New Hampshire Door Contractor Agreement - Self-Employed

Description

How to fill out Door Contractor Agreement - Self-Employed?

You can allocate time online searching for the official document template that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal documents that are reviewed by professionals. You can either download or print the New Hampshire Door Contractor Agreement - Self-Employed from this service.

If you already have a US Legal Forms account, you can Log In and then click the Download button. After that, you can complete, modify, print, or sign the New Hampshire Door Contractor Agreement - Self-Employed. Every legal document template you acquire is yours indefinitely.

Select the pricing plan you need, enter your information, and register for an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can complete, modify, sign, and print the New Hampshire Door Contractor Agreement - Self-Employed. Download and print thousands of document templates using the US Legal Forms website, which offers the largest array of legal forms. Utilize professional and state-specific templates to manage your business or personal needs.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/region you choose.

- Check the form description to guarantee you have chosen the appropriate document.

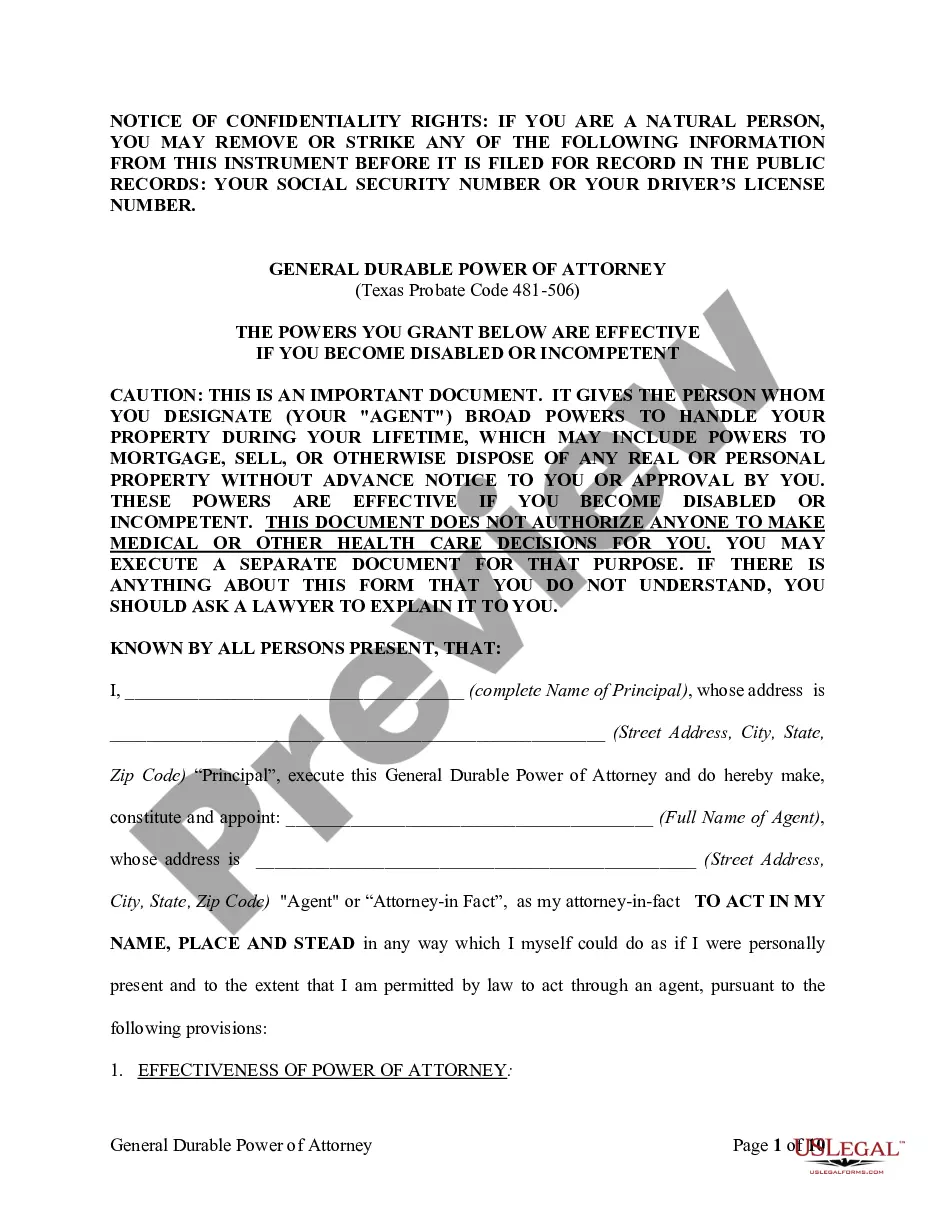

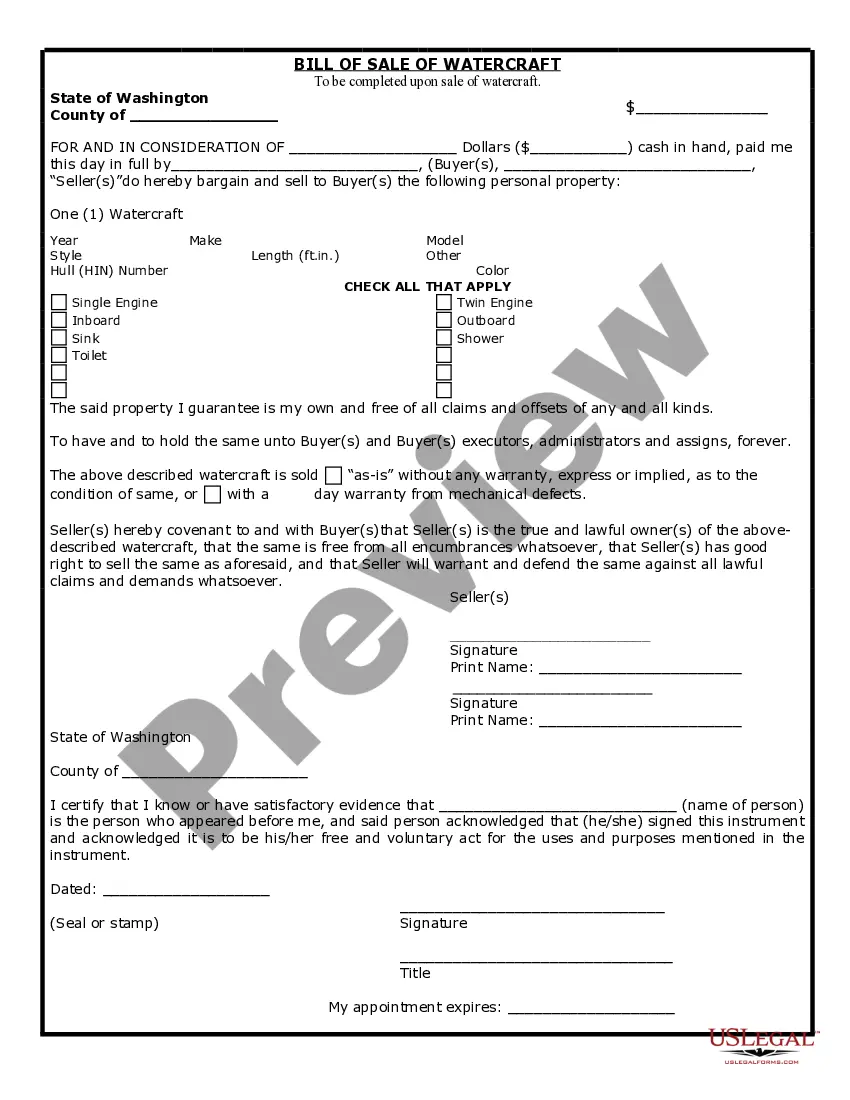

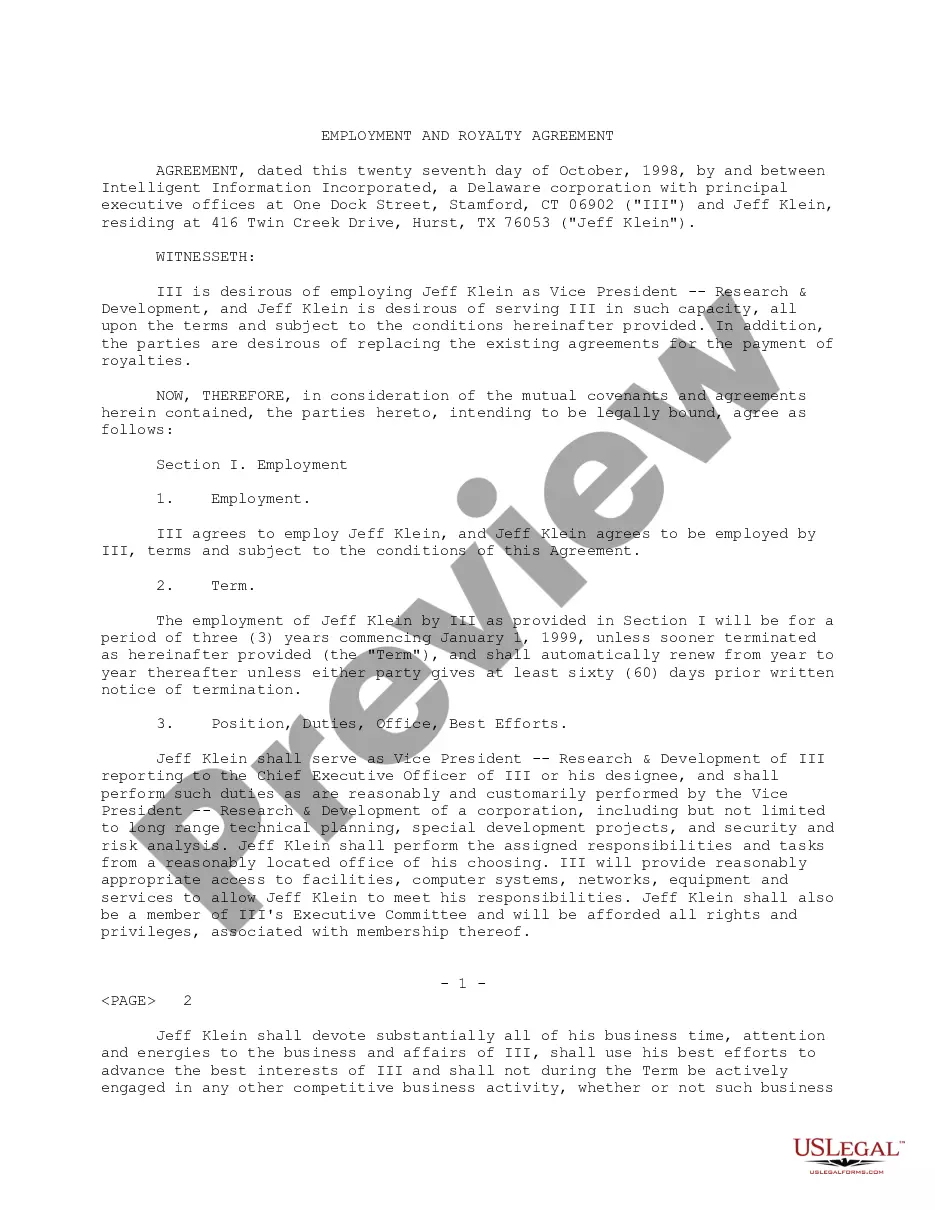

- If available, utilize the Review button to examine the document template as well.

- If you want to find another version of the form, use the Search field to discover the template that matches your needs and criteria.

- Once you have found the template you require, click Acquire now to proceed.

Form popularity

FAQ

An independent contractor needs to complete several key documents to establish a solid foundation for their business. Typically, a New Hampshire Door Contractor Agreement - Self-Employed is essential as it outlines the terms between the contractor and their client. Additionally, tax forms such as the W-9 are necessary for reporting income to the IRS. To simplify this process, the uslegalforms platform offers customizable templates to ensure compliance and clarity in all agreements.

