New Jersey Term Sheet - Series A Preferred Stock Financing of a Company

Description

The Term Sheet is not a commitment to invest, and is conditioned on the completion of the conditions to closing set forth.

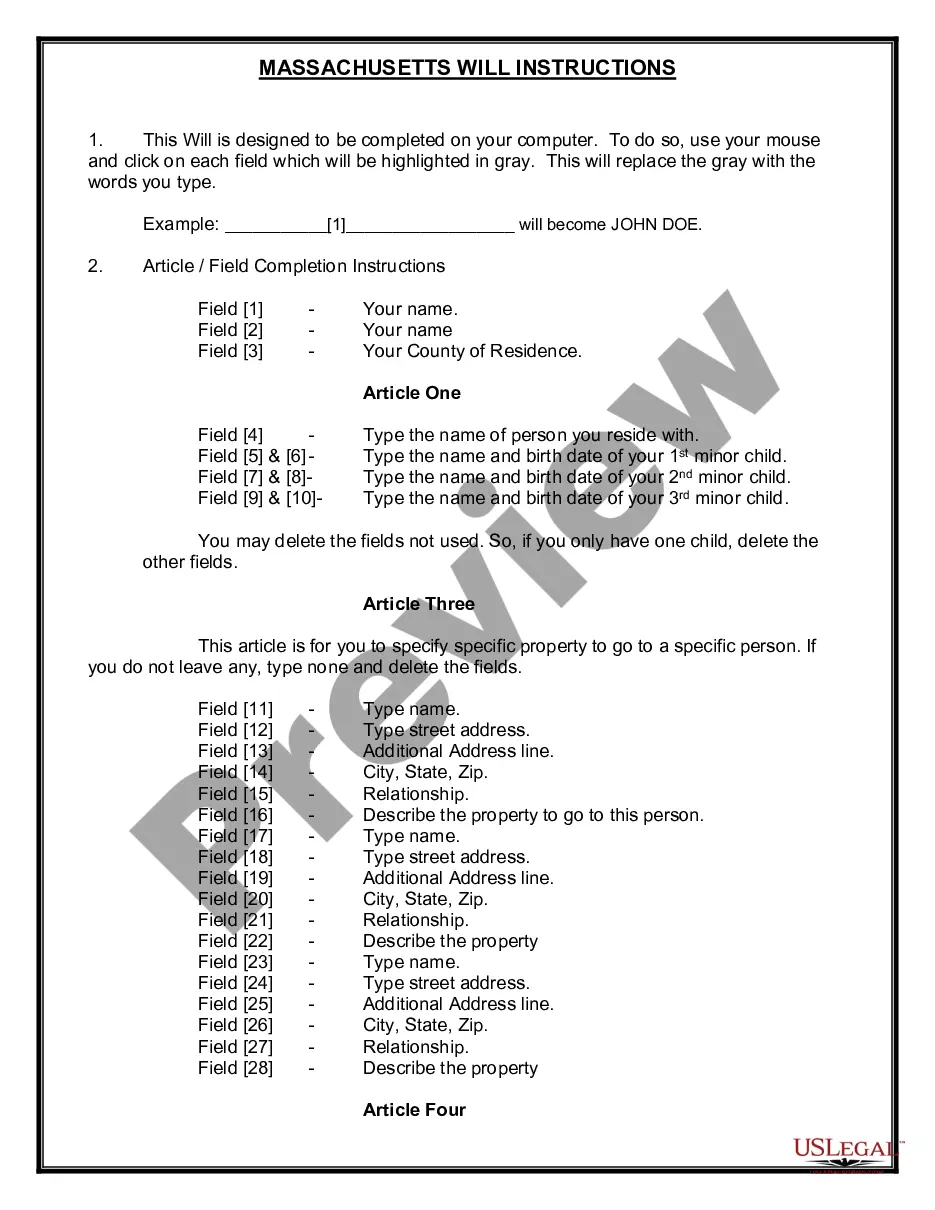

How to fill out Term Sheet - Series A Preferred Stock Financing Of A Company?

