New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed

Description

How to fill out Cabinet And Countertop Contract Agreement - Self-Employed?

Are you presently in a circumstance where you require documents for either business or personal purposes almost daily.

There are numerous trustworthy document templates accessible online, but finding ones you can depend on is not easy.

US Legal Forms offers a wide array of template documents, including the New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed, which is designed to meet federal and state regulations.

Once you obtain the correct form, click Buy now.

Select the pricing plan you prefer, fill out the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- After that, you can download the New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these instructions.

- Select the form you need and ensure it is for the correct city/county.

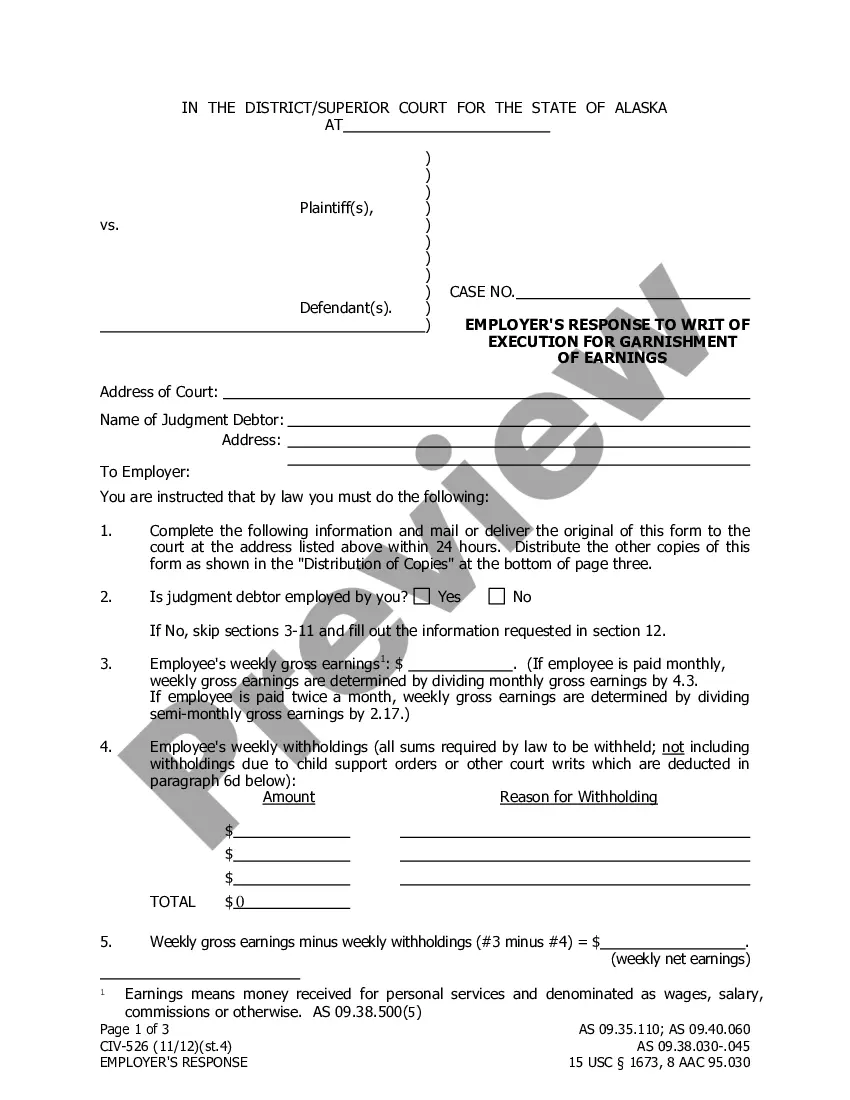

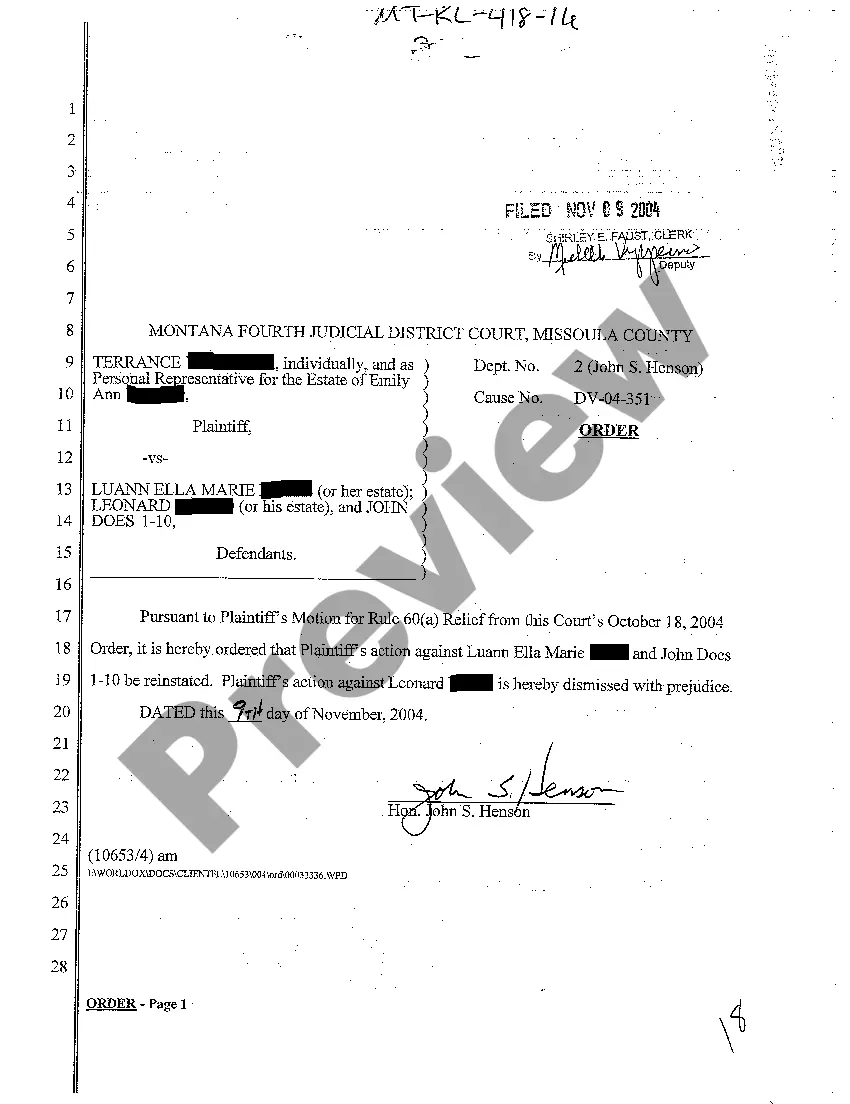

- Use the Review button to examine the form.

- Check the details to confirm that you have chosen the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

Writing an independent contractor agreement requires clarity and precision. Begin with the parties' information, the nature of the work, and compensation terms. Specify deliverables and deadlines, ensuring all expectations are clear. Using the New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed available at uslegalforms can provide you with a solid framework to complete your agreement effectively.

Filling out a contract agreement should be done carefully to ensure mutual understanding. Start with the names and addresses of both parties, followed by a detailed description of the project. Make sure to outline payment schedules and deadlines. The New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed from uslegalforms can simplify this process for you.

Writing a self-employed contract involves outlining the terms of the agreement clearly. Begin by defining the services provided, the timeline for completion, and the payment structure. It’s vital to include clauses for confidentiality and termination conditions to protect both parties. Check out the New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed on uslegalforms for a structured template.

