New Hampshire Carpentry Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

Have you encountered a circumstance that requires documents for either business or particular needs on a daily basis.

There are many legitimate document templates accessible online, but finding versions you can trust is challenging.

US Legal Forms offers a vast array of form templates, such as the New Hampshire Carpentry Services Agreement - Self-Employed Independent Contractor, designed to meet federal and state requirements.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you need, fill in the required information to create your account, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Hampshire Carpentry Services Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it corresponds to the right area/region.

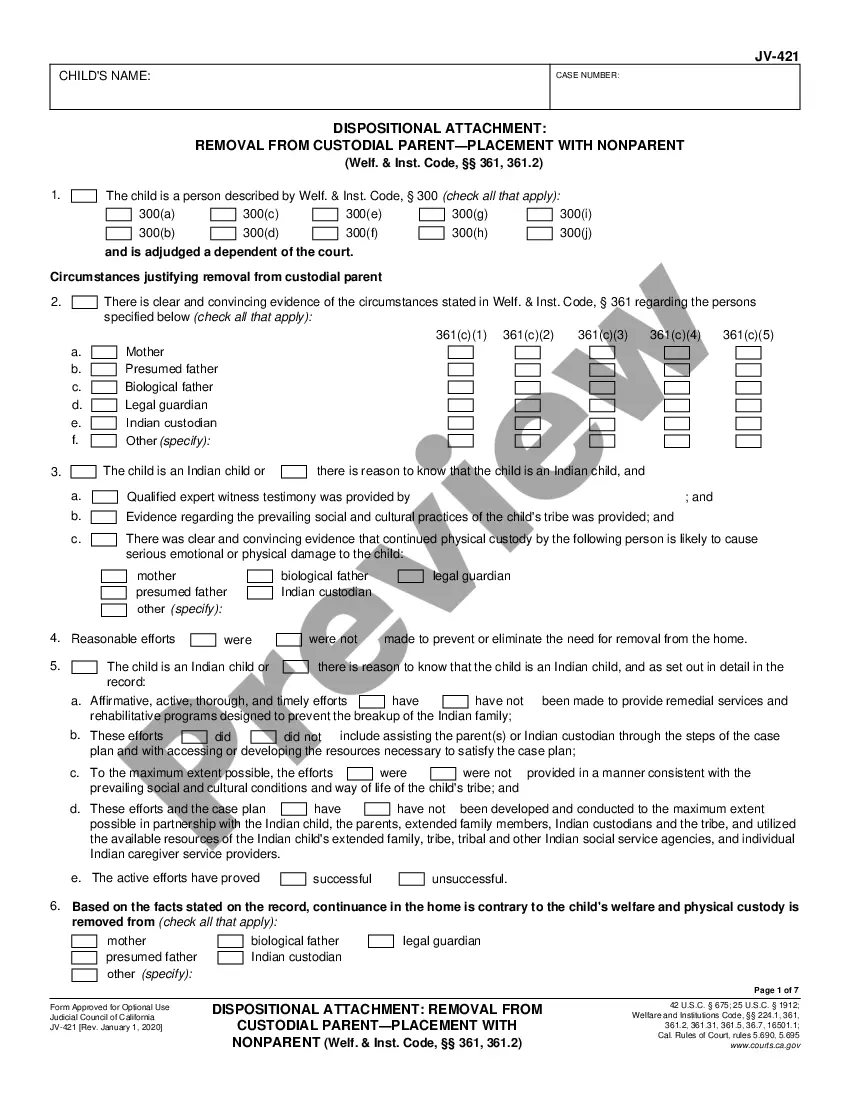

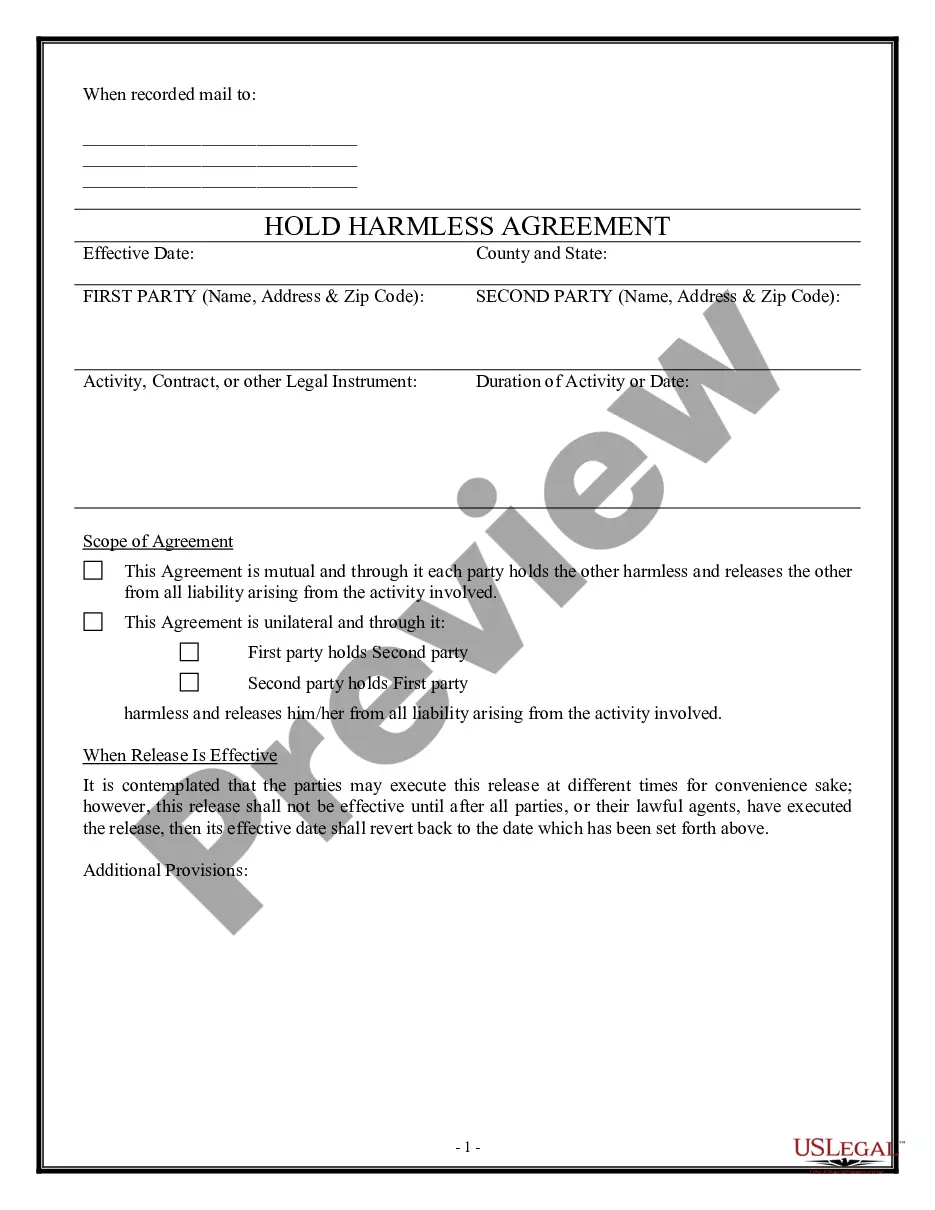

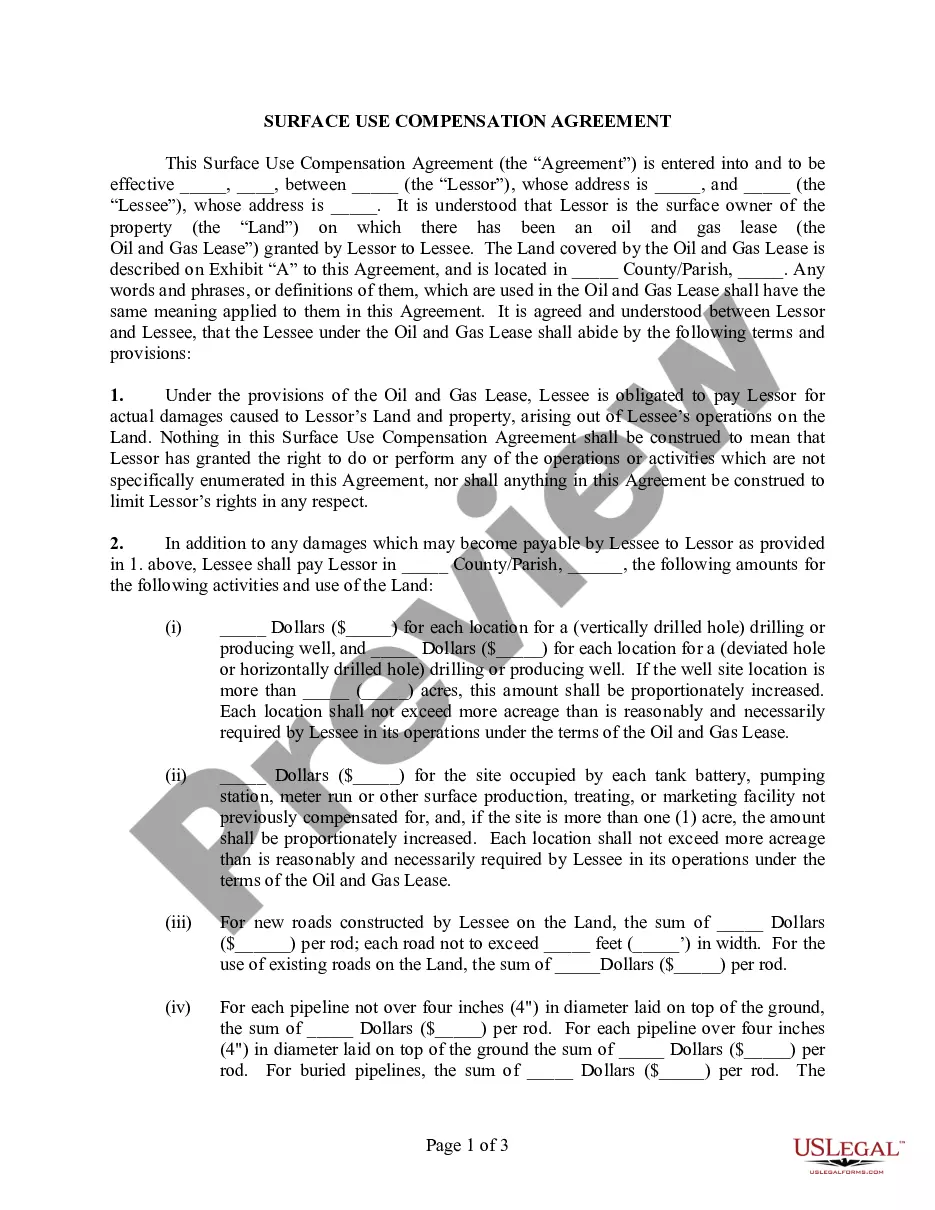

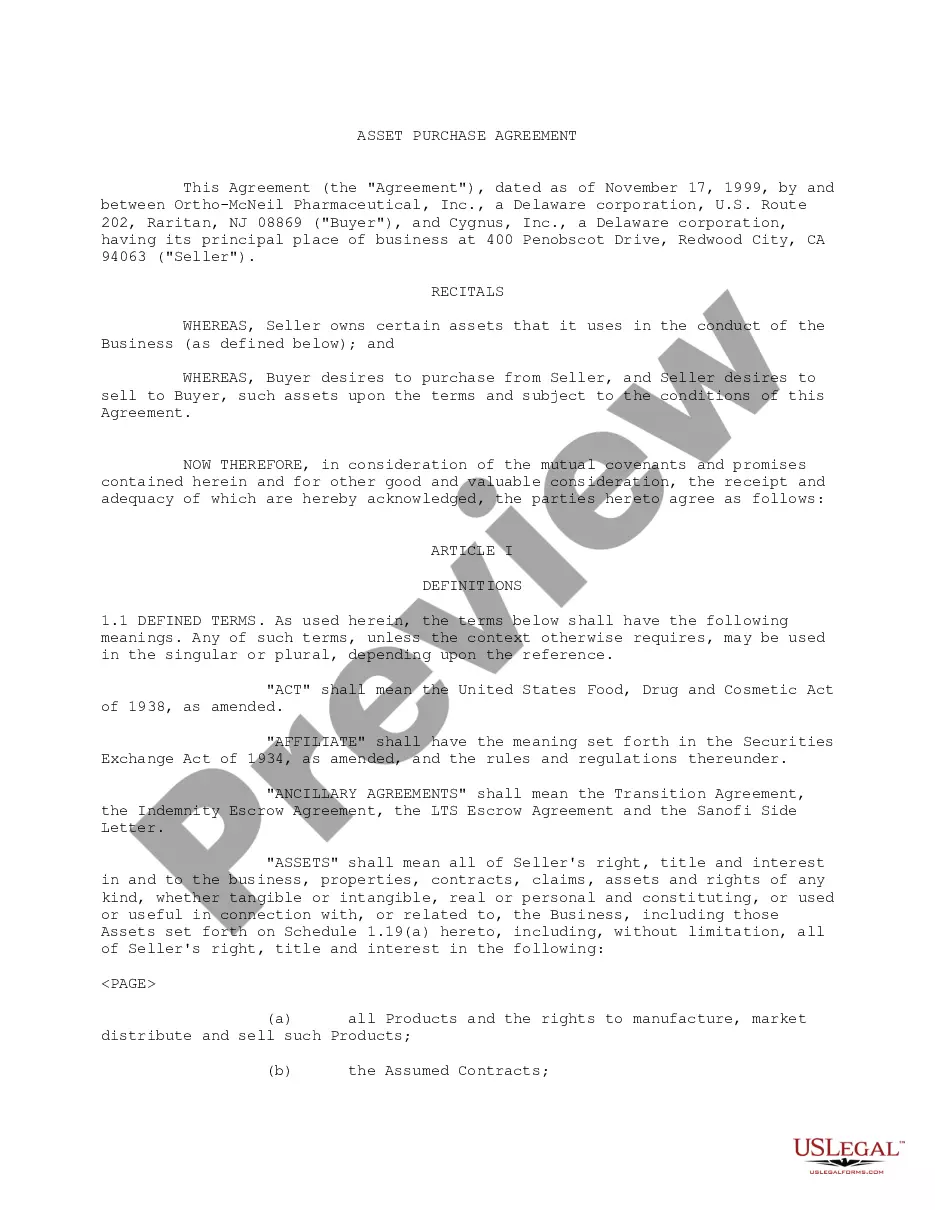

- Utilize the Preview button to examine the form.

- Review the details to ensure you have selected the correct form.

- If the form is not what you are searching for, use the Search field to find the form that fits your needs.

Form popularity

FAQ