It is possible to devote several hours on-line trying to find the lawful record format that meets the state and federal needs you need. US Legal Forms offers a large number of lawful types that happen to be analyzed by experts. It is possible to acquire or print the New Jersey Term Sheet - Series A Preferred Stock Financing of a Company from your assistance.

If you have a US Legal Forms accounts, you can log in and then click the Down load switch. After that, you can full, modify, print, or sign the New Jersey Term Sheet - Series A Preferred Stock Financing of a Company. Every lawful record format you get is your own property for a long time. To have another duplicate of any purchased form, proceed to the My Forms tab and then click the corresponding switch.

Should you use the US Legal Forms site the very first time, adhere to the basic directions under:

- Very first, ensure that you have selected the best record format to the area/area that you pick. Browse the form outline to ensure you have picked out the right form. If available, take advantage of the Preview switch to appear throughout the record format at the same time.

- If you want to find another version from the form, take advantage of the Lookup field to get the format that meets your requirements and needs.

- When you have identified the format you desire, simply click Buy now to carry on.

- Find the costs prepare you desire, type in your credentials, and register for your account on US Legal Forms.

- Total the purchase. You may use your bank card or PayPal accounts to cover the lawful form.

- Find the structure from the record and acquire it to your system.

- Make alterations to your record if possible. It is possible to full, modify and sign and print New Jersey Term Sheet - Series A Preferred Stock Financing of a Company.

Down load and print a large number of record web templates using the US Legal Forms web site, which offers the most important selection of lawful types. Use expert and status-distinct web templates to take on your business or person requires.

Form popularity

FAQ

A term sheet is a nonbinding agreement outlining the basic terms and conditions under which an investment will be made. Term sheets are most often associated with start-ups. Entrepreneurs find that this document is crucial to attracting investors, such as venture capitalists (VC) with capital to fund enterprises. Term Sheets: Definition, What's Included, Examples, and Key Terms investopedia.com ? terms ? termsheet investopedia.com ? terms ? termsheet

How to Prepare a Term Sheet Identify the Purpose of the Term Sheet Agreements. Briefly Summarize the Terms and Conditions. List the Offering Terms. Include Dividends, Liquidation Preference, and Provisions. Identify the Participation Rights. Create a Board of Directors. End with the Voting Agreement and Other Matters.

But no matter who the investor is, a term sheet will always contain six key components, including: A valuation. An estimate of what a company is worth as an investment opportunity. ... Securities being issued. ... Board rights. ... Investor protections. ... Dealing with shares. ... Miscellaneous provisions. The 6 key components of a term sheet - Espresso Capital espressocapital.com ? resources ? blog ? term-she... espressocapital.com ? resources ? blog ? term-she...

Letters of intent and term sheets are very similar. Both documents outline an agreement that two or more parties expect to make. A letter of intent, as the name implies, is written in the form of a letter whereas a term sheet is more often a list of the important parts of the anticipated contract or agreement. Letters of Intent and Term Sheets - Business Law - LawInfo.com lawinfo.com ? resources ? letters-of-intent-a... lawinfo.com ? resources ? letters-of-intent-a...

The essential difference between Term Sheets and Shareholder Agreements is that the former are not usually legally binding, while Shareholder Agreements, on the other hand, tend to be legally binding. Term Sheets will assist in the earlier stages of a deal, to agree on material commercial terms. What's the Difference Between Term Sheets and a Shareholder ... openlegal.com.au ? whats-the-difference-between-... openlegal.com.au ? whats-the-difference-between-...

A Preference Shares Investment Term Sheet is a record of discussions between the founders of a business and an investor for potential investment by preference shares. A Preference Shares Investment Term Sheet is not legally binding, except for confidentiality and exclusivity obligations (if applicable).

Term sheets for venture capital financings include detailed provisions describing the terms of the preferred stock being issued to investors. Some terms are more important than others. The following brief description of certain material terms divides them into two categories: economic terms and control rights.