To fill out an independent contractor form, start by gathering essential details about the work arrangement. Include basic information like names, contact information, and the duration of the contract. Specify the services to be provided, as well as payment terms. Using resources such as the New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed can guide you through the process with clarity.

Filling out an independent contractor agreement is key for establishing clear terms. Begin by entering your information and the contractor's details, including scope of work and payment terms. Ensure you clearly outline the responsibilities and expectations for both parties. For a comprehensive solution, consider the New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed available on uslegalforms.

Yes, New Hampshire does tax self-employment income under certain conditions. Income earned through activities, such as a New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed, falls under the purview of the state's business profits tax. It's crucial to keep detailed records and consult with tax professionals to ensure compliance and maximize your deductions.

Several states do not impose a self-employment tax, making them attractive for independent contractors. States like Florida and Texas offer this benefit. However, if you are based in New Hampshire and operate under a New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed, be aware of the state's specific tax obligations to avoid surprises.

Yes, New Hampshire does not impose a general income tax on ordinary wages; however, it does tax certain forms of income. For those using a New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed, 1099 income may be subject to other tax considerations, such as business profits tax on income derived from self-employment. Familiarizing yourself with the state's tax structure can help you navigate your financial responsibilities.

In New Hampshire, income from various sources is subject to taxation. This includes wages, salaries, and self-employment income, such as earnings from a New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed. It's essential to track all income and consult with a tax professional to ensure proper reporting and compliance with state tax laws.

Setting up as a self-employed contractor involves several steps. First, you need to choose a business structure, such as sole proprietorship or LLC. Next, register your business with the appropriate New Hampshire authorities and obtain any necessary licenses. Finally, looking into a New Hampshire Cabinet And Countertop Contract Agreement - Self-Employed can help streamline your agreements and ensure legal compliance.