Absolutely, you can be self-employed and have a contract. In fact, having a contract is often essential to define the relationship between you and your clients. It protects your work and clarifies payment terms, goals, and deadlines. A New Hampshire Door Contractor Agreement - Self-Employed provides a structured approach to ensure all parties understand their obligations.

Yes, being a contractor does count as being self-employed. Contractors operate their own businesses, manage their tax liabilities, and typically do not receive employee benefits. This autonomy allows for greater flexibility and control over your work. Utilizing a New Hampshire Door Contractor Agreement - Self-Employed can help structure your contracting work effectively, protecting your interests.

The terms self-employed and independent contractor are often used interchangeably, but they can have different implications. Self-employed generally refers to anyone working for themselves, while independent contractor typically denotes a specific type of self-employed person providing services under a contract. Choosing the more accurate term can impact how you market your services. Regardless of the term, using a New Hampshire Door Contractor Agreement - Self-Employed can help clarify your business arrangement.

Yes, having a contract is essential for self-employed individuals. A contract clearly outlines the scope of work, payment terms, and other responsibilities between you and your clients. This not only protects your rights but also ensures that both parties are aligned on expectations. A well-drafted New Hampshire Door Contractor Agreement - Self-Employed can serve as a solid foundation for your business relationships.

The new rules for self-employed individuals often include updated tax regulations and reporting requirements. For instance, ensuring compliance with federal and state rules is crucial. As a self-employed contractor, understanding these changes can significantly impact your income and expenses. To simplify this process, consider using a New Hampshire Door Contractor Agreement - Self-Employed tailored to your needs.

The 72-hour rule in New Hampshire requires that any independent contractor, including those using the New Hampshire Door Contractor Agreement - Self-Employed, must provide clients with a signed contract before commencing work. This rule aims to protect both the contractor and the client by ensuring clarity in the agreement. Adhering to this requirement can prevent misunderstandings down the line. For more detailed information and templates, consider resources like US Legal Forms.

To write an independent contractor agreement, begin by outlining the essential terms, including the project description, payment terms, and deadlines. Make sure to clarify any legal obligations for both parties. Incorporating the New Hampshire Door Contractor Agreement - Self-Employed ensures you meet all state guidelines. If you're unsure about crafting the document, check out US Legal Forms for professional templates that guide you step-by-step.

Filling out an independent contractor agreement involves detailing the roles and responsibilities of both parties. Include key information such as the nature of the services, payment structure, and project timelines. Using the New Hampshire Door Contractor Agreement - Self-Employed helps ensure that you are in compliance with local laws. Consider utilizing services from US Legal Forms to access ready-made agreements, which can save you time and effort.

To fill out an independent contractor form, start by providing your personal details, such as your name, address, and contact information. Include the specific details of the work arrangement, including the scope of work, payment terms, and deadlines. Ensure you are using the New Hampshire Door Contractor Agreement - Self-Employed to meet state requirements. If you need help, platforms like US Legal Forms provide templates that simplify this process.