take on employee status when they are part of a school district or educational institution with clearly defined roles and responsibilities. However, some teachers may also work as independent contractors, particularly in private tutoring or freelance educational services. Under a New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor, educators can maintain autonomy while offering their expertise.

Professors can be classified as either employees or independent contractors. Those who have a full-time position with benefits typically fall under employee status. However, individuals teaching courses on a contract basis may operate as independent contractors under a New Hampshire Visiting Professor Agreement - Self-Employed Independent Contractor, allowing them more flexibility in their teaching arrangements.