Receiving a 1099 form typically indicates that you have earned income as a freelancer or independent contractor, which is a clear sign of self-employment. This is often the case in agreements like a New Hampshire Carpentry Services Contract - Self-Employed Independent Contractor. However, it's important to manage your taxes and expenses appropriately to maintain your self-employed status.

Yes, an independent contractor is generally recognized as self-employed. These workers provide services to clients through contracts without being directly employed by them, reflecting the nature of a New Hampshire Carpentry Services Contract - Self-Employed Independent Contractor. This freelance arrangement allows for flexibility but also requires a clear understanding of obligations and liabilities.

To be considered self-employed, an individual must run their own business and earn income outside of traditional employment. This includes managing finances, setting hours, and building a client base, often seen in a New Hampshire Carpentry Services Contract - Self-Employed Independent Contractor. If you create your own contracts and control how you work, you are likely self-employed.

Choosing between the terms 'self-employed' and 'independent contractor' often depends on context. Both terms describe individuals who work for themselves, but 'independent contractor' often implies a specific type of agreement or contract, which can be important in a New Hampshire Carpentry Services Contract - Self-Employed Independent Contractor. Generally, using either term is acceptable, but clarity in your contracts is crucial.

The independent contractor rule outlines the criteria that determine whether an individual can be classified as an independent contractor. Key factors include the level of control the client has over how work is performed and the financial aspects of the relationship. For those in carpentry, understanding this rule is crucial for creating a robust New Hampshire Carpentry Services Contract that protects your status as a self-employed independent contractor.

Yes, New Hampshire does tax self-employment income. As a self-employed independent contractor in the carpentry sector, you are responsible for reporting and paying taxes on your earnings. It is advisable to consult with a tax professional familiar with New Hampshire laws to ensure compliance and optimize your New Hampshire Carpentry Services Contract accordingly.

The key difference lies in the relationship with the employer. An employee typically receives benefits and has less control over their work, while an independent contractor has more freedom and works on a contractual basis. If you are establishing a New Hampshire Carpentry Services Contract, understanding this distinction can help you set clear boundaries and expectations with your clients.

Absolutely, an independent contractor is considered self-employed. This status provides independence and flexibility, allowing you to manage your carpentry projects on your terms. When you create a New Hampshire Carpentry Services Contract, it will reflect your role as a self-employed independent contractor, clarifying expectations for both parties.

While the terms self-employed and independent contractor are often used interchangeably, there are nuances. Self-employed individuals may operate a business, while independent contractors typically work on a contract basis for clients. In the context of a New Hampshire Carpentry Services Contract, it is essential to outline the terms clearly to reflect the independent nature of the work.

Yes, 1099 employees are classified as self-employed. This means they have control over how they complete their work and are responsible for their own taxes. If you are in the carpentry business in New Hampshire, a 1099 status helps solidify your role as a self-employed independent contractor. This classification is important when drafting a New Hampshire Carpentry Services Contract.